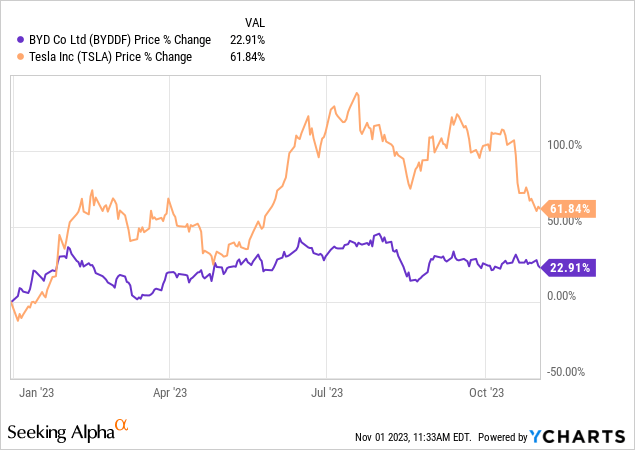

Tesla (TSLA) reported its fair share of troubles for the third-quarter, including a concerning short term margin trend that reflected the company’s aggressive pricing measures. However, one electric vehicle company that is absolutely crushing it right now is Chinese car brand BYD (OTCPK:BYDDF). I believe BYD will soon be able to overtake Tesla in terms of global delivery volumes and become the world’s leading EV company. BYD’s electric vehicle portfolio generated soaring profits in the third-quarter and the company has a promising EV product, the BYD Seal, for which export volumes have started to surge as well. Given the very low valuation multiplier, I believe BYD is a much more promising bet on the expansion of the global EV market than Tesla (although I like Tesla as well and recently bought the drop)!

Previous rating

I rated BYD as a strong buy due to its strong delivery growth potential in China and abroad as well as its cheap valuation: BYD: A Strong Bet On The Chinese EV Market. Given the most recent delivery accomplishments of BYD in the third-quarter, I expect the Chinese EV firm to become the largest electric vehicle company, by delivery volume, in the world and overtake Tesla in the near term. The company’s third-quarter profits also soared and reached a new all-time record, and BYD has a strong EV product — the BYD Seal — that is crushing it currently in export markets.

BYD is set to overtake Tesla in delivery volumes

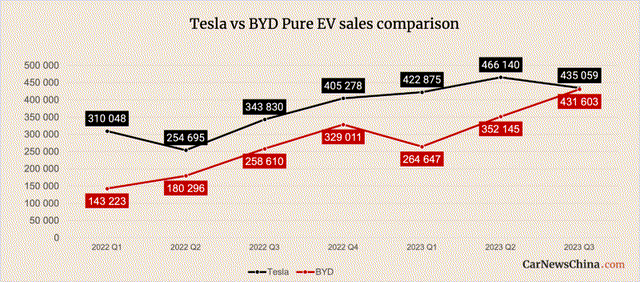

Tesla delivered 435,059 electric vehicles in the third-quarter, showing 27% year over year growth and the EV company, due to demand being boosted by price cuts, reported its second-highest delivery volume ever. In the second-quarter, Tesla achieved an all-time delivery record of 466,140 electric vehicles.

While the margin trend is a short term cause for concern, Tesla is still the largest EV company with the highest delivery volume. But this could soon change, the reason being that BYD is seeing massive delivery growth, mainly in China, but also in other geographies such as Europe and Latin America.

In the third-quarter, BYD reported a total delivery volume of 431,603 electric vehicles, showing a year over year growth rate of 67%. In other words, Tesla only delivered 3,456 electric vehicles more than BYD and the Chinese EV maker has managed to drastically lower the delivery gap that existed between the two companies. And we could soon see BYD overtake Tesla in terms of total delivery volumes as the Chinese firm is on fire right now: BYD grew 148% faster than Tesla in Q3 and BYD has an attractive portfolio of EVs, especially the relatively new BYD Seal for which there is strong demand in China and which shows a lot of export promise as well.

Source: CarNewsChina

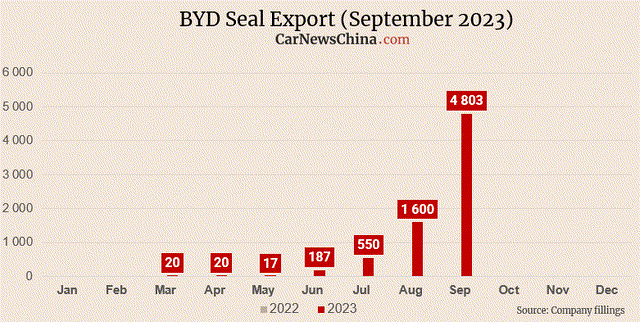

Focus on export growth

While China remains BYD’s core market, the firm is taking preparations to penetrate other geographies with its electric vehicle products, including Europe and Latin America. One promising product is the BYD Seal which went into production in 2022 and looks to make a big splash in major export markets, especially in Europe. The BYD Seal is a battery-powered electric passenger saloon and competes with the likes of Tesla’s Model 3 and the Polestar 2. The BYD Seal has a range of 354 miles on a single battery charge and already made waves in China with its sales success. The EV manufacturer sold more than 55 thousand BYD Seals in the first five months after launch.

