Investment brief

South American resources plays have offered compelling risk-reward in recent times, given (i) the vast exposure to major commodity classes, and (ii) the backing of structural market trends.

YPF Sociedad Anónima (NYSE:YPF) is one such name that has multiple factors for consideration in the investment debate. The company operates mostly in Argentina, with operations at 3 refineries with an annual capacity of ~120 million barrels of oil (“mmbbl”), or 328 thousand barrels per day (“mbbl/day”).

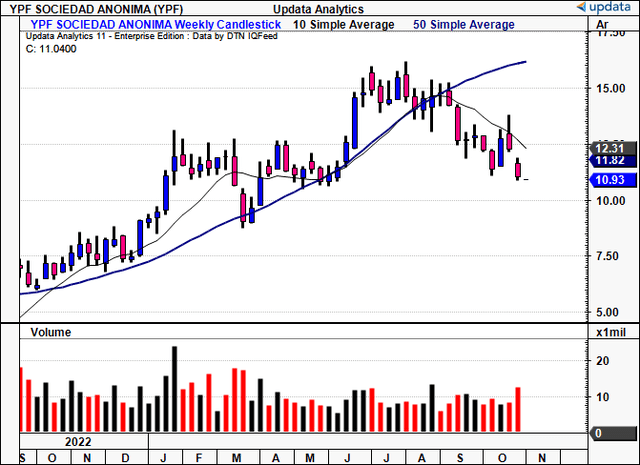

The company is set to report in the coming weeks and with the combination of (1) consolidation in stock price below 200DMA and 50DMA’s [Figure 1], (2) trading at tremendously cheap multiples, (3) market tailwinds from the underlying markets, and (4) recent fundamental developments; it is key to examine the critical investment facts for positioning into and after the company reports its Q3 numbers.

The market has revised its expectations of the company down, and this report will examine what YPF needs to do in order to outpace the market’s consensus view.

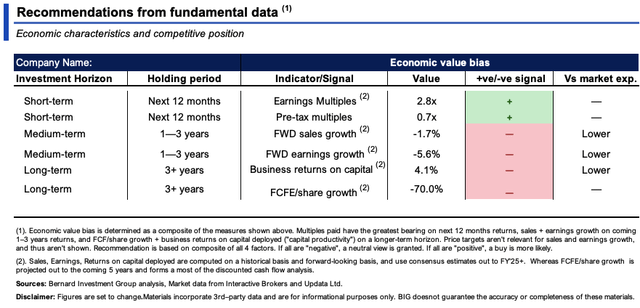

In that vein, my recommendations on leading into the company’s numbers across all horizons are the following:

- Short term (next 6–12m)— Potential value at 2.8x forward earnings, 0.8x sales and 14x EBIT. Priced at <0.5x book value increases the investor ROE to 30% at the time of writing. Reversals to the upside may be worth selling into.

- Medium-term (1–3 years)— Neutral, given lacklustre sales + earnings growth expectations, balanced by the fast pace of cash conversion on operating assets. Outsized financial performance is the key upside risk. Argentinian inflation numbers cannot be ignored here either.

- Long-term (3+ years)— Neutral, as returns + gross productivity produced on assets employed are flat and declining, no surety on outlook of underlying markets. There are also geopolitical factors to consider here as well.

Net-net, I rate YPF a hold based on these factors over a mid to long-term horizon, but acknowledge there may be potential value on a reversion to the upside in the next 12 months given the company’s compressed multiples.

Note: All figures presented in this report will be presented in USD unless otherwise stated.

Figure 1.

Data: Updata

Figure 1a. YPF monthly returns, 2007–date. Long-term downtrend remains well in situ.

Data: Updata.

