For many investors, funds that invest in preferred shares are fairly popular, as preferred shares provides high distribution yields with modest default risks, as they rank ahead of common stock in corporate capital structures. However, I believe the Nuveen Variable Rate Preferred & Income Fund (NYSE:NPFD) is a fund that should be avoided.

While marketed as a variable rate preferred fund, it actually mostly holds ‘Fixed-to-Fixed’ and ‘Fixed-to-Floating’ preferred securities that act like fixed rate preferreds over the short-term. This has led to duration losses that variable rate investors were not expecting.

Furthermore, the NPFD fund is heavily concentrated in the Financial sector, which may increase systemic risks for the fund. I would personally seek preferred share exposure elsewhere with much cheaper ETF options.

Fund Overview

The Nuveen Variable Rate Preferred & Income Fund is a recently launched closed-end fund (“CEF”) that aims to provide a high level of income by investing primarily in investment grade variable rate preferred securities.

The NPFD fund may invest up to 20% of managed assets in contingent capital securities or contingent convertible securities (“CoCos”) and up to 15% of assets in emerging market companies, but will stick with U.S. dollar denominated assets. At least 25% of managed assets in the NPFD fund will be invested outside of the Financials sector.

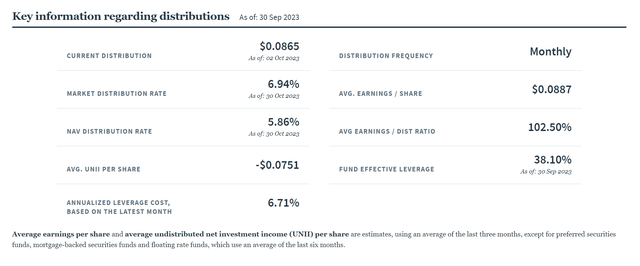

The NPFD fund uses leverage to enhance returns and as of September 30, 2023, the fund had 38.1% effective leverage (Figure 1).

Figure 1 – NPFD uses leverage to enhance returns (nuveen.com)

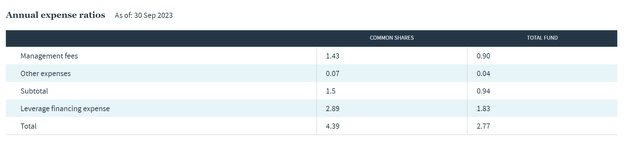

The NPFD fund has $446 million in net assets and charges an expensive 4.39% total expense ratio (Figure 2).

Figure 2 – NPFD charges an expensive 4.39% total expense ratio (nuveen.com)

Portfolio Holdings

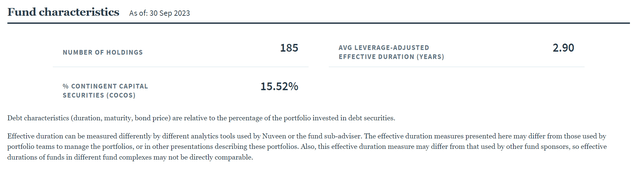

NPFD’s portfolio consists of 185 securities with an average leverage adjusted duration for 2.9 years (Figure 3). The portfolio contains 15.5% CoCos. NPFD’s 2.9 year duration is interesting, because variable rate securities should have duration close to zero.

Figure 3 – NPFD portfolio overview (nuveen.com)

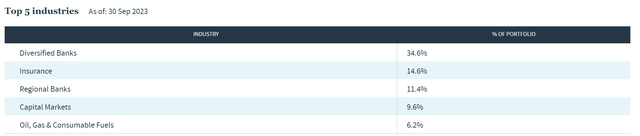

Financials are the biggest sector weight with Diversified Banks accounting for 34.6% of the portfolio, Insurance companies accounting for 14.6%, Regional Banks 11.4% and Capital Markets 9.6% (Figure 4).

