In my first article in July this year, I argued that Pool Corporation (NASDAQ:POOL) stock was a ‘strong sell’, which was against the general consensus at the time. I concluded that its high price of $385, its lackluster outlook and several other risks could sink the stock by 20% to reach a fair value below 300$.

It turns out that my article was well timed. Since its publication POOL has been trending down to a low of $309 (-20%) at the time of writing (27/10/2023). It peaked my interest in recent Q3 earnings update to see if its fortunes are changing. Could it soon be time to consider a position in POOL?

In this article I conclude that existing shareholders should still consider selling, while interested buyers better wait until POOL’s valuation reflects its deteriorated outlook and signs begin to appear that the worst is over.

Outlook For 2023 And Beyond

Looking at recent years we saw that a Covid tailwind helped to grow sales by 23% in 2020, which was 16% in excess of its long-term trend. In 2021 sales grew by 34.5%, a large part due to acquisitions, and in 2022 they grew by 16.7% or roughly 10% when corrected for inflation.

2023 is much worse. Q2 sales were down -12% and management adjusted its full-year outlook to a -10% decline. This was mainly attributed to the extreme weather in some states, resulting in deferred renovation projects and delayed pool openings.

During the recent Q3 earnings call, Mr Arvan CEO mentioned that the Summer weather in the USA had been normal, however the backlog of deferred renovation had ‘normalized’ without showing up in increased sales. In fact, the Q3 sales of $1.5 billion are a -9% decline compared to 2022.

Although this is a slight improvement compared to the -10% and -15% declines during Q2 and Q1, it mostly shows that the downward trend is more durable. In fact, during Q3 the year-round ‘base business’ declined 8%, while seasonal markets declined 10%. Key was the decline in overall building materials, down by 13% for the quarter, and new pools that were down by 30%. The latter also affects future revenues, as the installed base of pools creates 80% of sales.

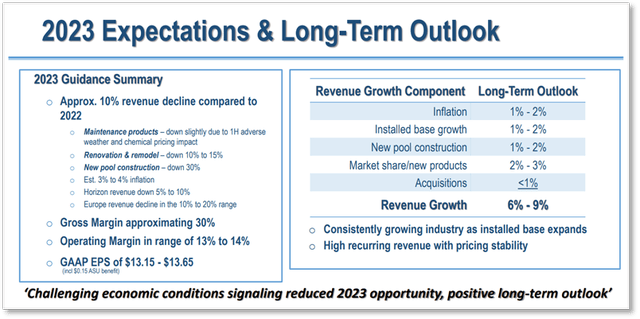

Obviously, the key question is when POOL’s market will bottom? Management admitted that their earlier prediction of modest growth in the second half of 2023 was clearly too optimistic. Q3 did not offer any signs of improvement and, assuming that new instalments will not decrease further, management now expects that 2023 sales will be down -10%. More cautious this time, they do not expect a strong recovery in 2024 but are still giving off a long-term revenue growth expectation of 6-9% per year.

Pool Corp long-term outlook on sales growth (Pool Corp Q2 earnings call presentation)

Profit Margins

In my previous article on POOL, I looked at profit margins during earlier periods when sales slumped, such as the 2007 financial crisis. It suggested me that every -1% decline in sales would result in a -3% decline in net income. With sales down by -9% and EPS down by -27% in Q3, this rule of thumb worked remarkably well.

When looking at these numbers it is important to realize that POOL’s business is seasonal. Sales and operating income are highest during Q2 and Q3, which are the peak months of swimming pool use, new builds, remodeling and repair activities. For example, POOL generated approximately 59% of annual net sales and 67% of operating income in the second and third quarters of 2022. These quarters are also used to reduce inventory that was build up during winter.

At the start of the Summer season this year, the size of POOL’s inventory was particularly large, which was probably partly an overhang from Covid-related supply chain issues. During the Q3 earnings call, Melanie Hart CFO put quite some spin on the fact that they have been able to reduce this inventory by $332 million despite 10 new greenfield stores and 4 newly acquired stores.

This is obviously a good thing, particularly when considering the rising cost of capital. At the moment POOL’s full year interest expense is expected to be approximately $61 million, which is 51% above 2022. Interest coverage was 25x Operating Income in 2022. This decreased to 17x in Q3 this year; a significant drop, but still a very healthy number.

Reducing inventory was the main factor that improved the net cash flow from operating activities, which is up by $442.5 million YTD. POOL values its inventory using a moving average method based on net realizable value, which has a positive effect on net income in times of inflation. Yet, gross margins declined to 29.1% during Q3; a 2.1 percent points YoY decline and below the company’s ‘above 30%’ target.

It is clear that this decline was a factor of concern with analysts during the earnings call. For example, one analyst remarked that the Q2 to Q3 decline of 1.5 percentage points in gross margin was more than double the typical sequential decline in other years. The last time such a decline was seen was during the 2007 financial crisis. Could weaker demand reduce prices and therefore affect gross margins? Whilst this question was somewhat brushed aside during the earnings call, shareholders were declined a clear answer whether the drastic reduction in inventory had caused a slip in selling prices.

