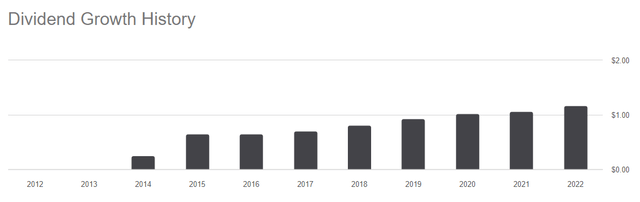

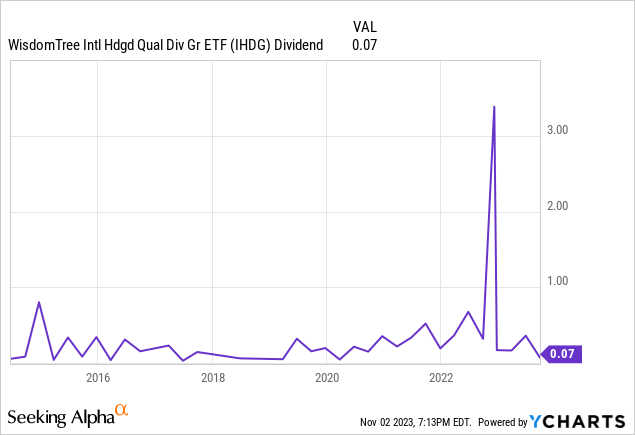

WisdomTree International Hedged Quality Dividend Growth Fund ETF (NYSEARCA:IHDG) is a targeted fund with a specific goal of growing dividends over time but ironically enough the fund’s short history of almost a decade failed to produce any meaningful dividend growth.

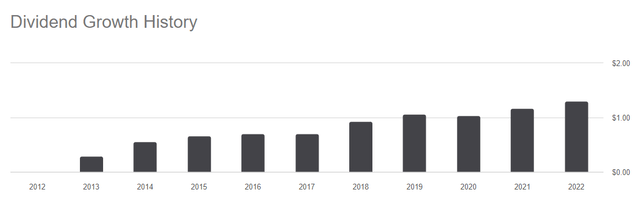

When one thing about dividend growth funds, one thinks of funds like WisdomTree U.S. Quality Dividend Growth Fund ETF (DGRW), iShares Core Dividend Growth ETF (DGRO) and Vanguard Dividend Appreciation Index Fund ETF Shares (VIG) which deliver higher and higher dividends (per share) every year.

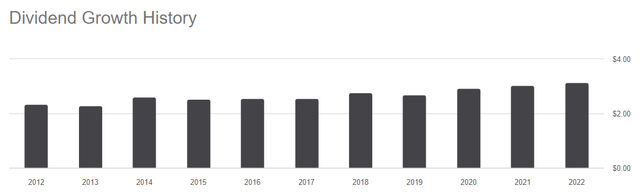

DGRW Dividend Growth (Seeking Alpha) DGRO Dividend Growth (Seeking Alpha) VIG Dividend Growth (Seeking Alpha)

Dividend growth funds don’t always deliver the highest yields, but one thing you can rely on them for delivering year after year is the growth of their dividend. This is their biggest purpose and entire point. Investors put their money into dividend growth stocks for the specific purpose of growing their income at a steady and reliable rate. Meanwhile, IHDG hasn’t delivered much of dividend growth in the last decade.

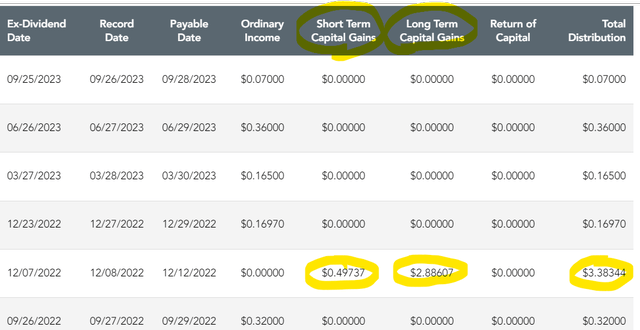

There was a pretty large spike in the fund’s dividend payments in 2022, and it was a one-time deal due to the fund selling some positions and booking short-term and long-term capital gains. When you invest into a dividend fund (or a dividend growth fund) you want your dividends to come from “Ordinary Income” column because it would indicate that the company is passing on dividends it receives from its holdings to you which is repeatable and sustainable.

