Dear Fellow Investors,

The Fund[1] returned approximately 3% net in the third quarter, bringing YTD returns to 30% net. Returns may vary by fund and investment class – please check your individual statements.

The theme of our last letter, was “one day closer.” I laid out that, on average, the companies that we own are getting stronger with each passing day. While the progress may not always be reflected in the share price, there should be a steady march forward for our businesses. The P/E multiple at which a company trades changes every millisecond the market is open; building a business, however, takes decades. The net result of this disconnect can create discrepancies between the progress a business makes and its share price, and the disconnect can widen or narrow in any day, month, quarter, or year. Over the course of a typical day, the share price is entirely determined by changes in expectations, which can be boiled down to changes in multiple. Over the course of a month or a quarter, the largest determinant of share price will be the multiple, which can be influenced by macro factors such as changes in interest rates or the health of the economy. However, over longer periods, business progress will be the primary driver of returns. Time is the friend of the talented management team. Time is the friend of the advantaged business.

The macro dominates today’s investor conversation. What is the Fed thinking? When will the Fed act? Where is the price of oil headed? When will the recession start? How long will it last? In my time on the operating side of business, macro considerations were secondary. Sure, we knew about unemployment rates and if the economy was in a recession, but 99% of the time our heads were down, trying to figure out how to grow our sales pipeline, serve our customers, manage our expenses, and recruit A players as team members. Never once was a decision made because of changes to the Federal Reserve dot plots or a forecast for the rate of change to core CPI ex housing. Over time, Greenhaven Road’s success will be tied to how well the management teams we are invested in navigate their operating challenges, and if they have the balance sheet to survive the inevitable ups and downs of the business cycle, not the macro conversation investors obsess over.

OVERNIGHT SUCCESS

On October 5, PAR issued a press release, saying that they had been “selected as the exclusive point of sale (POS) software and services provider with Brink POS® and marketplace order management software with MENU Link, for Burger King® traditional restaurants in North America.”

How did it happen? What does it mean? From the outside, it is difficult to know exactly what happened, but it appears that there is a combination of factors at PAR, Burger King, and within the industry that contributed to this customer win. Jeff

Bezos said, “[a]ll overnight success takes about ten years.” PAR’s journey to landing Burger King started about nine years ago when they purchased the Brink POS system, which was at the time used in just 300 locations.

Brink enjoyed years of rapid growth, but under-investment in the underlying technology and the strategy of promising customized versions to land larger new customers led the software to be unwieldy and difficult to maintain and update across its many versions. When Savneet Singh became CEO in 2019, neither the software nor the company could have serviced or supported a mega Tier 1 customer like Burger King. In fact, PAR’s own customers were screaming at them.

At the time, PAR’s net promoter score, an indicator of how likely a customer is to recommend you, was similar to that of cable companies, which are hardly the paragon of customer service. A wise decision was made to slow growth and fix the software.

The PAR of 2023 is vastly different than the PAR of 2019. Over the past four years, the team has been strengthened, offshore software development resources have been added, the software has been rewritten, and the balance sheet has been fixed through a capital raise. More importantly, the company culture has changed, and the customer value proposition has increased as additional modules have been bought or built, including back office, loyalty, online ordering, drive-through, and payments. Burger King would have been crazy to partner with the PAR of five years ago, but now you could argue they would be crazy not to partner with the PAR of today.

The demands on Burger King’s POS and technology stack have increased notably over the past decade as the operating environment of Tier 1 QSR (quick-service restaurant) chains has gotten significantly more complicated. Multiple software systems must all speak to each other. For example, the POS system needs to exchange data with the mobile app, online ordering site, multiple delivery services such as DoorDash, as well as the loyalty program and the back office/inventory management system. Having the systems working and speaking with each other is critical. An order placed online that does not get transferred to the POS or to the kitchen becomes lost revenue and an angry customer. Burger King invested enormous resources to navigate their technical challenges, bringing in the former CIO of McDonalds, employing over 100 software engineers, and spending more than $60M to reinvigorate their technology. In the end, senior management did not think this was enough and decided to pivot. The top three technology executives departed, and the company issued the RFP that PAR eventually won.

