Investment Thesis

SS&C Technologies Holdings, Inc. (NASDAQ:SSNC) is a major player in the financial services software industry, generating over $5 billion in revenue and holding leading positions in various segments. Its growth strategy has consistently involved mergers and acquisitions. Despite concerns about economic uncertainty and the possibility of a recession affecting near-term bookings, I believe that SS&C’s software and services are crucial for financial institutions, and the company’s track record of consistently delivering healthy earnings per share and free cash flow growth indicates that any challenges will likely be temporary rather than long-lasting. The company trades at an attractive valuation, and I am optimistic on the company and hence assign a buy rating to the stock.

Q3 Review and Outlook

SS&C has lowered its revenue guidance for 2023, mainly due to lower expectations for its software-license business. This decrease in revenue growth, which dropped to 2.3% in the third quarter from 2.5% in the second quarter, has prompted concerns. However, there is potential for a rebound in the fourth quarter, driven by price increases and synergies from recent acquisitions, which could enable the company to achieve its 2023 target of 2.5% revenue growth. Encouragingly, the intralinks unit showed positive momentum with an 11.6% increase in the third quarter, and the Blue Prism deal offers long-term growth opportunities, expanding by 10% in the same period. Additionally, there is potential for margin improvement as the Blue Prism deal allows for better utilization of SS&C’s outsourcing-heavy delivery model and the implementation of more digital workers. During the third quarter, the company repurchased $96.9 million worth of shares, which accounted for a significant portion of its capital returned to shareholders. In general, the management’s strategy is to allocate 50% of cash flow to stock buybacks and the remaining 50% to debt repayment.

Growth of AUM Remains Positive

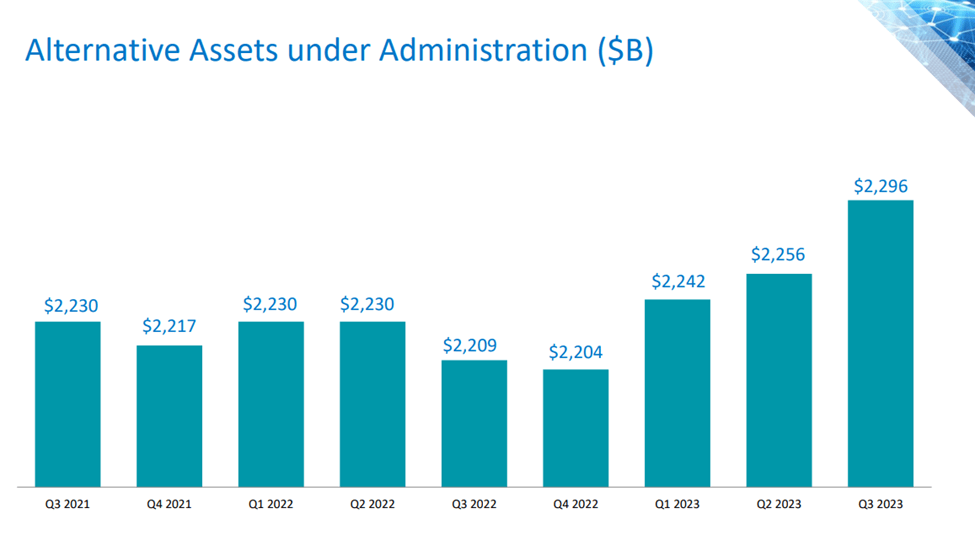

Being the largest third-party fund administrator for hedge funds and private equity firms, SS&C stands to gain from the growth of alternative assets under its administration. The company has successfully increased its market share in fund administration both through organic growth and acquisitions. By the end of the first quarter of 2023, SS&C had more than $2.2 trillion in alternative AUA, representing a slight increase from previous periods, especially as global challenges began to ease. Furthermore, SS&C’s active pursuit of mergers and acquisitions opens up possibilities for further expansion that may not be organic. This strategic approach can also create opportunities for cross-selling, ultimately enhancing margins and cash flow as SS&C integrates acquired businesses into its offshore delivery model.

Company Presentation

Financial Outlook & Valuation

In 2022, SS&C’s organic sales growth returned to a more typical level of 2%, aligning with its historical pattern of low-single-digit growth, following a surge to over 6% in 2021. The economic challenges faced during the current year are also restricting growth, but I expect economic conditions to improve, and there will be strong demand for both traditional and alternative asset administration software, potentially leading to low- to mid-single-digit organic growth. A significant portion of SS&C’s revenue comes from Software-Enabled Services, which are tied to software contracts lasting one to five years. The company maintains healthy revenue retention, with the Alternatives business benefiting from the strength of Private Markets. Additionally, the Wealth management sector presents another avenue for growth for SS&C.

SS&C generates substantial free cash flow and has the ability to efficiently manage costs and enhance margins with acquired companies. This capability allows the company to reduce its debt rapidly, even after significant acquisition expenditures, such as the acquisitions of DST Systems, EZE Software, and Intralinks, which totaled $8.4 billion in 2018. By the end of 2021, SS&C had managed to reduce its debt by over $2 billion, reducing its leverage from 4.5x at the end of 2018 to 2.7x. However, the acquisition of Blue Prism increased the company’s debt in 2022. Although the DST deal had a negative impact on organic sales growth, it resulted in increased cash flow and expanded margins. Despite facing challenges during the pandemic, SS&C’s margins held up well, though they were affected by inflation pressures in 2022.

