Introduction

Offshore support vessels are one of the themes in my portfolio. I like Tidewater (TDW) and Siem Offshore. However, the industry is much broader than that. Norway has traditions in shipping and shipbuilding, including offshore vessels. On the Oslo stock exchange are listed many OSV enterprises. However, in the US, there are only two publicly traded companies. TDW and SEACOR Marine (NYSE:SMHI).

SMHI has 59 vessels at an average age of 9.1 years, operating globally. In September, the company improved its debt structure, consolidating a few credit facilities into one. The direct vessel profit increased from $15,785 to $36,758, or more than a 100% growth. The company`s bottom line has almost reached the breakeven point in 3Q23. Compared to TDW and Siem, SMHI is priced in the middle. However, I consider TDW and Siem as superior businesses.

Why offshore? Part 2

In my article about TDW, I argued why I expect a deficit in the OSV market. In a few lines, I will recap my thesis and then add new information. Offshore vessels’ order book has been recording low at 2.5%. The figure is the lowest among all types of vessels. On the other hand, shipyard capacity has declined by 65% over the last 15 years. However, the demand is growing due to deep water exploration revival. The deep water projects have solid economics: $40/barrel breakeven cost, 31% IRR at $70/barrel, and the lowest average CO2 intensity among the various fields.

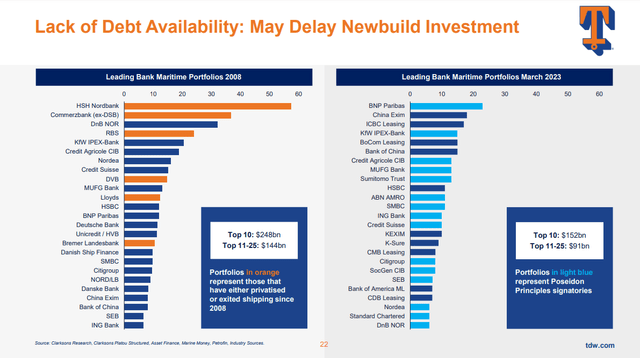

Let`s add two more arguments. The first one is the lack of debt availability. The chart below from the last TDW presentation gives a glimpse into the maritime lender’s portfolios.

Tidewater presentatio

The left column illustrates banks’ portfolios in 2008 and the right in March 2023. There are a few things to mention. Many Chinese banks are in the top ten, and Scandinavian banks have dropped their leadership. Change is heavily dependent on oil imports. I expect Chinese banks to cement their position as one of the leading financiers in the industry. Given the global economic balkanization, OSV financing will not be easily accessible. China will not finance US companies, and Europe might not finance Global South enterprises. The banks will prioritize funding businesses from friendly countries. Simply put, that will starve the industry for capital.

Another constraint is the limited capital. In 2008, the top ten banks held $248 billion of loans, while the top 11-25 held $144 billion. Today, the first ten banks own $152 billion, and the next 11-25 $91 billion. I expect banks` loan portfolios to grow. However, the growth rate will be a primary constraint for new-build investments.

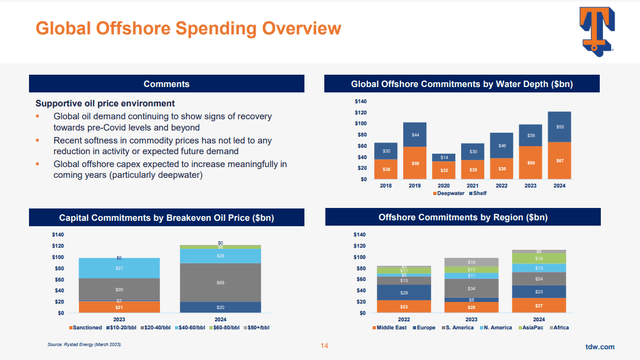

I mentioned the superior economics of deep-water projects will push the demand. Let’s dig deeper into the topic. The chart below from the TDW presentation gives more details on offshore spending.

Tidewater presentation

The top right graph shows global offshore commitments by water depth. The deep-water growth rate surpasses the shelf growth rate. The bottom right represents growth by region. In 2024, Europe and Asia/Pacific investment to grow by more than 150%. North America and the Middle East, too, keep attracting capital. The most significant decline in investment is in Africa and Latin America. Global demand will grow, but it will not be evenly distributed.

What does the company do?

