Investment action

I recommended a buy rating for DexCom (NASDAQ:DXCM) when I wrote about it the last time, as I expected DXCM to achieve FY23 guided revenue, and growth should persist at the previous strong pace for the near term as well, driven by the strong growth momentum and multiple drivers. Based on my current outlook and analysis of DXCM, I recommend a buy rating, as the 3Q23 results further reinforced my outlook and confidence in the business. While the stock has de-rated severely over the past few months, the business fundamentals continue to improve. Hence, I believe DXCM should continue to trade at a premium vs. peers and should eventually trade back to its historical valuation average.

Review

DXCM reported impressive financial results for 3Q23, characterized by robust performance in both revenue and EPS. This notable achievement prompted the company to revise its guidance upward, indicating an even more optimistic outlook for future performance. In 3Q23, the company reported a revenue figure of $975 million, surpassing the consensus estimates by $36 million. This notable achievement can be attributed primarily to the robust performance of the company’s international operations and improved outcomes in the United States. The gross margin and operating margin both experienced significant expansion, with the former increasing by 230bps and the latter increasing by 620bps. The expansion of profit margins led to EPS of $0.50, surpassing the consensus estimated value by $0.16. Diving deeper into the details, total sales in the United States amounted to $714 million. This notable figure can be attributed to several factors, including the strong performance of the G7 countries, the expansion of market coverage, and the successful launch of new products, all of which surpassed initial projections. T expect the growth momentum in the United States to persist due to the establishment of G7 reimbursement in the country across all channels. Additionally, the positive performance of Basal which led DXCM to successfully increased its market share across all channels in the US is another positive factor that drove my expectation. Regarding OUS, revenue grew by 33%, primarily attributed to the robust performance observed in the Europe markets. In a manner akin to the United States, the future trajectory of growth appears to be favorable for DXCM, as the company has successfully completed its comprehensive launch in 16 markets. This expansion has resulted in approximately 4 million individuals gaining access to DXCM’s offerings within the past two years. Furthermore, DXCM is poised to extend its operations into additional regions in the forthcoming months, further augmenting its potential for growth.

the second consecutive quarter of record financial performance and market share gains on all fronts. Our G7 launch remains in its early stages. There is tremendous amount of minimum left in this launch with our plan upgrades to the system and also, our upcoming AID integrations. 3Q23 call

The results of the 3Q23 have further substantiated my optimistic perspective on the business, as the primary contributors to revenue remain the growth in volume and acquisition of new customers, which can be attributed to the increasing awareness of CGM. The worldwide release of DXCM’s new G7 product, the expansion of Dexcom ONE into new geographies, the continuing momentum in T2 Basal, and the company’s impressive y/y expense leverage all continue to be positive factors for DXCM. In my opinion, DXCM is still early in the growth ramp as the majority of customers within the G7 group still exhibit a lack of prior experience with DXCM, as evidenced by their recent engagement. For reference, following the launch, there has been a significant increase in the number of physicians, reaching a total of 18,000, who have begun prescribing DXCM, despite not having done so previously. Additionally, this quarter saw the establishment of another record in terms of overall new patient starts in Medicare, which can be attributed to the contribution of Basal. This achievement is noteworthy, as management has indicated that the rate of adoption is comparable to the increase observed following the implementation of Medicare coverage for IIT2. This observation is highly encouraging.

We’re starting to see basal follow similar patterns to type two intensive, which, when you think about coming into this year, it’s about 40% to 45% adoption, but really the curve is starting to follow that. 3Q23 call

Lastly, the buzz word that has been in discussion is “GLP-1”. Fortunately, the increasing recognition of this phenomenon is advantageous for DXCM. During the conference call, the management restated their perspective regarding the positive impact of GLP-1s on CGM utilization. Furthermore, they expressed their anticipation that the study outcomes in the first half of 2024 will yield constructive findings. Additionally, management has engaged with pharmaceutical manufacturers regarding potential collaborations, and has implemented internal initiatives to progress clinical investigations on combination therapy. Furthermore, in terms of clinical aspects, I believe that DXCM’s commentary regarding the involvement of clinicians and professional societies in developing expanded guidelines for CGM utilization in individuals with non-insulin dependent Type 2 diabetes could potentially contribute to a greater adoption of CGM technology within a significantly large patient population. More importantly, management is not worried about any serious disruptions to AID/pump users during the G6 to G7 transition. However, it should be noted that there may be a temporary decrease in margin for DXCM due to a shift in product mix towards the less-scaled G7 product. Nonetheless, as the adoption of G7 increases, I believe the margin should recover as it attains scale.

All in all, 3Q23 was a tremendous quarter for the business and stock. The adoption of DXCM’s CGM is evidently increasing due to the launch of the G7 and the provision of basal coverage. This is reflected in the accelerating sales growth and the addition of a record number of new patients in the latest quarter. Also notably, management did a “beat and raise”, increasing its revenue guidance up to $3.575 billion to $3.6 billion from $3.5 billion to 3.55 billion, representing 23 to 24% revenue growth. From an absolute basis, the raise was ~$60M at the midpoint. While this indicates a modest decrease in the growth rate of 4Q23 (from over 25% to the low 20s%), however, considering the ongoing development of basal momentum, increasing reimbursement, and the sustained adoption of DXCM in G7 countries, I am optimistic about the possibility of DXCM surpassing the projected 4Q23 guidance.

Valuation

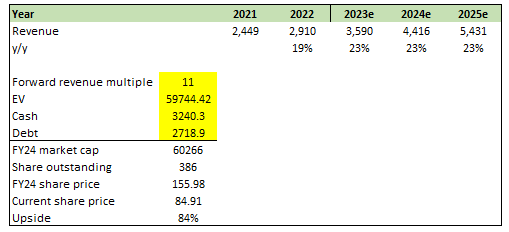

Author’s work

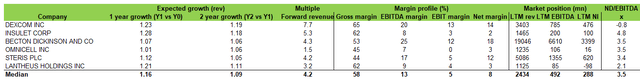

With the strong 3Q23 performance, I believe DXCM can grow at an even faster pace than I anticipated previously (21%). Using FY23 guidance, I modeled DXCM to sustain the same growth pace through FY25. While I acknowledged that the DXCM share price has risen significantly since I last wrote about it, the fundamentals have not deteriorated. In fact, it has gotten better, as can be seen in this quarter’s results and forward guidance. When I compared DXCM to peers, DXCM remains the best-performing business across almost every metric, be it growth, margins, or even balance sheet strength. As such, I expect DXCM to continue trading at a premium and should eventually trade back to its historical average of 11x forward revenue.

Author’s work

Risk and final thoughts

Several risk factors should be considered, including the possibility of market adoption falling below anticipated levels and the potential for advancements in modern medical research to result in a superior product that could negatively impact Dexcom’s market position. Finally, as previously stated, the research and development pipeline of DXCM may experience adverse effects due to delays in FDA approval or failures in clinical trials.

In conclusion, DXCM 3Q23 results were exceptional, reinforcing my bullish outlook on the company. The robust revenue growth, margin expansion, and impressive market share gains highlight the strength of Dexcom’s business fundamentals. The successful G7 launch, expansion into new geographies, and continued momentum in key product lines bode well for its future growth. The positive impact of GLP-1s and collaboration with pharmaceutical manufacturers also add to its potential. Despite the recent stock de-rating, Dexcom is poised to trade at a premium compared to peers due to its strong performance.

Read the full article here