It’s worth going through the minutia about PAR’s history and the rise in complexity of the POS and the fast-food restaurant technology stack because I want to hammer home two critical points:

- PAR has evolved and is ready to win more very large customers.

- Burger King is likely not unique. More is being asked of the POS and restaurant technology, and large chains that try to do it themselves are at a greater risk of falling behind. There are several QSR “whales” out there including Wendy’s, McDonalds, Taco Bell, and Subway, to name a few.

What does signing Burger King mean for PAR? With the stroke of a pen, they added more than 7,000 restaurant locations to their existing base of roughly 22,000, so it is meaningful customer win. Burger King should provide approximately $25M a year in annual recurring revenue on a base of approximately $130M, so PAR’s ARR should grow almost 20% just from Burger King locations in North America. It will take approximately two years to complete the Burger King installations, during which time PAR’s ARR growth rate should climb from >25% to close to >35% per year.

Being selected as the exclusive POS for Burger King North America is an outstanding outcome, and there are likely several additional waves of growth from this single announcement. Why? Burger King is owned by Restaurant Brands International (RBI), which also controls Tim Hortons and Popeyes. RBI has put their crown jewel, Burger King USA, exclusively on PAR’s platform for POS and online ordering, stepping back from internal development and towards standardized data from a single platform. If the Burger King implementation proceeds well, Tim Hortons and Popeyes are the next logical steps, as the same industrial logic that went into selecting PAR for Burger King North America applies to these other chains as well. Popeyes has 2,700 locations and Tim Hortons has more than 5,300 locations. In other words, 8,000+ locations are likely to convert to PAR in the next two to five years, which would represent another $25M+ in ARR. PAR needs to execute.

But wait, there’s more. There are also 10,000+ Burger King locations outside of North America that Restaurant Brands should logically want on the PAR platform. International locations are harder because of language, tax, and support challenges, so these rollouts would likely be the third phase of implementations (after Burger King North America and Popeyes/Tim Hortons). Pricing is likely lower for international, but in round numbers, it will likely add another $20M in ARR on top of the +$25M from Burger King North American (signed) and +25M from Tim Hortons/Popeyes (logical next step).

But wait, there’s still more. The Burger King transition to PAR is part of their “Reclaim the Flame” program, which is committing $400M to finance franchise updates and upgrades, likely involving significant hardware sales to PAR. Those hardware sales should be profitable and include PAR drive-thru and kiosks, on which PAR gets additional software fees. Burger King franchisees already use PAR products Punchh (loyalty) and Data Central, so additional sales of those software offerings seem highly likely as well. At the Burger King franchisee trade show in Miami, the Burger King restaurant of the future booth looked like a PAR showroom. Everywhere an attendee looked, they saw PAR hardware and PAR software.

The Burger King win is enormous for PAR. Perhaps even more importantly, the win also opens the door for other Tier 1 customers. It’s also a massive way to launch their MENU online ordering offering in the United States since Burger King is a great reference account. Will Burger King, Popeyes, or Tim Hortons show up in this quarter’s numbers? No, they will not. In fact, in the short term, there will likely be some elevated expenses for onboarding and support, but this is a massive win and benefits could exceed the $25M, $50M, or $70M in ARR. The Burger King signing marked a new chapter for PAR, validating their unified commerce strategy and showing that they can win RFPs over the largest legacy POS software companies for Super Tier 1 accounts. Theoretically nine years in the making, the Burger King win should roll through PAR’s financial statements for years to come.