SS&C’s cash-flow generation is backed by software contracts with highly recurring revenue streams. That supported more than $1.1 billion of operating cash flow in 2022, and consensus estimates suggest it will grow to $1.13 billion in 2023. Starting in 2019, the company began to leverage its pricing power, and it anticipates that price increases could contribute to approximately 100 basis points of annual sales growth through 2023.

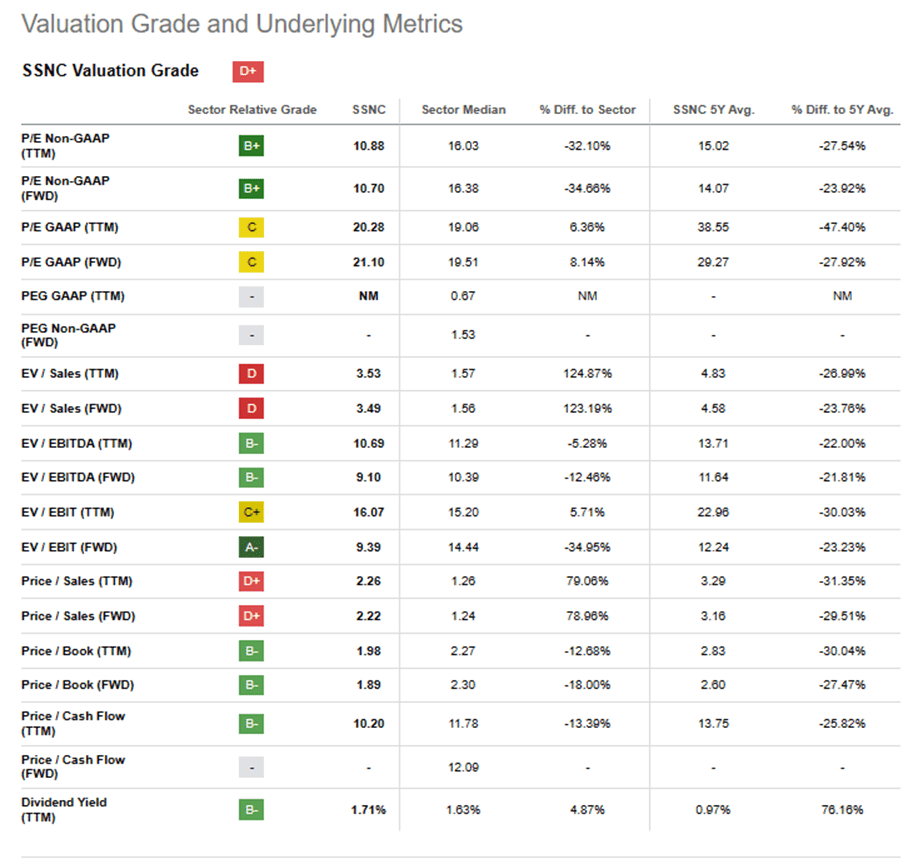

SSNC trades at a forward PE of 21x, just slightly above the sector median of 19x. The company generates one of the highest EBITDA as well as FCF margins among its peers, which is why I believe the multiple deserves a higher premium. Some of the company’s peers in the financial services space, like Enfusion, Inc. (ENFN) and Clearwater Analytics Holdings, Inc. (CWAN), trade at a significantly higher multiple compared to SSNC, although their revenue growth trajectory is much better compared to SSNC. However, I view the demand environment as supportive for SSNC, as clients look for cost optimization and think that SSNC’s multiple can re-rate higher to reduce the discount to large-cap peers in the financial services software space.

Seeking Alpha

Risks to Target

From 2005 to 2010, when SS&C was a private company, it acquired approximately 30 firms, spending around $500 million in total. These acquisitions had an average deal size of $17 million and were valued at 3-7 times the EBITDA multiple. However, as valuation multiples increased, it became progressively more challenging to generate value for investors based on return on invested capital. Between 2012 and 2022, SS&C conducted 35 acquisitions, including 8 significant deals, totaling over $14 billion in value. Given that acquisitions are likely to remain a crucial part of SS&C’s growth strategy in the future, the elevated valuation multiples could potentially slow down the company’s business development. Moreover, being a software provider and outsourcing partner for financial services firms during a recession can be challenging, as IT budget spending may be postponed or reduced. A recession can also result in a financial market downturn, leading to a decrease in assets under management and overall trading volumes, both of which are critical drivers of SS&C’s revenue growth, particularly in the fund administration business, which is priced based on assets under management.

Conclusion

SSNC is a leading provider of enterprise software and solutions for the financial industry, well-positioned to sustain its recent momentum by achieving mid-single-digit organic growth in its core businesses and realizing synergies from its acquisitions. Despite short-term challenges related to economic uncertainty, I believe SSNC’s essential software and services, coupled with a strong track record of robust EPS and FCF growth, will ensure that the company continues to navigate through a turbulent macro environment. I see the current valuation multiple appealing and assign a buy rating to the stock.

Read the full article here