Since I last wrote about Comerica (NYSE:CMA) two months ago, shares have fallen by 13% with losses that had been even worse before Thursday’s 6% rally on hopes the Federal Reserve has completed its rate-hiking cycle. Responding to a commenter on October 27th, I said that given the drop in shares, I would now view the stock as a buy, given what I believe was an overly punitive response to its quarterly earnings. In this article, I will explain the thinking behind my more optimistic view of CMA in more detail.

Seeking Alpha

Ultimately, like many regional banks, Comerica faces pressures. The fight for deposits has been competitive and increased funding costs. The inverted yield curve has weighed on net interest margins, and unrealized losses on its fixed income portfolio will take years to fully disappear. However, at some point, as long as a business is viable, enough of the bad news can get priced in to make shares, even in a battleground stock, attractive. That is where I land on Comerica. Its problems have not disappeared, but it is working through them, and they are sufficiently in the price.

In the company’s third quarter, Comerica earned $1.84, which was down from $2.60 last year. As with essentially every bank, Comerica has been hit with higher funding costs as Silicon Valley Bank’s failure caused significant churn in deposits, particularly those above the FDIC insurance limit and those that are non-interest bearing (NIB). NIB accounts are largely transactional (i.e. used to make payroll), which is why banks do not pay interest on them. When rates were close to 0%, customers may leave excess funds in NIB accounts since the opportunity cost was so small. With rates above 5%, there has been an effort to bring those balances down to the lowest level needed to meet daily/weekly transactional needs and re-deploy the rest into interest-earning vehicles.

I first recommended investors rotate out of Comerica back in October 2022 specifically because they were paying so little on deposits relative to peers that they would be susceptible to deposit flight. Indeed CMA has been a relative “loser” in the deposit battle this year, with $8 billion of net deposit loss, representing an over 11% decline. While it seems the worst of the regional banking crisis has passed, a key litmus test for me before investing in any of these stocks is growing comfortable that they have stabilized their deposit situation. If they have, we can estimate and model future earnings, which may be impaired vs the past but at least can be predicted vs those who may see ongoing attrition.

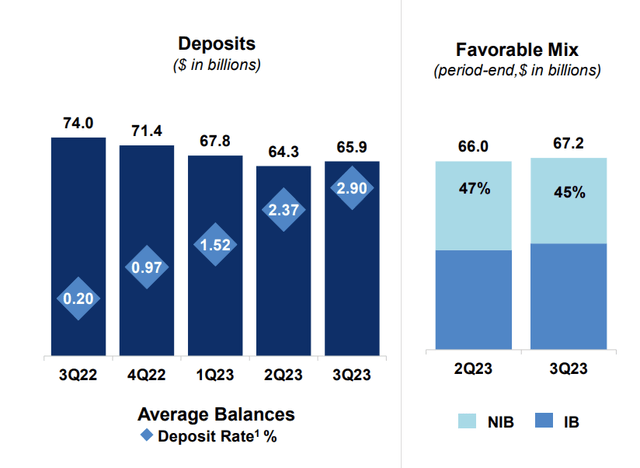

As painful as the process has been, Comerica appears to have turned the corner and bottomed out on deposits. In Q3, average deposits were up $1.5 billion to $65.9 billion. CMA has done this by aggressively raising the rate it pays on deposits, from just 0.20% last year to 2.90% in Q3. This 53bp increase was the slowest increase since Q3 2022, suggesting we are getting towards the end of the deposit funding increases. Indeed, management said that deposit “betas” (the amount of fed hikes it has to pass through) have begun to moderate late in Q3.

Comerica

Now, mathematically even if deposit rates hold at end of Q3 levels, funding costs will be higher in Q4 as increases made partially through Q3 are in place for all of Q4. However, I would expect a much smaller increase in Q4 as rates have stabilized with no changes by the Fed, likely about 25bp. During the quarter, interest-bearing deposits were up $3.1 billion, and noninterest-bearing down $1.5 billion. During the conference call, management noted the pace of NIB decline has fallen, and they are seeing balances stabilize as accounts hit their practical floors needed to support clients’ transaction activity.

CMA has finally brought deposit rates up enough and is beginning to grow balances again. As noted, this has come at a significantly increased funding cost. Because of increased funding costs, net interest income was $601 million, down $20 million from last quarter. While loan yields rose by 16bp, given the July rate hike, this was not enough to offset the 53bp rise in deposit yields, which pushed down net interest margins (NIM). NIM compressed to 2.84% from 2.93% last quarter and 3.5% last year. Next quarter, higher deposit costs will continue to weigh on NIM as I expect loan yields to be relatively flat. One positive though is that if CMA can continue to grow deposits, it can continue to pay down expensive wholesale funding. Comerica had $8.8 billion of short-term borrowings on average at 5.6%, which is down from $10.6 billion in Q2. At period-end, it was about $4.8 billion as it repaid balances throughout the quarter. If it can replace another $1.8 billion of short-term funding with deposits, that would offset about half of the 25bp rise in deposit costs and limit NIM compression.

Comerica also has $1.3 billion of unrealized losses on its swaps portfolio where it locked in rates below 3%, effectively turning some floating rate loans into fixed rate instruments. After years of 0% rates, banks were eager to lock-in higher rates, though they clearly did so too quickly. The headwind from these swaps should peak in the next two quarters and gradually decline similar to the securities portfolio. CMA has not done any new swaps this year to avoid exacerbating the problem.