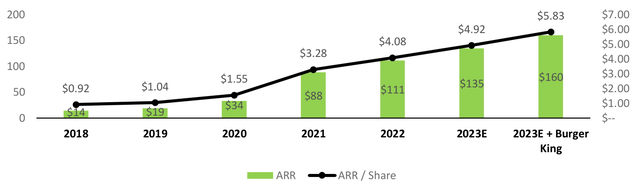

I am spending a lot of time on PAR because it is our largest position. The share price has gone down since the Burger King announcement and greatly lagged the business progress over the last five years. Fortunately, the business has gotten significantly better along just about every metric I can think of. PAR has gone from a single POS offering with significant technical debt and several distracting legacy businesses to a company with six primary offerings (POS, loyalty, online ordering, back office, payments, table service) capable of landing Burger King. This growth was assisted by a capital raise and acquisitions funded with stock, so the most appropriate way to view the business progress, in my opinion, is on a per share basis. The chart below shows the annual recurring revenue (ARR) on a per share basis.

ARR/Share Growth

PAR has grown from less than $1 per share in ARR in 2018 to more than $4.50 today and should end the year at just under $5; if you want to give them credit for just Burger King North America, which is signed, you get to almost $6 per share in ARR. Tim Horton/Popeyes would add another ~$1 per share in ARR, and Burger King International would get you another $1 on top of that. PAR has also made substantial investments that are not yet showing up in revenue, but will begin contributing in 2024, including MENU, the online ordering platform, and table service to name two.

PAR has single-digit market share, a strong product offering, a favorable competitive landscape, and a history of successful acquisitions and product development. PAR should have multiple shots on goal at other large Tier 1s. None of these waves of growth require massive R&D or massive marketing spend: the products are built and the customers already exist.

PAR should inflect to profitability in 2024 and never look back. Given the foundation that has been built, there is reason to believe that the next five years of operating progress will be even better than the last five years and today’s sub-billiondollar valuation will seem quaint. With the October 5 announcement of Burger King, we got one day closer, but in my opinion, we are far, far from the final destination.

Top Holdings

In addition to PAR, our other top holdings include Burford Capital (BUR), KKR, APi Group (APG), and Cellebrite (CLBT):

Burford Capital (BUR)

Burford is a litigation funder that funds legal cases for a portion of the proceeds. The company’s downside is limited to the cost of funding a lawsuit, and their upside is limited only by the size of the settlement or jury award. Burford’s most successful investment to date has been YPF, where they funded a case against the government of Argentina, which privatized the YPF oil company without providing compensation to shareholders. During the third quarter, a judge in New York ruled in favor of Burford and other YPF claimants in every way possible. Burford’s share of the verdict is $6.2B and accruing interest at over $300M per year. This is quite significant relative to Burford’s $3B market capitalization, though the market is discounting the award because Argentina has a history of trying to avoid paying.

In my opinion, if Burford is going to be successful, a few massive cases like YPF will drive a significant portion of the returns. In venture capital, this dynamic is referred to as Power Law. As the investor Peter Thiel said, the “biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined.” On paper, this has been the case with YPF where Burford has invested a total of $35M to date. Yes, on paper that is a 177 bagger. Burford already sold $7M of their investment for $236M, or more than a 30 bagger. It is likely that Burford will take a discount to collect their $6.2B YPF judgement but, given that their basis is only $28M whatever the discount, the returns should be eye-popping.

Over the course of the summer, we spent significant energy looking at other cases that Burford has funded. The company is intentionally opaque and will not discuss individual cases for many reasons, including confidentiality. However, after sifting through thousands of pages of court documents (via the public access resource PACER), Burford presentations, SEC filings, and news media accounts, there is reason to believe that Burford has line of sight to another multibillion-dollar award where collectability is far less of an issue than with YPF. Given the multiple sources and triangulation involved, the presentation of our analysis is far more suited to PowerPoint than a quarterly letter. We will email the presentation to all limited partners next week, but for now, rest assured I believe Burford is worth far more than the $13 per share Mr. Market has ascribed to it.

