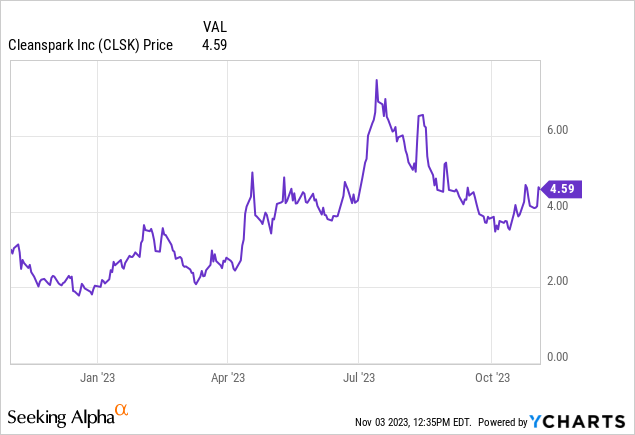

CleanSpark’s (NASDAQ:CLSK) stock has delivered a one-year performance of 27%, but at around $4.6 a share, it is still far below its July 13 high of $7.5. Now, as a Bitcoin (BTC-USD) miner, its shares are certainly impacted by the price of the cryptocurrency, but other factors also come into play such as finances, cost of production in an economic environment still marred by the lingering effects of high inflation while not forgetting the forthcoming Bitcoin halving event in April 2024.

By going through these factors, the aim of this thesis is to make a strong investment case for the miner and I also take this opportunity to highlight some of the risks.

I start by deep-diving into the catalysts that are determining the current performance of the cryptocurrency.

Bitcoin’s Price Determines Miner’s Revenue

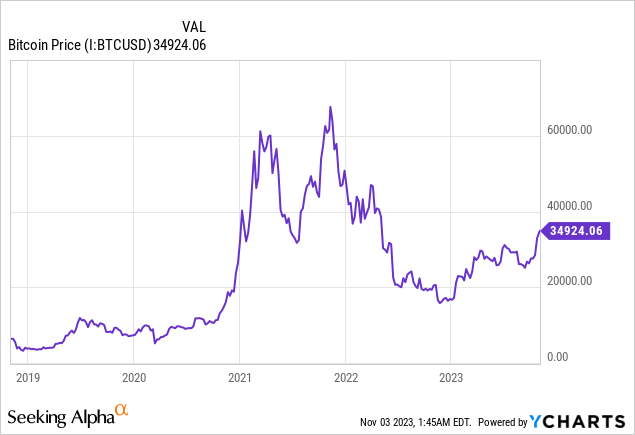

It seems all green for the world’s largest cryptocurrency by market cap as it broke through the $35K resistance level on November 1, last reached around mid-May 2022 as charted below. At that time, the main reason for its downfall was a super hawkish Federal Reserve, which had just embarked on a path to hiking interest rates at an unprecedented pace in recent memory. The situation is completely different today with rates already at a record of 5.5%, a level only exceeded in the early 2000s. Furthermore, the Chairman of the U.S Central Bank recently hinted that he could be done with raising implying that a continued pause could give further impetus to Bitcoin, in a reversal of what happened in 2022.

Coming back to 2022, another factor that weighed significantly on the performance of digital assets was the crash of cryptocurrency exchanges like FTX in November of that year whose founder Sam Bankman-Fried has just been convicted of fraud for allegedly stealing at least $10 billion from customers and investors.

Learning from that event, the collapse of an exchange can be contagious to the whole ecosystem as investors desperately try to exit their positions, in turn causing liquidity issues and volatility, illustrated by Bitcoin’s dropping to a low of around $18K at the end of 2022. Furthermore, unlike tech which benefited from the enthusiasm around the artificial intelligence theme, the dark moment for the world of cryptocurrencies persisted in the beginning of 2023.

