On Monday, shares of leading semiconductor solutions provider ON Semiconductor (ON) sold off by more than 20% following a surprise Q4 earnings warning with the projected shortfall mostly the result of substantially lower silicon carbide demand by a “single automotive OEM” as outlined by management on the conference call (emphasis added by author):

(…) last week, we announced that we completed our expansion of the world’s largest silicon carbide fab in Bucheon. At full capacity, the state-of-the-art facility will be able to manufacture more than 1 million 200-millimeter silicon carbide wafers per year.

Our manufacturing output continues to exceed expectations, and the acceleration of our ramp resulted in achieving a $1 billion run rate quarter in Q3, increasing nearly 50% over Q2.

However, for the full year, a single automotive OEM’s recent reduction in demand will impact our $1 billion target, and we now expect to ship more than $800 million of silicon carbide in 2023, 4x last year’s revenue.

Clearly, the slowing trajectory of worldwide EV sales is taking its toll on ON Semiconductor’s silicon carbide business. While management still expects silicon carbide sales to grow strongly in 2024 and beyond, the company is slowing capacity expansion (emphasis added by author):

Further, the yield improvement learnings we’re getting from our 150-millimeter wafer production ramp is increasing our confidence in our 200-millimeter capability and validating our strategy of driving cost savings through brownfield investments. This incredible execution and improved manufacturing output on 150 millimeters enables us to slow our capacity expansion and lower 2024 capital intensity from the high teens to the low teens percentage points ahead of our original plan and closing in on our long-term model.

For my part, I would expect this decision to impact the company’s wafer level test and burn-in system supplier Aehr Test Systems (NASDAQ:AEHR) or “Aehr” quite meaningfully going forward.

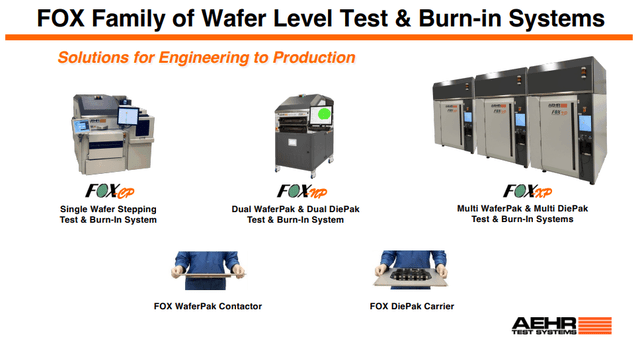

Company Presentation

While Aehr is in the process of diversifying its customer base, ON Semiconductor accounted for approximately 80% of the company’s revenues in both FY2022 and FY2023.

In Q1/2024, ON Semiconductor accounted for 88% of Aehr’s revenues and with the vast majority of its $24 million backlog also associated with its largest customer, ON Semiconductor’s stated plans to slow down capacity expansion apparently provides substantial risk for the company’s top- and bottom line going forward.

In order to achieve management’s FY2024 (ending May 31, 2024) revenue projection of $100 million, the company needs to ship its entire backlog and secure and ship more than $55 million in additional orders over the remainder of the fiscal year.

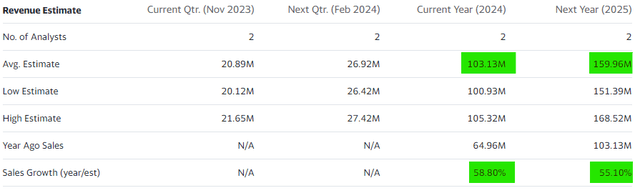

FY2025 expectations might be even tougher to achieve as the current analyst consensus is calling for approximately 55% top line growth next fiscal year:

Yahoo Finance

However, ON Semiconductor still expects its silicon carbide business to grow at 2x the market rate next year which would translate to approximately 80% year-over-year growth. As a result, silicon carbide revenues should grow from $800 million this year to just shy of $1.5 billion in 2024.

But with the company’s recently expanded facility in Bucheon, South Korea already having achieved a $1 billion annual revenue run rate last quarter despite still being in the ramp-up process, additional near-term capacity investments are likely to be limited.

With ON Semiconductor’s capital expenditures expected to decrease from 19% of revenue currently to the “low teens” in 2024 and year-over-year revenue growth not a given anymore after Monday’s announcement, I firmly expect Aehr Test Systems’ near-term order flow to be impacted by the projected decrease in capex spending by its key customer.

At least in my opinion, investors will likely have to prepare for Aehr management taking down FY2024 guidance quite meaningfully next year.

Longer-term, the company’s efforts to diversify its customer base should gain some traction albeit weaker-than-expected growth in EV sales could provide for a persistent headwind.

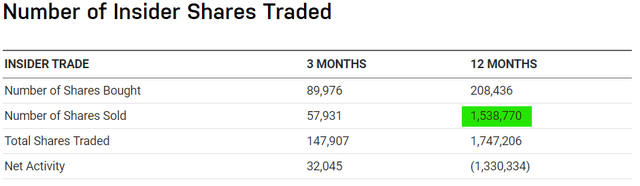

Please note that insiders have sold substantial amounts of shares into the open market over the past twelve months while reported buys almost solely relate to option exercises at a tiny fraction of prevailing trading prices.

Nasdaq.com

However, considering the stock’s stellar performance in recent quarters, it’s hard to blame them.

Bottom Line

Key customer ON Semiconductor’s surprise decision to slow down near-term silicon carbide capacity expansion and decrease 2024 capital expenditures significantly is likely to hurt Aehr Test Systems’ top- and bottom line materially.

Given my expectation for the company’s near-term growth and earnings trajectory taking a major hit, I would advise investors to sell existing positions and wait for the current headwinds to subside.

Key Risk Factor

Any signs of the impact from ON Semiconductor being less material than anticipated by market participants or even non-existent is likely to result in a major relief rally.

Read the full article here