KKR (KKR)

By market capitalization, KKR is the largest company that we own, and it is also the highest quality as one of the oldest and most reputable private equity firms. The industry is still growing on the order of 10% per year as large investors like endowments and pension funds continue to increase their allocations to private equity. KKR’s next legs of growth should come from their growing high-net-worth franchise (currently less than 5% of AUM) and offerings for insurance companies. KKR is rapidly growing both their base of investors and the slate of products that they offer, with funds ranging from a classic private equity fund to private credit to climate-focused investments. KKR has a durable business with almost half of the capital being “permanent.” Coupled with a bulletproof balance sheet, KKR can outlast us all. Despite this quality, shares trade at a discount to the market. In round numbers, at the end of the quarter, KKR traded at 12 times consensus 2024 earnings vs. 17 times for the overall market despite ending the second quarter with more than $20 per share in net cash and total investments. The rate of growth may moderate or accelerate with changes in interest rates and GDP growth rates, but the steady march up should continue. Next year, KKR should also benefit from being included into the S&P 500 as it should meet all the criteria, creating a wave of “forced buyers.”

APi Group (APG)

The investment thesis remains the same: APi Group has a wonderful asset-light fire/life safety business whose customers are legally required to purchase their type of services. This business has grown organically at mid- to high single digits with incremental growth coming from tuck-in acquisitions. With very low customer churn for their nondiscretionary services, APi revenues and earnings should grow with the passage of time, and 2024 earnings should benefit from the resolution of supply chain issues and the company’s full digestion of its large acquisition, Chubb. Our returns should come from a combination of improved earnings through organic growth, small acquisitions, and margin improvement. The real “juice,” if there is any, will come from multiple expansion, as there are several asset-light noncyclical business trading at >2x APG’s multiple.

Cellebrite (CLBT)

Cellebrite provides tools to law enforcement to extract data (evidence) from cell phones, analyze the data, and manage the data. Solving many crimes without their tools is inconceivable. They are mission critical. One of the best indicators of business quality is pricing power. The ability to raise price only comes with attributes such as high switching costs and a limited competitive landscape. Cellebrite benefits from both, but has not aggressively flexed their pricing power to date. After being acquired by private equity, the company’s competitor, Grayshift, has reportedly been raising prices by more than 30% on select products. Cellebrite is taking more of a velvet glove approach, offering newer products with more functionality at higher prices, e.g., their “Premium” offering, which offers additional features and is, in fact, “premium” but is also 40-50% more expensive. The combination of raising prices, introducing new products, and cross-selling analytics products should fuel growth for the next several years. Extracting data from devices and making sense of it is not going to get easier nor is it going to become less mission-critical. Law enforcement needs tools to fight crime, and Cellebrite is the leading “arms dealer” to collect and review data from mobile phones.

Over the course of the quarter, Cellebrite hired an Executive Chairman from the private equity firm Vista Equity Partners. It will be interesting to see if he can apply any of the “Vista playbook” to Cellebrite operations, and if he can help put some of the $230M+ in cash that Cellebrite has on its books to work via acquisitions. At just over 3x 2024 revenue and profitable, Cellebrite is priced at a significant discount to peers, as if growth will evaporate. I suspect that, over time, growth occurs and multiple expands, or a firm like Vista Equity Partners acquires them.

New Investments

During the quarter, we made no new significant investments. Any available capital went to increasing exposure to PAR, given my optimism about signing Burger King, and LifeCore (LFCR), which I believe has significant upside if they are successful in their sales process.

Shorts

We remain short the flying taxi company that has the trifecta of regulatory risk, technology risk, and business model risk – and you could arguably throw in a healthy dose of execution risk. Shares remain up on the year, but I do not think time is the friend of this business. We are also short another “science project” battery company with no currently viable product and two years of funding remaining. For them, every passing day brings them one day closer to bankruptcy. We are short an EV manufacturer that produced only 1,550 vehicles last quarter, which is DOWN from last year. This is a subscale manufacturer that loses money with each car sold. In an increasingly competitive market place with declining prices, it seems hard to justify a $10B+ valuation at the end of the quarter.

We added an additional short during the third quarter in a company facing significant litigation with the potential for treble damages (i.e., 3x the actual amount) for their actions and potential liabilities far in excess of their market capitalizations. The litigation will take time to play out, but given the low margins, commodity nature of their product, and capital intensity, it is an unlikely candidate for a GameStop-type short squeeze and has the potential to decline by 50% or more.