Figure 4 – NPFD is heavily concentrated in Financials sector (nuveen.com)

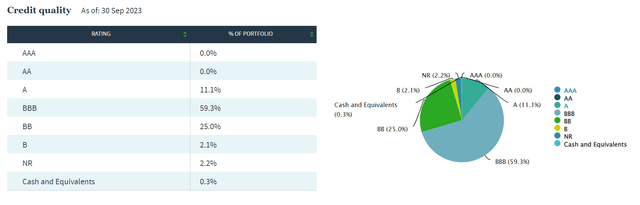

Credit quality is primarily investment grade with 59.3% of the portfolio BBB-rated, 11.1% A-rated. However, there is ~30% that is not investment grade, led by a 25.0% allocation to BB-rated securities (Figure 5).

Figure 5 – NPFD credit quality allocation (nuveen.com)

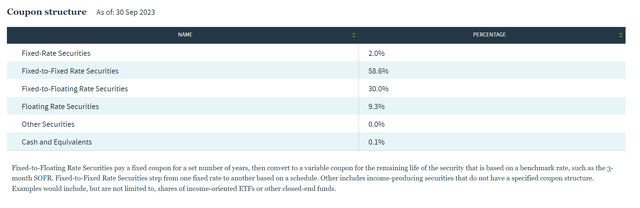

While the fund is billed as investing in ‘variable rate’ preferreds, its coupon structure is actually heavily geared towards securities with fixed rate coupons that reset to another fixed rate coupon (“Fixed-to-Fixed”) at 58.6% of the portfolio (Figure 5). There is also a heavy allocation to “Fixed-to-Floating” securities where securities pay a fixed coupon for a number of years before converting to a variable rate for the remainder at a floating rate (30.0%). Actual floating rate securities exposure is only 9.3%.

Figure 5 – NPFD coupon structure (nuveen.com)

So counter to the marketing headline, the NPFD fund actually mostly holds fixed coupon preferred securities, if viewed from a short-term time horizon before the securities rate reset or converts to floating. This explains the puzzling 2.9 year duration that we saw earlier.

Distribution & Yield

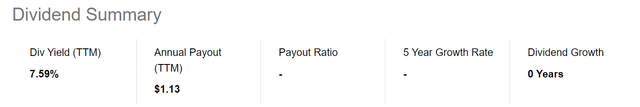

The NPFD fund pays an attractive monthly distribution with trailing 12 month distribution yield of 7.6% on market price (Figure 6). On NAV, NPFD is yielding 6.4%.

Figure 6 – NPFD is yielding 7.6% (Seeking Alpha)

