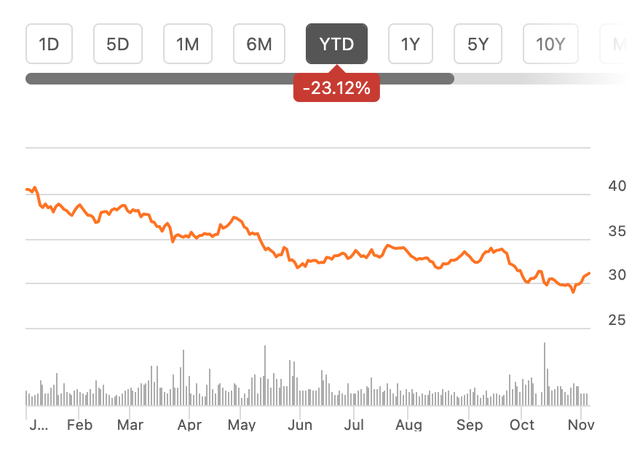

Tobacco company British American Tobacco (NYSE:BTI) (OTCPK:BTAFF) or BAT for short, has had a poor year at the stock markets, with a 23% decline in price year-to-date [YTD]. With a proportionally bigger price decline, even with a high trailing twelve months [TTM] dividend yield of 9.2%, its total returns are down by 19%. In absolute terms, its price is now down to multi-year lows, excluding the stock market crash of March 2020.

This brings up the question, has it fallen low enough now to make the Dunhill and Pall Mall cigarettes manufacturer attractive? To assess this, here, I look at the company with reference to my first article on it over a year ago, when a host of macroeconomic factors, coupled with its own weak performance and its ongoing business transitions to non-combustible products made it a risky bet.

Price Chart (Source: Seeking Alpha)

The difference a year makes

At this time last year, the risk of a recession loomed, inflation was still uncomfortably high and interest rates were on the upward trajectory. Now, however, the macroeconomy looks far more stable in general. The forecast recession didn’t happen, inflation has cooled down considerably and the interest rate hike cycle is essentially at its end.

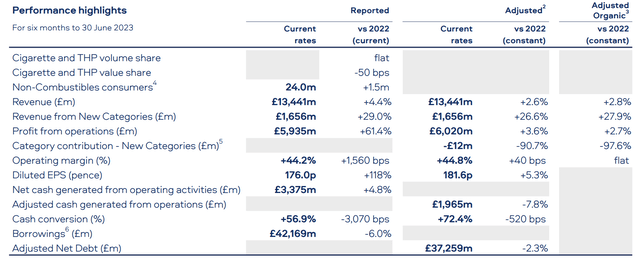

BAT’s own performance is also significantly improved. First, the company’s full year outlook itself is slightly better, with expectation of 3-5% organic constant currency revenue growth in 2023, compared to the 2-4% growth expectation for 2022 (Actual: 2.3%). While the revenue growth figures have come in at 2.8% for the first half of 2023 (H1 2023), which is lower than forecast, they are only slightly so. And there’s a possibility that the numbers can improve in H2 2023 considering that the company has kept its guidance unchanged.

The real improvement, though, is in the earnings. Reported operating profit is up by 61.4% year-on-year (YoY) compared to a 25% decline in H1 2022, when they were impacted by a big on-off charge. The operating margin also improved significantly to 44.2% (H1 2022: 28.6%).

The reported diluted EPS is also up by a huge 118% compared to a 42.9% fall in H1 2022, buoyed by a strong operating performance, a favourable currency conversion effect and the weak base that impacted operating earnings last year too.

Source: British American Tobacco

Comparing BAT to peers

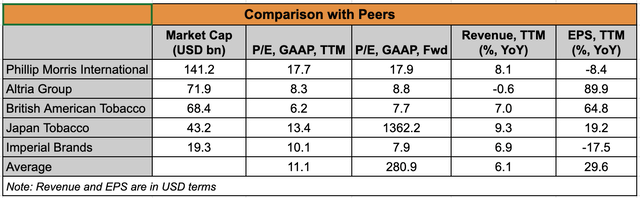

Since I last checked, the company also compares rather well to peers as well. The table below shows the comparison of revenue, EPS and P/E ratios of the five biggest tobacco companies by market capitalisation, highlighting how BAT is placed among them. The following points are of note:

- At a TTM revenue growth of 7% year-on-year (YoY) in USD terms, the company largely compares favourably to the sector. On average, tobacco companies have seen a 6.1% growth. Altria Group (MO), which sells Marlboro cigarettes in the US, has even shown a small negative growth.

- BAT’s diluted EPS growth at 64.8%, significantly higher than the already very healthy 29.6% on average for the sector. Its EPS growth is second only to Altria’s, and significantly higher than that for Japan Tobacco (OTCPK:JAPAF), the only other tobacco company to see positive EPS growth.

- Despite this, both BAT’s TTM GAAP and forward GAAP price-to-earnings (P/E) ratios is the lowest among all the other tobacco stocks, making it far more competitive since I last checked. The average forward P/E is skewed significantly to the upside because of Japan Tobacco’s outlier ratio, but even excluding that, the average P/E is at 10.6x. This is higher than the 7.65x for BAT.

Source: Seeking Alpha, Author’s Estimates

Dividends good for now, but medium term risks stay

With a robust earnings growth, the dividend outlook is cheery. Assuming that the payout ratio is at 65% in the next year, in line with the company’s stated long-term policy, with a forecast EPS of USD 4.52 for 2023, the dividend per share amounts to USD 2.94. This in turn gives a forward dividend yield of 9.4%.

However, I do believe that there are risks to the level of its dividends over the medium term considering that the company is the transitional phase it’s in right now. Demand for traditional tobacco is on the decline for not just BAT but also for the industry as such as awareness of the health risks from consuming it rise.

This is reflected in the company’s own numbers. In its H1 2023 release, it reported a 5.8% year-on-year (YoY) fall in reported volumes for combustibles, after a 5.2% volume decline in 2022. BAT also expects a volume decline for the global tobacco industry of 3% for the full year 2023.

While the demand for non-combustibles is rising, the fact remains that combustibles still contribute the lion’s share to revenues, at 81.6% in H1 2023. Combustibles are brings in the company’s profits, with non-combustibles expected to become profitable only next year.

As the share of combustibles declines over time, it’s quite possible that there can be a decline in earnings as the transition accelerates. In fact analysts already expect muted earnings per share [EPS] growth in 2023 and 2024 before contracting (see table below) in the following years. This in turn can puts the current level of dividends at risk.

EPS estimates (Source: Seeking Alpha)

What next?

A dividend cut, however, isn’t either today’s or even tomorrow’s problem keeping in mind that even next year, BAT is expected to report positive earnings growth.

For now, the stock’s story looks far better than it did a year ago. The latest numbers, for H1 2023, show robust growth in both operating profits and EPS, which bodes well dividends in the next year. They have also resulted in attractive market multiples for BAT compared to peers, which is further reinforced by its solid dividend yield.

With the stock having fallen significantly YTD, it’s now due for an uptick even though its business is in a period of transition which might impact its profits in the medium term. I’m upgrading BAT to Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here