There is more Comerica can do to manage net interest income. One of the biggest headaches for almost all banks is their securities portfolio of high-quality fixed income bought when rates were low and now sitting on large unrealized losses in accumulated other comprehensive income (AOCI). CMA’s portfolio is $20 billion on an amortized purchased price basis with a $3.6 billion unrealized loss ($2.8 billion after-tax) sitting in AOCI. The portfolio had $400 million of principal paydown in Q3, and CMA is not reinvesting principal, instead shrinking this portfolio to build liquidity. This portfolio has about $400-600 million in repayments per quarter with a yield on those assets below 2.25% through 2024. The marginal cost of funding for CMA as noted above is 5.6%, meaning these assets are cash-flow negative. As they mature, CMA can continue to pay down its highest cost funding and improve NIM. These principal payments provide natural liquidity for CMA.

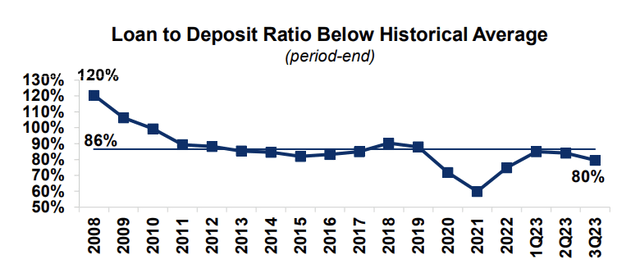

As it pays down these balances, CMA can also begin to grow its higher-yielding loan book. Average loans are down $1.4 billion sequentially to $54 billion as it is more selective about how it lends as falling deposits squeezed liquidity. Due to the Fed rate hike and mix shift, loan yields rose 16bp to 6.34%. As you can see below as deposits fell late last year into early this year, its loan-to-deposit ratio rose to post-financial crisis highs, which is why it turned to higher cost short-term funding. This is why CMA has rationalized its loan book and pulled back on new lending to a degree to create some breathing room here.

Comerica

Over the next few quarters, I would expect loan growth to stay constrained as Comerica ensure its deposit base has indeed stabilized. Once it has completed paying down all of its highest-cost funding via deposit growth and securities principal payment, it should be able to gradually grow loans with moderate growth a goal for management in 2024. The combination of slowing deposit beta, a funding mix shift away from wholesale funding to deposits, and an asset mix shift from low-yielding securities to loans should mean that Q4 is the nadir for net interest income with growth resuming slowly in 2024.

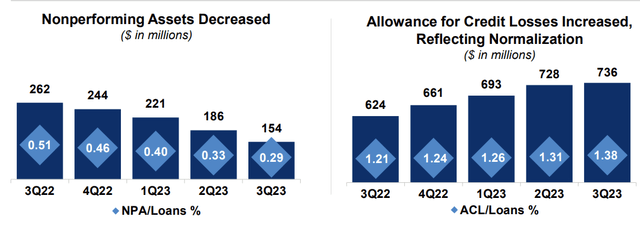

One positive about CMA is that while interest rates have been a challenge, the credit quality of its loan book is really strong. Loan loss provisions were $14 million, down from $28 million last year and $33 million last quarter. Provisions have been able to stay low because credit quality has held in. CMA had just 5bps of charge-offs. Even with provisions declining, its reserves still rose to 1.38% of loans. This provides more than 4x coverage of nonperforming assets, in excess of my 250-300% “healthy” level.

Comerica

One particular positive is that Comerica has focused on business banking, not commercial real estate lending. This is the sector that faces the most pressure. It is particularly encouraging to see that office is just 6% of its commercial real estate loan portfolio and 1% of its total loan portfolio. Even if losses on this portfolio were to be elevated, the share of loans is so small as to have only a marginal impact on CMA’s financials.

The bank’s Common Equity Tier 1 (CET1) ratio was 10.8% from 10.3% last quarter. This is a healthy level in isolation. Given its asset quality, CMA can safely run at about 9-9.5% with a regulatory minimum of 7%. However, this excludes its unrealized losses in AOCI, which would have a -5% impact. Now because CMA has below $100 billion in assets, it does not need to fully phase in these losses to its capital calculations like bigger banks will. Still, it is useful context as this is why CMA is building capital and not buying back stock.

Fortunately as bonds and swaps mature, its AOCI loss will shrink. At the 9/30 rate curve, this headwind will improve by 185bp by end of 2025. That would leave CMA with 7.7% of capital, above its 7% minimum but still too low. Of course, CMA is also generating capital. Assuming about 7bp of NIM compression from Q3 levels and no improvement in 2024 alongside modest expense growth to be conservative, CMA has about $6.20 in earnings power. After its dividend, it can retain over $400 million/year in earnings. That would get it past 9.5% fully including AOCI by the end of 2025.

Today, shares are at less than 7x forward earnings. I believe investors can feel increasingly comfortable about CMA’s earnings power with deposits stabilizing, and improving asset/liability mix shift should be a tailwind. Right now, investors also earn a 6.7% dividend yield, and I see scope for a slow return to buybacks in 2025. As markets grow comfortable the deposit situation has normalized and begin to see buybacks entering the 12-month outlook next year, I see room for shares to move higher and believe they can gradually move to a high-single digit multiple seen elsewhere in the sector or about $55, providing over 20% of upside. The bad news is fully priced in, and CMA is a buy.

Read the full article here