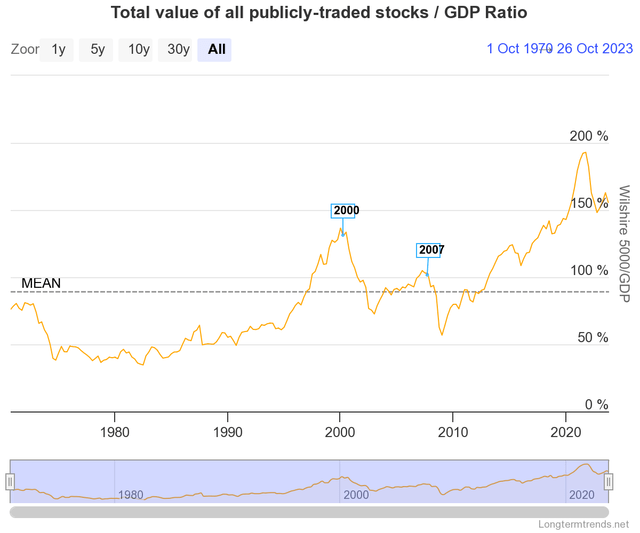

While the short- to medium-term direction for the broader equity market appears to be very much uncertain, many investors may be looking for more defensive plays. With the Buffett Indicator still flashing overvalued, pivoting to defensive makes a lot of sense:

Wilshire 5000 to GDP Ratio (Longtermtrends)

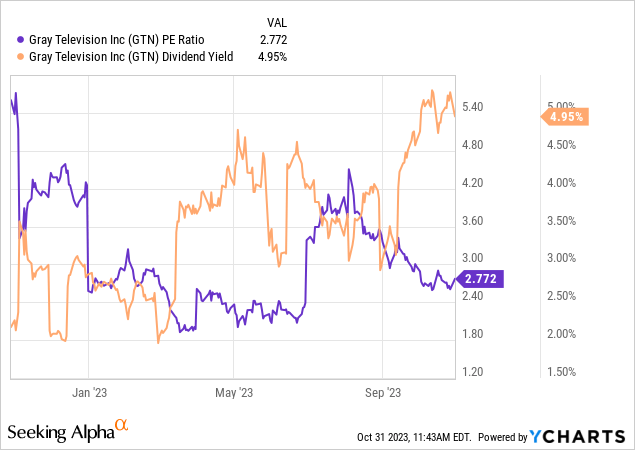

In the quest to find value ideas, one might prioritize businesses with low price-to-earnings multiples and dividends among other things. With Gray Television (NYSE:GTN) we check each of these boxes.

But even at a sub-3 PE ratio with a dividend yield of 5%, I still see a lot of risk in longing Gray as a value stock even after the 55% share price selloff over the last 12 months. In this article, we’ll look at the pay TV model and what I view as a major concern on Gray’s balance sheet.

The Pay TV Problem

As a local TV broadcast group, Gray generates revenue mainly from two sources; carriage fees and advertising sales. When I’ve covered the local broadcast space in the past, one of the main metrics that I’ve liked to look at is retransmission revenue as a percentage of total revenue. For most of these companies, that figure has increased from under 30% back in 2016 to over 50% today. Given their positions as the top two local station groups by enterprise value, I’m using Gray and Nexstar Media Group (NXST) for the sake of peer comparison:

| Q2-23 Revenue | Gray Television | Nexstar Media |

|---|---|---|

| Retransmission | $394 | $696 |

| Advertising | $391 | $413 |

| Total | $813 | $1,240 |

| Retransmission % | 48.46% | 56.13% |

Sources: company filings, dollars in millions

At 48.5% of total revenue, Gray has lagged peers like Nexstar in this regard. On one hand, this could be interpreted as Gray leaving subscription revenue on the table – which is bad. On the other hand, Gray theoretically has less to lose than its peers through continued cord-cutting. Which brings us to the larger issue for Gray and its peers; the pay TV model has been eroding for several years.

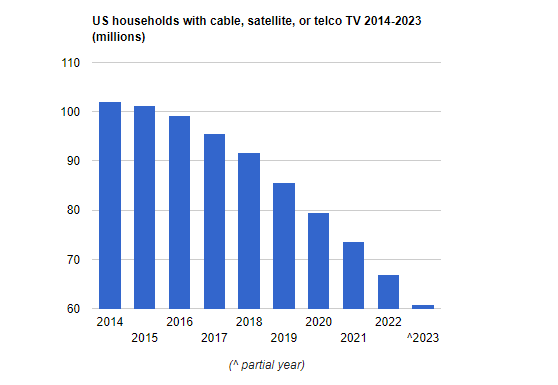

Cord cutting trend (nScreenMedia)