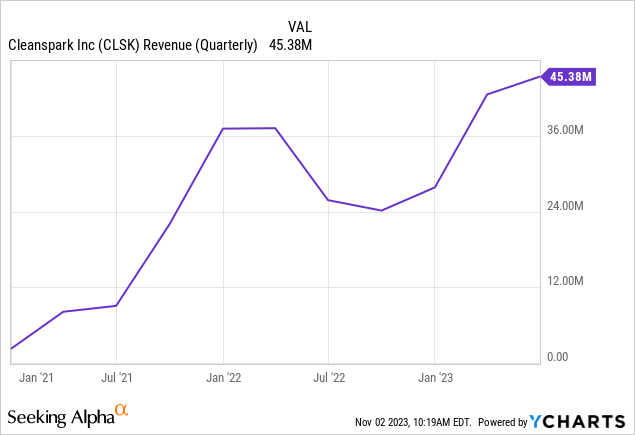

As a result, CleanSpark’s quarterly revenues which were previously on an uptrend, took a hit (chart below) as the miner obtained less money for the same quantity of Bitcoin sold, with the recovery only happening this year.

Now, instead of selling the digital assets it produces, a miner can HODL or hold part or all of them in its treasury. In this regard, strategies differ, and looking back at the beginning of 2022, CleanSpark was more of an exception as it sold most of its produce, instead of HODLing as was generally the norm among miners. This strategy paid off as, unlike peers, it did not have to eventually sell at a lower price.

More recently, the miner changed its policy to favor HODLing.

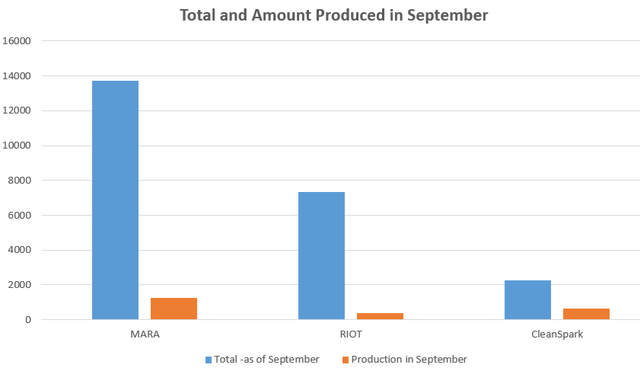

Thus, during the month of September, it mined 643 Bitcoins and sold only 80, or 12%, as it was left with a total of 2,240 Bitcoin holdings.

Comparing with Peers in View of Halving

Now, this is much lower than the 7,327 BTCs and 13,726 BTCs held by Riot Blockchain (RIOT) and Marathon Digital (MARA) respectively. This means that these two miners’ balance sheets (in terms of cryptos) are stronger going into the Bitcoin halving event. For investors, halving refers to the process of reducing the rate of generation of cryptocurrencies or coins per block (of blockchain) implying less reward for Bitcoin miners.

Looking further, this feature was coded into Bitcoin’s software code at the time of creation to ensure that its supply becomes limited with time thereby conferring to it more value. Hence, currently, miners receive 6.25 bitcoins (BTC) for each block they successfully mine, and the next halving event, to take place sometime in April 2024 will cut this to 3.125. In other words, it means that mining difficulty will increase by two times in about six months, making it important for CleanSpark to catch up.

In this respect, it produced 643 BTC in September which is more than RIOT’s 362, and is second only to Mara’s 1242. Therefore, while not being the first in terms of production capacity among the publicly listed miners, one still has to reckon with CleanSpark, especially given the speed with which it is boosting capacity.

Chart prepared using data from (www.seekingalpha.com)

For this purpose, during its third-quarter earnings call on August 9, the company reported that it was increasing production capacity from its current hashrate of over 9 EH/s to 15 EH/s over the next half of the year through additional mining rigs.

Now, considering the 659 BTC and 643 BTC for August and September respectively, this leads to an average of 651. Now, for October to April 2024, or seven months, this comes to about 4,557 (651 x 7). Now considering that it sells about 12%, its treasury will be left with 3,990 Bitcoins, which added to the 2,240 gives 6,230 BTC in total. This figure does not take into account that it is adding capacity by around 67% (15/9) within the seven-month period leading to April 2024.

