Introduction

North America-focused household products direct-to-consumer company Betterware de Mexico (NASDAQ:BWMX) is on my watchlist and I’ve written a total of six articles about it on SA to date. The latest of them was in September when I said that the valuation was starting to look stretched and that it could be a good time for investors to trim or close positions.

On October 26, Betterware de Mexico released its financial results for Q3 2023 and I think were slightly weak as revenues went down by 1.6% year on year and the guidance for the full year was cut by a little. Yet, the market capitalization has dropped by 27.5% since the results were published and I feel comfortable upgrading my rating on the stock to buy at this share price level. I think the market has overreacted here and this creates a buying opportunity. Let’s review.

Overview of the Q3 2023 financial results

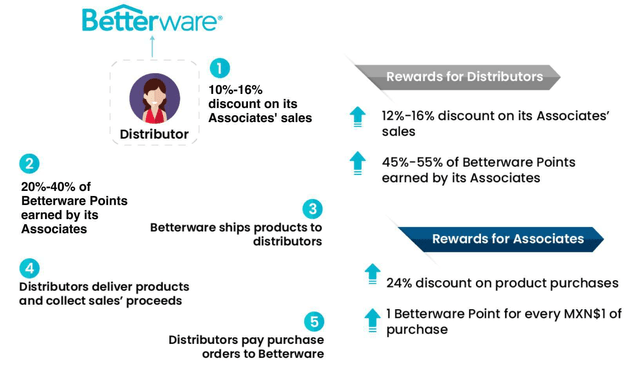

If you’re not familiar with Betterware de Mexico or my earlier coverage, here’s a short description of the business. The company mainly sells kitchen and home products and was founded in 1995 as the Mexican arm of British multi-level marketing (MLM) group Betterware. In 2001, Betterware de Mexico was sold to its current president Luis Campos, and it listed on NASDAQ in 2020 following a combination with a special purpose acquisition company (SPAC) named DD3 Acquisition. Betterware de Mexico launches more than 300 new products annually, with most of them being manufactured by suppliers in China. It could also be viewed as a Big Data company as it collects and analyzes millions of pieces of data points within its operations with the aim of determining the likes and dislikes of its customers for its next products. Unlike many other MLM companies, the distribution network of Betterware de Mexico is made up of just two tiers – distributors and associates. In addition, there are no commissions for recruiting more people. Distributors make orders and deliver products to associates, who can then sell them. Both tiers get discounts on products, which are higher for distributors. In addition, Betterware de Mexico has a B2C app, with products being shipped to the closest available distributor meaning the latter is in charge of last mile delivery if a person makes a direct order.

Betterware de Mexico

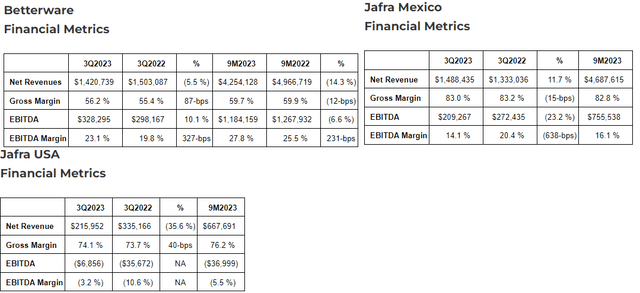

The business of Betterware de Mexico is split into three segments – Betterware. Jafra Mexico, and Jafra USA. In April 2022, the company bought the Mexican and U.S. operations of international cosmetics company Jafra for $255 million. The idea behind the deal was to achieve cost synergies of around $5 million and $10 million with the Jafra business and re-focus in on the USA.

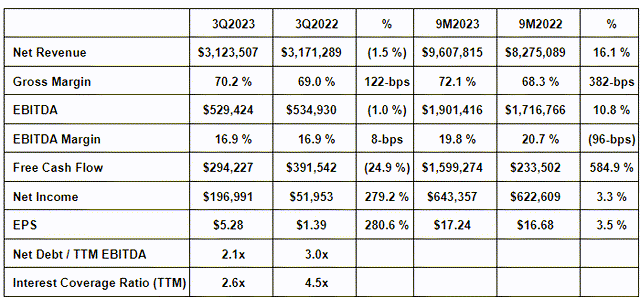

Looking at the Q3 2023 financial results, I think they were slightly disappointing as net revenue inched down by 1.5% year on year to 3.12 billion Mexican pesos ($173.1 million). The main reasons for the decrease included a lower average associates and distributors base at the Betterware business as well as a slump in revenues at Jafra USA. The latter is undergoing a complete business turnaround with the aim of getting in the black. On a positive note, the EBITDA margin of the company improved by 8 basis points thanks to cost-cutting measures as well as lower freight and raw material costs.

Betterware de Mexico Betterware de Mexico

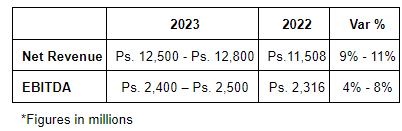

As a result of the small decreases in net revenue and EBITDA, Betterware de Mexico has decided to cut its guidance for the full year. The company now expects to book net revenues of between 12.5 billion pesos ($692.5 million) and 12.8 billion pesos ($709.2 million) and EBITDA of between 2.4 billion pesos ($133 million) and 2.6 billion pesos ($144 million) for 2023.

Betterware de Mexico

For comparison, the previous guidance included net revenues of between 13.2 billion pesos ($731.3 million) and 14.2 billion pesos ($786.7 million) and EBITDA of between 2.6 billion pesos ($144 million) and 2.8 billion pesos ($155.1 million). As you can see, it’s not a major revision of the expected EBITDA and I think the market has overreacted here considering the share price of Betterware de Mexico dropped by 38.2% on October 27 alone (the first day following the release of the Q3 results). Looking at what to expect for the future, I think that net revenue and EBITDA are likely to grow by single digit percentage points in 2024 as Jafra Mexico has strong momentum while the Betterware business is set to launch operations in the US in a few months.

Looking at the valuation, I continue to think that Betterware de Mexico should be valued at about 6x EV/EBITDA considering it lacks a strong moat, but it had a strong growth before and the COVID-19 pandemic. At the moment, the company has an enterprise value of $745.3 million and is trading at 5x EV/EBITDA based on the midpoint of the revised 2023 EBITDA guidance of $149.6 million. In my view, the prospects for the business look good for 2024 and there is now a decent margin of safety here following the recent selloff.

Turning our attention to the downside risks, I think that the major one is that I could be overoptimistic about the financial performance of the company in 2024. It’s possible that the launch of Betterware US is delayed or that its revenues for next year are underwhelming. Jafra Mexico could lose momentum or the turnaround of the business of Jafra USA could take a long time. In addition, demand for discretionary goods in Mexico and the USA could be negatively affected by sluggish economic growth and high interest rates over the coming months.

Investor takeaway

Betterware de Mexico has revised its 2023 guidance slightly downwards, but it still expects to book a slight improvement in its revenues and EBITDA in Q4 2023. In addition, I think that 2024 could be a good year for the company and considering the EV/EBITDA based on the midpoint of the revised 2023 EBITDA guidance is at 5x, this could be a good time to open a small position. My rating on the stock is a speculative buy.

Read the full article here