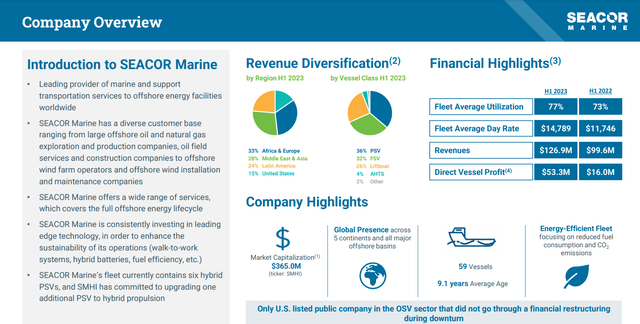

The leading OSV country is Norway. In the US, we have two major companies: Tidewater and SEACOR Marine. SMHI has a global presence with an accent on Africa, the Middle East, and Europe. The image below from the last SMHI presentation gives an overview of the company`s activities.

Seacore presentation

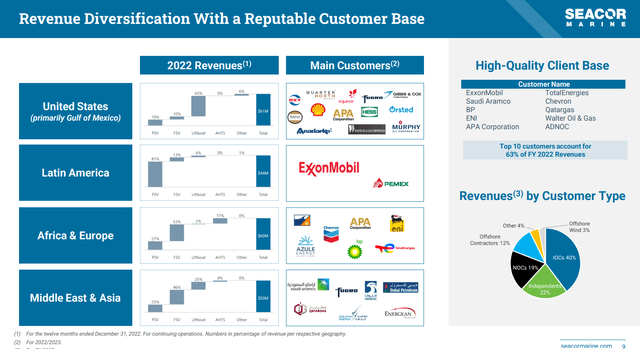

Focusing on Europe, the Middle East, and Africa is an advantage, considering the expected investment growth in those regions. SMHI`s clients are major oil and gas companies. The graph below shows geographical and by-customer revenue changes for 2022.

Seacore presentation

The top ten customers account for 63% of the company’s revenue. The pie chart on the bottom left shows customers by type: 19% national oil companies (NOC), 40% international oil companies (IOC), 22% Independent oil companies, 12% offshore contractors, and the remaining is offshore wind and other.

Company Fleet

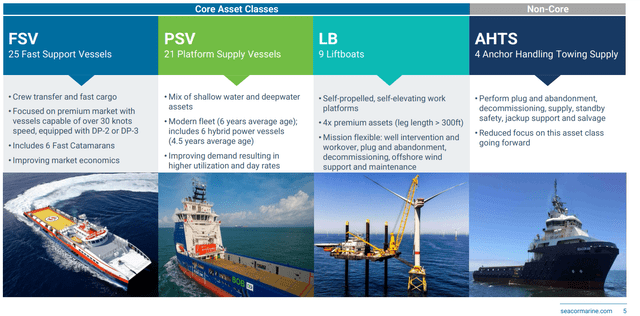

SMHI fleet is shown in the image below.

Seacore presentation

The company owns 25 fast support vessels (FSV), 21 platform support vessels (PSV), 9 lifeboats (LB) and 4 Anchor Handling Towing Supply (AHTS). Fleet’s average age is 9.1 years.

In the 3Q23 results report, SMHI reported fleet utilization figures across different regions.

- United States 57% 3Q23, five-quarters average 48%

- Africa and Europe 84% 3Q23, five-quarters average 87.6%

- Middle East and Asia 67% 3Q23, five-quarters average 77.8%

- Latin America 87 % 3Q23, five-quarters average 91.2%

The best-performing region is Latin America, followed by Africa and Europe. The laggard is the United States region.

Shareholders

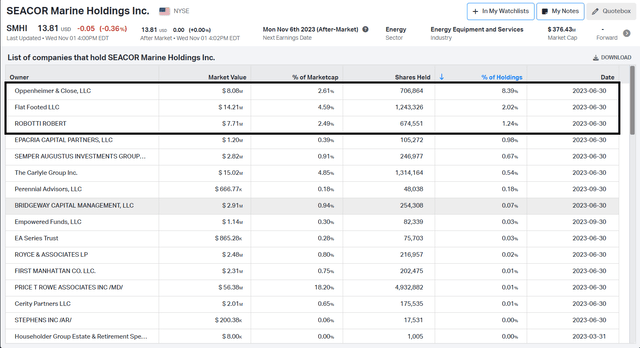

The major shareholders are shown below. I filtered the data not by the highest % of Market Cap but by the highest % of holdings.

