Maxeon Solar Technologies, Ltd. (NASDAQ:MAXN) is a noteworthy player in the expansive global solar technology landscape, sailing under the reputable flags of SunPower and MAXN brands. Initiated as an independent entity in 2020, the firm has earnestly navigated the renewable energy domain, with notable investments like the $1 billion facility in Albuquerque, showcasing its allegiance to sustainable manufacturing practices. Moreover, its astute diversification into smart energy solutions, encompassing batteries and chargers, not only broadens its revenue avenues but also aligns with the preferences of the eco-conscious market segment. However, the recent stock rating revision by Bank of America from Buy to Neutral, spurred by SunPower contractual snags and market demand apprehensions, accentuates the necessity for an exhaustive analysis of MAXN’s market positioning and long-term operational effectiveness. Yet, from a quantitative standpoint, I believe my valuation model highlights the stock as undervalued, thus, I rate it as a “buy” with a $7.90 price target, although I infer it remains a relatively speculative venture.

Business Overview

MAXN stands as a prominent entity in the global solar technology landscape, chiefly dedicated to the design, manufacture, and marketing of solar panels and related components. Operating under the SunPower brand across many international domains and the MAXN brand in the US, Canada, and Japan, the firm exhibits a robust market presence spanning over 100 countries, facilitated by a comprehensive network of more than 1,700 sales and installation partners. The crux of its revenue generation is anchored in selling solar panels and solar system components. The company prides itself on a broad installation base segmented into residential, commercial, and large solar power plants, with the latter category boasting over 5 GW of installed capacity across six continents. Their technological prowess is augmented by over 1,000 solar patents, propelling the delivery of industry-leading solar panel product lines.

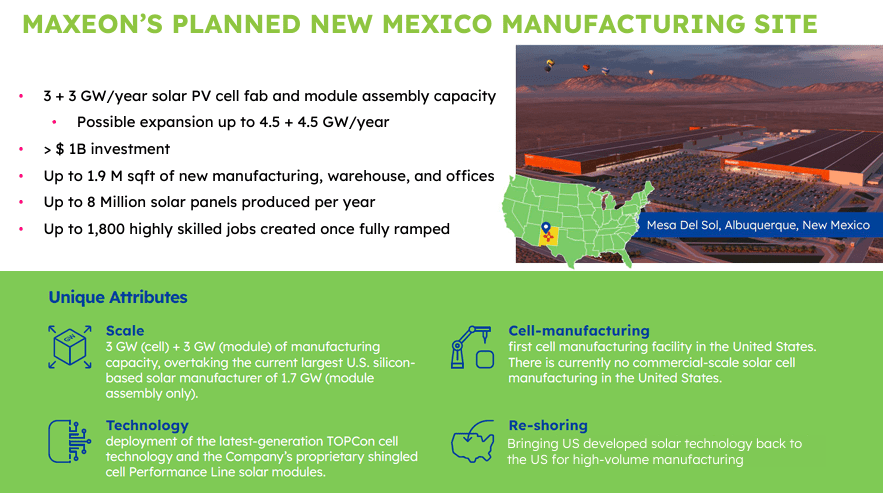

In my view, the substantial investments made by MAXN in manufacturing, epitomized by the $1 billion facility in Albuquerque, New Mexico, along with stringent adherence to sustainable practices as demonstrated by their two LEED Gold-certified manufacturing facilities, strategically position them to seize the burgeoning opportunities in the global renewable energy sphere. Their accolade as one of the World’s 100 most sustainable companies in 2023 significantly heightens their market credibility and underscores their alignment with global sustainability aspirations. However, since stepping out as an independent company in 2020, it’s crucial to thoroughly evaluate MAXN to understand its market growth and operational effectiveness over a longer period. I believe that MAXN’s decision to broaden its product range to include smart energy solutions like batteries and chargers is a smart move. This initiative not only opens up new revenue streams but also expands its market presence among eco-friendly consumers and businesses looking for more energy independence.