Macro backdrop + recent developments

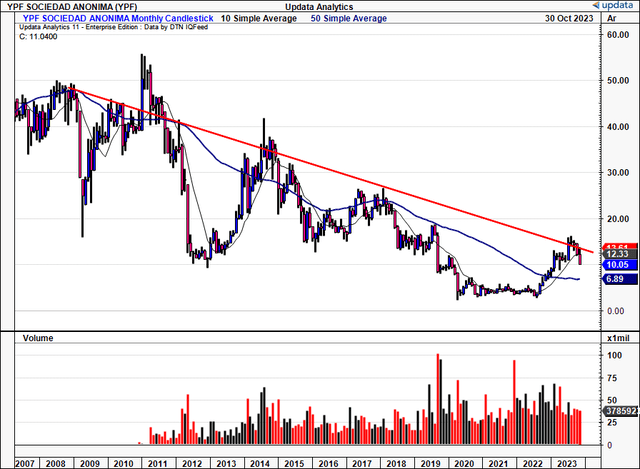

The central story for YPF’s equity line is the travel of oil pricing into the coming months. Brent crude, of which ~90% of the world’s oil trading is priced off, dipped below $90/barrel on Monday, after a resurgence of June/July lows of ~$73/barrel. Investors were slow to price in the ’22 gains of oil prices into YPF’s stock price, as seen below (Figure 1c). Tensions in the Middle East have added to the recent volatility.

Figure 1c.

Data: Updata

Secondly, there was bullish news from oil major Shell (NYSE:SHEL) in September, stating it hopes to increase its production in the Vaca Muerta shale formation, located in northern Argentina. According to Seeking Alpha, SHEL is “Vaca Muerta’s second-largest crude oil producer” second to YPF. This is constructive, as it calls for potential investment in the region, which YPF may follow.

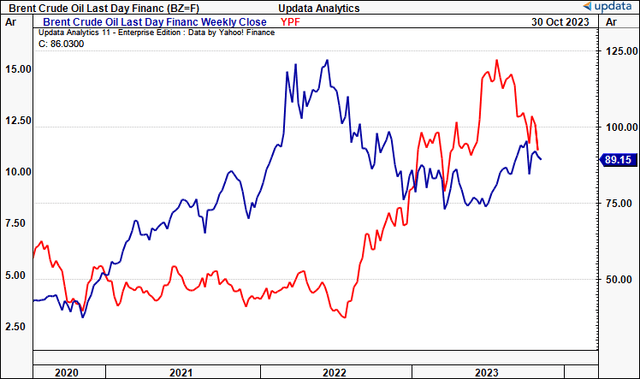

However, there’s a major spike in the wheel that turns YPF’s potential growth and investment value. The Argentinian government stepped in and froze the country’s domestic oil price in August, capping it at $56/bbl until the end of October. The move hoped to clamp Argentina’s inflation rate, which currently sits at ~140% (Figure 1d). This isn’t a new phenomenon—Argentina has “long controlled the domestic oil price“, according to Reuters. However, this is well below the $63/barrel historical cap, and ~37% below the current Brent contract.

Figure 1d. Argentina inflation growth, 2022–date

Source: Trading Economics

The move was negative to YPF’s stock price (seeing it is a state-run enterprise), resulting in a sharp reversal in August from the company’s high of ~$16.20/share. The price controls have likely dented competitiveness and reduced CapEx into the region in the mid-term.

Compounding this, there was a further selloff in YPF’s equity after it emerged the current ruling party in Argentina pulled a victory in the country’s 1st round of electoral voting. This “[prompted] concerns about the continuation of free-spending policies that have driven triple-digit inflation,” per Seeking Alpha. One might view a further cap on oil prices in the country from these developments, but we will have to wait and see. Arguably, YPF is highly leveraged to the country’s presidential election, a notion supported by Jefferies in a recent note.

Fundamental factors for consideration

Note: All figures presented in this report will be presented in USD unless otherwise stated.

The investment recommendations from above are summarized across all horizons, along with their reasoning, in Figure 2. Critically, consensus sales + earnings growth are below the market’s expectations, whilst lack of FCF/share growth has eroded shareholder value in recent years.

Figure 2.

BIG Insights

Oil and gas majors with upstream and downstream production (as in YPF’s case) incur unique challenges specific to the sector. The main headwind is that there’s no differentiation in product or price. Both demand and pricing are exogenous, set by the market, even with offtakes and so forth in place. In that vein, you’re looking for high productivity and/or high rates of cash conversion. Examining YPF’s economic characteristics, many findings within the data support this neutral posture.

