Economic data released earlier on Friday revealed a larger-than-expected slowdown in the US jobs market in October, triggering downside in US bond yields and a pump in the US stock market and price of Bitcoin (BTC), which was last around $34,600.

The latest jobs report revealed that the US economy added 150,000 jobs last month, less than the expected gain of 180,000 and marking the slowest pace of job gains since early 2021.

Macro investors responded to the data by pulling back on bets that the US Federal Reserve will implement one further rate hike, as it warned was a possibility earlier in the week.

As per the CME’s Fed Watch Tool, the US money market implied probability that the Fed hikes interest rates by another 25 bps by January 2024 fell to just 10% on Friday from around 26% on Thursday.

The implied probability that the Fed will have cut interest rates by at least 100 bps by the end of 2024 jumped to around 65% from just over 40% one day ago.

The latest US jobs numbers also revealed a surprise rise in the US unemployment rate to 3.9% from 3.8% and an unexpected slow down in the MoM pace of wage growth to 0.2% from 0.3%.

The Fed started aggressively hiking interest rates in early 2022 to combat an unexpectedly powerful surge in US inflation that began in mid-2021.

Whilst good progress has been made in bringing US inflation back towards the Fed’s 2.0% goal, the continued strong performance of the US economy and resilience of its labor market in 2023 has been complicating this task.

Following two stronger-than-expected jobs reports over the past two months, Friday’s jobs data confirms that a gradual weakening trend in the US labor market remains in place, reducing pressure on the Fed to implement further rate hikes, and to keep interest rates as high for as long.

That’s why investors responded to the data by lowering their bets on a further hike from the Fed, and upping their bets on how quickly the Fed will start cutting interest rates.

When investors reduce their expectations as to how high the Fed will raise interest rates, US government bond yields tend to fade.

This tends to boost risk appetite in the stock market, as well as the prices of non-yielding assets like Bitcoin and Gold, as a lower yield means a reduced incentive to hold US bonds, which are considered a risk-free asset.

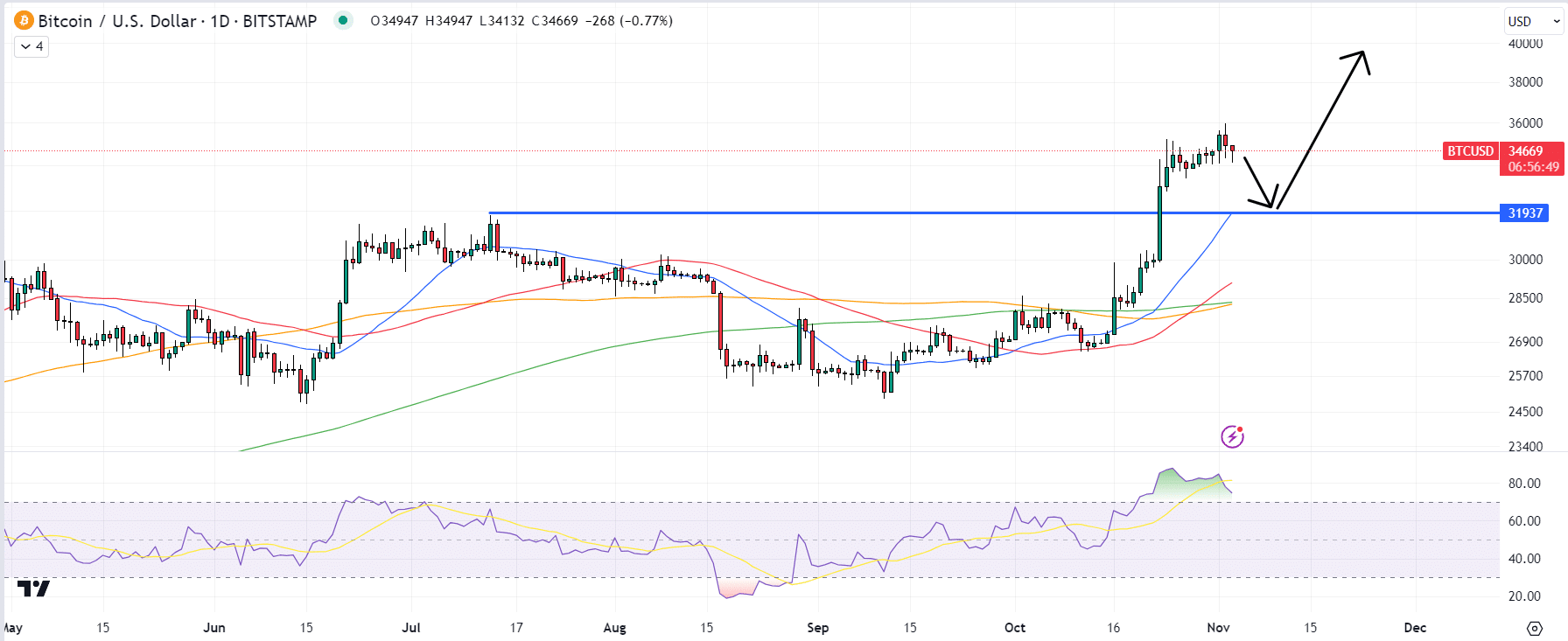

Where Next for the Bitcoin (BTC) Price?

Whilst at current levels in the $34,600s, BTC is up 1.5% versus earlier session lows ust above $34,000, the world’s largest cryptocurrency by market cap is still down around 0.75% on the session.

After hitting fresh yearly highs near $36,000 on Thursday, Bitcoin is succumbing to profit-taking, as short-term speculators book profit following BTC’s more than 30% pump from October lows.

That pump was primarily driven by optimism surrounding expected upcoming approvals of spot Bitcoin Exchange Traded Funds (ETFs) in the US.

And while profit-taking is acting as a headwind for now, the bulls could soon regain control with the broader macro backdrop switching to become a tailwind rather than headwind for BTC.

Yields on 10-year US government bonds, last just above 4.5%, have fallen around 40 bps, the US Dollar Index (DXY) has weakened more than 1.5% and the S&P 500 is up over 4% since the start of the month as traders bet the peak in US interest rates is in, and easier financial conditions lay ahead.

If this trend continues, this will be a major medium-term tailwind for BTC.

Whilst chart analysis suggests a dip back to retest the prior yearly highs in the $31,800 area remains a possibility, expect pullbacks to remain relatively short-lived.

$40,000 remains on the horizon before the end of 2023.

Crypto analysis firm Matrixport even went as far as predicting that a Santa Rally could propel Bitcoin as high as $56,000 by the year’s end.

Read the full article here