Novo Nordisk

reported a surge in earnings and revenue on Thursday as it continues to benefit from the popularity of its weight-loss drugs. However, the company is still struggling with raising the supply of the drugs to meet demand.

Novo

(ticker: NVO) said its third-quarter sales came to 58.7 billion Danish krone ($8.3 billion), up 38% from the same period a year earlier at constant exchange rates.

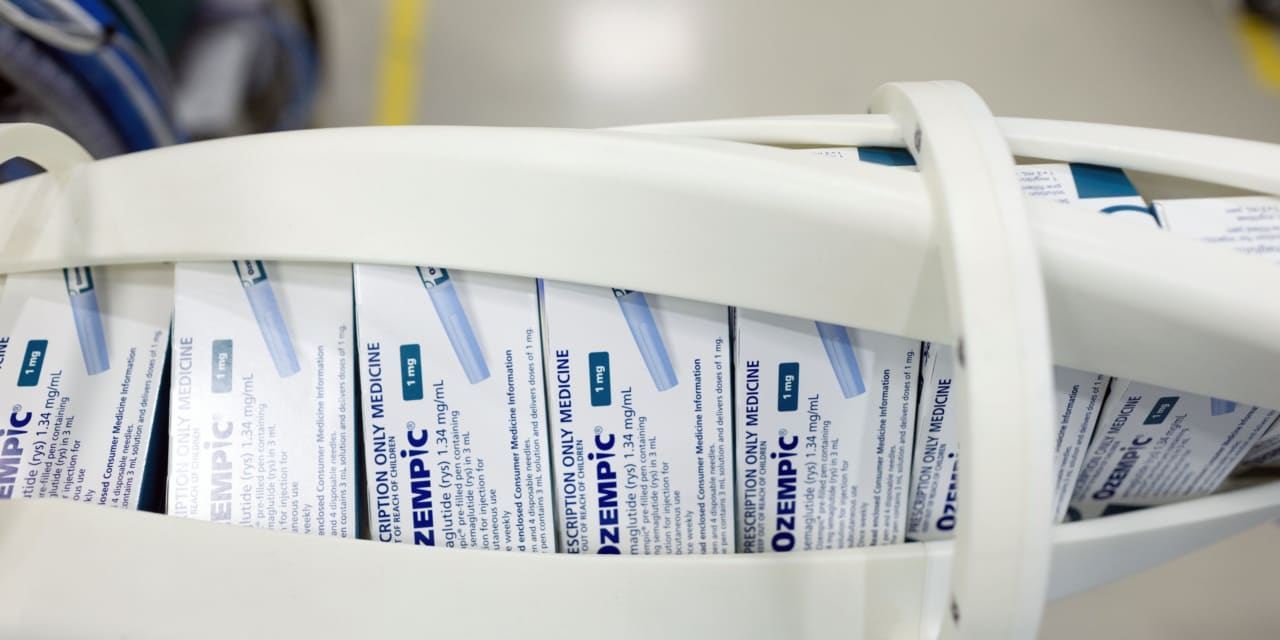

Investors are focused on sales of Novo’s blockbuster anti-obesity medicines Wegovy and Ozempic, which have captured the cultural imagination over the past year.

The company’s sales growth was driven by demand for the drugs in the U.S. but Novo said it was having to restrict supplies of some doses. That could open the door for its rival

Eli Lilly

(LLY), which is expected to gain approval for its Mounjaro diabetes drug to treat obesity in the near future, to gain market share.

“Novo Nordisk is investing in internal and external capacity to increase supply both short and long term. While supply capacity for Wegovy is gradually being expanded, the supply of the lower dose strengths in the U.S. will remain restricted to safeguard continuity of care,” Novo said in its earnings statement.

Novo said its quarterly earnings came to 5.00 Danish krone per share, rising 58% from the same period a year earlier.

Wall Street analysts expected Novo to report earnings of 4.81 Danish krone per share on sales of 57.8 billion Danish krone ($8.2 billion) for the third quarter, according to FactSet.

Novo’s American depositary receipt was up 2.5% in premarket trading on Thursday.

Novo’s American depositary receipt is up more than 40% this year on excitement over its weight-loss and Type 2 diabetes drugs. The company’s market value has climbed to roughly $430 billion, making it one of the most valuable healthcare companies in the world.

The earnings report comes amid what has been a surprisingly grim two weeks for the pharmaceutical sector: Investors have sold off shares of virtually every large drugmaker that has reported earnings in recent days. That has led to share-price losses for

Sanofi

(SNY),

Amgen

(AMGN), and other companies. Investors have even dumped shares of companies as they reported generally good news, as was the case with

GSK

(GSK) on Wednesday.

Novo and its competitor

Eli Lilly

have been the exceptions to the rule in the drug sector so far this year, rising while most of the rest of the pharmaceutical sector has fallen.

While Novo and Lilly’s shares have skyrocketed, the

NYSE Arca Pharmaceutical Index

(DRG), which tracks drug stocks, is down 1.1% on the year.

Novo took some of the intrigue out of Thursday’s announcement in mid-October, when it previewed its earnings and raised its full-year estimates.

At the time, Novo said it expects sales for 2023 to climb between 32% and 38% from 2022 to 2023, up from its prior estimate of an increase of between 27% and 33%. It projected full-year operating profits to grow between 40% and 46%, up from its previous estimate of between 31% and 37%. Novo reiterated the raised guidance on Thursday.

Novo had also raised its sales guidance to reflect increased expectations for sales of Ozempic, its Type 2 diabetes drug. A higher-dose version of Ozempic, called Wegovy, is sold as a weight-loss treatment.

The company is hosting an investor call at 8 a.m. ET.

Write to Josh Nathan-Kazis at [email protected]

Read the full article here