In this article, we highlight a subset of preferreds that we feel are very suited to the current environment of high and rising long-term interest rates. These are the so-called CMT (Constant Maturity Treasury) preferreds or shares linked to the Treasury yield as the base rate.

The standard CMT preferred is issued with a fixed rate and is linked to the 5Y Treasury yield i.e. the 5Y CMT. After the initial 5-year fixed-rate period, the stock will switch to another fixed-rate coupon which will be set as the sum of the then 5Y Treasury yield and a fixed spread, unless redeemed.

CMT preferreds have several advantages. One is that they have modest duration, limiting their overall interest rate sensitivity. Their maximum duration is that of a 5Y bond which then decreases until the next reset. Two, they can provide some accretion to “par” because they will reset back to a market risk-free interest rate on the next reset date. And three, they can be decent diversifiers in income portfolios which often sink under pressure of rising interest rates.

Why CMT Preferreds Align Well For The Current Market

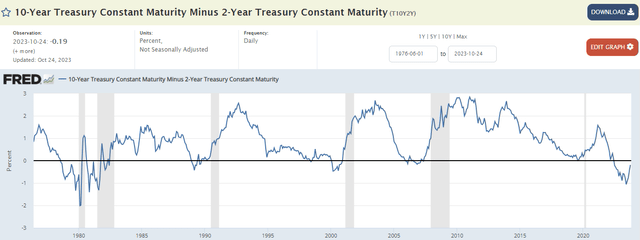

The rise in long-end interest rates has been the key market dynamic over the last couple of months. The 10Y Treasury yield is now higher this century than a couple of months preceding the GFC.

FRED

This rise in yields has hammered many income investment options, leaving investors looking for opportunities that can be more resilient to this development. One obvious option is corporate loans which are floating-rate securities. And, indeed, loans and loan vehicles both public (e.g. loan CEFs) and private (e.g. BDCs) have performed relatively well as credit spreads have held up.

However, loans may not be a slam-dunk option here for three reasons. One, loan borrowers tend to be on the lower-quality side (bank loan borrower sweet spot is in the single-B area) – a particular concern as interest coverage has moved towards and, in many cases, below 1x.

Two, loans are vulnerable to a swift drop in income were the Fed to cut rates. Historically, the Fed policy rate goes up the escalator and goes down the elevator, meaning the policy rate tends to be cut swiftly during recessionary periods.

And finally, short-term rates have flatlined a while ago while long-term rates seem to be climbing without pause. This means that securities like CMT preferreds that are linked to longer-term rates are benefiting much more than loans and certainly more from fixed-rate securities from the ongoing yield curve disinversion. Although the curve has disinverted by quite a bit already, there is likely more to come given the historic “normal” i.e. upward sloping position.

FRED

Some Ideas

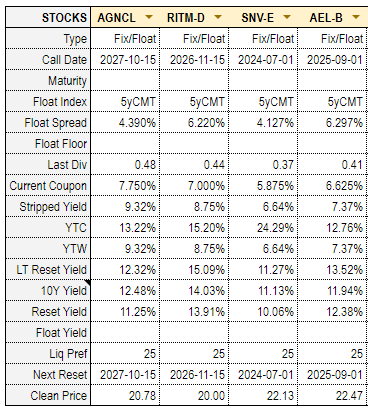

In this section, we highlight the CMT preferreds that we either topped up or added to recently on the back of the recent rise in Treasury yields. These are listed in the table below – an extract from our service Preferreds Tool.

Systematic Income Preferreds Tool

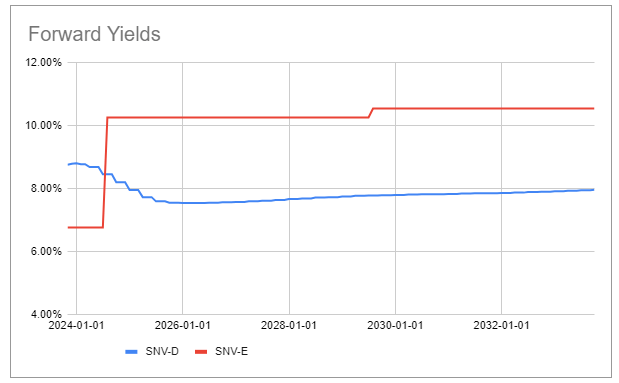

For the first time, we allocated to the Synovus Financial Series E (SNV.PR.E) – formerly Columbus Bank – a top 50 US bank by assets. SNV.PR.E is trading at a relatively modest yield of 6.64% at present, however, it’s expected to move out to a double-digit yield on its first call date in July of next year. A redemption will be a 15% windfall.

