Earnings Impact: Carvana’s Stock Price Reaction

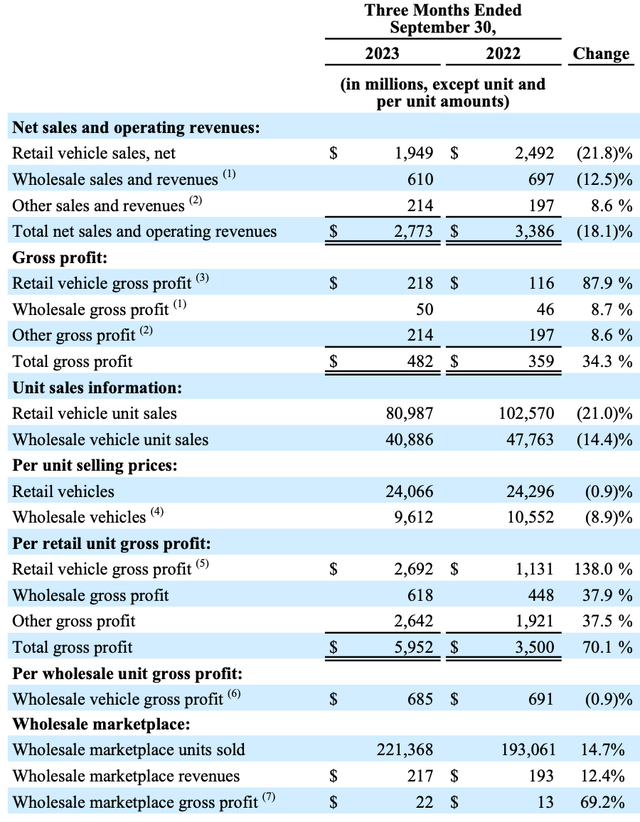

In September, we published a pre-earnings analysis identifying potential catalysts to watch, including expected details from management on fixed and variable costs. The stock was down 41% since then but still was up 370% since our initial coverage in May. Carvana (NYSE:CVNA) reported its third-quarter earnings on November 3, 2023. The company’s stock price jumped 15% following the earnings release, after having already risen 15% the previous day. Carvana continued facing headwinds in consumer used vehicle sales during the quarter. However, the company significantly improved profitability – gross margin rose to 17% from 10% in the year-ago period. Key factors driving margin expansion included cost control and operating efficiency gains.

Reassessing Carvana’s Market Position: A New Outlook

After reading their earnings, we realized that we may have significantly underestimated the potential of Carvana. We issued a strong buy report on CarMax (KMX). We argued that CarMax’s omnichannel presence would provide greater benefits compared to Carvana. However, we now believe Carvana will become much larger than CarMax and will explain it as follows.

Despite facing inflationary and high-interest rate headwinds, Carvana’s wholesale marketplace unit saw sales rebound to strong double-digit growth. Specifically, wholesale unit sales grew 117% in the nine months ended September 30 compared to the same period last year. Furthermore, gross profit for the wholesale marketplace expanded 311% to $74 million over this timeframe.

CVNA

Why is this business and metric important?

In April, we published an analysis on The RealReal (REAL) discussed the turnaround story of this company. The distressed online luxury e-commerce platform is shifting its focus from B2C to B2B. We were bullish on this strategy change because the problem of counterfeit luxury goods sold online can be better addressed by transferring authentication responsibility from retail buyers to professional buyers. Professional buyers have more experience and comfort in purchasing luxury products online. Online platforms also better serve professional buyers’ needs for vast product selection and transparency.

This insight from The RealReal is relevant when evaluating Carvana’s latest quarterly earnings. Just as professional buyers are better suited for purchasing luxury products online, Carvana is capitalizing on professional vehicle buyers(dealers) through its wholesale marketplace.

B2B is a More Profitable Model

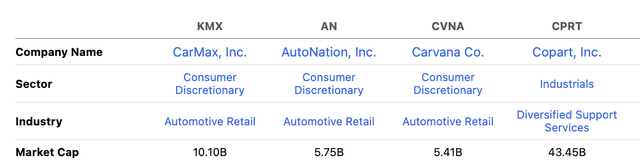

We will further explain the benefits and potential of the shifting focus to B2B from B2C for Carvana. CarMax, despite being the market share leader with 2% of the used car dealership market, generated $26 billion in revenue over the last twelve months yet has a market capitalization of only $10 billion. On the other hand, Copart (CPRT), a leading used car auction platform, generated just $3.8 billion in revenue but has a much higher market capitalization of $43 billion.