MAXN’s Voyage Under the Sun and Operating Challenges

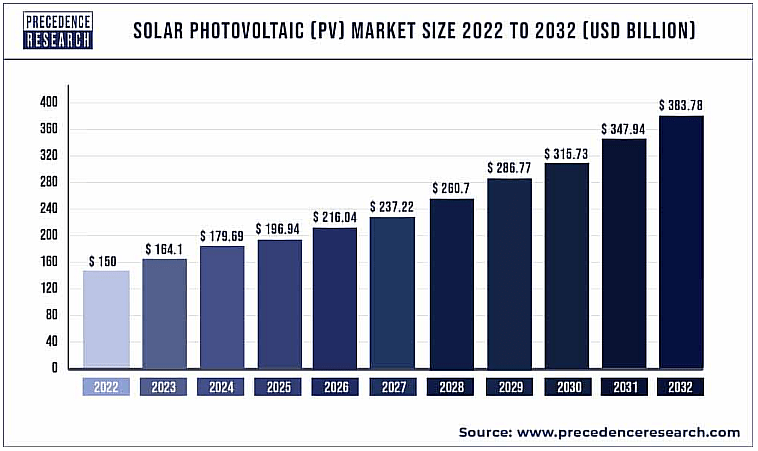

Interestingly, the unfolding growth in the global solar photovoltaic (PV) market spells positive tidings for MAXN. A substantial chunk of this expansion is foreseen to emanate from the swiftly progressing Asia-Pacific region, poised to elevate the demand for MAXN’s offerings. This anticipated demand escalation will bolster MAXN’s sales and revenue figures. The PV market’s expansion, driven by technological strides and amenable governmental frameworks, might facilitate a reduction in MAXN’s production expenditures owing to economies of scale.

Source: Precedence Research.

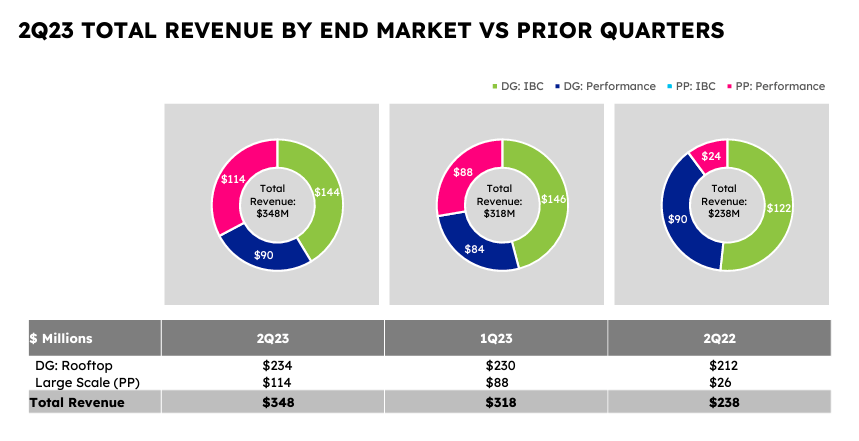

Also, in Q2 2023, MAXN witnessed a significant revenue ascent, registering a 9% increment from the prior quarter and a remarkable 46% elevation compared to the previous year. This surge is principally ascribed to MAXN’s enlarged footprint in the U.S. utility-scale sector. Despite confronting pricing obstacles in the distributed generation (DG) market, MAXN succeeded in upholding sturdy selling prices, culminating in a favorable gross profit and adjusted EBITDA. Nevertheless, a modest demand downturn towards the quarter’s finale adversely influenced the DG shipment volume and revenue.

A cardinal decision by MAXN was the selection of Albuquerque, New Mexico, for their U.S. manufacturing hub. They are mulling over a 50% capacity enhancement in the factory. MAXN is plotting a trajectory to attain full-capacity operation in utility-scale manufacturing facilities by 2024, amplify capacity by 2025, and escalate its Albuquerque facility by 2026 to become one of the solar industry’s most profitable enterprises.

MAXN 2Q 2023 Earnings Supplementary Slides

In Q2, a rapid shift in market demand emerged within the Distributed Generation (DG) market, primarily due to elevated inventory levels across the U.S. and Europe. Reacting to this, MAXN pivoted towards Commercial and Industrial (C&I) applications in these locales, with an aim to bolster sales in this segment through Q4 2023 and 2024. This strategic recalibration garnered attention on October 16, 2023, when Bank of America reclassified MAXN’s stock rating from Buy to Neutral, resetting the price target to $12. Escalating concerns over unresolved issues with SunPower and the yield margins within the residential channels alongside the end-market demand propelled this adjustment.

