Author’s note: This article is about Merck KGaA, not about the “other” Merck, listed natively on the US market.

Dear readers/followers,

After being very heavily in Pharma and MedTech, I mostly sold out my positions at a profitable level following the downturn of COVID-19 about a year back. At the time, this was a fairly controversial decision, and one I frankly wasn’t 100% sure of at the time either how it would play out. It was probably one of the bigger moves I made in my portfolio without companies being strictly overvalued. I did not leave pharma or medtech behind entirely, but I re-weighted it to where it is now less than 2%. Some of the major positions here were Bristol Myers (BMY), Merck (MRK), and Johnson & Johnson (JNJ).

None of these companies were, or are “bad” companies as such. They’re great businesses. But in conjunction with an overall slowdown and increased costs, pressure from macro, and overall pressure from efficiencies in-country health/medication systems, I did not view this as a favorable sector compared to other sectors . In hindsight, I’m happy I managed to exit when I did. While I sold at a mix of prices, in the case of my BMY, I managed to rotate at a price of above $80/share, because this was where my price alert was. BMY now trades at $51, and my reinvested capital has gone up 10%. A successful rotation.

At this time, I’m seeing to start to take advantage of the undervaluations and trends we see in the pharma sector today. But I’m not beginning with BMY, I’m beginning with Merck – and not the MRK symbol or company, but the MKGAF ticker, or native MRK on the German market, which is Merck KGaA (OTCPK:MKGAF).

Merck KGaA – Looking at a 1.5% yielding pharma company

Merck is a bit confusing. There’s the MRK ticker on NYSE, which is Merck, and there’s MRK on the German market, which is Merck KGaA. These are two different companies.

The Merck Group, which by the way probably has one of the ugliest logos I’ve seen in a decade, is a multinational science and tech business based out of Darmstadt with about 60,000 employees from 66 nations. The Merck KGaA family is about 250 companies, with the main one called Merck KGaA.

So, advantages.

First off, Merck KGaA is the world’s oldest still-operating chemical and pharma companies on the world, aside from being one of the largest. It has a mind-boggling operating history going back to 1668, which predates most global nations in their current geographical configuration. It also predates the United States. It has global R&D facilities, and part of its history is the pioneering of morphine, and for a time holding a virtual global monopoly on Cocaine.

It was private for a long time. Over 300 years. It went public back in 1995, and since going public has been a superb investment for shareholders. Since 2003, the company even with a drawdown, has offered RoR of 1,100%+ in 20 years, or almost 13% per year. Again, that’s with the significant decline we’ve seen in the past 2 years.

It has a market capitalization of over €62B, a credit rating of A, and operational and profitability specifics that should interest you a great deal.

Why should it interest you?

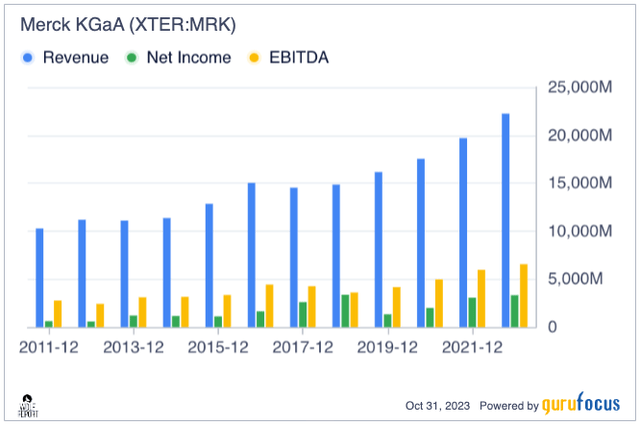

Because this company has sector-beating or above-average margins in quite literally every relevant KPI. We’re talking above average GM at 61%+, net margin at 14%, and above all, a close to 20% operating margin, which is in the upper 80/90th percentile. (Source: GuruFocus). The company is inherently profitable and has a very appealing ROIC to WACC, even after the recent decline after a 2021 record. While debt has been increasing, Merck KGaA has a superb track record of both sales, EBITDA, and net income.

Merck Revenue/net (GuruFocus)

The company also has relevant insider trading trends – insiders have been adding to the company since after the drop, with purchases in early 2023 when the company really started declining.

Merck isn’t your typical pharma/healthcare company, because it does a mix of everything. 46% of the company’s 2022 revenues come from the healthcare segment, and 35% from the life science segment. However, 18%, the remainder, comes from the electronics segment. This approach gives the company the almost holistic approach and ability to healthcare overall, working with several fields as one.