Seeking Alpha

The dramatic difference in market value relative to revenue is better explained by comparing profitability. CarMax has a gross margin of 11.3% and an ROE of 7.9%, while Copart has a substantially higher gross margin of 45% and ROE of 23%.

Seeking Alpha

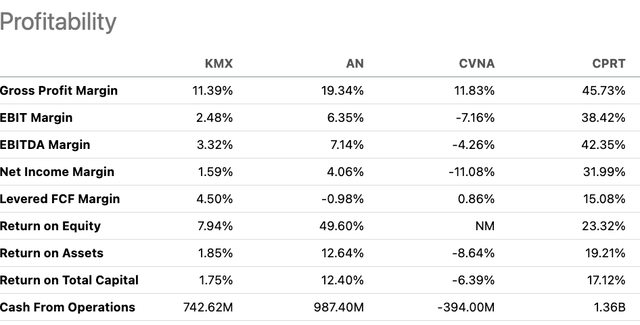

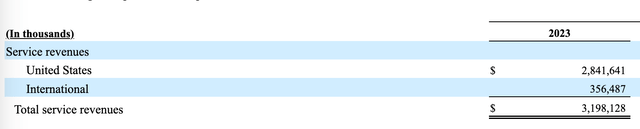

This divergence stems from Copart’s business model. Copart generates 83% of its revenue from high-margin service offerings, consisting primarily of auction fees. In contrast, CarMax primarily earns revenue by reselling used cars at retail locations, a lower margin business.

Our service revenue consists of auction and auction related sales transaction fees charged for vehicle remarketing services

CPRT

To illustrate further, Copart’s used car sales in the US are only around 1/9th the size of CarMax. Yet Copart generates higher profits due to its high-margin auction model.

CPRT CPRT

As a result, despite its far greater revenue scale, CarMax is valued at a fraction of Copart due to Copart’s asset-light, high-margin auction model. Copart’s business requires less inventory risk and capital investment compared to CarMax’s nationwide retail footprint. Investors reward the superior profitability and capital efficiency of Copart’s model, underscoring the importance of margins and return on capital versus pure revenue size.

Carvana’s Wholesale Strategy: A Bright Future

This comparison highlights why the continued ramp-up in Carvana’s wholesale marketplace segment is so notable. Carvana, through its acquisition of ADESA, has become the second-largest wholesale player in the used vehicle market. It now operates more locations and sells more wholesale units than Copart.

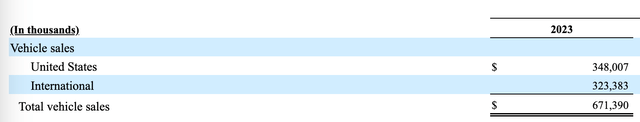

At the moment, Carvana generates less revenue from service fees than Copart but more revenue from wholesale than Copart.

CPRT, CVNA, LEL

As Carvana scales its wholesale business, it is essentially leveraging a platform similar to Copart’s. By replicating an asset-light, high-margin auction model, Carvana can potentially drive profitability closer more even higher to Copart’s levels over time.

Competitive advantage

Further, Copart primarily sources used vehicles through partnerships with insurance companies, while Carvana obtains 85 of its inventory directly from consumers. This positions Carvana to potentially acquire vehicles at better prices compared to Copart, since Carvana deals with individual sellers rather than professional insurance appraisers.

Higher than FY 2021 customer sourcing rate. We have enhanced our offering of buying cars from customers and sourced ~85% of retail units sold from customers in YTD 2023 compared to 73% in FY 2021.

Given Carvana’s scale and cost advantages from its online model, we believe it can disrupt the wholesale market despite Copart’s early mover position. As Carvana continues growing its wholesale unit rapidly, it benefits from lower costs to acquire, transport, and resell vehicles versus Copart’s physical-only auction model.

Carvana’s early entry and disruptive potential in used car auctions, combined with its direct sourcing from consumers, can drive profitability above CarMax and Copart long-term.

