Author’s Note: This article was published on iREIT on Alpha during April of 2023.

Dear subscribers,

It’s time for me to update on the apartment REITs (real estate investment trusts) as they report quarterly results. In this case, we’re looking at Essex Property Trust, Inc. (NYSE:ESS), which very recently reported Q1 2023. I didn’t expect a significant beat, but seeing this, I expect good things out of similar-quality REITs in the segment.

Let’s review ESS and let me show you why, still after this beat, I consider ESS a “BUY.” It’s not the best or highest-upside BUY, but it’s definitely one of the safest around.

Let’s take a look here.

Essex Property Trust – Plenty of upside and return potential still there

Essex, on every indicator that matters to me when reviewing a business, is still an undervalued REIT. This is despite a near-4% growth on Friday after a good beat. First, a quick recap.

Safety, Safety, Safety.

Moving into what many people are characterizing as a recessionary environment, we need to make sure that we’re well-prepared for eventual downturns and that our recurring cashflows, from dividends, are as safe as they can be.

My recipe for this is investing in quality businesses with well-covered dividends in fundamentally sound sectors. Essex is most certainly part of this – and it is, as I see it, being much undervalued compared to the potential it has.

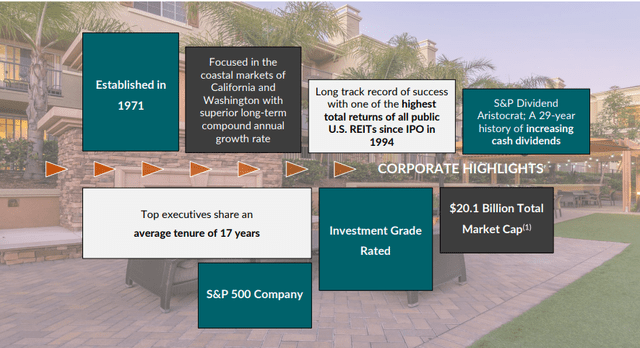

Even back when I wrote about ESS the first time, I said that Essex seems really like the perfect sort of Residential REIT. You have a BBB+ credit rating, a yield of 4%+ that’s more than covered by a superb funds from operations (“FFO”), and stable underlying operations.

Essex has a market cap, following the decline, of close to $14.6B.

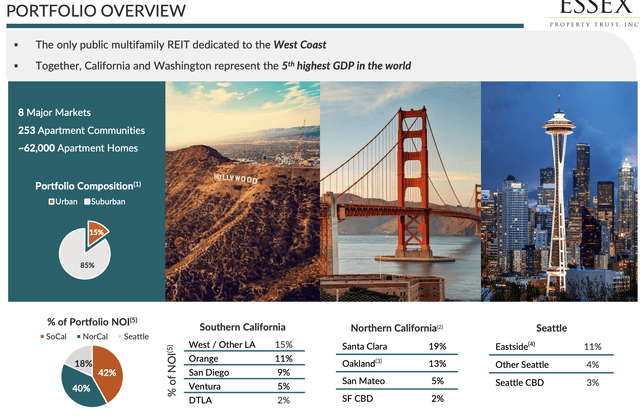

ESS IR (ESS IR)

That is the company portfolio. And you can obviously see some of the challenges or problems with this, given the current macro in particular in Cali and the west coast of the USA. This has also resulted in the market heavily discounting Essex compared to levels where it has previously been. While I am full “along” for the ride when it comes to discounting this company somewhat, I do believe the market has gone too far.

That is why I have invested in the business.

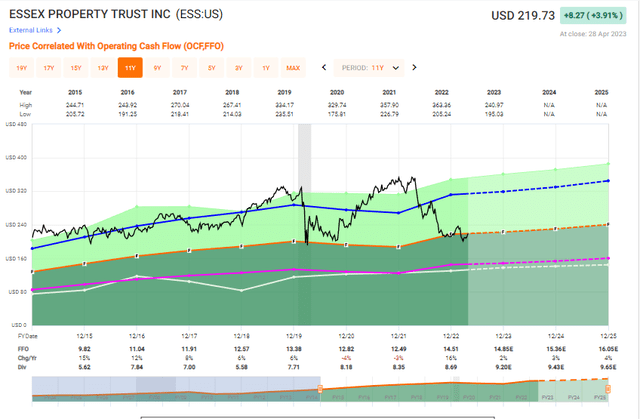

Look, put into context, Essex has only been priced at the current level 3 times during the past 20 years. Essex typically warrants a premium of over 20x P/FFO. It’s now at 15x. That’s the level, or below, we’ve only seen in the GFC up til -09, in COVID up til late 2020, or now. That’s it.

At any other time in the past 20 years, we’ve been either at or above 18x P/FFO for this company.