Koyfin

Like TDW, Robert Robotti is here, owning 2.49% of the company, which is 1.24% of his holdings. Oppenheimer and Close LLC is a hedge fund following value investing principles. It has a concentrated portfolio, with SMHI being the largest, with 8.39% of the fund’s holdings. Flat Footed LLC is a boutique hedge fund holding 4.59% of SMHI shares. They represent 2.02% of the fund`s holdings.

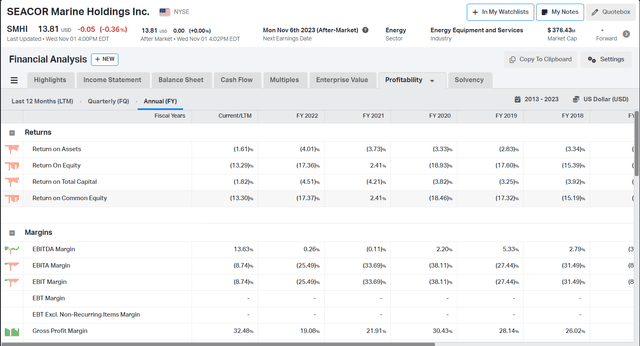

SMHI solvency, liquidity, and profitability

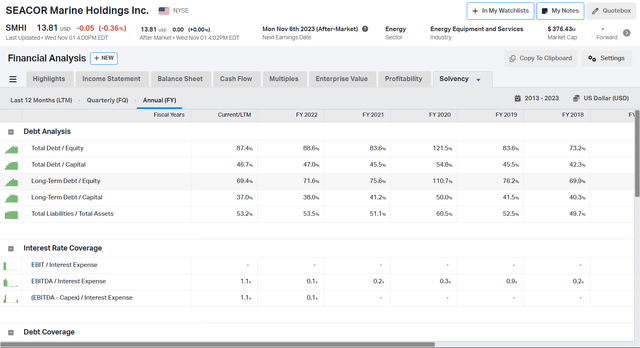

SMHI’s balance sheet is not overleveraged. The company`s management has been prudent with debt despite the difficult years. The table below shows the company`s debt profile and interest coverage.

Koyfin

SMHI has $291 million in long-term debt and $55 million in cash. The interest expenses (TTM) are $35.5 million, while EBITDA (TTM) is $52 million. The total debt/Total capital ratio has been stable between 45-52% for the last five years. Those figures prove SMHI’s standing as a liquid and solvent company.

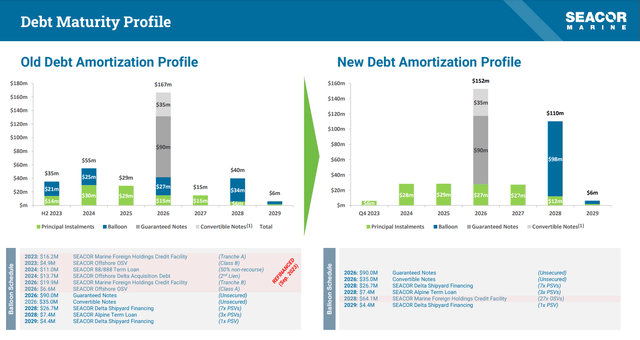

In September, the company signed a new $122 million secured credit facility. It consolidated five separate facilities with maturities 2023-2026. The consolidated maturity is moved to 2028. The table below provides information about the new company`s debt profile.

Seacor presentation

The left side shows the old debt amortization profile, and the right is the one. In 2026, the company has to repay $152 million; $ 135 million are unsecured notes, while $27 million are principal installments. Until 2026, SMHI will pay $63 million in principal installments to repay. Currently, SMHI has $55 million in cash and $63 million in receivables. I do not expect any issues with those obligations.

SMHI’s profitability has improved, as seen in the graph below.

Koyfin

EBITDA margin has increased from almost zero in 2022 to 13.63%. It is still lower than TDW’s 40% margin. I expect, with rising day rates, margins to grow further, increasing the company’s Return on Capital.

