Ari Emanuel knows a thing or two about getting a good deal.

I just sold IMG Academy, which I got zero value for, for $1.2 billion. I sold my production company for a billion dollars. And then I have a betting business, Open Bet. I’m not getting any credit for any of those things. I actually don’t expect it to be 15 times because that’s the private market. It shouldn’t be 1.5 times. Give me six (times). I got kids to feed.

Endeavor Group (NYSE:EDR) CEO Ari Emanuel is really upset about how low his company’s stock is trading. So upset in fact, he could be about to quit the public markets game altogether:

Given the continued dislocation between Endeavor’s public market value and the intrinsic value of Endeavor’s underlying assets, we believe an evaluation of strategic alternatives is a prudent approach to ensure we are maximizing value for our shareholders.

This article will discuss why management believes Endeavor is undervalued. Why the company is a buy with a price target of at least $35 a share, as well as the risks to the thesis.

The Argument for Endeavor’s Undervaluation

So why does Emanuel think the company is undervalued? To get to that, let’s familiarize ourselves with the company’s structure.

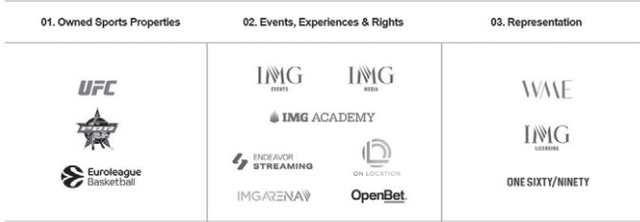

Endeavor’s conglomeration of businesses is difficult to value as one company (Company filings)

The company had three segments as can be seen from the company’s 2022 10-K. The owned sports properties include UFC, Professional Bull Riders (PBL), and EuroLeague (Europe’s top basketball competition). The events & experiences segments had things like international production of the English Premier League, food festivals, sports betting and much more. The representation business is what the company is known for, mainly agents for Hollywood and sports stars like Joaquin Phoenix and Luka Doncic.

That changed in 2023 as the UFC was merged with the WWE and spun out to form TKO Group (TKO), though Endeavor still has 51% voting rights and its CEO is the CEO of TKO, OpenBet has become its own segment related to sports analytics. It sold IMG Academy for an enterprise value of $1.2 billion and its content studio for $1 billion. It also attempted to buy parts or all of the PGA Tour but failed.

If you are finding it hard to keep up with the company’s business units, that’s precisely why management thinks it is undervalued, given the complexity involved in keeping up with each business, understanding its business model and how it can evolve, not to mention what used to be a high debt load before the sale of IMG Academy and the content studio. From Bloomberg:

Despite recent moves that might have lifted the stock – acquiring World Wrestling Entertainment, a new dividend and a stock buyback – the shares sank below $18 a share this past week. Shares have jumped about $5 since the announcement of a strategic review. But even at $23 a share, Endeavor is trading at about a third below where it ought to be, according to Bloomberg Intelligence.

The article then shares a table of the value of the company’s various units according to analysts, with the combined value trading at $17.3 billion, or $55 a share. It is worth noting that the company also has $5 billion in debt, so the equity value could be close to $39 a share according to that particular calculation.

There is a different event however that prompted Emanuel’s outrage conveyed in the quote I started the article with, and that is the sale of competitor agency CAA for a reported $7 billion. The company is a much smaller competitor of Endeavor. This means that Endeavor’s other businesses (PBL, EuroLeague, Miami Open and Madrid Open in tennis, New York Fashion Week, the sales of media rights like the Premier League, the Olympics, ATP Tour, NHL, sports betting and analytics, not to mention a 51% controlling stake in TKO which sells for $14 billion and hundreds of other events) for around $7 billion. The 51% of TKO alone sells for 7 billion today, meaning all the rest is free. That is also assuming Endeavor’s agency business sells for the same price as its much smaller competitor CAA, so there is a chance that those other businesses are trading for a negative value.

The Catalyst for Endeavor’s $35 A Share Potential Take-Private Deal

All those factors combined prompted the company to start a strategic review. Silver Lake, which owns 71% of the voting power in Endeavor, came out with a statement of its own saying it values the company and doesn’t intend to sell its shares. The statement also said that it is working on a proposal to take Endeavor private.

Most analyst research I read seemed to suggest the company should trade at around $30 a share for the non-TKO business, like this note.

I personally think the take-private deal would be at least $35 based on two premises:

1) I find it highly unlikely a company, having only been public for less than 3 years, would consider going private for being 66 percent undervalued. There is plenty of time to turn investors around having spent only 2.5 years as a public company.

2) In its statement, Silver Lake is committed “to strategies that deliver value for all shareholders of Endeavor.”

That to me sounded like making all investors whole. The all-time high for Endeavor as a public company was $35.28 a share. So that sounds to me like the region they’ll need to make the offer at. This represents an upside of approximately 54% for investors who buy today. It is also almost 100% higher than the closing price when Endeavor announced the start of the strategic review. Seeking Alpha’s article noted a CNBC M&A expert saying the deal could take place before year-end, so that would be blockbuster returns for investors if true.

Risks

The first major risk is that making valuation assumptions based on comparables applies a fixed measurement to a variable. Imagine if you bought a social media company based on Twitter’s take-private valuation of $48 billion. In other words, TKO and CAA can go down in value, rather than Endeavor going up in value. Shorting TKO and buying Endeavor might not work as well, given that the disconnect could result in TKO going up much more than Endeavor.

The second major risk is that Silver Lake, given it controls 71% of the voting shares, may seek a deal advantageous to itself at the expense of other Shareholders. That seems unlikely given Emanuel also has a significant net worth in the company. But it is something to be cognizant of.

There is also the chance the strategic review ends up with the decision not to take the company private. While I think the stock will produce long-term value for shareholders, that outcome might not be the desired one for those who were betting on the more immediate return a take-private deal would create.

Read the full article here