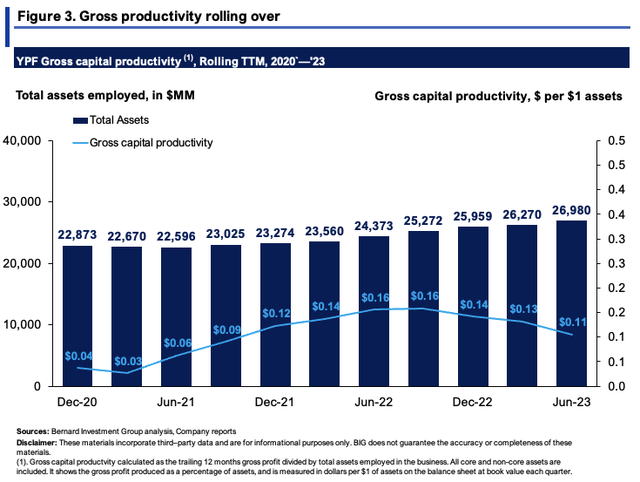

One, productivity on the assets YPF has employed on the balance sheet has reversed course since global markets began pricing in a higher cost of capital in ’22. YPF had ~$27Bn employed to run the business last period, with just c.$1.5Bn of this in cash on hand. Around $19Bn of this was deployed into fixed capital. Inflationary cycles aren’t kind to tangible asset-heavy businesses, given the high and increasing replacement costs and costs to run this capital.

Critically, YPF’s gross productivity looks to have suffered as a result, and it now returns just $0.11 in TTM gross per $1 of assets employed from its operations. Total asset values have increased from $22.8Bn in 2020 to the $27Bn last period. In my opinion, it doesn’t enjoy production advantages based on these economics.

BIG Insights

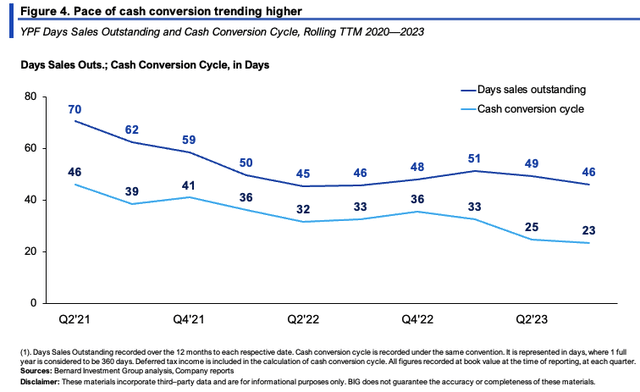

Two, this is balanced by the fact that YPF recycles cash on its NWC at a reasonable pace. Its cash conversion cycle has contracted from 46 days in 2020 to 23 days last period, meaning it recycles each $1 invested in NWC back to cash in <1 month. It could turn over its NWC ~16x per year at this pace, nearly double that of 2020. So, whilst gross productivity isn’t attractive, the company’s operating efficiency is something to consider.

BIG Insights

Technical factors to guide price visibility into earnings

In my opinion, the most critical data we have leading into the company’s earnings is the market’s sentiment + positioning. Each of the technical studies below helps to guide price visibility moving forward.

