Tesla Q3 Earnings

Last month, Tesla, Inc. (NASDAQ:TSLA) released its Q3 earnings. Ever since, the stock has fallen by more than 20%. After reading the report and transcript, we were unconcerned about Elon’s lack of enthusiasm for the cybertruck outlook because our original thesis did not account for any positive outcomes. Further, we do not value any of Tesla’s businesses beyond what is shown in its revenue breakdown.

TSLA

Tesla’s Valuation Drivers

When we first evaluated why the company was worth so much, we took a detailed look at its energy and car-related operations. We noticed that the energy side of the business had a bigger Total Addressable Market (“TAM”) and was growing more quickly than the car side. Specifically, the part of the business that deals with storing energy—helping to save energy and use it more efficiently during times of high and low demand—has a lot of room to grow. It could move from just serving homes to also helping industries like data centers.

There are two essential components that impact the growth stock valuation: (1) the company must be the leader in the industry; and (2) it currently exhibits strong growth.

Emerging Competition in Energy Storage

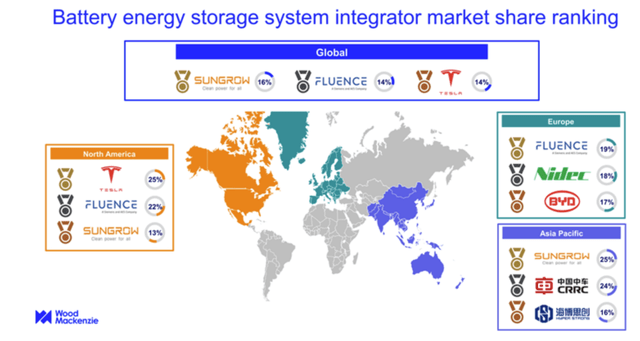

Tesla was the global leader in the energy storage market in 2022. But as we approach H2 2023, the landscape of the global energy storage market has undergone a substantial change. In Q3 2023, Sungrow outperformed Tesla in terms of market presence and performance, according to Wood Mackenzie.

Leading vendor, Sungrow dominated the market with 16% of global market share rankings by shipment (MWh), jointly followed by Fluence (14%) and Tesla (14%), Huawei (9%), and BYD (9%).

Wood Mackenzie

Background on Sungrow

Some background about Sungrow:

– Sungrow is a Chinese company that specializes in solar inverters and energy storage systems. It operates in over 150 countries globally, including Western markets like the U.S., Germany, and Australia.

– Sungrow was founded in 1997. It started its energy storage business in 2016 through a strategic partnership with Samsung SDI.

– According to Sungrow’s Q3 earnings, its energy storage business continued triple-digit growth of 177% in the first 3 quarters of 2023. 85% of its energy storage revenue comes from overseas markets.

– Recently, Sungrow signed deals for 825MWh in the UK and 330MWh in Australia.

– Sungrow has a higher energy storage gross margin of 30%, approximately 1200 basis points higher than Tesla’s 18% margin in its energy business.

Tesla’s Strategy in Energy Storage

Tesla developed its energy business as a byproduct of its auto business, similar to how the Amazon (AMZN) Amazon Web Services (“AWS”) business grew out of its e-commerce operations. As AWS leveraged Amazon’s data center scale, Tesla leverages its electric vehicle (“EV”) leadership and battery production to fuel energy storage. As Tesla increases EV production, it benefits energy storage by improving battery production costs, since cost leadership is more important in energy storage than consumer EVs. Further, the faster growth and larger scale of energy storage versus consumer EVs can accelerate Tesla’s battery cost reductions beyond what it could achieve in auto alone.

Emerging Battery Leaders

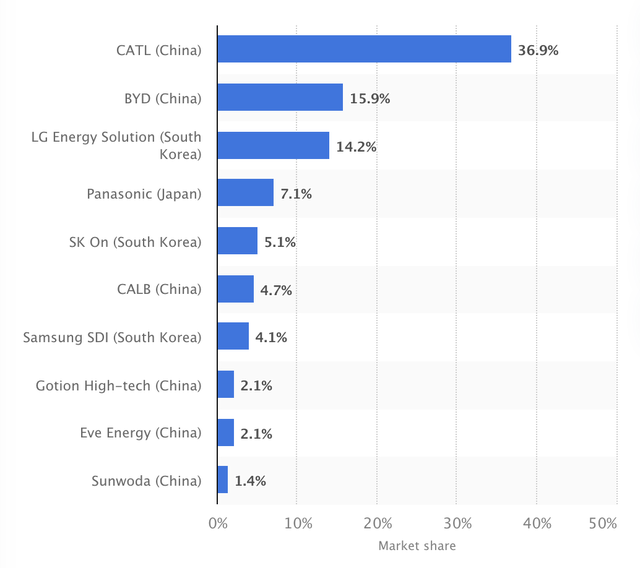

Batteries have established leaders, unlike the emerging data center market Amazon entered with AWS. CATL currently ranks 1st and BYD Company Limited (OTCPK:BYDDF) 2nd in batteries and energy storage. BYD has a higher market share, entering energy storage in 2008, versus CATL in 2022. However, CATL’s battery production volume suggests it may surpass BYD and Tesla in energy storage soon given scale and cost advantages.

Global market distribution of lithium-ion battery makers (Statista)

Tesla’s recent use of BYD’s blade battery design in German Model Y production implies BYD offers better performance, undermining Tesla’s energy storage cost edge since battery costs are crucial. Unlike EVs, energy storage does not attract government sanctions, exposing Tesla to global competition from Chinese players. Despite Tesla’s’ still-impressive 90% energy business growth in Q3, it slowed from 222% in Q2 and 17% quarterly.