Returns

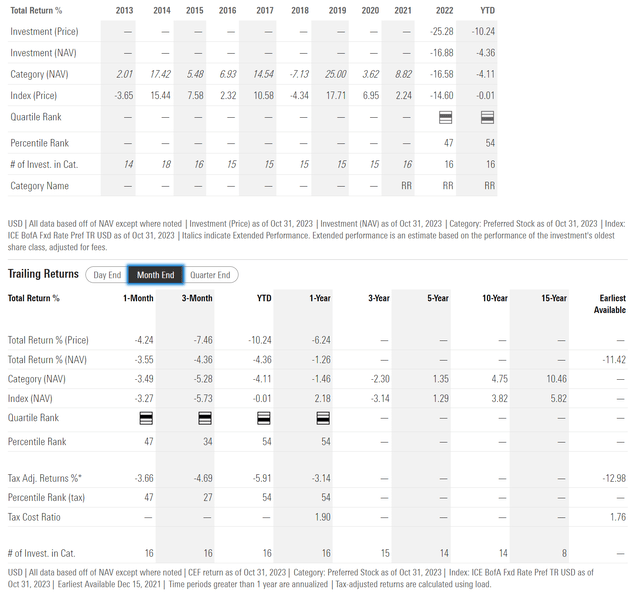

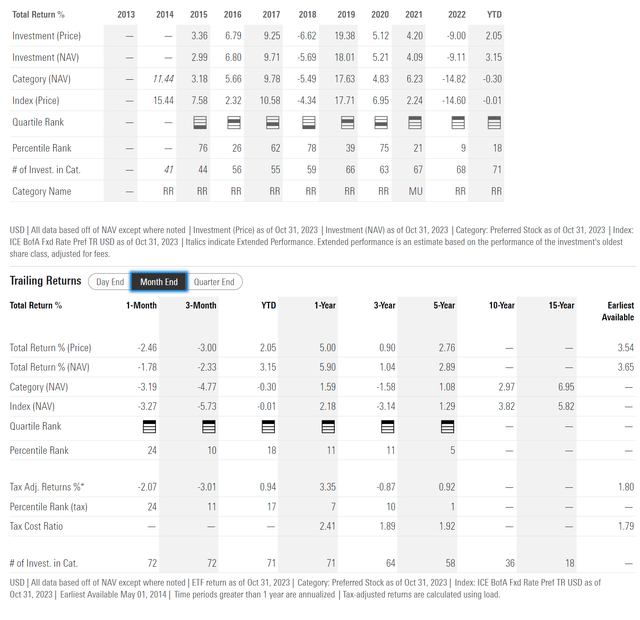

Timing for the NPFD fund could not have been worse, as it was launched in December 2021 and its first full year of operation coincided with 2022, when the Federal Reserve raised interest rates at the fastest pace on record and caused significant duration losses to fixed income portfolios.

As mentioned above, NPFD’s portfolio is technically not variable rate, as it holds many fixed rate securities that either resets to another fixed rate or converts to a variable rate. Therefore, the NPFD fund lost 16.9% in 2022. So far in 2023, the NPFD fund has lost 4.4% to October 31, 2023 (Figure 7).

Figure 7 – NPFD historical returns (morningstar.com)

NPFD’s poor performance is especially stark when we compare it to a variable rate preferred fund, the Invesco Variable Rate Preferred ETF (VRP). The VRP ETF only lost 9.1% in 2022, and has returned 3.2% so far in 2023 (Figure 8).

Figure 8 – VRP historical returns (morningstar.com)

In the end, it once again comes down to investors taking the time to read the fine print before making investments. Too often, fund management companies release products billed and marketed as one thing, but in fact, is another. The NPFD fund was marketed as a variable rate preferred fund, but holds securities that act like fixed coupon preferreds in the short-term.

Too Much Financial Exposure For My Tastes

In addition to being closet fixed-rate preferreds, the NPFD fund has too much Financials exposure for my tastes. As I have written in recent articles, one potential issue with financial preferred shares is that they are subject to ‘gap risk’ that other sectors may not have. What this means is that for a long period of time, financial preferred shares can pay their contractual dividends and their valuations fluctuate very little.

