Investment Thesis

After revisiting its pandemic lows in 2022, Shopify (NYSE:SHOP) stock has seen a nice rebound. A string of quarterly beats and the overall outperformance of Large-cap Tech helped boost the stock 37% over the last year. This optimism has carried the stock out of attractive Buy-levels in my view. Nonetheless, Shopify’s long-term opportunity remains intact. Numerous growth verticals, a focus on product development, and a high-quality business model make Shopify a strong buy should prices return to the $30’s.

Growth Outlook

Shopify’s emphasis on product development was a key contributor to the firm’s 54% annual topline growth the past 5 years. It also helped propel the company to become the leading e-commerce software platform in the U.S., now hosting 28% of e-commerce websites. This is in addition to holding the runner-up position for share of U.S. e-commerce sales at 10% behind Amazon’s (AMZN) 41% share. Twice a year the company showcases new products and innovations in their ‘Shopify Editions’ release. This summer’s was in excess of 100. Because Shopify succeeds when merchants succeed, product development can be focused exclusively on helping merchants win. That is a powerful incentive cycle. And with it comes several compelling avenues for growth.

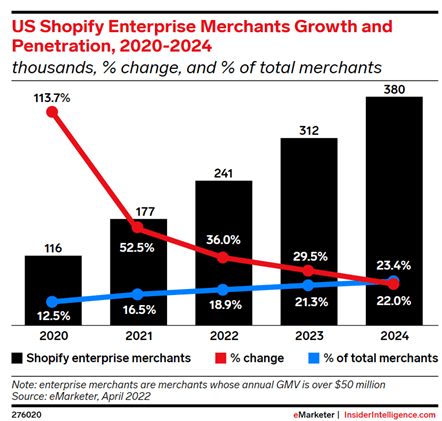

Traditionally, Shopify targets entrepreneurs and small businesses, enabling them to quickly build an online storefront. But recently, Shopify has moved up-market and increased their share of enterprise clients. The company has won contracts with notable brands like Accenture, Deloitte, Mattel, IBM, Cognizant, Meta, and many others. This is on the heels of Shopify releasing its enterprise-tailored product Commerce Components by Shopify in early 2023. Enterprise retailers now make up nearly a quarter of Shopify’s merchants.

eMarketer

A growing proportion of large merchants benefits Shopify in several ways:

- More rigid and long-term budgets = more stable, sticky, and recurring revenue

- Bigger budgets = more opportunity to increase wallet share via other products

- Popular brands = enhanced network effect

Other areas seeing heavy product investment are business-to-business (B2B), Point-of-Sale (PoS), Shop Pay, and AI. Wholesale (B2B) is an emerging opportunity for Shopify as they leverage their massive merchant network. Though a small portion of overall revenue, B2B gross merchandise volume (‘GMV’) increased 61% in the first half of 2023. PoS was a tool used for up-market acquisition as larger merchants require the added capabilities. Offline GMV climbed 23% YoY and merchants with more than 20 locations grew 120% YoY in Q2. PoS is not only effective for merchant acquisition but also is a market expected to grow over 15% annually through 2030.

Shop Pay, an accelerated checkout method, was launched in 2017 as part of the growing ‘Shopify Payments’ segment. An independent study found that “Shopify’s (Shop Pay) overall conversion rate outpaces the competition by up to 36% and by an average of 15%… and it can lift conversion by as much as 50% compared to guest checkout, outpacing other accelerated checkouts by at least 10%. The mere presence of Shop Pay, according to the study, can increase lower funnel conversion by 5%.” Additionally, Shop Pay can be paired with Shopify’s PoS and buy-now-pay-later (‘BNPL’) solutions, creating a consistent offering in-person and online. In Q2, Shop Pay facilitated $11B in GMV, up 37% YoY – highlighting merchant excitement around the product.

