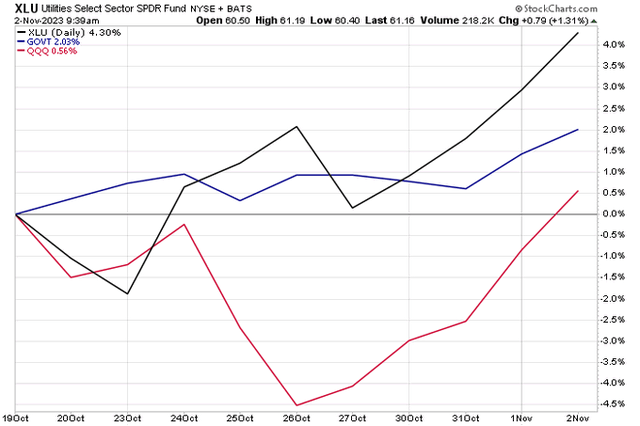

In an unusual twist, the often risk-off Utilities sector has outperformed the usually risk-on Nasdaq 100 ETF (QQQ) since Treasury yields hit their highs during the middle of October. I pointed this out to Michael Batnick, as he and Josh Brown discussed that the next market rally – should it occur on lower bond rates – could very well feature alpha from the XLU ETF. That has been the case so far, and with a mixed reaction to Apple’s (AAPL) earnings, that trend might just continue.

I have a buy rating on Alliant Energy Corporation (NASDAQ:LNT). I see shares as a value given relative strength in recent years and better regulatory conditions in the areas in which the company operates. Moreover, solid EPS growth should warrant stronger cash flows over the coming periods.

XLU Beating QQQ Since Yields Peaked

Stockcharts.com

According to Bank of America Global Research, Alliant Energy Corp. is a regulated investor-owned public utility holding company that provides electric and natural gas service to customers in the Midwest primarily through its Interstate Power and Light Company (IPL) and Wisconsin Power and Light (WPL) subsidiaries. LNT also has 16% ownership in the American Transmission Company (ATC), a federally regulated transmission company that operates in the Midwest.

The Wisconsin-based $12.7 billion market cap Electric Utilities industry company within the Utilities sector trades at a near-market 19.3 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.6% forward dividend yield. Implied volatility is low to moderate at 26.4% while the stock’s short interest is low at just 1.9%.

In early November, Alliant reported a mixed Q3. Operating EPS verified at $1.05, a solid $0.12 beat, while revenue of $1.08 billion was more than 4% lower than year-ago levels and a material $160 million miss. The management team offered guidance for 2024 – per-share profits are seen in the $2.99 to $3.13 range with a $1.92 dividend payout target. Earnings growth of 5-7% is seen over the intermediate term. Shares were up over 3% in early trading on Friday in reaction to the decent earnings report.

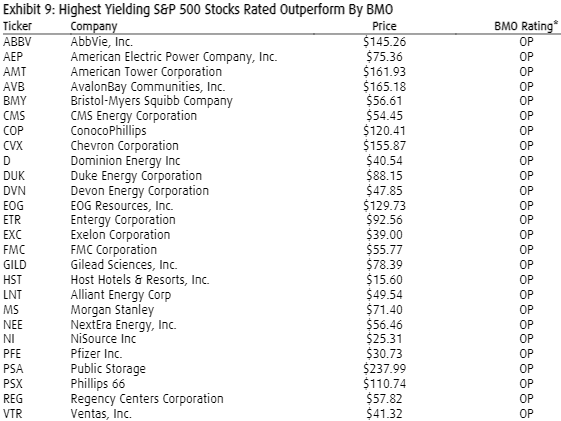

That news came after BMO Capital markets listed LNT as one of the highest-yielding S&P 500 stocks rated with an outperform.

BMO’s Top Yielders Rated Outperform

BMO

In terms of the firm’s operating environment, positive outcomes by the Iowa Utilities Board (IUB) regarding advance ratemaking for solar may imply better regulatory conditions for firms like Alliant, according to BofA analysts. While the renewable energy space has been hit hard lately, solar and wind installations across the Midwest remain important to the sector.

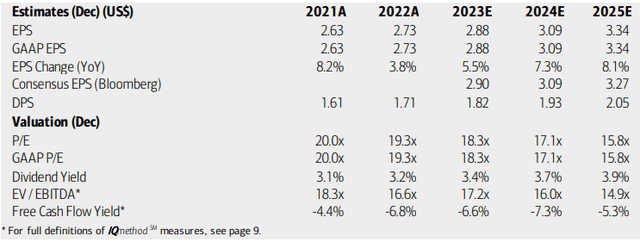

On valuation, analysts at BofA see earnings having risen by more than 5% this year with an acceleration in per-share profit growth in both 2024 and ‘25. The Bloomberg consensus forecast is about on par with what BofA sees. Dividends, meanwhile, are expected to rise at a steady clip over the next several years while its earnings multiples are not at screaming buy levels, but they are more attractive today compared with lofty ratios seen at times in 2022.

Alliant: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

If we assume $3 of next 12-month EPS and apply the stock’s 5-year average forward operating P/E, then the stock would be near $63. We should, however, put the P/E a few of turns lower given higher interest rates today. Using an 18 multiple, the stock should be at $54, putting shares mildly undervalued.