While based on these portfolio specifics, you can understand why downturns in the west coast markets would erode the confidence in the company’s operations, I believe the recent set of results gives confirmation in the forecast for the company’s FFO/AFFO. Because there is no expectation of an FFO/AFFO downturn in ESS. It’s expected to grow 2% in 2023, and another 2-4% in 2024-2025.

ESS IR (ESS IR)

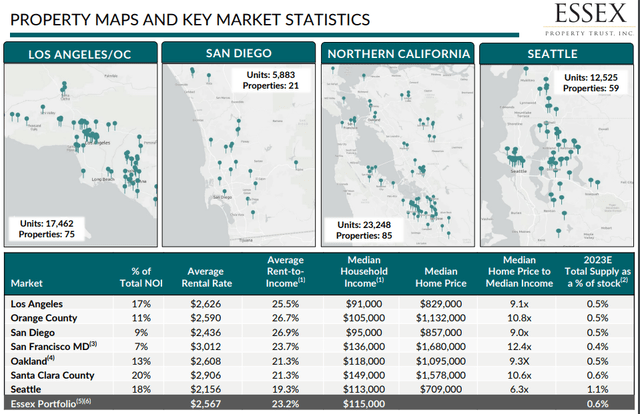

The company’s business idea is to rent properties across appealing markets, with an average portfolio monthly rental rate of around $2,550, a rent-to-income of 23.5% on average, and a median household income of $115,000, bringing their client’s homes with average values of close to $1M. These are super-solid fundamentals.

While some of the demand drivers for the West Coast might be not as strong as they once were – economically, I believe the West Coast is down for a hard time, and this will influence the jobs/income situation and therefore the demand for solutions from Essex – I still believe there will remain a demand for Essex solutions.

The company itself continues to argue that despite some recent softness in the Seattle area, the company’s markets remain very resilient. There are some data backing this up. Despite the recent tech downturn, this shouldn’t be interpreted as all tech employment in the area, or other areas are dropping.

With rising interest rates, the cost of actually owning versus renting a home will go up even further, which will drive interest for Essex properties – at least theoretically. The after-tax cost to own/vs rent has always been high in Essex markets, but the latest year it spiked to a record-high 2.3x in Cali/Washington, and it’s bound to go higher.

The company’s value creation is similar to most REITs. Active acquisitions and dispositions to make sure its asset portfolio is comparatively A-grade, developing high-quality tenant-desired apartment homes with close proximity to jobs, redevelopments resulting in better rents, a co-investment platform to increase the sourcing of capital (private capital), structured finance possibilities, and just overall offering quality at a good price.

The main risk to ESS is really its key markets – because it’s entirely west-coast based.

ESS IR (ESS IR)

Unless you can see your way to viewing this company as too cheap for what is being offered, even with the market the way it is, you’re investing in a business with exposure you might not find all that appealing. However, 1Q results should at least offer you pause.

Because despite market challenges, the company saw Core FFO growth of 8.3% on a diluted EPS basis, which non-trivially exceeds the midpoint guidance range, due to favorable same-property top-line growth. NOI grew by 9.2%, so even more, and the company managed to sell an apartment community at just over $91M. It also showed confidence in the low stock price by buying back nearly half a million shares at an average of $218.88. Whenever you’re buying at the price the company itself buys, or below, you can generally say that it’s not a bad deal overall.

This also came with an above-average 5% dividend increase, making it the 29th annual dividend increase, alongside a guidance increase to nearly $15/share on the high end for core FFO.

There isn’t much negativity to discuss that isn’t macro-based. ES is about 20% Seattle, 40% North Cali, and 40% South Cali, which means that the area of worst impact, the north west coast, is actually the lowest in exposure. There are “pockets” of issues that are found in downtown Seattle and parts of downtown L.A., but this accounts for no more than 2-4% of the company’s portfolio, which is also why the company really hasn’t seen that much overall impact.

Essex’s base case is currently a mild recession. The risks here are nothing we haven’t seen before, the risk of increased delinquency, the risk of more layoffs – all of these are things that are hard to accurately forecast, which is why i view it as speculative to really granularly talk about them.

Instead, I’m comfortable discounting the REIT to an appropriate level where these are “included.”

Let’s look at valuation.

Essex valuation – still attractive

Essex is not the biggest apartment REIT in my portfolio. That honor currently goes to AvalonBay Communities, Inc. (AVB) – but Essex is a close second, and AVB also provided 1Q by the way, which is the second REIT I review this week. Both of these provide quite excellent upsides and trends, and both of them actually beat estimates, with both also boosting guidance.

While not as bottom-feeding cheap as they once were, Essex is still one of the REITs in the space that can be bought at an attractive overall upside.

You can argue all you want about invalid premiums and challenging macro, but the fact is that in this sort of picture when premiums are far higher and established over 20 years, I’m unwilling to invalidate them in a short a time as this.

