Investment (Short) Thesis

The Direxion Daily FTSE China Bull 3x Shares ETF (NYSEARCA:YINN) is structured to provide leveraged gains during bullish market phases, provided there is little market oscillation. However, this high-reward proposition comes tethered to high risks, especially during market downturns and especially volatility. The leveraged nature of YINN means that losses are magnified three times during adverse market conditions. Moreover, the daily reset of leverage can lead to a compounding of losses over multiple periods, making YINN a tricky instrument to handle over extended periods. Given recent involvements in the Chinese stock market around derivative products called “Snowballs” (you can’t make this up), the leveraged ETF is particularly at risk in the event of a market drop. Its 3x leverage means that any drop in the Chinese stock market (from a literal snowball effect) would be amplified by 3x on this ETF product.

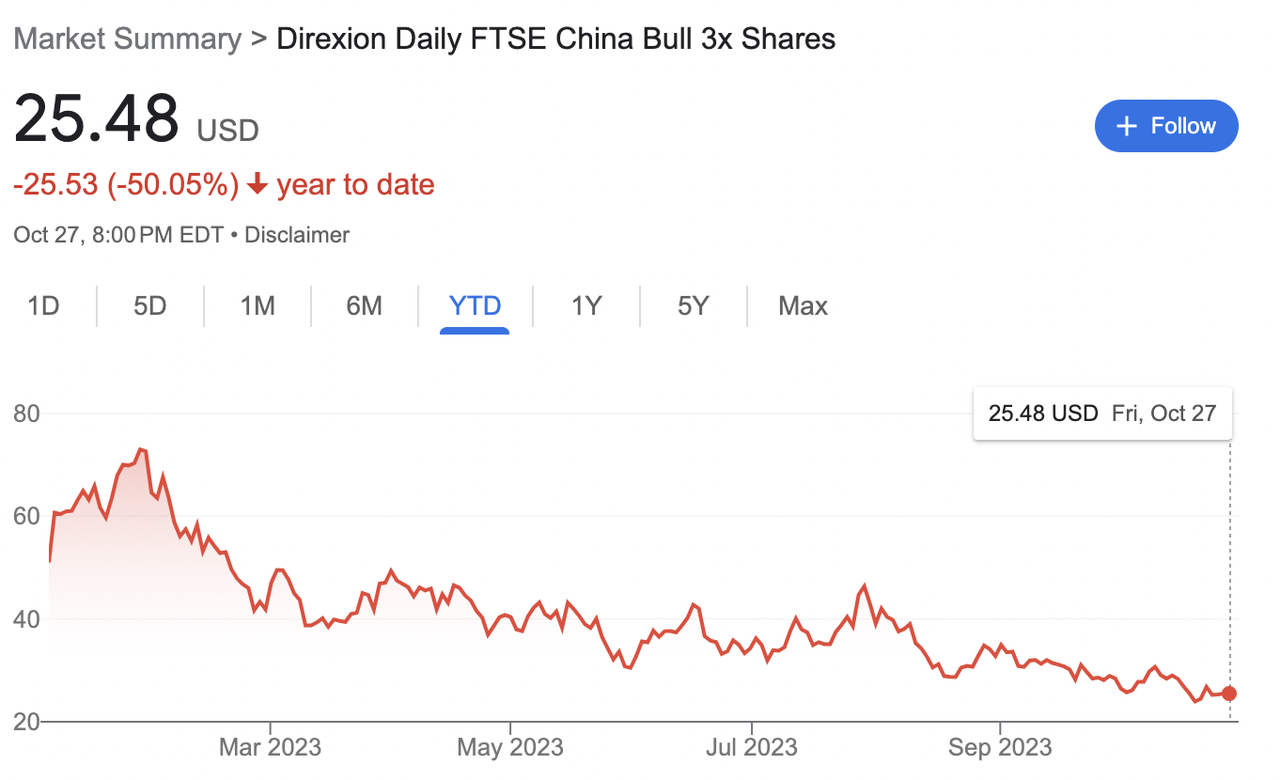

The ETF’s price as of October 27, 2023, stood at $25.30, with a 52-week trading range of $19.75 to $73.55, and assets under management (AUM) of $622.1 million, indicating significant volatility and a broad spectrum of price movement over the year. The ETF is down over 50% year-to-date due in part to the decaying nature of leveraged ETFs.

YINN Performance Year to Date (Google Finance)

Introduction

YINN serves as a high-leverage instrument for investors seeking to capitalize on the daily performance of Chinese stocks. Specifically, YINN tracks 300% of the FTSE China 50 Index, aiming to offer thrice the daily returns of the index. Managed by Rafferty Asset Management, the ETF caters to investors with a bullish short-term outlook on Chinese large-cap equities. However, the inherent leverage, which resets daily, coupled with the complex economic landscape in China, casts a long shadow of risk over YINN, making it a potentially perilous venture for the unprepared investor.

Background on the Chinese Economy

The Chinese Economy has been slowing since the end of COVID. While this used to be a high-growth, developing economy, growth by 2030 is only projected to be 3.5% and by 2050 it may only be about 1% according to projections from Economists. Much of this has to do with the declining population, which makes it hard to grow a market in China for a business (and therefore increase the stock prices of the businesses that serve these markets). The economy is too dependent on Real Estate, which usually requires (generally) a rising population to support it. This is no longer the case, with an ex-Chinese official noting there are more residential property units in China than people, meaning there is almost guaranteed to be excess supply.

