Introduction

My August 1st article talks about some ways Google’s (NASDAQ:GOOGL) (NASDAQ:GOOG) work on quantum computing has potential to change the world. Since that time, a September 5th article in New Scientist says we continue to get closer to a point where quantum computers are useful:

“Eventually, the number of qubits will become large enough that no classical algorithm can catch up, but it’s unclear at which point that is – which is one thing that Google are trying to figure out,” says Bill Fefferman at the University of Chicago, Illinois.

Despite Google’s potential with quantum computing, the economics for this segment are not yet significant and we have to judge Google on other metrics when thinking about their valuation range. Per Reuters, Microsoft’s (MSFT) ChatGPT reached 100 million users by the end of January. Many felt at the time that tools like ChatGPT would be a substitute for Google’s search tools such that Google’s advertising revenue would suffer. Google’s search tools are still doing fine at the time of this writing but the Google Cloud segment has slowed down. My thesis is that Google has improved nicely from 3Q22 to 3Q23 despite a slowdown in the growth rate for Google Cloud revenue.

Cloud Challenges

The Wall Street Journal contrasts the YoY revenue growth rate of Google Cloud versus Microsoft Azure in an October 25th article by Dan Gallagher. In the quarter ending September 2021, their growth rates were 45% and 50%, respectively. These went down to 38% and 35%, respectively for September 2022 and down again to 22% and 29%, respectively for September 2023. Looking at company filings from Amazon, AWS always has the lowest growth rate but this is expected seeing as they have the highest base revenue figures:

|

Cloud |

Microsoft Azure |

AWS |

|

|

Sep 2020 |

45% |

48% |

29% |

|

Dec 2020 |

47% |

61% |

28% |

|

Mar 2021 |

46% |

50% |

32% |

|

Jun 2021 |

54% |

51% |

37% |

|

Sep 2021 |

45% |

50% |

39% |

|

Dec 2021 |

45% |

46% |

40% |

|

Mar 2022 |

44% |

46% |

37% |

|

Jun 2022 |

36% |

40% |

33% |

|

Sep 2022 |

38% |

35% |

28% |

|

Dec 2022 |

32% |

31% |

20% |

|

Mar 2023 |

28% |

27% |

16% |

|

Jun 2023 |

28% |

26% |

12% |

|

Sep 2023 |

22% |

29% |

12% |

Spreadsheet source: Company filings and October 25th WSJ article

Again, AWS has the largest base so it isn’t surprising that their September 2023 YoY growth rate is the lowest at 12%. Microsoft Azure has the next biggest base so it is interesting that their September 2023 YoY growth rate of 29% is higher than the Google Cloud September 2023 YoY growth rate of 22%. Azure’s 3Q23 YoY growth rate of 29% was higher than their 2Q23 YoY growth rate of 26% while Google Cloud’s 3Q23 YoY growth rate of 22% was lower than their 2Q23 growth rate of 28%. Microsoft expects Azure growth to continue in the quarter ending in December and then the second half of their fiscal year which ends in June 2024 per remarks from CFO Amy Hood in the 1Q24 call (emphasis added):

In Azure, we expect revenue growth to be 26% to 27% in constant currency, with an increasing contribution from AI. Growth continues to be driven by Azure consumption business and we expect the trends from Q1 to continue into Q2. Our per user business should continue to benefit from Microsoft 365 suite momentum, though we expect continued moderation in seat growth rates, given the size of the installed base. For H2, assuming the optimization and new workload trends continue and with the growing contribution from AI, we expect Azure revenue growth in constant currency to remain roughly stable compared to Q2.

The disturbing developments for Google Cloud go beyond the disappointing revenue growth. We also see Google Cloud operating income slipped from $395 million in 2Q23 down to $266 million for 3Q23. Meanwhile, AWS operating income skyrocketed from $5,365 million in 2Q23 all the way up to $6,976 million in 3Q23 for a three month climb of more than $1.6 billion! Amazon says the quarter-over-quarter operating margin improvement of 600 basis points was mainly driven by increased leverage on headcount costs. Amazon CFO Brian Olsavsky talked about the AWS margin improvement in the 3Q23 call:

And Justin, on your comment about – a question about AWS margins. So yes, the margin improved 600 basis points quarter-over-quarter, an increase of income of $1.6 billion quarter-over-quarter was driven by – primarily by our headcount reductions in Q2 and also continued slowness in hiring, rehiring – open positions. There’s been also a lot of cost control in non people categories, things like infrastructure costs and also discretionary costs. Natural gas prices and other energy costs have come down a bit in Q3 as well. So as we’ve said historically, the operating margin for AWS is going to fluctuate quarter-to-quarter, and this is a good example of that.