Therefore, CleanSpark has shifted gears in time to accumulate the digital commodity which is positive for its treasury as halving introduces additional constraints on supply. This also means that in case demand remains the same, the prices should go up. Additionally, as a miner, it makes sense to HODL since this means receiving direct compensation for every block mined from the Bitcoin network.

Another key factor to consider is production costs.

Valuing in View of Better Growth and Profitability

These costs have to factor in the halving event as well as energy expenses, which makes it important to run facilities that are power efficient while operating at scale. Along the same lines, it is important to have all the mining rigs operating optimally instead of some lying idle as it consumes space. Therefore, irrespective of whether a miner has 500K or 200K machines and is producing one thousand or 500 coins per month, it is efficiency that ultimately counts.

To this end, according to CleanSpark’s CEO who is also the founder, the miner “runs the most efficient facilities at scale in the industry”.

Now, being efficient, or achieving more hash rates using less power should translate into better margins. Again, making a comparison with Marathon and RIOT, I found that CleanSpark indeed has the highest margins at 43.8% (as shown in the table below) and this despite having fewer revenues (on a trailing twelve-month basis) on which to spread its fixed costs.

Comparison of main metrics with MARA and RIOT (seekingalpha.com)

Furthermore, the degree by which its profitability exceeds peers, or more than 19% compared to Marathon, shows that CleanSpark has attained one of its corporate objectives to be “one of the largest most efficient publicly traded Bitcoin mining operators in the world”.

Shifting to growth, the miner scores better too as shown in the above table, a performance that is not being rewarded by the market when looking at its price-to-sales multiple of only 2.25x. Adjusting for a 67% increase of the P/S to 3.76x (2.25 x 1.67) which is still undervalued relative to its peers, the share price can potentially reach $7.75 (4.64 x 1.67). This target remains well below Wall Street’s average estimate of $9.97.

This is a fair target, given that it is based on CleanSpark’s capacity expansion of 67% which can further be enhanced by its higher level of efficiency. The miner also seems to be getting the timing right, notably by selling Bitcoin on the open market before the 2022 market slump and recently favoring HODLing, both in view of the halving event and Bitcoin breaking the $35K resistance level. At the same time, it is using the $22.5 million of cash available at the end of June 2023 to “fully fund” the purchase of additional equipment. Moreover, its treasury boasts a $14 million equivalent of Bitcoin while debt stood at only $18.8 million.

Therefore, with better growth and profitability metrics, while boasting a healthy balance sheet, CleanSpark is a Strong Buy. This said it is important to factor in some of the volatility risks impacting Bitcoin which is the miner’s underlying asset.

A Strong Buy After Factoring Risks

Some of these can be traced down to the war between Israel and Hamas, which weighed down on crypto assets according to Coindesk, in sharp contrast to March 2022 when the cryptocurrency spiked to 16% because of an escalation in the Ukraine-Russia conflict.

On a separate note, there is also giant asset manager BlackRock’s (BLK) application to issue spot Bitcoin ETF, the iShares Bitcoin Trust as I recently elaborated in a thesis. Now, this ETF which still has to be approved by the SEC re-appeared on a list of the Depository Trust & Clearing Corporation (DTCC), a financial services company, after being delisted for a few hours. This may have been interpreted by some investors as a sign of a launch of the spot Bitcoin ETF happening sooner rather than later.

Consequently, with some of the trading activity apparently dependent on ETF-related developments, there could be volatility to the downside, and, for this matter, the stock’s RSI of 60.38 indicates a slightly overbought condition. Also, the stock price being above its 10-day and 50-day moving averages, but below the 50-day moving averages shows that the price action will likely see fluctuations.

However, for those who want to focus on the longer term, or April 2024 and beyond, CleanSpark deserves much better, with its proven track record of getting the timing right.

Finally, by going through some of the factors that influence the price of Bitcoin and the impact of the halving event, this thesis rates CleanSpark as a Strong Buy, due to its undervaluation with respect to peers. Also, it is adding capacity to its mining fleet while operating with optimum efficiency.

Read the full article here