Two final R&D areas to highlight are artificial intelligence (‘AI’) and advertising. AI has been quite the buzzword this year. Its promise has even been price a catalyst for many tech firms, who’ve outperformed the broader market. For some firms, AI investments will result in meaningful profits and for others, not so much. In Shopify’s case, commerce-specific AI is a greenfield opportunity – and they know it. The company’s AI suite is called Shopify Magic. Magic allows merchants to leverage AI through text generation and task automation, while buyers can use Shopify Sidekick for an improved shopping experience. What differentiates Shopify is their demonstrated focus on creating value for Merchants through constant innovation. Though direct profits may not materialize with Magic, a value-add for merchants makes the platform more attractive and sticky. Shopify also has a head start with over 10 years of commerce-specific data to utilize.

Lastly, Shopify launched into the advertising space last year with Shopify Audiences. The product is exclusively for Shopify Plus merchants (higher tier subscription) and is only monetized through these subscription premiums and the increased GMV it brings to the platform. Audiences enables merchants to decrease customer acquisition costs and deploy targeted ads for improved return-on-ad-spend (‘ROAS’). Global digital ad-spend is a massive market, expected to approach $700B in 2024. Large players like Google (GOOG) (GOOGL) dominate the market, but Shopify’s network of over 2 million merchants in a nice place to start.

Business Quality

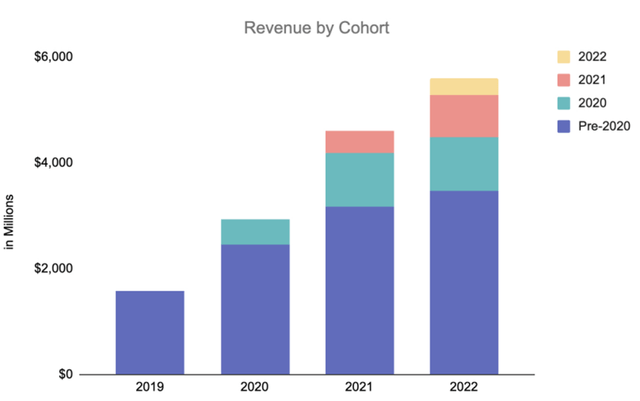

Shopify’s merchant network is the foundation of the company’s competitive moat. Millions of merchants of all sizes and industries rely on Shopify software and products, which facilitates revenue diversification, retention, and expansion overtime.

Shopify 2022 40-F

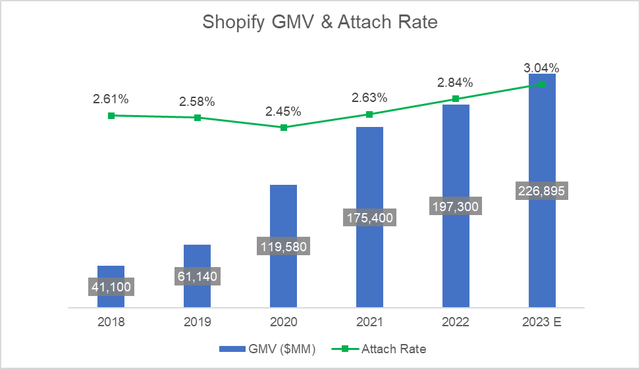

Shopify uses its core competency of innovation to cross and up-sell its existing merchant base in tandem with organic merchant acquisition. The company recently started reporting attach rate, defined as total revenue as a % of GMV, or how much volume the company converts to revenue. In Q2, the attach rate expanded from 2.76% to 3.08% in large part due to greater adoption of Shopify Payments. I took the liberty of calculating the attach rate for the past 5 years and found more evidence of Shopify’s ability to expand monetization – even as GMV has is moving upwards of $200B in FY23.