The core of apprehensions originated from a frayed contract relationship with SunPower, casting a pall over MAXN’s financial outlook for Q3. The cessation of SunPower shipments this quarter is forecasted to slash MAXN’s revenue by $50M, albeit presenting a financial respite for SunPower. In my view, this scenario outlines a challenging financial tableau for MAXN whilst affording SunPower a fiscal cushion, elucidating the pivotal role of inter-company relations in navigating market currents.

Positively, MAXN is advancing through the second phase of a Department of Energy loan application for a distinguished project. This stride could potentially position MAXN favorably against imported modules, courtesy of the anticipated financial buffers from tax credits under the Inflation Reduction Act. This may augment MAXN’s long-term market posture despite the short-term tribulations caused by the contractual disagreements with SunPower.

MAXN 2Q 2023 Earnings Supplementary Slides

Furthermore, MAXN’s acquisition of Solaria’s sales channel assets is aimed at boosting its IBC product sales in the US and introducing a “value” offering alongside its premium IBC product. This strategy mirrors a successful model already implemented in Europe. Additionally, preparations at the Fab 3 facility in Malaysia for a TOPCon solar cell pilot line are underway to de-risk the planned US factory ramp-up.

Additionally, in the Q2 2023 earnings call, executives broached the European market dynamics, their liaison with SunPower, and blueprints for the Albuquerque facility. They recognized the inventory quandary in Europe and exuded optimism about ameliorating the contractual quandaries with SunPower. They also alluded to a transition towards higher efficiency solutions for solar cell designs, signaling a technological evolution. They aspire to secure a loan for their venture, underscoring a multifaceted approach to catering to different market segments and articulating a predilection for the C&I market to counterbalance some residential sector downturns.

However, MAXN lowered its Q3/2023 financial guidance, the firm adjusted its operations and technology investments to navigate the market changes. Despite reduced revenue and shipment projections, MAXM aims to accelerate the introduction of Maxeon 7 panels, maintain its planned US factory ramp-up, and recently acquire shingled solar panel IP from Complete Solaria to bolster its market position.