Merck KGaA IR (Merck KGaA IR)

In terms of company treatment areas, we’re talking about Oncology, Neurology, Immunology, Fertility, Endocrinology and General Medicine. What I like about Merck is the generality and diversification of its business. It’s not limited to any one area, and a downturn in overall pharma will only do so much. The company has a strong trend of outperforming overall global growth rates and other companies in its peer group.

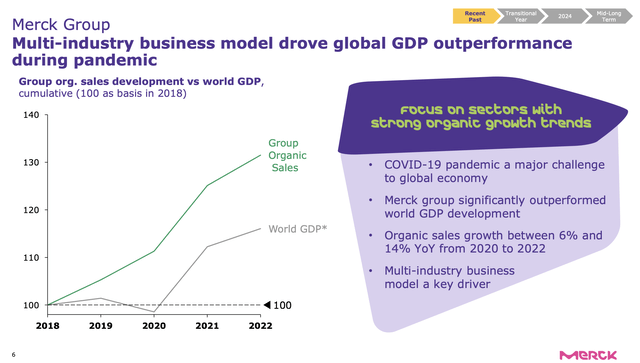

Merck IR (Merck IR)

The company announced very early on that 2023E is going to be a transitional year, and indeed it is. The reason is expected significant destocking in key areas, the semi-cycle (due to electronics, the company has a higher-than-usual exposure to this), macro inflation and China uncertainty, and low customer demand in key segments like displays.

On the other hand, there are significant positives that speak to a reversal in 2024E including no exposure to the Inflation Reduction Act, its significant geographical footprint, regaining full rights to Bavencio in healthcare, and a very strong product portfolio with good expected sales on a forward basis.

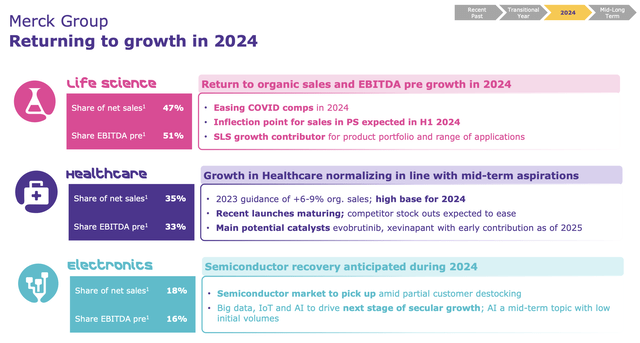

2024E is expected to be a year of growth again.

Merck KGaA IR (Merck KGaA IR)

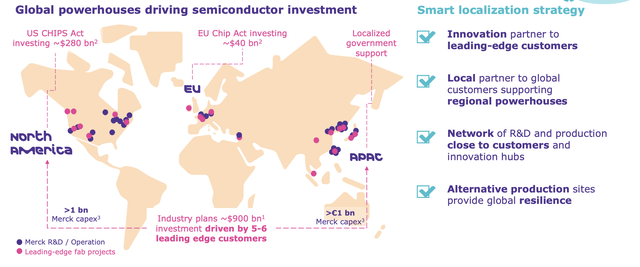

Merck KGaA is a company that works with megatrends – and more importantly to me, it doesn’t work with some specific megatrend relying on a single medication, but in global megatrends with key treatment areas across the board, as well as AI, IoT and other large sectors. What I find most interesting is the company’s continued investment and focus on the electronics segment, where the company is targeting significant investments to become the first-choice partner to local and global customers.

Merck KGaA IR (Merck KGaA IR)

Electronics is in no way the fastest-growth sort of segment here – in fact, it’s the lowest growth at a low end of 3% on the mid-term CAGR due to the cyclicality of Semi, with Life science at an expected 7-10%, but the company’s investment here is obviously long-term, with superb growth prospects well beyond the 2025E period, benefitting from megatrends in every sector. Rather than playing, as some pharma and healthcare companies do, the short-term game, Merck KGaA here plays, as I see it, an extremely long-term game. The company continues to leverage M&As and similar strategies here, but in everything that it does, the company is very conservative. I am frankly surprised that the downturn in Merck is as strong as we’re seeing in 2023E because it’s very atypical for a company that’s managed unbroken growth of over 11 years. In the past 20 or so years, less than 4 years have seen EPS decline. The company is usually very apt at beating or meeting estimates, with a very low forecast miss ratio (source: FactSet).

Perhaps the one problem with Merck KGaA – because we certainly can’t point to something like fundamentals as a negative, is the dividend yield.