Author (data from company filings)

Shopify Payments (‘Payments’ for short) is a veiled source of growth and competitive advantage for Shopify. It falls under Merchant Solutions revenue, a less recurring more GMV-dependent source of revenue. Because of Payments, it has seen stronger growth (35% in Q2) than Subscription Solutions (21%) and makes up the majority of total revenue. This hidden fintech arm of Shopify lets merchants process payments without the need of a third-party service. And it allows Shopify to take a greater portion of transacted volume than through third-party, thereby increasing revenue per-merchant. Payments has seen widespread adoption, now used by 2/3 of merchants and contributing over half of total Shopify GMV.

Shopify also generates significant recurring revenue through subscriptions. Subscriptions revenue has expanded at a CAGR of 26% the past 5 years. Through subscriptions growth slid to 11% in 2022, Q2 of 2023 saw growth back in the low 20’s as Shopify won larger merchant contracts. In fact, 30% of Shopify’s monthly recurring revenue (‘MRR’) is from Shopify Plus, representing many of those enterprise clients. Subscriptions revenue has fallen from 43% to 27% in its share of total revenues the past 5 years due to the success of Shopify Payments. Even so, the vast majority of Shopify’s revenue is sticky in my view. Subscriptions represent pure recurring revenue, while Merchant Solutions revenue is largely tied to volume and the number of merchants using the platform. But the growth in Merchant Solutions is indicative of greater product adoption, number of new merchants, and success of existing merchants. When merchants grow on Shopify, so does their incentive to stay in my view.

Management & Strategy

Shopify’s success is largely attributable to strategy execution and will be a big factor going forward. The company’s historic strategy has been centered around helping merchants succeed via high quality products and new innovations as we saw earlier. This led to massive merchant network growth and capturing an industry-leading position. Shopify has plenty of avenues to continue growing as a result. A strategy centered around growth comes at a cost though.

Research and development (‘R&D’) as a percent of revenue has climbed from about 20% in 2017 to 30% the last twelve months, helping return the company to the negative operating margins seen before their COVID-19 boom. R&D is important to remain competitive but too much can have diminishing returns. This is also after management laid-off 10% of the workforce in 2022 and then another 20% in 2023 after planned growth “didn’t payoff”. Though headcount had clearly been bloated after the company’s unbelievable growth during the pandemic, I believe it speaks to a somewhat lack of foresight and discipline on the part of management.

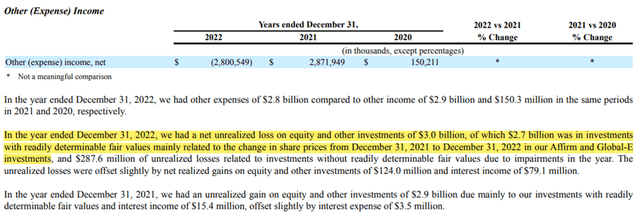

Another damper on performance in 2022 was attributable to huge investments in strategic investments. Shopify often invests in the equity of companies it partners with. The company has large stakes in buy-now-pay-later company Affirm (AFRM) and cross-border payments partner Global-e (GLBE). Both of these firms saw their stocks sell-off in 2022, resulting in Shopify’s large bottom-line losses. These big investments introduce risk to investors as profitability is partially reliant upon their performance.

Shopify 2022 40-F

What’s promising is management’s rhetoric around a new focus of balance between growth and cash flow generation. Shopify’s gross margins have compressed the past few years due to the growth of Shopify Payments. Though Shopify Payments weighs on gross margins, its beneficial to operating margins as it requires significantly less sales & marketing (‘S&M’) expense. Shopify’s recent cost discipline has helped them reduce their S&M spend from 33% in 2017 to 22% in 2022. Management has an opportunity to begin leveraging Shopify’s scale to drive operating leverage, and investors should look for more of it in the upcoming Q3 results.

Risks & Uncertainties

In addition to the uncertainties with management’s capital allocation just mentioned, there are a few more internal risks investors should take note of. Shopify was founded by Tobias Lütke who remains CEO to this day. Tobias and other insiders own over 6% of outstanding shares which has helped align management’s interests with that of shareholders. In addition to Lütke’s personal investment stake, he has placed significant weight on his vision for Shopify through a Founder’s Share. In 2022, the company issued a Founder’s Share to Lütke which gives him 40% of the aggregate voting power attached to all of the company’s outstanding shares. This presents significant ‘key person risk’ to shareholders should the founder take the company in the wrong direction. Tobias has faced some criticism over the past few years resulting in a poor rating according to Glassdoor reviews.