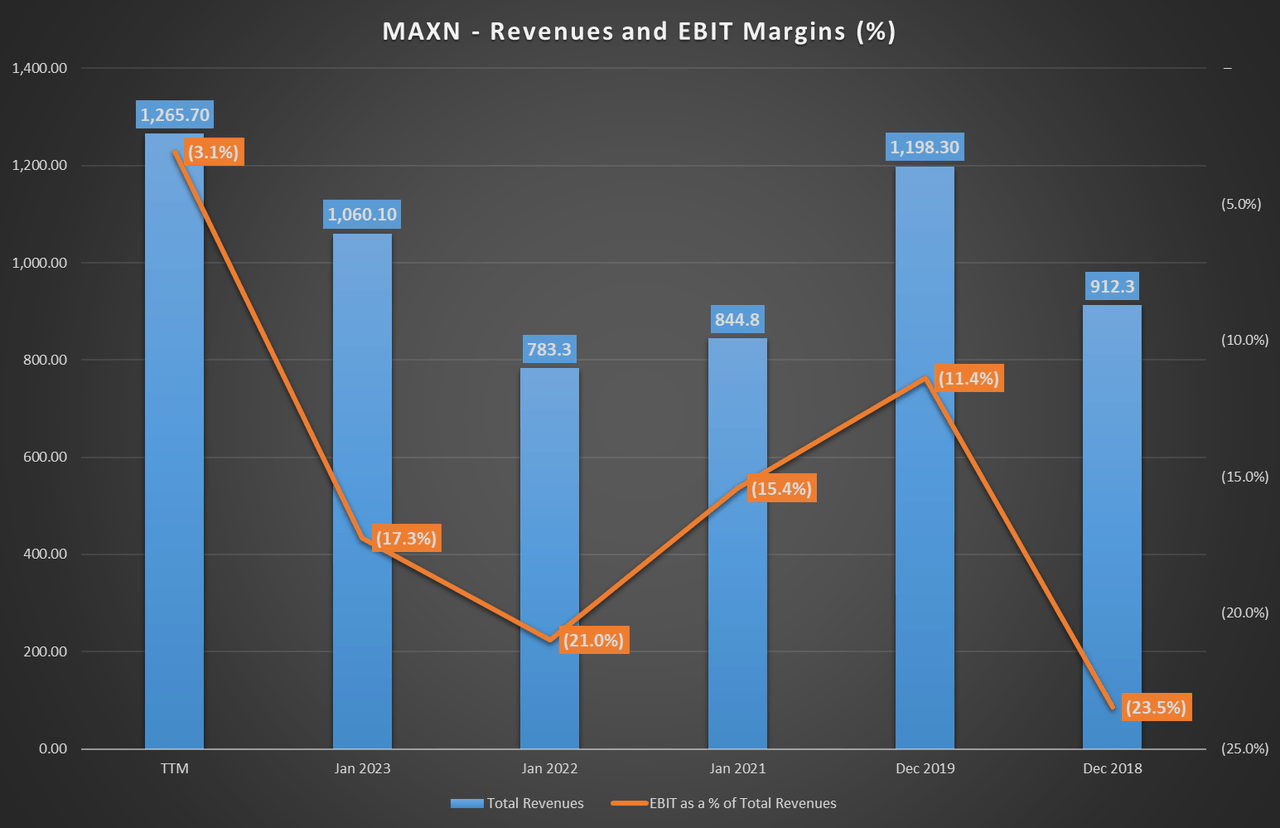

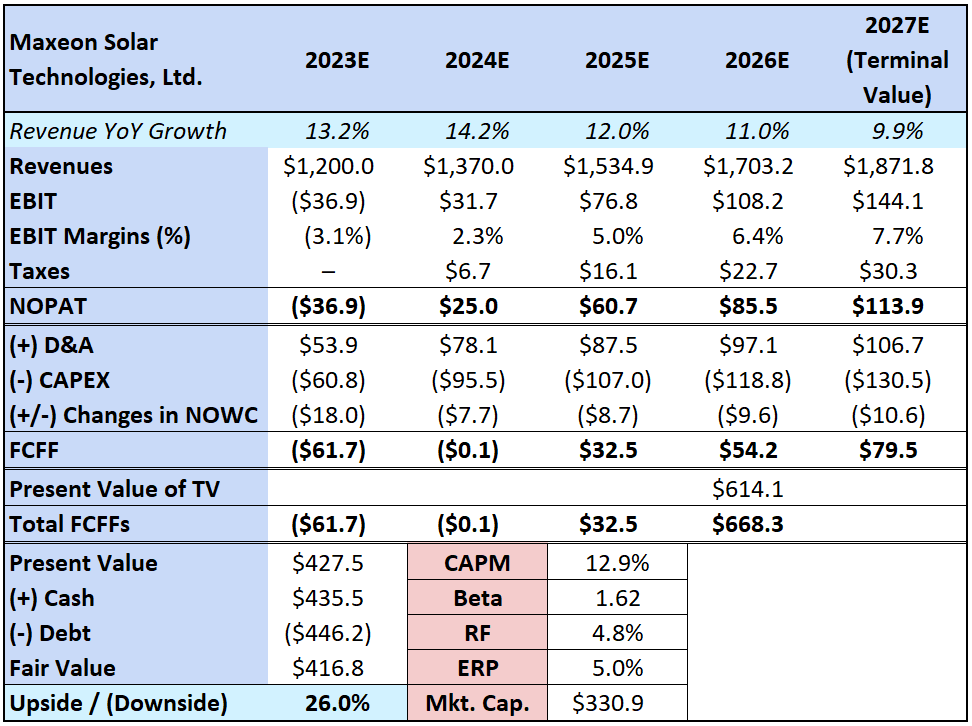

Valuation Analysis and Price Target

Upon closer analysis, it’s evident that MAXN is charting a positive course, with notable advancements in its topline and EBIT margins. Although the transition to profitability remains pending, the consistent uptrend in EBIT margins over time reflects favorably on the company’s financial health. In my view, if this positive momentum sustains, it won’t be long before MAXN reaches the breakeven point, subsequently transitioning into a phase of positive EBIT figures, as seen in the trailing twelve months (TTM). However, I believe a cautious stance is warranted until we observe a sustained positive EBIT, which would provide a more robust foundation for optimism regarding MAXN’s financial future.

Author’s elaboration.