Source: Cleantechnica

Export volumes for the BYD Seal have soared lately and I believe the model, given its popularity in China, could also make a big impact in major export markets in Europe, including the U.K. In September, the latest month for which delivery/export numbers are available, the BYD Seal’s export volumes soared 300% to 4,803 models.

Source: CarNewsChina

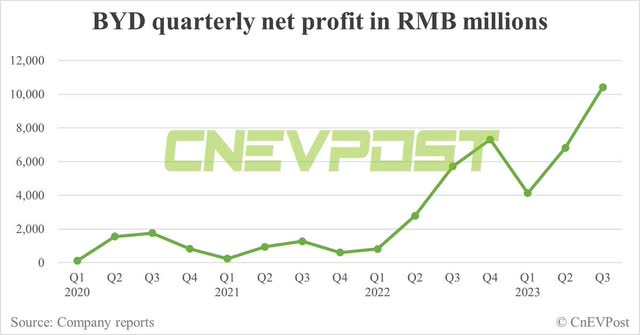

BYD’s Q3 earnings were soaring

While Tesla’s earnings dropped off in Q3’23 — they were down 44% year over year — due to aggressive price measures that were meant to stimulate additional EV demand, BYD’s earnings are going through the roof right now: BYD reported third-quarter profits of 10.4B Chinese Yuan ($1.42B), showing a massive 82% year over year growth rate. BYD achieved record profits and the trend continues to point upwards…

Source: InsideEVs

BYD’s valuation vs. Tesla

One more attractive feature of BYD is that the company’s shares trade at a much lower revenue multiplier than Tesla… despite BYD being set to overtake TSLA in terms of delivery growth.

BYD is valued at 0.85x FY 2024 revenues and expected to see 27% top line growth next year. The average annual top line growth rate in the next five years, between FY 2023 and FY 2028, is 15%.

Source: Seeking Alpha

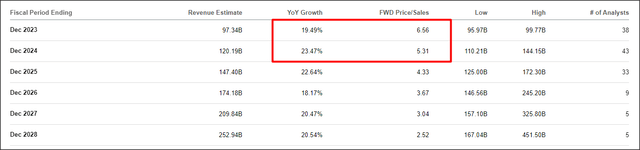

Tesla’s valuation metrics are inferior relative to BYD’s: shares of the U.S.-based EV company trade at 5.31X FY 2024 revenues — a multiplier factor 6.2X larger than BYD’s — and Tesla is expected to grow its revenues 23% next year. Tesla’s average five year annual revenue growth rate is 21%, so Tesla is expected to grow faster than BYD: the top line difference is 6 PP per year… which is not enough to justify such a large difference in the valuation multiplier, in my opinion.

Source: Seeking Alpha

Risks with BYD

The biggest risk for U.S. investors is that BYD is a Chinese electric vehicle company and some investors do have legitimate concerns about investing in Chinese (EV) companies that are not subject to U.S. accounting standards and reporting requirements. In terms of commercial risks, I see the current fall-out in China’s real estate market as a risk factor that could affect consumer spending negatively. Additionally, competition in the EV market is generally increasing with both domestic and foreign companies trying to dominate the EV market in China. This makes broad-scale price erosion for new electric vehicles more likely… which may ultimately affect BYD’s earnings picture.

Final thoughts

BYD is crushing it in a number of metrics, especially with regards to delivery growth, total delivery volume and earnings growth. The company is set, in my opinion, to overtake Tesla in terms of quarterly (and annual) deliveries as BYD is growing much faster. This growth is translating into soaring profits for BYD while Tesla has seen a margin and earnings downtrend in the third-quarter. The Warren Buffett-backed Chinese electric vehicle company is executing extremely well right now and the BYD Seal could turn out to be an export hit as well take sales away from the Tesla Model 3. With shares of BYD being significantly cheaper than Tesla’s — although Tesla is expected to grow a bit faster than BYD in the next five years — I believe China’s Tesla is a highly attractive investment play on the global EV market!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here