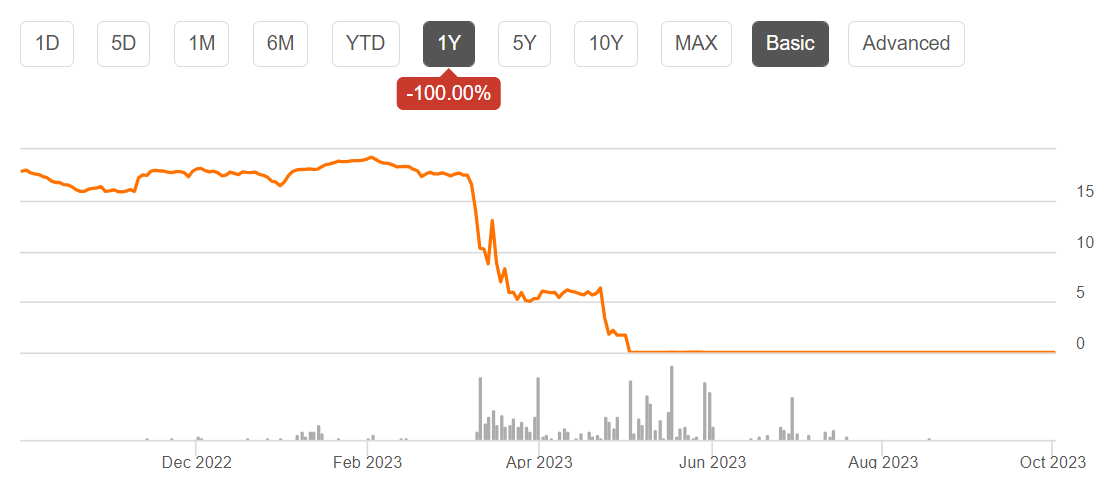

However, when there is a systemic problem with the financial system like what happened in March with the regional banks, financial companies and their preferred shares can be wiped out virtually overnight. First Republic Bank (“FRC”) was a prime example.

FRC preferred shares had traded between $16-19 for much 2022, a discount due to higher interest rates but in line with the rest of the sector. Then almost overnight, these preferred shares collapsed to $5 and then $0, as the bank was taken over by the FDIC and sold to JPMorgan (Figure 9).

Figure 9 – FRC preferred shares were wiped out virtually overnight (Seeking Alpha)