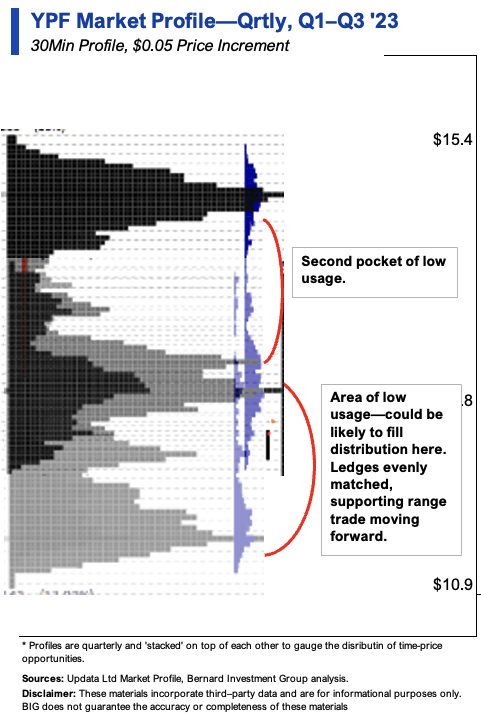

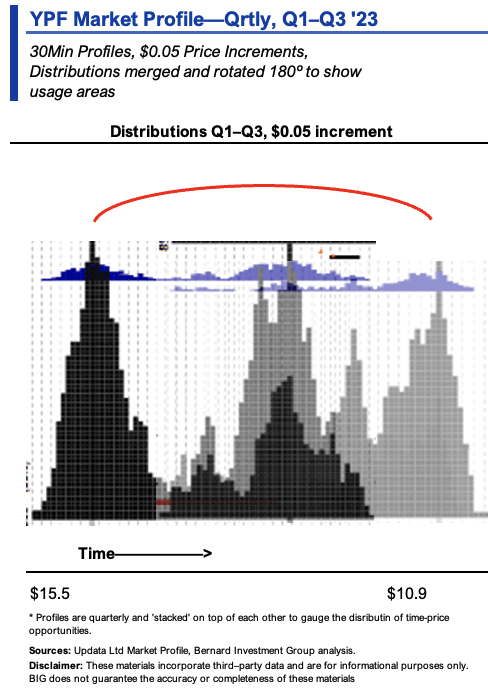

The market profile of YPF’s price distribution from Q1–Q3 shows an uncompleted bell curve with two deep pockets of low usage. This suggests the following:

(i). That rangebound trade is supported between the two ledges of value at the upper and lower end of the range, corresponding to $11–$15/share.

(ii). Markets typically move from areas of high to low usage. You can see the two low-usage areas in Figure 5. There is scope for the stock to trade within the $12–$15 range if it comes in with a flat set of numbers, resulting in no change to market expectations. Figure 6 displays this in a more comprehensive view.

Upside risks to this view include a large earnings surprise, sharp upswing in both oil + gas prices, and a more favourable geopolitical situation in Argentina.

Figure 5.

Data: Updata

Figure 6.

Data: Updata

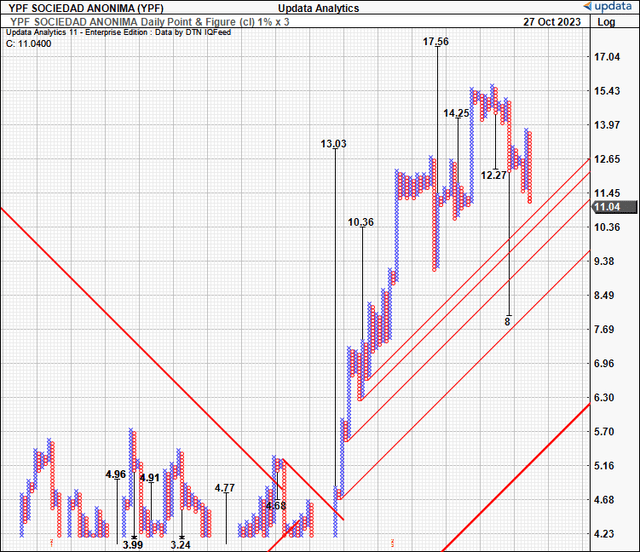

We have downside targets of $8.00/share, which can’t be overlooked. Bad news happens in downtrends, and we must get used to it. The point and figure studies below have eyed each key level well so far and should be factored in. A beak below the support lines shown in Figure 7 would certainly activate this level, and $8.00 could be the next level to watch out for.

Figure 7.

Data: Updata

Regarding trend action, both short-term and mid-term outlooks are indicative of negative sentiment in YPF’s stock price.

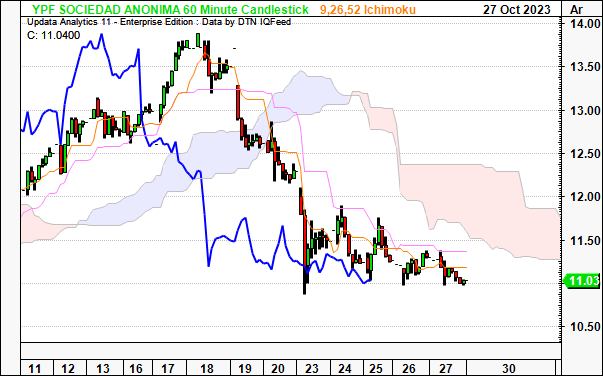

Hourly chart, looking to the coming days—

- This is the most telling for me as we are looking to the days ahead on the 60-minute chart which likely encapsulates YPF’s next earnings. We are beneath the cloud with both price and lagging lines, having crossed earlier this month.