Glassdoor

Shopify also recently sold its logistics arm to Flexport, making it the preferred fulfillment provider for merchants and taking a 13% (17% as of Q2) ownership stake in the company. Outsourcing fulfillment could benefit Shopify by reducing resources used to run the logistics business but could also hurt Shopify by forfeiting the economic advantages of vertical integration.

The external challenges Shopify faces are mainly related to the current macro environment. I see competition as a lower risk given Shopify’s leadership and strong partner network, even with rivals such as Amazon (AMZN). Being an ecommerce platform means a heavy reliance on seller success and thus consumer demand. Consumer spending has remained robust in 2023, despite tightening financial conditions. But how long will this last? Consumers are faced with higher borrowing and mortgage rates, resuming student loan payments, and somewhat persistent inflation. Shopify has shown resilience through tough environments, but investors should be aware of these near-term risks.

Valuation

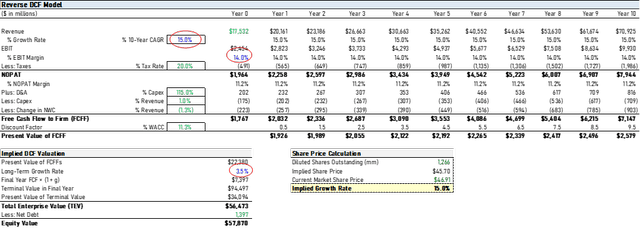

Before jumping into the expected fair value of SHOP stock, it’s helpful to evaluate the market’s expectations for Shopify implied by the current stock price. Using a reverse DCF and assuming a 20% tax rate and an 11.7% cost of capital (‘WACC’), Shopify would need to achieve the following for the next 10 years to justify the current price:

- EBIT margin of 14%

- Revenue growth of 15%

- Perpetual FCFF growth of 3.5%

Author

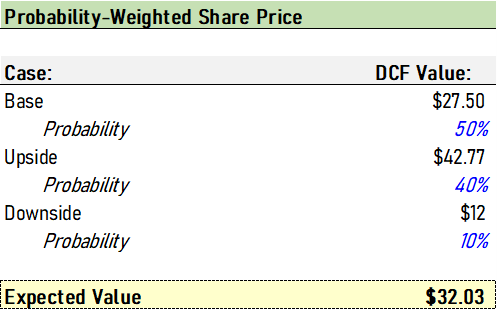

While I think the revenue growth is achievable for Shopify, my expectations for profitability are not as optimistic. My base case is revenue growth of 18% annually for a 10-year forecast period given the numerous growth verticals and demonstrated revenue retention previously discussed. I expect gross margins to stick near 50% as Shopify Payments counteracts any margin expansion from subscriptions. I expect all operating expense line items to fall steadily over the forecast period, with the exception of R&D, as Shopify leverages its scale and improves cost discipline. This results in EBIT margins staying slightly negative for the next 2 years but improving to 18% by year 10. I kept incremental capex, depreciation, and net working capital comparable to historical rates. Using the same cost of capital and perpetual growth numbers as above, my base case results in a fair value of $27.50. I also tested an upside and downside case then assigned a probability weighting to each to find an expected value. Given Shopify’s ability to beat expectations and wide moat, I assigned the following probabilities.

Author

Conclusion

I am not worried about Shopify’s ability to continue meaningfully growing its topline through new verticals but will be looking for improvement in returns on capital going forward. Shopify’s business model is defensible, of high quality, and should be leveraged to drive more value for shareholders. I urge long-term investors to be patient through near-term uncertainties and look to buy more SHOP should prices reach the $30’s.

Read the full article here