Fund’s dividend breakdown (WisdomTree)

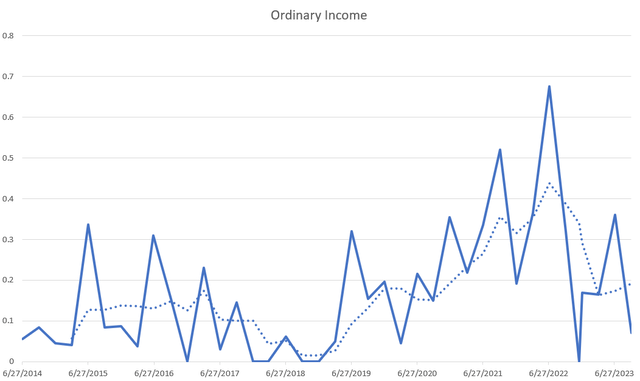

When I pulled the Ordinary Income column of the fund’s entire dividend history and created a line graph of it, I noticed no steady and consistent growth. There are periods of growth like the four-year period between 2018-2022, but the long term picture doesn’t show reliable dividend growth that investors expect from those funds that advertise themselves as dividend growth funds.

Ordinary Income Historical (Author)

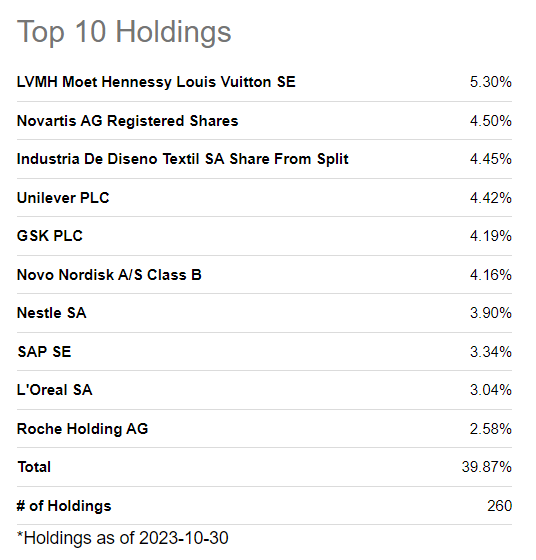

I find this interesting and curious because when I look at the fund’s top holdings, I actually see a lot of companies with a history of dividend growth. One thing to note is that “dividend growth” is a more common thing in the US than the rest of the world. I am not saying that it doesn’t exist elsewhere, but it’s more rare. In the US, dividend-paying companies are almost certainly expected to grow their dividends year after year, or they are punished severely by investors, but in most other countries this expectation is not necessarily as strong. There are certainly some foreign countries that choose to grow their dividends year after year, but those are not in the majority.

Top 10 Holdings (Seeking Alpha)

Having said that, many of this fund’s top holdings have a history of hiking dividends, which is puzzling because it’s not reflected in the fund’s own dividend history. For example, let’s take the fund’s largest holding, Louis Vuitton (OTCPK:LVMHF). The company has a long history of dividend growth. In the last decade, the company’s dividend nearly tripled and its annual dividend growth rate has been around 14%. The company didn’t grow its revenues every single year, but the overall trend has been upwards over the years.

Louis Vuitton Dividend History (Seeking Alpha)

The fund’s second-largest holding is Novartis (NVS) which posted 7% average annual dividend growth rate for the last decade and 9% annual dividend growth rate since 2000. The company has been posting a pretty steady and predictable dividend growth over multiple decades.

Novartis Dividend History (Seeking Alpha)

Most of the company’s top holdings from Unilever (UL) to SAP (SAP) and Nestle (OTCPK:NSRGY) posted at least some dividend growth over the years. Maybe the fund’s picks outside of its top 10 holdings aren’t great at growing dividends, but then again the fund’s top 10 holdings account for almost 40% of its total weight, so it should count for something.

Another culprit could have been foreign currency exchange rates because it is possible for a company to hike its dividends in its own currency but not be able to grow its dividends in the US dollar, but this isn’t the case since this fund is currency-hedged as its name implies. The fund should be protected from currency movements and volatilities in the currency exchange markets. Maybe currency hedging is actually working against the fund instead of helping it out.