Q4 is seasonally expected to be less profitable than the full year and the Q4 gross margin is expected to be ‘around 29%’. This is likely to be somewhat below 29%, as POOL experiences a YoY increase in average cost of inventory and management expects continued pressures on margins from product mix, similar to Q3. At this moment, POOL’s management is not giving any further guidance but are expecting overall revenues to stabilize, while new pool construction will remain subdued in 2024.

Capital Allocation And Growth

POOL’s revenues grew at a CAGR of 9.5% during the past 20 years. Going forward, management expects a long-term growth in the range of 6-9%. With the growth of the pool market in the lower single digits, organic growth should be small, so most of POOL’s growth should come from capital projects, acquisitions and franchises. If POOL’s growth engine is to remain intact, we should look at its capital allocation and whether it is gearing up to meet its growth targets.

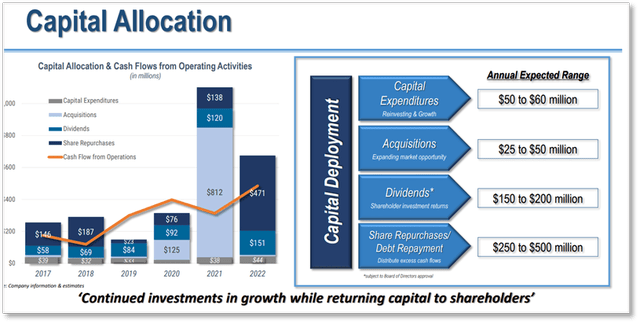

However, POOL’s guidance on capital allocation remains the same with approximately $25 million for acquisitions, $60 million for capital expenditures and $170 million for cash dividends. Any excess cash will be used to retire debt and repurchase stock opportunistically.

Pool Corp expected capital allocation (Pool Corp Q2 Earnings call presentation)

To date, the extra cash flow that I discussed above was used to reduce debt by $353 million from year-end 2022, resulting in a healthy debt leverage ratio of 1.5x. So far POOL has made $180 million of share buybacks YTD. This 1.8% is similar to its long-term average of around 2% per year.

In my view, a shareholder should wonder why dividend is given such priority? And whether the $85 million that will be spent on inorganic growth (roughly half of dividend) suffices to maintain POOL’s impressive track record. Interested investors should not overlook the fact that in recent years POOL has benefited from two factors. Firstly, buying growth they have spent much more than 25-50 million on acquisitions most years and, secondly, they have benefitted in multiple ways from the low interest environment: multiple expansion on the stock market, low borrowing costs as well as a buoyant housing market and cheap loans for new pool construction. I expect it will take some time before the company and its share price adapt to the new reality of higher interest rates.

Valuation And Risks

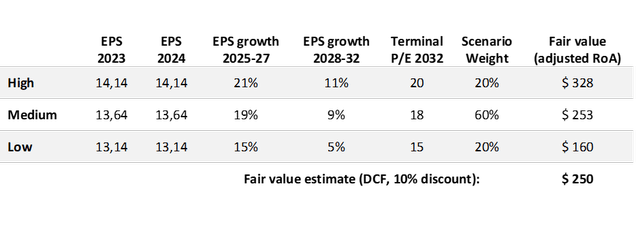

Many readers will be familiar with the limitations and possible pitfalls of a DCF valuation. Nevertheless, in my deep-dive on POOL in July 2023, I attempted a DCF with reasonably conservative assumptions and arrived at a fair value estimate around $290 per share.

If the bearish picture in this article holds, then we could see 0% sales growth in 2024, despite the -10% sales decline this year. For sake of brevity I won’t describe the DCF assumptions again, however, simply assuming that 2024 would have the same EPS as 2023 (a ‘lost year’ in terms of growth) and leaving all other assumptions the same as described in my previous deep-dive, gives a new estimate POOL’s fair value at $250. This suggests that a substantial further decline of its share price could still be in the cards.

DCF valuation (author’s analysis)

Obviously, I could be wrong with this bearish thesis. It is therefore important to also think of factors that could challenge it.

Firstly, I am assuming that the interest rate will stay higher for longer. This means that the low interest rate that has benefitted POOL in multiple ways in the past, will not return anywhere soon. It is unlikely, but a major economic shock could cause the Fed to drop interest rates fast that could recreate the beneficial low interest rate conditions.

Secondly, if POOL is indeed the strongest in its sector, then a serious downturn could also create opportunities to act as the ‘gorilla of the industry’. For example, POOL could acquire struggling competitors for pennies, or drive them out of business by deeper prices cuts than they could follow.

We will need to wait and see if either of these factors can materialize. During the Q&A section of the recent earnings call, Mr. Arvan, CEO mentioned that so far price competition was only felt in the chemicals business. In other areas they are focusing on ‘best customer experience’ so that it doesn’t come down to having to match a ‘desperate price’.

Wrapping up

At a forward PE of 23x, POOL is still priced for substantial growth. The current outlook for 2023 is a decline in sales of -10%. In 2024, sales growth is expected to remain subdued at best or could even decline further. Gross margins are under pressure, making analysts worried.

Despite all this, POOL’s guidance on capital allocation remains the same. I am concerned that POOL is prioritizing dividend payout over long-term growth and conclude that at today’s share price it is better to stay out of the POOL.

Read the full article here