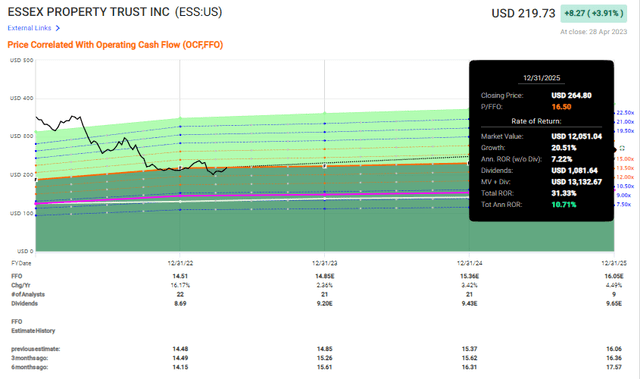

ESS Upside (F.A.S.T graphs)

Remember, the market always overreacts – this seems to be a cardinal rule, both in the positive and negative. It does this both in the short term, but also in the medium term (and sometimes in the longer term as well.)

15x P/FFO is something we have not seen for the company since the depths of the COVID-19 crash. It’s an extreme sort of trough that I don’t view as being justified even in a negative potential future scenario for this company. Even in the case of only a 15-17x P/FFO on a forward basis, you’re still making double-digit RoRs of 10% annually until 2025E. And that’s if the company goes close to absolutely nowhere for 2 years, which I view as very unlikely.

F.A.S.T graphs ESS (F.A.S:T graphs)

In the case of full normalization, you could get a BBB+ rated upside annually of close to 19-20%, or 58.32% Return on your capital invested. In this market, and at these safeties, that is almost ridiculous – and it’s still very attractive, despite the company being above $210/share.

Simply put, the overall downside is very limited – and the upside is significant enough to beat most current realistic market scenarios. This is exactly what I look for when I want to invest capital. Upside even in the case of a relatively negative scenario.

Even if ESS were to continue to decline under these expectations, we’d still make positive RoR thanks to the dividend and valuation up until it reached a long-term of around 12x P/FFO. I don’t view this as realistic in the least – but if it did, that’s what we can expect.

I also want to reiterate that analyst accuracy has historically not allowed for any sort of negative result – they have a 100% accuracy rating, either with company beats or company “hits” with a 10% margin of error. This is not unique in the REIT space, but this is why apartment REITs are some of the safest in any sector. Safer than offices, safer than data centers, safer than industrials and healthcare – safer than almost anything in this space.

This is not the “best investment” I see as possible to make at this time – I need to clarify this. In fact, there are many companies on my list that should provide better potential for return, even at similar yields.

However, at the credit safety and overall fundamentals that ESS offers, there aren’t many companies that offer the same sort of potential that Essex does.

For that, it’s one of my highest-conviction “BUY” in the entire REIT space at this time.

Not only that, but I do also believe that the safety offered by the conservative assets that are residential properties allows for a premium. Given that Essex manages some of the top-tier units and properties available on the market in these areas, it seems natural that this should allow for a bit of a premium. I can understand why some investors would be hesitant given the current state of the tech industry and specifically in these areas.

While I do believe we’ll see some market softness, I do also forecast that the company’s impact from these will be limited – and for this valuation to be as it has been before from a historical context – very appealing.

We have to remember that we as humans are prone to behavioral heuristics and fallacies – and one of those is that once something happens, we view a repeat of that instance as likely – even something as scientifically unlikely as lightning striking the same spot twice.

A downward trend that’s been going on for some time gives investors the belief that things “won’t turn around” – but this is provably false. While Essex has been punished for some time – from a massive overvaluation where I would not have touched it – we’re currently in a place where I believe that the potential for ESS is massive, and much of what is holding the share price back is in fact not company performance, but investors being careful.

This is perfect for us – because we can keep buying cheap.

I do not forecast any earnings/cash flow issues for the company – not material ones. Nor does any other analyst I follow or consider to be knowledgeable on the subject.

In my last article, I rated ESS as a “STRONG BUY” Below $220/share.

That’s still my position, and this is my thesis on Essex after 1Q.

Thesis

- Essex Property Trust, Inc. is without a doubt one of the more qualitative apartment REITs out there. It has a superb portfolio and excellent quality indicators, and over the past 20 years, it has only failed to produce annual FFO growth for 3 years, which is an excellent track record. Also, 2 of those years declined less than 5%.

- I view ESS as a BBB+ rated REIT stalwart with a 4.21% yield that will keep you “warm and safe” for years to come. The company is currently 1.7% of my total portfolio, and I’m open to increasing this further.

- My current PT for ESS is $240 based on a 2025E, and I believe it becomes a STRONG BUY below $220/share.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I won’t call it massively cheap here, but it definitely has an upside, and a good one.

Read the full article here