Investment Thesis

Atlassian Corporation (NASDAQ:TEAM), the enterprise software company, has fallen from grace. Investors are not looking too kindly on the fact that this supposedly high-growth business appears to be rapidly decelerating with every passing quarter.

While many bullish investors may contend that this is more to do with the underlying economy rather than lackluster prospects with Atlassian itself, I’m quick to highlight that at the price Atlassian trades for, everything needs to be sparkling clean. And that’s not the case here.

Why Atlassian? Why Now?

Atlassian is a collaboration and workflow company. It holds two main flagship products. Atlassian’s Jira is a project management service that helps teams plan their work. While Atlassian’s Confluence is a collaboration platform that helps teams develop and share knowledge within an organization

In my previous article, as we headed into Q3 earnings, I said:

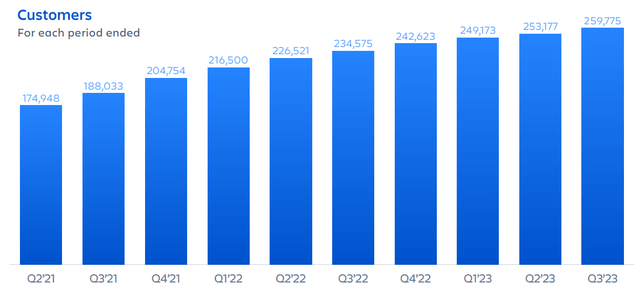

If you’ve read my work before, you’ll have seen contention that the best way to follow the appeal of a growing business is by following the customer growth rates.

TEAM Q3 2023

See if you pick up a trend?

- In Q1 2023 customer growth rates: 15%

- In Q2 2023 customer growth rates: 12%

- In Q3 2023 customer growth rates: 11%.

The pace of customer adoption of Atlassian’s platform is slowing down. Next, let’s get to Atlassian’s financials.

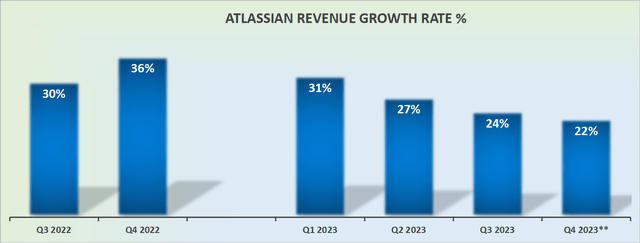

Revenue Growth Rates Decelerate, What Will Fiscal 2024 Look Like?

TEAM revenue growth rates

This is an echo of the themes we’ve already discussed. Q4 2023 is expected to grow at less than 25% CAGR y/y. For a business that not long ago was priding itself on its 30% CAGR rates, the pace of revenue growth rates appears to be slowing.

This led management to state in the shareholder letter:

The moderating growth rate of cloud revenue continues to be impacted by worsening macroeconomic headwinds on paid seat expansion from existing customers, free-to-paid conversions, and modest seat count reductions in some customers that have announced layoffs. (emphasis added)

With this context in mind, let’s now discuss the core of the bear argument.

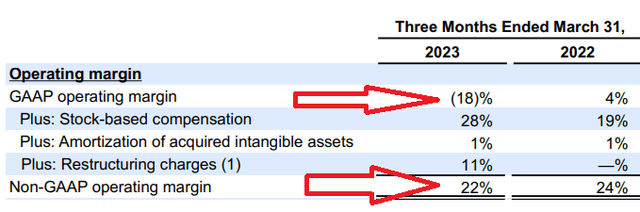

Profitability Profile Doesn’t Inspire Hope

TEAM Q3 2023

Let me put the table in context. When the share price was going up, nobody was asking difficult questions about Atlassian’s stock-based compensation (“SBC”) expenses. It was essentially free money.

But now, with the share price down 70% from the all-time highs, management is eyeing up their shrinking stock-based compensation and asking for more stock-based compensation to remain incentivized.

More specifically, we can see that in fiscal Q3 2023, stock-based compensation was up 93% y/y, while revenues grew by 24% y/y.

Put another way, back in Q3 of last year, stock-based compensation made up 19% of revenues, while in the most recently reported period, SBC makes 28% of total revenues.

The Bottom Line

It’s not only the case that Atlassian saw substantial charges in fiscal Q3 2023, from severances and lease consolidation. Even on an ”everything-added back” non-GAAP basis, this stock is simply very expensive.

Personally, I struggle to see how paying more than 70x this year’s years for a business like Atlassian Corporation, with slowing customer adoption, is likely to provide new investors with much, if any, upside potential.

Even if we were to look even further out, to fiscal 2024, I suspect that Atlassian Corporation stock is still being priced at more than 60x next year’s fully adjusted non-GAAP EPS.

I recognize that tech is expensive to invest in. But I believe there are better opportunities elsewhere than Atlassian Corporation stock.

Read the full article here