One has to wonder why Google Cloud didn’t see this same improvement in operating margin and it might be because they are scrambling to spend more on AI initiatives in order to compete more vigorously with Azure on AI. A recent MarketWatch article by Emily Bary says Microsoft is outperforming Google with AI. It reveals analysts are getting the sense that AI is driving the contrasting cloud performances (emphasis added):

Bernstein analyst Mark Moerdler was encouraged by Microsoft’s talk of planned sequential increases in capital expenditures during fiscal 2024. He took that commentary to mean that Alphabet’s management has decent visibility into cloud revenue increases for later in the fiscal year. “We also see this as an indicator that Microsoft has taken the AI mantel from Google and that Azure could become a bigger and more important hyperscale provider than AWS,” he wrote, in reference to Amazon.com Inc.’s AMZN, cloud-computing business. “If this trend continues, then AI will be a very large driver of the size of Azure’s long term revenue and will require re-evaluation up of how big Azure could be.”

In addition to AI challenges, Google Cloud exists in a world where they started four years after AWS such that they’re always in catch-up mode. AWS didn’t really have any competition at similar revenue levels so their operating income was much higher. I don’t think Google Cloud will ever have the same operating margins as AWS but I think the gap will narrow over time such that Google Cloud will be a nice business. This spreadsheet shows Google Cloud and AWS revenue numbers at similar levels. The Google Cloud operating income numbers are shown as they were reported initially instead of using recast numbers:

|

in millions $ |

||||||

|

Google Cloud Qtr End |

Google Cloud Operating Income |

Google Cloud Revenue |

AWS Qtr End |

AWS Operating Income |

AWS Revenue |

|

|

Dec 2019 |

$ (1,194) |

$2,614 |

Dec 2015 |

$580 |

$2,405 |

|

|

Mar 2020 |

$ (1,730) |

$2,777 |

Mar 2016 |

$604 |

$2,566 |

|

|

Jun 2020 |

$ (1,426) |

$3,007 |

Jun 2016 |

$718 |

$2,886 |

|

|

Sep 2020 |

$ (1,208) |

$3,444 |

Sep 2016 |

$861 |

$3,231 |

|

|

Dec 2020 |

$ (1,243) |

$3,831 |

Dec 2016 |

$926 |

$3,536 |

|

|

Mar 2021 |

$ (974) |

$4,047 |

Mar 2017 |

$890 |

$3,661 |

|

|

Jun 2021 |

$ (591) |

$4,628 |

Jun 2017 |

$916 |

$4,100 |

|

|

Sep 2021 |

$ (644) |

$4,990 |

Sep 2017 |

$1,171 |

$4,584 |

|

|

Dec 2021 |

$ (890) |

$5,541 |

Dec 2017 |

$1,354 |

$5,113 |

|

|

Mar 2022 |

$ (931) |

$5,821 |

Mar 2018 |

$1,400 |

$5,442 |

|

|

Jun 2022 |

$ (858) |

$6,276 |

Jun 2018 |

$1,642 |

$6,105 |

|

|

Sep 2022 |

$ (699) |

$6,868 |

Sep 2018 |

$2,077 |

$6,679 |

|

|

Dec 2022 |

$ (480) |

$7,315 |

Dec 2018 |

$2,177 |

$7,430 |

|

|

Mar 2023 |

$ 191 |

$7,454 |

Mar 2019 |

$2,223 |

$7,696 |

|

|

Jun 2023 |

$ 395 |

$8,031 |

Jun 2019 |

$2,121 |

$8,381 |

|

|

Sep 2023 |

$ 266 |

$8,411 |

Sep 2019 |

$2,261 |

$8,995 |

|

|

$ (12,016) |

$ 85,055 |

$ 21,921 |

$ 82,810 |

Per an 8-K filing from April 20th, segment cost allocation has changed at Google meaning some costs previously assigned to Google Cloud are now assigned to Google Services beginning with 1Q23:

As a result of these changes, more of the previously unallocated corporate costs are allocated to our segments, and more of certain previously allocated costs are allocated to our consumer-facing Google Services products and less to Google Cloud enterprise products.