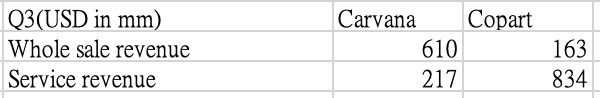

Infrastructure Utilization: Preparing for Expansion

In Q3, Carvana showed significant excess distribution capacity in a chart, which bears laughed at due to the resulting low utilization rates. However, we see this as a positive signal. With its wholesale marketplace expanding rapidly, Carvana has ready infrastructure to absorb substantial additional wholesale volume. With its cost position, Carvana can profitably scale nationwide used vehicle auctions and maximize the utilization of its existing footprint.

In summary, Carvana’s wholesale marketplace success demonstrates it is well-positioned to disrupt legacy players like Copart.

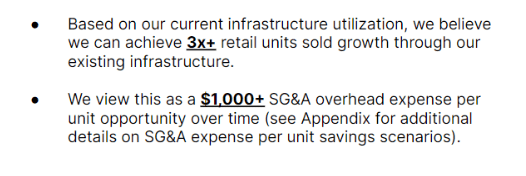

CVNA

We believe this segment will catalyze margin expansion and earnings growth to surpass incumbent dealers and auction platforms as indicated by the management on potential further cost savings.

CVNA

Reducing Bankruptcy and Business Model Risk

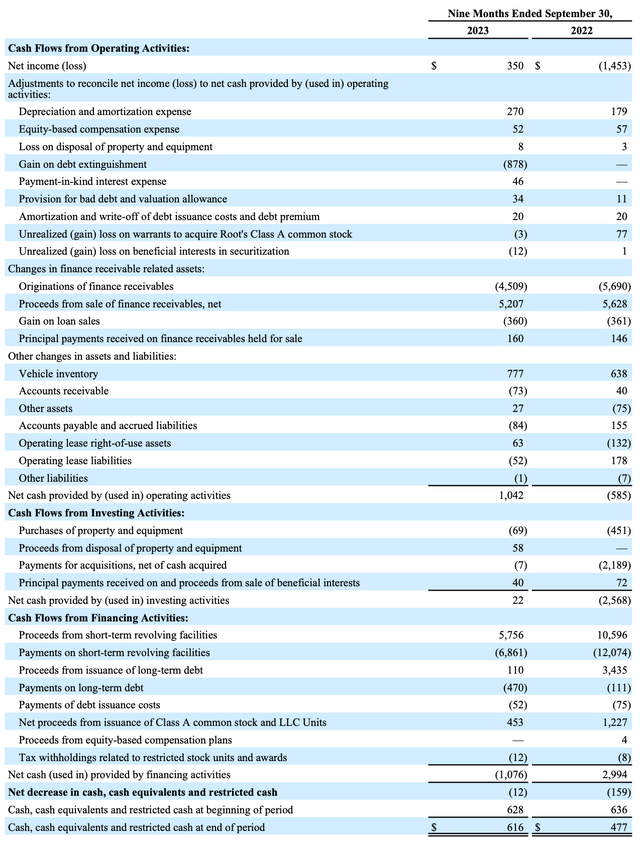

Bankruptcy risk appears to be diminishing for Carvana following its latest earnings. The company generated $1 billion in cash from operations in the nine months ended September 30th. This demonstrates Carvana’s ability to fund ongoing operations from internal cash flows.

CVNA

Furthermore, Carvana showcased the immense potential of its wholesale auction marketplace business. As this high-margin segment scales, Carvana can rival and exceed industry-leading profitability.

Given the wholesale opportunity, we no longer view Carvana’s penetration rate in the retail used car market as a major concern. It is not critical for Carvana to dethrone CarMax as the B2C used vehicle leader. Instead, we will focus analysis on Carvana’s progress in expanding its auction fee revenue. This will be the key driver of long-term profitability.

The Marketplace Model: A Transformational Strategy

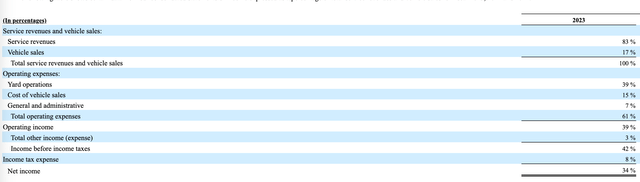

Additionally, it is important for investors to note that Carvana separates its marketplace revenue from its traditional wholesale revenue in its financial reporting. This is because they represent distinct business activities.

Specifically, Carvana charges a fee when other dealers use its platform to auction vehicles. This marketplace revenue comes from Carvana providing an online auction marketplace, not from holding inventory.