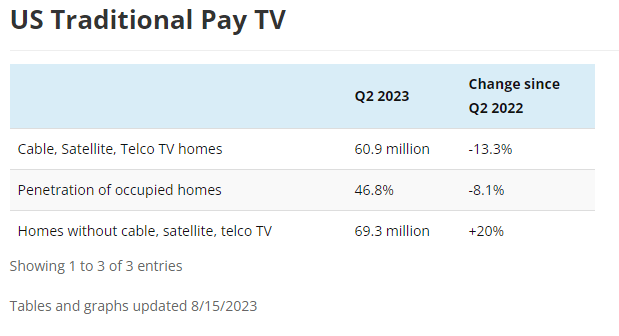

After peaking roughly a decade ago with over 100 million total households subscribing to a pay TV service, the cord-cutting trend now has total US subs under 61 million per data from nScreenMedia. There are now more US households that don’t pay for cable, satellite, or telco TV services than households that do. Perhaps more worrying is this trend doesn’t seem to be slowing down with pay TV subscribers falling 13.3% from this time last year:

Pay TV Subs YoY (nScreenMedia)

Despite this trend, local station groups have still been able to actually grow retransmission revenue over that same timeframe simply by charging the MVPDs more for programming even as total subscribers have declined. Though it hasn’t happened yet, at a certain point that strategy will stop working.

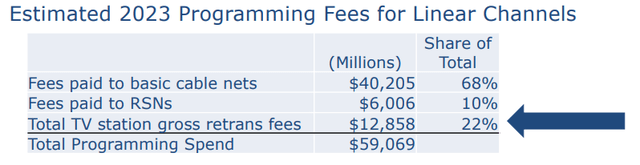

Nevertheless, Gray thinks retransmission revenue should continue higher from here due to the industry still receiving less than a quarter of MVPD programming spend despite broadcast stations delivering over 43% of TV ratings in the month of September.

October Investor Deck, slide 6 (Gray Television)

While Gray appears to be very positive on revenue growth from retransmission fees in the future, the market seems to be much less convinced of that, and rightfully so in my personal view. The fundamental problem for local TV station groups now is the same as it was before retransmission started to become a larger portion of revenues; this programming is still available to the consumer at no charge with a one-time purchase of a half-decent antenna.

Balance Sheet Concerns

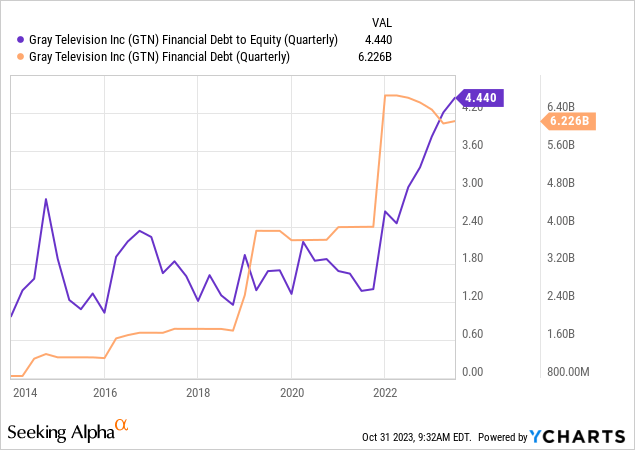

From a balance sheet standpoint, I think the market clearly understands the issue with Gray’s debt load. With well over $6 billion in debt, the company has seen its quarterly debt to equity more than triple in the last 6 quarters:

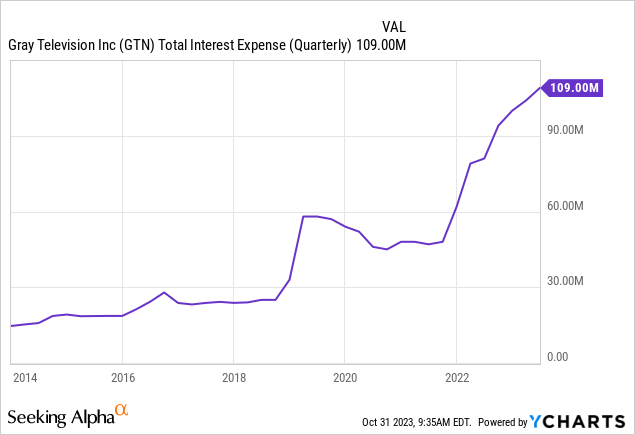

Interest payments on this debt continue to rise and are now over 13.4% of revenue as of Q2-23:

This might not be as big of a concern if Gray had a meaningful cash pile that was accruing interest, but with just $36 million in cash at the 2023 midway point, that’s not really the case. Arguably, just as concerning as the company’s enormous debt load is the degree to which Gray relies on intangible assets. Specifically, broadcast licenses:

| Assets | Gray | Nexstar |

|---|---|---|

| Cash | $36 | $346 |

| Property/Equipment | $1,574 | $1,267 |

| Broadcast Licenses | $5,320 | $2,910 |

| Goodwill | $2,660 | $2,961 |

| Total Assets | $10,810 | $12,310 |

| Licenses % | 49.21% | 23.64% |

Source: company filings, dollars in millions

Nearly half of Gray’s total assets are made up of broadcast licenses. This is over double Nexstar’s percentage and other peers in the space are more in line with Nexstar than with Gray on this metric. My interpretation of this is Gray’s licenses are theoretically more valuable due to their footprint of market-leading news operations.