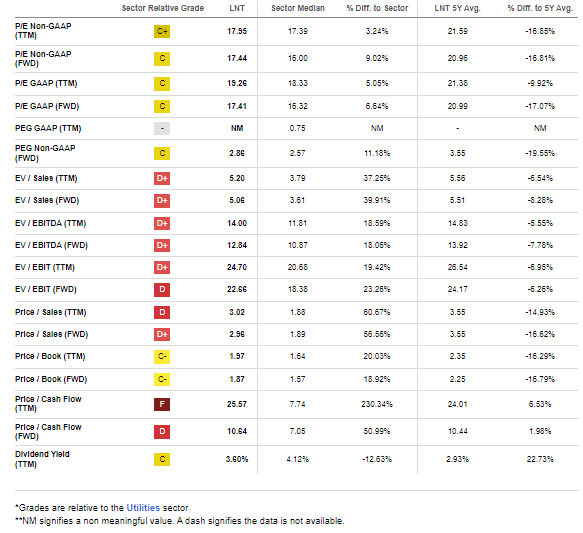

LNT: Mixed Valuation Ratios, Cheaper Vs 2022 Levels

Seeking Alpha

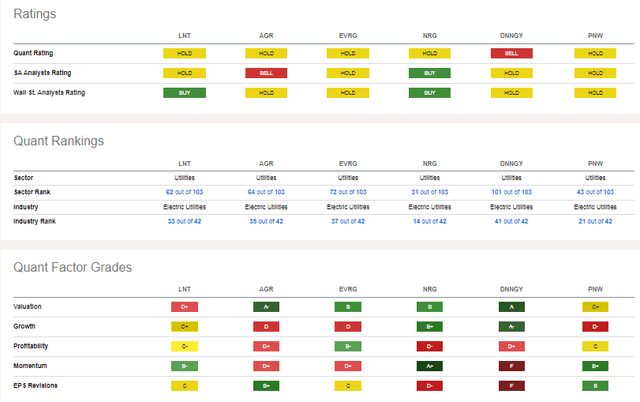

Compared to its peers, LNT features a soft valuation with near-average growth prospects. However, I like that the EPS is forecast to accelerate in the quarters ahead. Profitability should thus be robust, and with emerging share-price momentum, the valuation and technicals are coming together nicely – though I do not expect this Utilities-sector firm to skyrocket. EPS revisions have been mixed, but the recent earnings beat should help on that front.

Competitor Analysis

Seeking Alpha

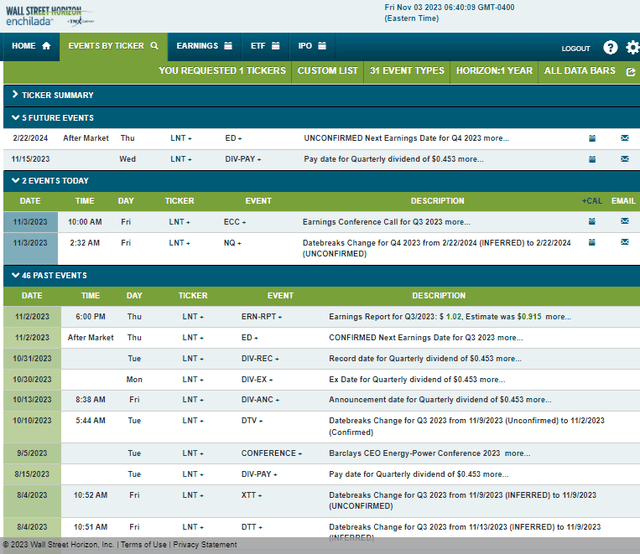

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 2023 earnings date of Thursday, February 22. The firm holds its Q3 2023 earnings call on the day of this writing.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

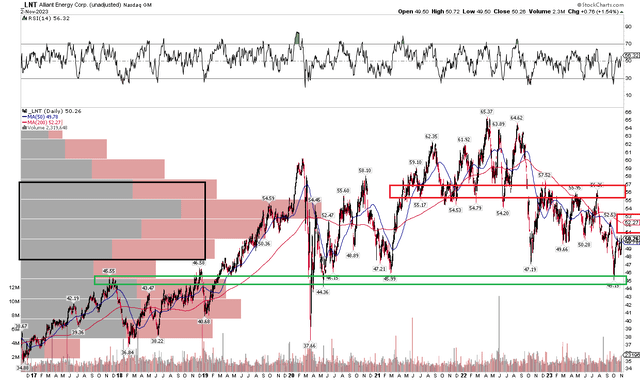

LNT has outperformed XLU by more than five percentage points thus far on the year. Still, the broader trend is lower off its 2022 highs in the mid-$60s. Notice in the chart below that the long-term 200-day moving average remains negatively sloped, indicating that the bears are in control. But with a significant low notched just above $45 a few weeks ago – right near long-term support – I see shares as on the mend. While the $44 to $47 zone is indeed long-term support, I see resistance between $56 and $58 – so that may be tough slogging for the bulls on a further rally attempt (of course, that is also where I see the intrinsic value for the stock). Moreover, there is a high amount of volume by price from the upper $40s to mid-$50s.

Overall, the technical situation is mixed, but LNT’s relative strength on the year makes me lean bullish.

LNT: Holding Long-Term Support, Resistance Near $56

Stockcharts.com

The Bottom Line

I have a soft buy rating on LNT. Both its valuation and technical situations are decent to me, though upside potential is not overly strong in my view.

Read the full article here