Merck KGaA is unfortunately a very conservative company, and even after a significant share price drop, the yield is still below 1.6%, at 1.54%. Even if we expect growth here in the next fiscal, we’re not going above 2% (at least I don’t see that happening). This is an investment that’s unusually heavy on capital appreciation, even for this particular sector.

But if you’re fine with this, and are willing to play the very long term (as I am with this investment), you have excellent potential here.

Merck KGaA – A lot to like with a good upside.

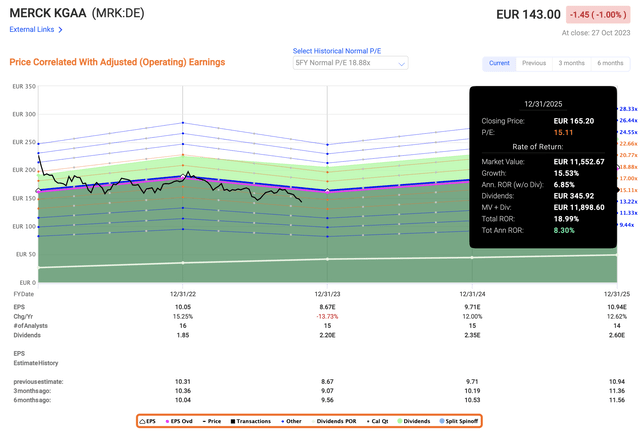

How low can Merck go? That’s an important question here. We’re now in November, and I don’t think that 4Q23 will be any sort of significant unexpected decline – so I don’t expect things to grow materially lower than we’re currently seeing it. Over the past 10 years, the company has reverted very quickly from around a 15x P/E, which for the impacted results would imply around €133/share, about €10 lower than we’re seeing today.

The average for the company has been around 18x P/E, which for the impacted 2023E would imply around €160, and for the next few years quickly go above €200/share based on estimates.

The company’s margins are the primary improvements that we want to see here – because while sales have been increasing, this has not, during 2023, translated into significantly increased EBITDA due to margins, which in itself is due to in part, an increase overall CapEx/sales, up from 6.5% to 8-9% and that 8-9% is actually the company’s long-term target.

I can accept based on this that we may need to forecast the company at a somewhat lower range of multiples and premiums – that 19-20x P/E we’ve seen some years is no longer relevant. But a 17-18x P/E should still be very much possible for this company, given the growth rates which in 2023-2025E are in the double digits.

The forecasted growth rate beyond 2023, in 2024E, is 12%, followed by another 12-13% growth as things normalize. Forecasting the company at 17-18.5x P/E would give us an 18.5% annualized, or almost 44% until 2025E. Even at 17x, the upside is over 14% annualized, and even at 15x P/E, we’re not talking a loss – even if we’re not seeing a double-digit RoR due to the company’s sub-par (contextually) yield.

Merck Upside (F.A.S.T Graphs)

All in all, Merck KGaA at this valuation is a very strong possibility for an investment – and one that’s long-term. S&P Global analysts that follow the company give Merck KGaA a very lofty target range – starting at €167 on the low side and going all the way to €220 on the high side, with an average of €193/share, implying a 40% upside to the company at the current price of €137. I wouldn’t quite go as high as that €193, but I would say the company is easily worth around €180/share in the longer term, coming to an upside over 25% here.

DCF estimates and PS value indications if we look at the broader sector where Merck “plays” implies minimum valuations of €140-€160/share (Source: GuruFocus) – and I don’t see any realistic scenario where this company is worth less than €150/share in the long term.

That results in only one possible stance for me – the stance of “BUY”.

Merck KGaA is an undervalued leader in the healthcare, pharma and electronics space. It has a superb sales and business mix, far superior of the otherwise-focused businesses that some of its peers have. I have been waiting for a long time for this company to become cheap – and now it has.

Here is my current thesis for Merck KGaA.

Thesis

- Merck KGaA is the world’s largest still-operating pharma and healthcare company, with a 300+ year history. It has absolutely stellar fundamentals, and what risks do exist are well-covered by the company’s long-term upside and expertise here.

- I say that at a good valuation, the company is almost a “must-BUY” for the long term. While it cannot be said here that Merck KGaA is “cheap” yet, because that would for me demand it drop below €130/share, it’s closing in on being cheap, and it’s most definitely an attractive play here.

- I view Merck KGaA as being a “BUY” with a price target of at least €180/share for the long term. This implies buying the company’s German-listed ticker, which I do believe is the way to go here for the company.

- I’ve added shares, and may add more.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here