That said, this is still a long-term concern because broadcast licenses aren’t required by alternative media insurgents. Meaning, when local journalists and newer media companies inevitably go more direct to consumer through their own online channels to a larger degree, I believe the value of traditional media licenses will deteriorate. This is especially relevant considering ATSC 3.0 appears to be a flop. From a recent MediaPost article:

LG, for example, is dropping its support to include ATSC 3.0 into future TVs. Early this year, a Vizio spokesperson — at the Consumer Electronic Show in Las Vegas — said its current TV-set models do not include ATSC 3.0 tuners. Word has it Samsung and Sony may be next.

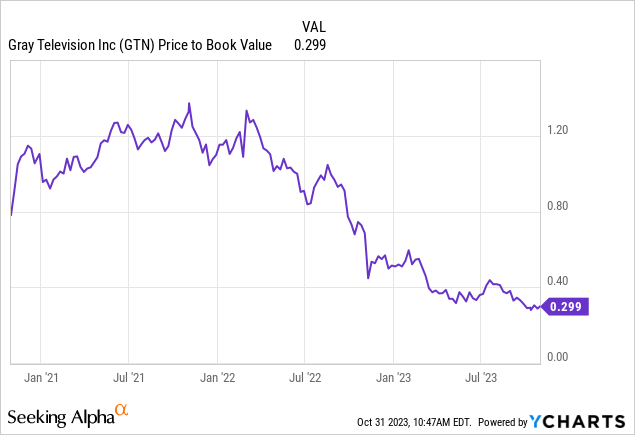

Not exactly a ringing endorsement for a technology that many in the traditional broadcast space believed would save the industry 4 or 5 years ago. In addition to the debt, I suspect Gray’s reliance on intangibles could be contributing to the company’s stock trading at a 70% discount to book value:

If we mark down Gray’s licenses to something more in line with peers, the problems become apparent. Revaluing Gray’s $5.3 billion in licenses to the $2.9 billion we observe from Nexstar shaves Gray’s total assets down to $8.4 billion. This would be against total liabilities of $8.1 billion for a liquidation value of $300 million – or about $3.25 per share. This gives us an adjusted price-to-book ratio of about 2, which is far more in line with industry peers. But I want to be clear, this is more of a back-of-the-envelope estimate and shouldn’t be taken as a hard company valuation attempt. However, I do think it’s something investors should consider.

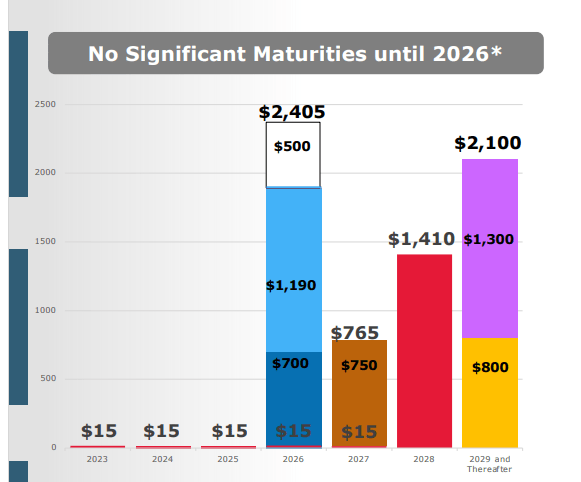

While Gray’s debt load is very high, I would say there is a somewhat favorable maturity profile. The company doesn’t have to deal with any significant rollovers until 2026. And by that time it’s entirely possible that borrow costs will be cheaper than they are today.

February Investor Deck, slide 12 (Gray Television)

During the company’s last earnings call, CFO James Ryan made note of how quickly Gray has been able to generate free cash flow during past political years and we have a general election in 2024. However, we aren’t going to see that reflected in earnings until Q4-24.

Investor Takeaways

I’ve laid out what I feel are considerable risks with longing GTN stock even after a 55% selloff over the last 12 months. While maturity isn’t a concern yet, Gray’s debt load is high and interest payments are already starting to become a meaningful expense for the company. Due to cord-cutting, I suspect we’re closer to the end of retransmission revenue growth than the beginning. Beyond that, I think one could make the case that the company is overly reliant on broadcast licenses for balance sheet health. I also can’t help but wonder if it might make sense for the company to pull back on the dividend and pay down some of this debt load faster.

While I haven’t touched on Gray’s Assembly Studios project or the impressive number of top local stations within the group itself, I do think the company does own valuable assets. However, what remains to be seen is how those assets are monetized going forward. Linear’s TV audience is aging and younger demos that advertisers seek are simply not watching live TV to the degree that previous generations did. This can be alleviated by acquiring live sports distribution rights and Gray is already doing this in some markets, but the profitability of those kinds of deals to the broadcasters hasn’t necessarily been a slam dunk.

I can’t justify a sell recommendation at current valuations. But I’m not personally taking a stab at Gray down here. In my view, GTN is more of a value trap than a deep value buy. For now, it’s a hold for me.

Read the full article here