An economy overly dependent on real estate doesn’t bode well, historically, we know this based on the US from 2008.

Catalyst

The primary catalyst for concern stems from YINN’s exposure to the Chinese economy and, by extension, to a derivative known as “Snowball” products (aptly named) on the Chinese stock market. These products offer bond-like coupons to investors as long as the underlying assets remain within a specified range. A critical feature of Snowball products is the “knock-in” level, which triggers the liquidation of hedges, usually held as long positions in stock index futures if the stock market descends to that level. The popularity of Snowball products soared in 2021 amid market volatility. However, they pose a massive risk as a significant market decline could trigger a wave of selling, worsening the market downturn. A recent estimate shows that many of these products have “knock-in” levels only 10% below the current market range. This could cause a tsunami of selling in the Chinese stock market.

…the average threshold is 4,865, according to estimates by China International Capital Corp. The gauge traded at around 5,417 as of 9:52 a.m. Friday” -Yahoo Finance/Bloomberg.

Gains the previous Monday were only enabled because the “state fund Central Huijin Investment started buying exchange-traded funds (ETFs) and the government approved extra sovereign borrowing to stimulate a frail economy” (Reuters). If the economy continues to worsen, this could spill over. The reason this catalyst is becoming timely now is due to these Snowball derivatives being near a key level. Circuit breakers (see below) can exacerbate this decline.

Oscillating vs. Trending Risks (And Where I Could Be Wrong)

The risks entwined with YINN are multi-fold. I already spoke about the ETF’s inherent 3x leverage, but it’s the Snowball derivatives that really scare me personally. These Snowball products and the broader Chinese economy, which have shown signs of weakening, have prompted the Communist Party in China to ask firms to buy up stocks to support the market.

While this state-supported market infusion will definitely put some upward pressure on the Chinese stock market (and could cause this ETF to rise in the short run), this may not be enough to support YINN. This is more due to the nature of how leveraged ETFs get hurt when markets oscillate. Leveraged ETFs get hurt when the market Oscillates because they reset daily. This means that gains and losses (and the 3x return on them) are recalibrated daily, causing the ETF’s losses to be harder to recover.

This is because if the underlying Chinese stock market falls 8% in one day, it has to go up ~8.7% the next day in order to get back to the original value. If a 3x leveraged ETF falls 24% in one day, it has to rise 31.5% the next day in order to return to par, implying the base index needs to rise 10.5%. This creates a cycle where once the ETF falls it’s harder to get back up. In markets that are trending upward, this is not as much of an issue.

While we have seen periods where the Chinese stock market trends up, the unique mechanics of their market (see below) mean the oscillations are violent, likely more than offsetting any upward trends this ETF could benefit from.

Unique Circuit Breakers Can Cause Unique Problems

The Chinese stock market here has unique circumstances that will cause more problems with a leveraged ETF that resets daily. In China, the circuit breaker (a trading range tool regulated by exchanges) causes stocks to halt trading for a day at a 7% rise or fall. This behavior can cause panic selling day after day on the risk that the market may hit its down limit before you can get out for the day. Then the market is frozen for you till the next day and the daily leverage resets. These are lower than the 20% circuit breaker limits in the US, which cause stocks to be paused for the trading day. Since the crash of 1987 (circuit breakers implemented after), we have never hit the 20% one-day drop in the US that pauses stocks for the rest of the day.

Multiple times during the 2015-2016 Chinese stock market crash, the Chinese market hit its circuit breaker limit causing the exchanges to temporarily suspend it for the day. They have since reinstituted it. Since this ETF resets daily, if the Chinese stock market hits the limit down circuit breaker (for reasons such as Snowball derivatives being triggered) the leveraged ETF will not be able to recover its losses for the day before the daily reset occurs. There is a really good study from Princeton on the Chinese stock market behavior:

daily price limits, a widely adopted market stabilization mechanism, may lead to unintended, destructive market behavior: large investors tend to buy on the day when a stock hits the…upper price limit and then sell on the next day -Princeton Paper.

Back-to-back volatility in the Chinese stock market has the unique mechanics to be unlike what we could see in the US. This puts this leveraged ETF at a unique risk.

This is a product that could be both dangerous to hold in your portfolio, or to try to bet against it by shorting it. I personally believe a financial instrument like this that is high risk should be entirely avoided, and current participants should take the opportunity to get away from it.

Conclusion

YINN, with its 300% leverage on the FTSE China 50 Index, presents a high-risk scenario for investors. The intertwined risks emanating from the leveraged nature of YINN, its exposure to Snowball products, and the underlying economic conditions in China, make it a precarious investment avenue. The potential for outsized gains is overshadowed by the magnitude of losses that could be incurred during adverse market conditions. Investors should exercise a high degree of caution and a thorough understanding of the complex dynamics at play before trading YINN. The latent risks associated with Snowball products, in particular, pose a significant threat that could trigger a wave of liquidation, with detrimental effects on YINN and the broader market. I don’t think YINN is a good ETF to own, and those who do should think about selling. I would refrain from Shorting, though. As Buffett has said before, short selling is a hard business. I definitely would not try it here.

Read the full article here