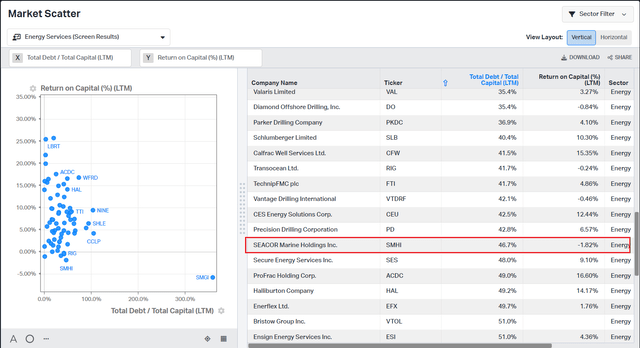

SMHI is a mediocre capital allocator. The chart below compares energy services companies based on Tota debt/Total Capital and ROIC.

Koyfin

Despite an adequate Total debt to Total capital ratio of 46.7%, the company cannot generate positive ROIC. Siem Offshore has 55% Total debt/ capital and 5.5% ROIC. TDW has 16.9% and 4.7%, respectively.

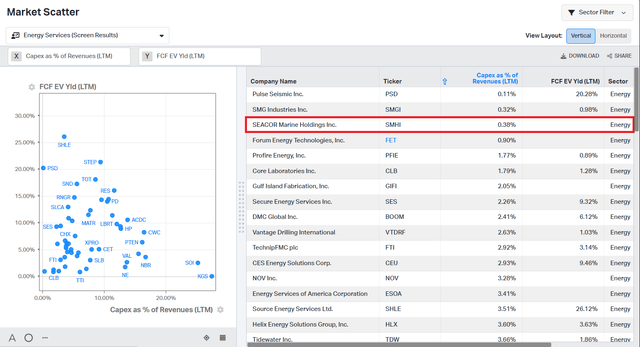

SMHI spends a mere 0.38% of its revenues on capital investments, as seen in the graph below.

Koyfin

The company`s managers did an excellent job with its balance sheet, maintaining adequate leverage and restructuring its debt. However, such low CAPEX is not impressive. TDW`s CAPEX/Revenue is 3.66%, and Siem Offshore is 5.6%.

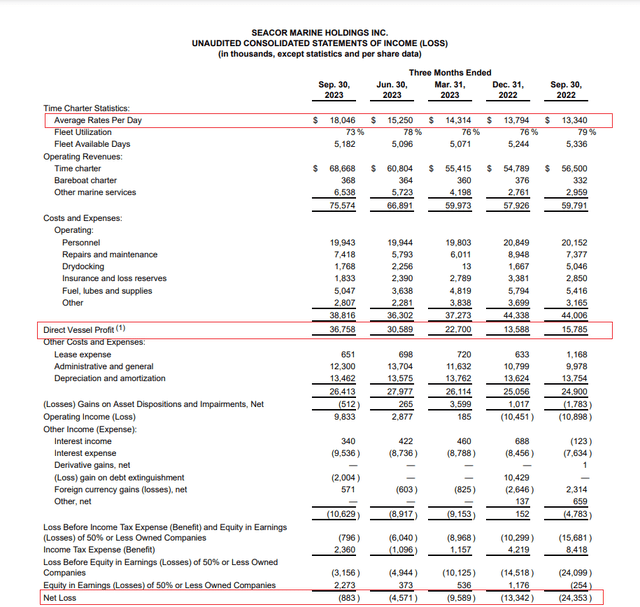

SMHI 3Q23 results

Let’s look at the last company results published yesterday. The table below from 3Q23 results shows SMHI’s income statement for the previous five quarters.

Secor 3Q23 results

For the last five quarters, the day rates have grown significantly: from $13,340 in 3Q22 to $18,046 in 3Q23. It is 38% growth for that period. Direct vessel profit increased from $15,785 to $36,758, or more than a 100% growth. The company`s bottom line has almost reached the breakeven point 3Q23. With the new debt structure and rising pay rates, I expect SMHI to become profitable next quarter.

Valuation

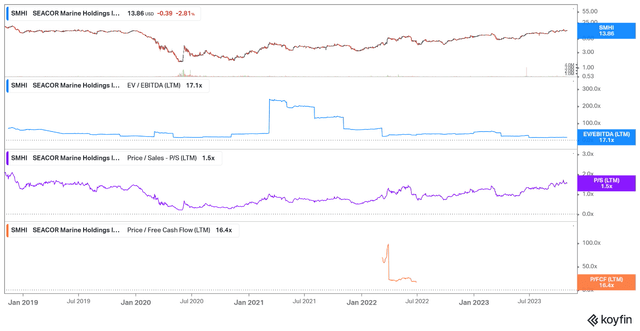

To value SHMI, I use EV/EBITDA, Price/Sales, and Price/Free/Cash Flow.