- The bearish cross below the cloud indicates two things—one, the reaction to the political updates in Argentina, and two, potential flat expectations from the company’s upcoming numbers. This does give scope for a contrarian view, but you would need to see a break above c.$12 to corroborate a bullish view.

- In the meantime, we have price line in the same direction as the cloud, where you’d expect a convergence of these to markets to indicate a reversal.

Figure 8. Hourly chart

Data: Updata

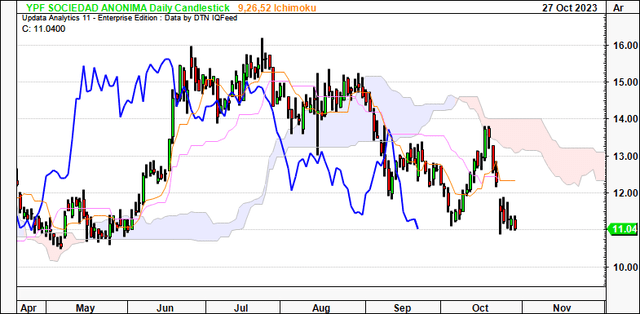

Daily chart, looking to weeks ahead—

- Equally as important, considering the effects of post-earnings drift. You would need a break above $13.00 to corroborate a bullish outlook on technicals over the coming weeks, based on this chart. Only a strong set of numbers could achieve this.

- For now, we’ve been beneath the cloud on the daily since September. We tested the cloud base this month but were rejected firmly, with the evening start shown at the reversal point. We have since gapped down 2x in a matter of days, and bulls haven’t retaken this level. We’ve also set a new low and are back within May’s trading range. To me, this is a neutral setup.

Figure 9. Daily chart

Data: Updata

Valuation and conclusion

As mentioned, the stock sells at 2.8x forward earnings, 14x forward EBIT, and 0.5x forward book value. On a short-term horizon, there may be some value may be realized at these prices, so those with a 12-month holding period might be interested.

Additionally, consider the following:

- The company produced a 15% trailing ROE last period, below the sector, but propped to 30% for the investor if paying 0.5x book value.

- In this vein, you’re getting a good portion of the company’s equity value at a reasonable price, undoubtedly attractive if oil + gas markets rally to new highs.

- At 2.8x forward earnings, when factoring in the company’s growth expectations, the PEG ratio comes to 0.28x at the time of publication.

The last point answers the question of whether YPF’s compressed multiples may be justified. Whether they are or not, the facts are that (i) the implied growth moving forward signals value, and (ii) the investor’s profitability could be increased at a reasonable magnitude at such cheap levels.

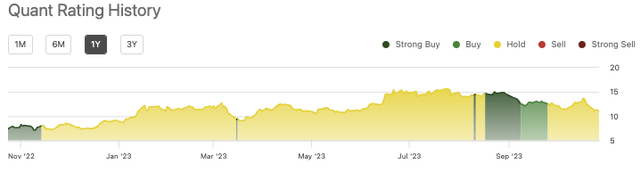

In that vein, I reiterate my stance that the next 12 months’ returns could be attractive in buying YPF, but further out (1+ years) may be hindered by financials and economics. Importantly, the quant system also reiterates a hold stance on the company, which tracks a composite of objective factors. Again, I would opine a contrarian view might be at risk here, as YPF needs a large beat at its upcoming earnings to overthrow this outlook.

Figure 10.

Source: Seeking Alpha

In short, there are many factors to consider here. YPF sells exceptionally cheap to peers, and on an absolute basis, which could be beneficial to short-term returns. But cheap valuations alone don’t make an investment case. Notwithstanding volatility in the current oil + gas markets, several political risks can’t be overlooked.

YPF’s upcoming numbers are therefore critical to convince investors it is a buy at these cheap levels. A gargantuan effort is required to do this. But, the distribution of probabilities isn’t convincing in my opinion:

(1). Oil prices in Argentina have been capped at $56/bbl since August,

(2). The country’s inflation rate is in the triple digits (hurting input costs),

(3). YPF’s sales + profitability are likely to have been impacted by these two factors.

Each of these points reduces the predictability of the company’s future cash flows in a market that should be structurally supportive for a business in YPF’s prominent position. Net-net, there is too much risk to suggest YPF could surprise to the upside in a meaningful way when it reports in the coming weeks. Rate hold.

Read the full article here