Systematic Income Preferreds Tool

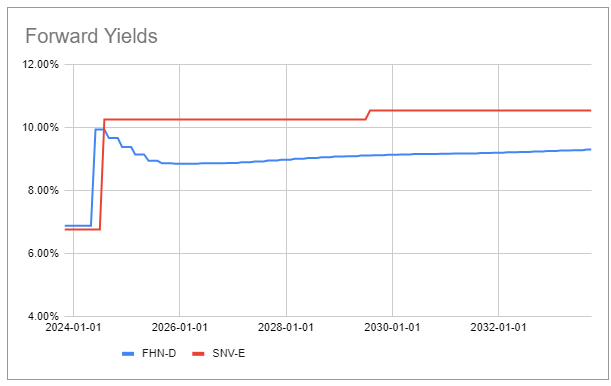

To free up capital for SNV.PR.E in our Income Portfolios we swapped from another regional bank preferred FHN.PR.D. Since our first allocation to FHN.PR.D in April, it has outperformed the Bank preferred sector by 11% despite the TD Bank merger falling away. The stock’s resilience is owed in part to its reset to a significantly higher yield on its first call date unless redeemed.

As the following chart shows, SNV.PR.E is not only expected to step up to a higher yield than FHN.PR.D, but its yield will also be “locked in” for a longer period of time since 5Y CMT resets reset only every 5 years whereas 3-month term SOFR – the base rate for FHN.PR.D – is reset every 3 months. This means that its yield is likely to drop after the initial reset since both the market and the Fed expect short-term rates to fall over the medium term.

Systematic Income Preferreds Tool

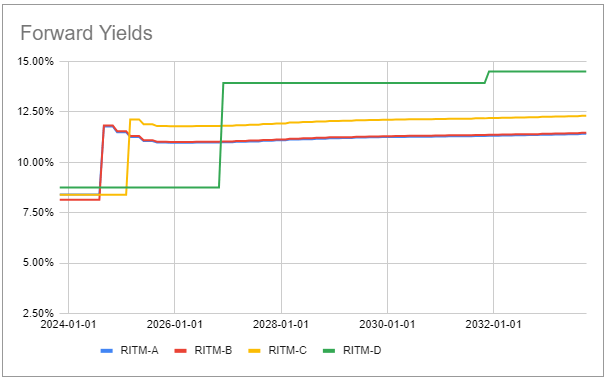

We also added the mortgage REIT Rithm Capital Series D (RITM.PR.D) – one of four preferreds in the suite. The key attraction for RITM in the mREIT sector is that its book value has held up very well over the last couple of years, in contrast to the rest of the sector which has struggled in light of wider Agency OAS and high interest rate volatility. RITM.PR.D is trading at the highest yield in the suite until the other series reset next year. However, it will very likely come back with a vengeance on its own first reset in 2026. The stock is trading currently at an 8.75% stripped yield.

Systematic Income Preferreds Tool

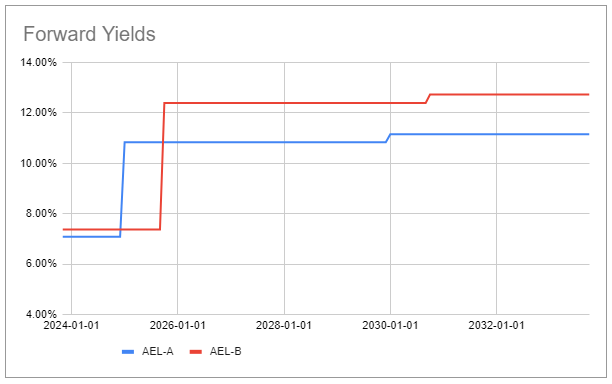

Finally, we added the annuity provider American Equity Series B (AEL.PR.B). The company is being acquired by Brookfield however its preferreds will remain exchange-traded. AEL.PR.B trades at a slightly higher yield of 7.37%.

Systematic Income Preferreds Tool

In case of redemption, the preferreds will not move to reset to the Treasury yield-based rate, however, all will enjoy a double-digit yield as they all trade well below “par”.

Takeaways

CMT preferreds are a niche sub-sector of income securities that can play an important role in income portfolios. While bank and private loans are more familiar to private investors, they also come with downsides such as their relatively low-quality profile and quick adjustment to the drop in short-term rates.

CMT preferreds, on the other hand, tend to be up-in-quality while providing a kind of slow-motion floating-rate feature. They also have the potential to “lock in” an attractive level of interest rates for 5 years as well as take advantage of a yield curve that is likely to continue to normalize. This combination makes them an important part of diversified income portfolios.

Read the full article here