We are also short three major indices. For the first time in the history of Greenhaven Road, we also bought some “insurance” in the form of out-of-the-money options. This was possible in August when puts on indices declined to their lowest prices in almost 20 years. The puts will soften the blow of any major decline in equity prices and are both an insurance policy and allow us to remain invested in this turbulent time.

Outlook

Investors are people. Almost all of us consume news, and it is hard not to be impacted by the events around us. There is a war in Ukraine and a very dire and unstable situation in Israel/Palestine. The U.S. Congress does not have a Speaker of the House, inflation is stubborn, and everyone expects a recession – the only argument is when. Right now, it is a slog to be informed. As a citizen, I am depressed, but as an investor, I am fully engaged. With small caps down for the year, we are entering the time of year when tax loss selling accelerates. We are seeing some violent moves in equity prices; in many cases, in my opinion, the balance sheets are being ignored as are new contracts. We are in a “show me” market. It feels like rainy season, but I think seeds are being planted. We have had multiple 50%+ up years. The returns come in chunks. I don’t know when the chunks are coming, but the gap between business progress and share price for our portfolio feels very wide. Fundamentals ignored. Macro dominating. Multiples can continue to compress, but when they eventually stop – I believe that we are well-positioned.

Watching the news can be depressing. Pandemics can surge and wars can be fought. But, through it all, pensions are still going to invest in private equity (KKR), police will need to extract data from cell phones (Cellebrite), and people will still eat fast food. Multiples will go up and multiples will go down, but as long as the companies we own can keep winning the Burger King’s, we are one day closer.

Sincerely,

Scott

Footnotes[1] Greenhaven Road Capital Fund 1, LP, Greenhaven Road Capital Fund 1 Offshore, Ltd., and Greenhaven Road Capital Fund 2, LP are referred to herein as the “Fund” or the “Partnership.”Disclaimer:This document, which is being provided on a confidential basis, shall not constitute an offer to sell or the solicitation of any offer to buy which may only be made at the time a qualified offeree receives a confidential private placement memorandum (“PPM”), which contains important information (including investment objective, policies, risk factors, fees, tax implications, and relevant qualifications), and only in those jurisdictions where permitted by law. In the case of any inconsistency between the descriptions or terms in this document and the PPM, the PPM shall control. These securities shall not be offered or sold in any jurisdiction in which such offer, solicitation or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied. This document is not intended for public use or distribution. While all the information prepared in this document is believed to be accurate, MVM Funds LLC (“MVM”), Greenhaven Road Capital Partners Fund GP LLC (“Partners GP”), and Greenhaven Road Special Opportunities GP LLC (“Opportunities GP”) (each a “relevant GP” and together, the “GPs”) make no express warranty as to the completeness or accuracy, nor can it accept responsibility for errors, appearing in the document. An investment in the Fund/Partnership is speculative and involves a high degree of risk. Opportunities for withdrawal/redemption and transferability of interests are restricted, so investors may not have access to capital when it is needed. There is no secondary market for the interests, and none is expected to develop. The portfolio is under the sole investment authority of the general partner/investment manager. A portion of the underlying trades executed may take place on non-U.S. exchanges. Leverage may be employed in the portfolio, which can make investment performance volatile. An investor should not make an investment unless they are prepared to lose all or a substantial portion of their investment. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits. There is no guarantee that the investment objective will be achieved. Moreover, the past performance of the investment team should not be construed as an indicator of future performance. Any projections, market outlooks or estimates in this document are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of the Fund/Partnership. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of the relevant GP. The information in this material is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of the GPs, which are subject to change and which the GPs do not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the Fund/Partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. The Fund/Partnership are not registered under the Investment Company Act of 1940, as amended, in reliance on exemption(s) thereunder. Interests in each Fund/Partnership have not been registered under the U.S. Securities Act of 1933, as amended, or the securities laws of any state, and are being offered and sold in reliance on exemptions from the registration requirements of said Act and laws. The references to our largest positions and any positions listed in the Appendix are not based on performance. All of our positions will be available upon a reasonable request. All hyperlinks contained herein are not endorsements and we are not responsible for such links or the content therein. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here