In contrast, Carvana’s traditional wholesale revenue comes from buying and selling vehicles to dealers from its own inventory, taking ownership risk. The company wholesale vehicles just like any other used car dealer.

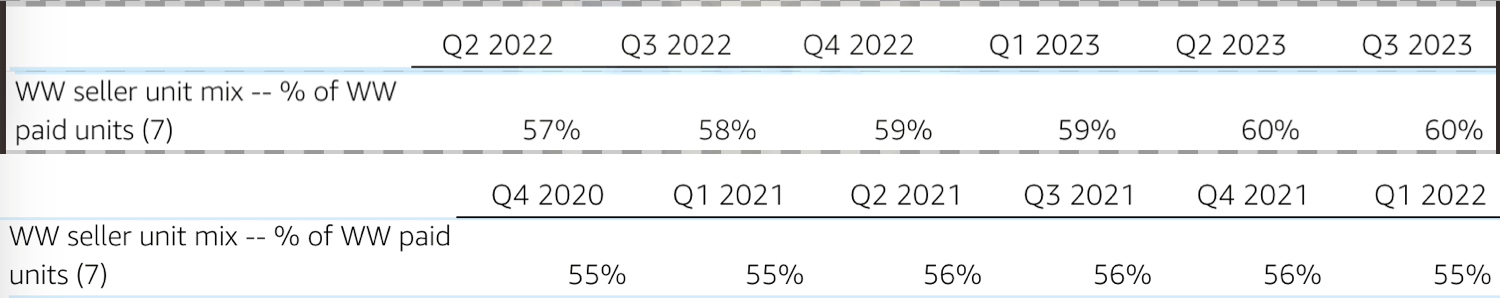

In a recent article, “Wayfair’s Marketplace Model: Unleashing Long-Term Potential”, we discussed the immense potential of marketplace business models compared to traditional retail. We used Amazon as a prime example of a company that transformed from an inventory-holding online retailer to a marketplace platform. As shown in the chart below, Amazon’s revenue mix has shifted with third-party seller services steadily rising from 2020 to 2023.

AMZN, LEL

To recap the key benefits of the marketplace model that we highlighted previously:

Advantages of the Marketplace Model

The advantage of the marketplace is obvious. First, Amazon can increase revenue streams such as third-party seller services (shipping, etc) and advertising services. In fact, we see these two business streams are growing at a strong double-digit rate and become a core contribution to Amazon’s retail growth in recent years. The additional revenue streams can further fuel more promotional room for Amazon to gain market share in events such as Prime Day or Black Friday, thus securing its cost advantage.

Second, the marketplace offloads the inventory burden of the retailer. The question investors should think about is first why do retailers hold inventory in the first place? Because in the traditional retailer model, it is very hard to track the performance and consumer feedback of suppliers of the retailers. For instance, a supplier in China should have a hard time understanding how their products perform in Walmart’s retail locations in Minnesota. It’s just too hard to track the sales and adjust production based on consumer feedback in the traditional model. That’s one of the main reasons retailers bought out the inventory in the first place.

However, the emergence of e-commerce has solved this issue as now consumer footprints are traceable in real-time. Hence, the emergence of the marketplace is the revolution of the retailer model as now the retailer doesn’t need to carry the inventory. Suppliers of retailers can trace everything through the marketplace platform and adjust their product strategy and inventory levels in real-time. As consumers are now more comfortable buying things online, the marketplace model saves friction costs through the value chain by connecting consumers with suppliers directly. This cost reduction will enhance the competitive advantage of the marketplace compared to traditional retailers over time. Hence, we are very optimistic about the long-term opportunity of Wayfair’s marketplace model.

This analysis underscores why Carvana’s expansion into online used vehicle auctions has such strong potential. As Carvana grows its marketplace revenue, it can emulate Amazon’s platform playbook – earning high margin fees on transactions without the risks of holding vehicle inventory. The marketplace opportunity could be transformative for Carvana’s profitability and valuation over time. We believe this segment deserves close tracking as a barometer of Carvana’s total addressable market and path to sustainably higher earnings power. Carvana’s wholesale marketplace capabilities can also ultimately feed back into and strengthen its B2C used car sales. Looking ahead 10 years, we foresee the used vehicle marketplace operating model transforming dramatically from today.

For these reasons, we are very bullish on Carvana’s long-term future as it leverages its wholesale segment and technology to revolutionize the used car value chain. The transformation towards a digital marketplace has only just begun, and Carvana appears poised to emerge as the dominant player in this expanding ecosystem.