The original 3Q22 operating income number reported for the Google Cloud segment above was $(699) million. If we use the recast operating income number of $(440) million then operating income increased by $706 million to $266 million for 3Q23 as it swung from negative to positive. In terms of operating margin, recast Google Cloud operating income increased from negative 6.4% of revenue in 3Q22 up to positive 3.1% of revenue in 3Q23.

Overall Numbers

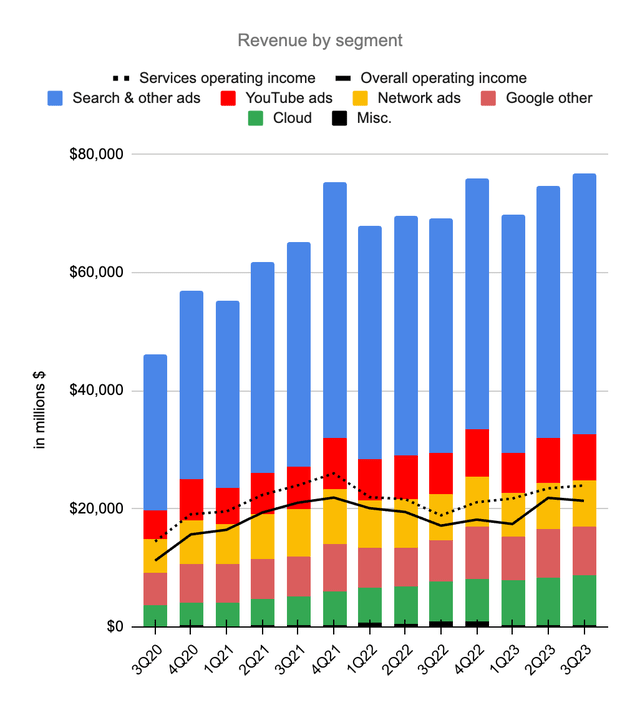

Both the overall operating income and revenue have improved nicely from 3Q22 to 3Q23:

Google Revenue by Segment (Author’s spreadsheet)

Valuation

A recent court case against Google has shed light on their economics. A key part of their traffic acquisition costs (“TAC”) consideration is the amount they pay for search default deals but this has been obfuscated in quarterly filings as it isn’t separated from the rest of TAC. A recent FT article says it was revealed in legal proceedings that Google paid $26.3 billion for search default deals in 2021 – a year in which Google’s total for TAC was $45.6 billion. In 3Q23 the total for TAC was $12.6 billion.

Looking at the 3Q23 10-Q and the 2022 annual report, Google Services has trailing twelve month (“TTM”) operating income of $93.2 billion or $69,128 million + $86,572 million – $62,477 million on revenue of $264,070 million or $196,232 million + $253,528 million – $185,690 million. I think a segment valuation range of 18 to 20x operating income is reasonable implying a range of $1,680 billion to $1,865 billion when rounding to the nearest $5 billion.

The YoY revenue growth from 2Q22 to 2Q23 for Google Cloud was 28% but the YoY revenue growth from 3Q22 to 3Q23 slipped down to 22.5%. Given this slowdown, my valuation for the Google Cloud segment has slipped. Google Cloud has now had 3 quarters in a row with positive operating income. Seeing as AWS had 3Q23 operating income of $6,976 million on revenue of $23,059 million for a margin of 30%, I’m optimistic Google Cloud can get to a more steady state operating margin of 15 to 20% implying a hypothetical operating income range of $5 to $6.7 billion on a revenue run rate of $33.6 billion. Using a segment valuation range of 16 to 18x hypothetical operating income and rounding to the nearest $5 billion gives us a range of $80 to $120 billion. In the past I used a multiple of 18 to 20x for Google Cloud but that was before we saw the YoY revenue growth slide.

Here is my sum of the parts valuation:

$1,680 to $1,865 billion Google Services

$80 to $120 billion Google Cloud

$25 to $50 billion Other Bets

—————————————

$1,785 to $2,035 billion Total

The 3Q23 10-Q shows 5,918 million A shares + 873 million shares B for a consideration of 6,791 million shares which we multiply by the October 27th GOOGL share price of $122.17 to get a partial market cap of $829.7 billion. There are also 5,725 million shares C shares which we multiply by the October 27th GOOG share price of $123.40 to get another partial market cap consideration of $706.5 billion. Summing these together, the market cap is $1,536 billion.

Cash and equivalents heavily outweigh debt such that the enterprise value is well below the market cap.

The market cap is underneath my valuation range so I think the stock is a buy for long-term investors.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Read the full article here