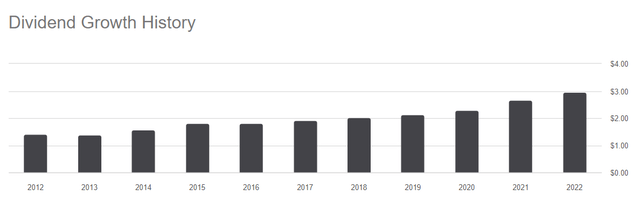

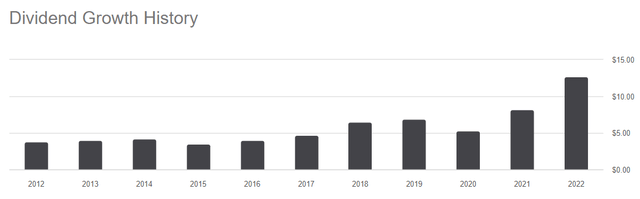

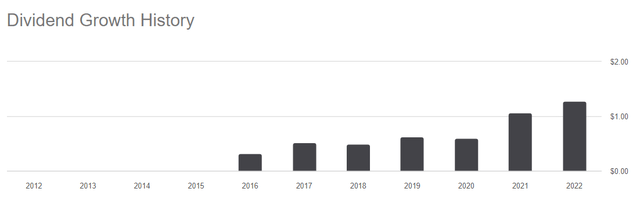

It’s puzzling to know that the fund picked a large number of dividend growth names but didn’t grow its own dividend. Interestingly enough, WisdomTree has another fund with a similar approach and similar holdings called WisdomTree International Quality Dividend Growth Fund ETF (IQDG) and this fund actually shows signs of dividend growth.

IQDG Dividend History (Seeking Alpha)

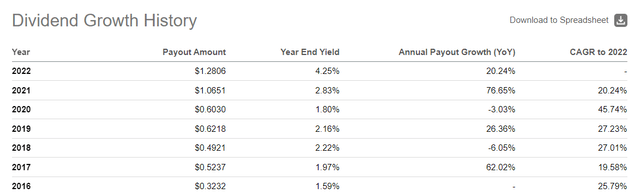

As a matter of fact, the fund actually posted an impressive average annual dividend growth rate of 25% since its inception in 2016.

IQDG Dividend Growth (Seeking Alpha)

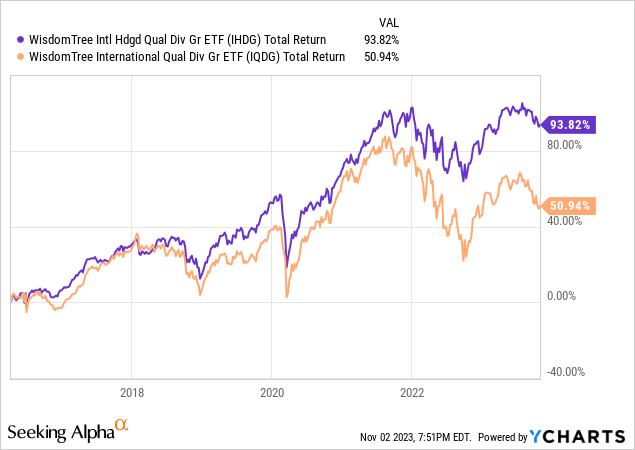

If investors are looking for a dividend growth fund, IQDG seems like a much better fund than IHDG. Then again we have another problem. When we compare the two funds in total returns, IHDG is doing much better than IQDG even though it’s lacking in dividend growth. Since 2016 IHDG resulted in total returns of 94% versus its sister fund IQDG delivering 51%.

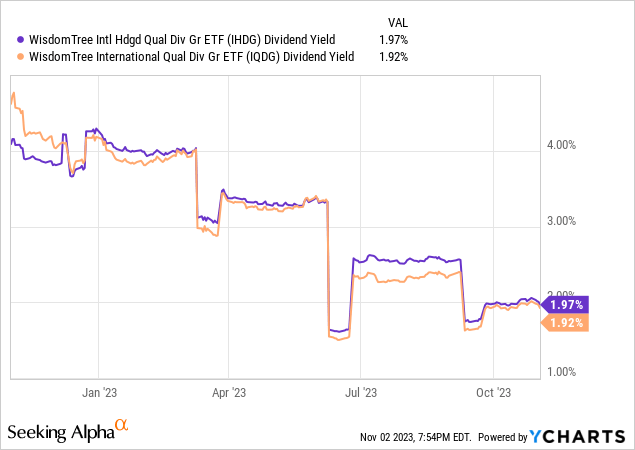

To add even more to the mystery, the two funds have identical dividend yields even though one is posting 25% dividend growth while the other isn’t doing so.

So we have one fund which advertises itself as a dividend growth fund but doesn’t offer much of a dividend growth, but it vastly outperforms another fund which actually offers dividend growth. What should investors do? It depends on what they value better. If they value dividend growth and looking for a dividend growth fund, they should go with the fund that offers dividend growth which is IQDG but also know that it could underperform in total returns.

For me when it comes to dividend growth, I will want to focus more on the US because American companies tend to have more emphasis on dividend growth on average, and they are more likely to keep growing their dividends year after year in fears of getting abandoned by investors. For this, I like some of the funds I mentioned above such as VIG, DGRW and DGRO.

Read the full article here