Valuation Reassessment: Recognizing Carvana’s Potential

Our initial valuation approach for Carvana assumed it could capture a 5% share of the total B2C used vehicle market long-term.

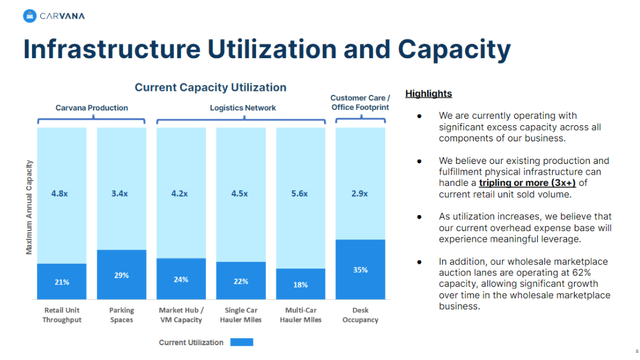

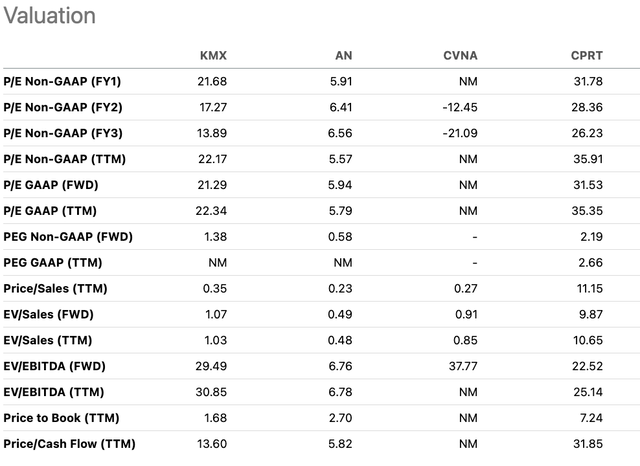

However, after assessing the potential of Carvana’s wholesale auction marketplace, we believe a different valuation framework is warranted. Carvana currently trades at a P/S ratio of just 0.27x, in line with B2C used car peers but far below the valuation of wholesale peer Copart.

Seeking Alpha

Copart trades at a P/S ratio of 11.15 overall because the majority of its profits come from high-margin service revenue consisting of auction fees and ancillary offerings. If we value Copart just on its service revenue stream, it trades at a P/S of 15.3x, a much higher multiple.

If the market sees the potential of Carvana in the auction space, Copart will be the appropriate benchmark for Carvana as a result. For the last twelve months, Carvana generated $890 million in marketplace revenue. Valuing this segment at a comparable 15.3x P/S multiple yields a valuation of $13.6 billion. Carvana’s current market cap stands at just $5.4 billion in comparison.

We are confident that Carvana’s marketplace revenue will continue rapidly expanding in the coming years. The current revenue run rate likely understates the earnings potential as the segment grows. Consequently, a 15.3x multiple represents a conservative floor for valuing Carvana’s marketplace today.

Given the immense potential of its wholesale auction platform, we are raising our price target for Carvana to $78 per share. This target applies the marketplace comp to Carvana’s current revenue scale but accounts for significant further growth ahead.

Conclusion

2022’s inflation and rising interest rates have prompted many investors to shed companies perceived as unprofitable “zombies.” We agree this is prudent in most cases, but are actively buying the dip in certain e-commerce names like Carvana and Wayfair (W) despite profitability concerns.

Our conviction stems from the power of the marketplace model to transform economics for digital platforms. By shifting from outright retail to commission-based transactions, companies can boost margins, capital efficiency, and cash generation. Carvana’s early success with used car auctions demonstrates this potential perfectly.

Despite widespread doubts, Carvana’s management stuck to their vision and is now seeing the benefits materialize. The long-term plan is coming together with wholesale marketplace revenue scaling rapidly. Even in a challenging macro climate, Carvana is delivering the proof points needed to transition towards sustainable profitability.

We applaud Carvana’s determination and foresight. The company appears poised to emerge as the clear leader in online used auto transactions. We upgrade Carvana to a Strong Buy rating as the market fails to recognize the immense earnings potential ahead. The wholesale opportunity is the light at the end of the tunnel that will allow Carvana to transform into a fundamentally strong business.

Read the full article here