Koyfin

SMHI has 17.1 EV/EBITDA, 1.5 Price/sales, and 16.6 Price/FCF. It is cheaper than TDW. I believe the reason for that is the smaller Secor fleet (59 vessels) and its lower utilization (77%) compared to TDW. Looking at TDW’s past performance, I expect EV/EBITDA to reach at least 40 due to improved profitability caused by rising day rates and constrained supply.

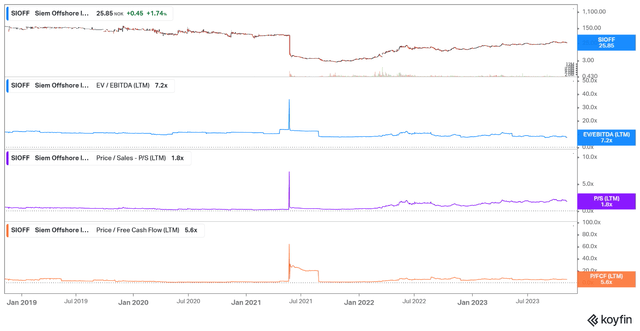

Let’s look at Seim Offshore multiples.

Koyfin

EV/EBITDA is 7.2, Price/Sales 1.8, Price/Cash Flow 5.6. Siem is cheaper than SMHI and TDW. The company is listed on the Oslo Stock Exchange and the London Stock Exchange. Its lack of NYSE listing keeps it the cheapest in the group.

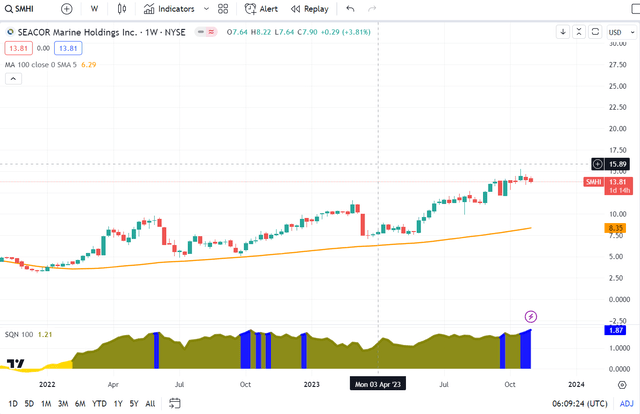

Price Action

SMHI price action is not extended like TDW. Its shares trade above 100 weeks simple moving average. However, the SQN indicator is in a bull volatile regime (blue color).

Trading View

Bull volatile regimes are risky for the first entry. However, they are great for adding risk to the already open position. The immediate resistance is at $14.35 – $14.75 area. A confirmed breakout above might indicate a potential bull move.

Risk

SMHI carries all inherent risks for the offshore industry. The company`s debt is well structured, giving enough room for adjustments. For the next three years (including 2023), the company must repay $63 million. SMHI owns enough cash to cover its obligations.

The geopolitical risk is getting more pronounced. SMHI has 16 vessels dispatched to the Middle East and Asia. This is 27% of the company`s fleet. The region brings in 28% of the company`s revenue. For comparison, TDW has less than its fleet in the Middle East, while Siem does not operate there.

The cyclicality of the business is another risk to consider when buying offshore stocks. Despite how good the company is during a bear market, all businesses suffer. Bear markets in the oil and gas industry are incredibly steep, while during good times, the price can reach stratospheric levels.

Investors takeaway

SEACOR Marine is a good company but not good enough. It has a fleet with a 9.1-year average age. The company operates globally with an accent on Europe, Africa, and the Middle East. The rising day rates improved notably company profitability. SMHI restructured its debt, pushing further debt maturity. I hope the spare cash will be allocated to capital investments to grow its fleet. SMHI is cheaper than TDW but dearer than Siem Offshore. In my opinion, Siem and TDW are better companies. Investing means picking the best companies (according to my criteria) and not being satisfied with average businesses. For now, my verdict is a hold rating.

Read the full article here