Generac Holdings (GNRC) is seeing a post-earnings options surge, after the company posted upbeat third-quarter results on strong demand for power backup equipment. Extreme weather and power outages caused a 24% uptick in sales in its commercial and industrial (C&I) business segment.

So far, 7,226 calls and 6,512 puts have been exchanged, which is already 2.3 times GNRC’s average daily options volume. The January 2025 100-strike put is the most popular, followed by the weekly 11/3 92-strike put, with new positions being sold to open at both.

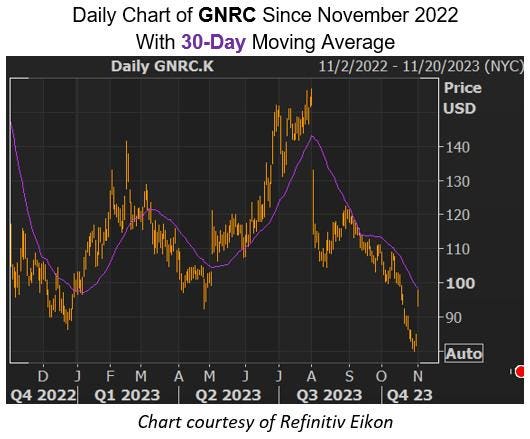

At last glance, Generac stock was up 14.5% at $96.25, bouncing further from its recent Oct. 30 three-year low of $79.86. The stock’s 30-day moving average appears to be providing pressure, however. Since the start of the year, the equity is still down 4.2%.

It’s also worth noting that the stock is overdue for a short-term bounce such as this, per its 14-day relative strength index (RSI) of 13.6, which sits firmly in “oversold” territory. Plus, short interest represents 7.9% of the stock’s available float, leaving plenty of room for covering.

Read the full article here