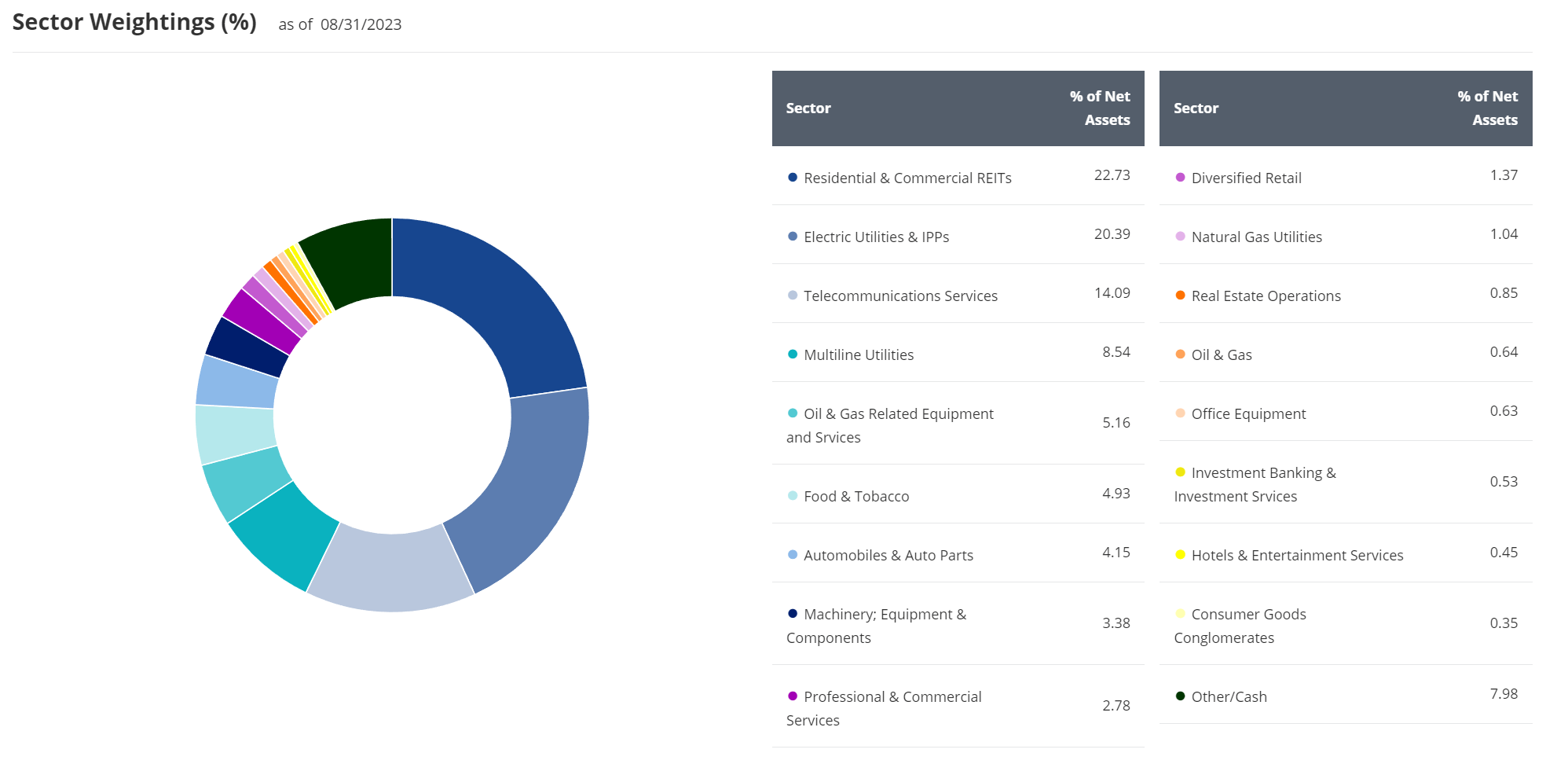

That is why instead of preferred funds heavily invested in Financial companies, I recommend investors seeking preferred share exposure to consider the VanEck Preferred Securities ex Financials ETF (PFXF). PFXF, as its name implies, do not own financial preferred shares. Instead, its portfolio is broadly diversified across sectors excluding Financials (Figure 10).

Figure 10 – PFXF sector allocation (vaneck.com)

While PFXF is still exposed to interest rate risk, non-financial sector preferred shares usually do not have the same level of systemic risk as financial preferred shares.

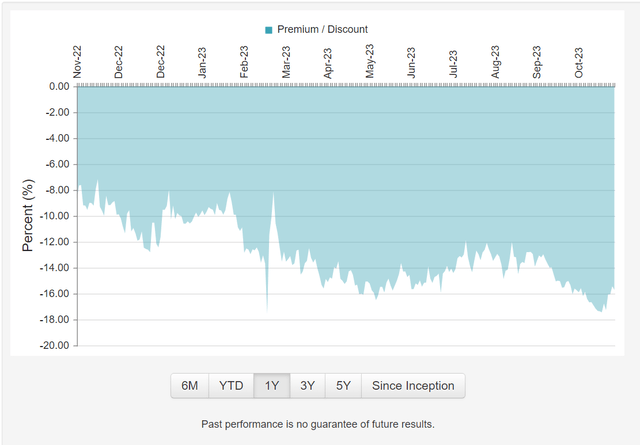

Deep Discount To NAV

With its poor performance since inception, the NPFD fund is currently trading at a steep 15.7% discount to NAV as many investors may have lost faith in the fund (Figure 11).

Figure 11 – NPFD trading at a steep discount (cefconnect.com)

Unfortunately, I do not see any near-term catalysts that can close this NAV-discount, short of an activist investor like Saba Capital agitating for a management change.

Conclusion

The Nuveen Variable Rate Preferred & Income Fund is marketed as a CEF that invests in a portfolio of variable rate preferred securities. However, careful analysis of its portfolio shows that it primarily holds ‘Fixed-to-Fixed’ and ‘Fixed-to-Floating’ preferred securities that actually act like fixed rate securities over short horizons. This has led to the NPFD fund suffering steep losses as the Fed raised interest rates in the past year.

Furthermore, the NPFD fund is heavily concentrated in the Financial sector with over 70% of its portfolio. Financial preferreds have higher systemic risks compared to other sectors as was shown in the recent March regional bank crisis.

I would personally avoid the NPFD fund.

Read the full article here