If Tesla’s high valuation relies on energy storage growth prospects, it risks declining as competitive advantage erodes and growth slows further.

Valuation Risks

The Bear case

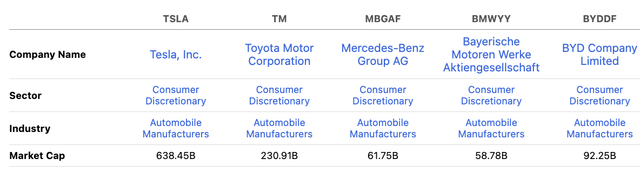

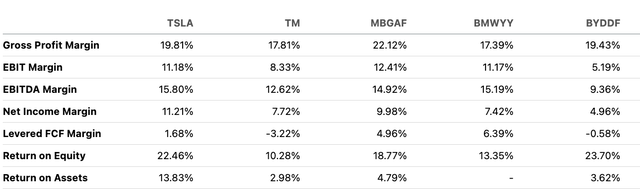

The worst-case scenario is that the market prices Tesla solely as an automaker. Despite Tesla having 200-300 basis points higher gross and EBIT margins than Toyota, it is in line with luxury peers like Mercedes (OTCPK:MBGAF) and BMW (OTCPK:BMWYY). Although Tesla plans a more affordable Model Q after 2025 around Toyota’s price point, that is still uncertain.

Seeking Alpha Seeking Alpha

Given Model 3 prices remain much higher than typical Toyota (TM) prices, the worst case could be Tesla valued strictly as a luxury automaker. In that scenario, Tesla’s market cap could fall to $60 billion, an 85-90% decline from current levels.

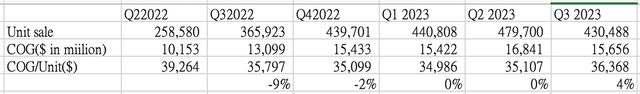

Despite the fact that the current risk is still relatively low, we now see that this extreme downside case risk is increasing. This is because though Tesla continued to slash sales prices on paper to appear more competitive, in reality, Tesla has failed to reduce per unit costs for 3 consecutive quarters. If the market sees through pricing actions without underlying cost improvements, the extreme downside scenario becomes more likely.

TSLA, LEL

The second worst scenario is the market valuing Tesla as the auto market leader. Toyota currently trades around $230 billion, which could be the downside floor since Tesla has higher margins. However, BYD has comparable or higher margins than Tesla just looking at auto, yet trades at only $90 billion and has a higher growth rate. Tesla’s valuation story looks very challenging if viewed as just an automaker.

The risky outlook reflects Tesla’s inability to substantiate competitive pricing with structural cost reductions. Unless Tesla can clearly demonstrate major cost efficiency gains, the market may limit its valuation to an automaker multiple far below levels justified by its energy storage growth narrative.

Limited Upside from Other Businesses

Many investors remain excited about Tesla initiatives like Dojo and full self-driving (“FSD”), but we see risks in FSD. Tesla’s level 2 FSD technology currently lags behind level 4 leaders like Alphabet/Google (GOOG) and Baidu (BIDU) that don’t require driver oversight. Even among level 2, Xiaopeng (XPEV) outperforms Tesla. Further, the total addressable market for robotaxis also appears overestimated. As we analyzed during Uber’s IPO hype, the costs of entirely replacing car ownership with robotaxis for daily commutes remain higher than owning your own vehicle. The ceiling for robotaxis looks more like today’s taxi and rental car markets – a new opportunity but far too small to justify Tesla’s valuation.

Similarly, Cybertruck’s addressable market seems small relative to the total auto market. Pickup trucks were only 7.8% of US sales in 2022. CEO Elon Musk’s subdued Cybertruck production outlook makes it a less compelling story given likely high starting selling prices.

Thus, Tesla’s other emerging businesses do not seem poised to sustain its stretched valuation.

The Bull Case

Our initial bull case, which had a target price of $356—78% higher than the going rate—was predicated on a 5% market penetration rate for the energy market(beyond residential space). The upside depends on energy storage sustaining growth despite mounting competition. While the addressable market remains large and penetration low, Tesla must demonstrate accelerating growth and major battery cost reductions. With Tesla no longer holding the top spot in the world for energy storage and having a weaker battery cost competitive advantage than BYD and CATL, we can see that the likelihood of a bull market is dwindling.

Conclusion

Competition in the energy storage business is intensifying. From both battery production capacity and market share perspectives, Tesla is losing its crown in the third quarter. Despite the fact that Tesla still grew an impressive 90% in the quarter, there is a chance that the market could price Tesla more pessimistically than in the first half of 2023.

Our bull case has been predicated on Tesla’s energy storage business sustaining strong growth despite competition. However, the downside risks now appear to clearly outweigh this upside potential.

Absent a compelling vision for how Tesla can maintain differentiation as competition mounts, justifying its premium valuation becomes very difficult. Tesla’s automotive business and emerging initiatives like robotaxis and Cybertruck have more limited total addressable markets that cannot sustain Tesla’s growth narrative alone.

In light of the deteriorating outlook for energy storage competitiveness and the lack of alternative business drivers to offset this risk, we believe the risk-reward for Tesla, Inc. stock is skewed to the downside. Therefore, we are lowering our rating on Tesla, Inc. stock from Buy to Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here