In my analysis, MAXN is poised to capitalize on the sector’s anticipated CAGR of 9.90% up until 2032. There’s a consensus among analysts that MAXN will outpace the sector growth in 2023 and 2024, thus presenting a robust value proposition and possible competitive advantages. It’s a commendable trajectory when a company enlarges its market share in a fast-evolving market. This trajectory is further bolstered by MAXN’s history of enhancing its EBIT margins. Moreover, the historical data regarding D&A, CAPEX, and NOWC, coupled with an assumed tax rate of 21%, facilitates the derivation of FCFF employed in the model below. These cash flows are subsequently discounted at the company’s implied CAPM rate of 12.9%. This rate is on the higher side, driven by the stock’s above-average beta of 1.62, which, in my opinion, requires a cautious approach when projecting future financial performance.

Author’s elaboration.

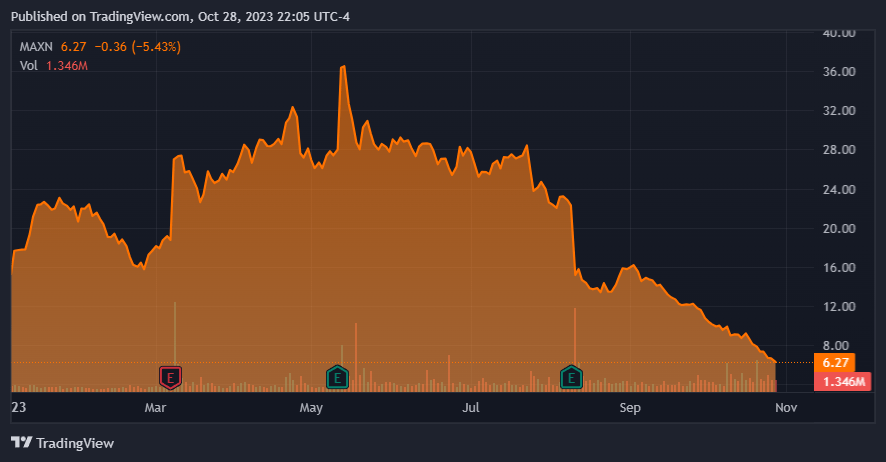

My valuation model illustrates that the company is currently undervalued, indicating a 26.0% upside potential. I believe this suggests that acquiring the company’s shares up to a price of $7.90 each is a sound decision, especially in light of the fact that the stock peaked at $36.50 per share earlier this May. In my view, the substantial opportunity in MAXN is underscored particularly when acknowledging the recent notable drop in its stock price. This scenario, when paired with its seemingly undervalued status and relatively favorable technological and business outlook, ushers in a bullish sentiment. I infer that a thorough examination of MAXN’s business fundamentals bolsters this stance. Consequently, I advocate a “buy” rating for MAXN with a price target of $7.90 per share, which I find to be a reasonable and achievable target given the aforementioned factors.

A Promising Investment With Considerable Risks

While I maintain a positive perspective on MAXN, it’s imperative to recognize the inherent investment risks. A notable issue is MAXN’s ongoing contractual discord with SunPower, adversely impacting its Q3 financial projection. Moreover, Q2 witnessed fluctuating demand in the distributed generation (DG) market, and a Bank of America downgrade due to SunPower and end-market demand concerns could potentially erode investor confidence. Challenges in the European market, inventory dilemmas. Collectively, these elements pose a threat to MAXN’s revenue streams, operational efficacy, and long-term growth trajectory.

MAXN has experienced a substantial price decline, which might be a promising entry, but also showcases its inherent risks (TradingView)

Furthermore, MAXN’s shares have endured a substantial descent since May 2023, nosediving from $36.50 to $6.30 per share, translating to an 82.7% depreciation. This downtrend might persist, exacerbating the disparity between the intrinsic and market value of shares. I believe it’s prudent for investors to incrementally build a position, mitigating the risk of an unfavorable price entry should this downward trajectory continue.

And notably, MAXN recently disclosed that in Q3 2023, it grappled with performance impediments, largely attributed to diminished shipments to its primary DG customer in the US and a generalized slowdown in global DG markets triggered by a payment default from the US DG customer in late July. Consequently, the projected Q3 2023 revenue is bracketed between $224 to $229 million, with shipment estimations hovering between 622 to 632 megawatts. This scenario precipitated a downward revision of the Adjusted EBITDA guidance by approximately $30 million. In response, the company is realigning its Interdigitated Back Contact (IBC) manufacturing capacity and pivoting towards the DG business, expediting the market introduction of Maxeon 7 panels. These strategies aim to curtail capital expenditures by roughly $100 million. However, should demand continue to languish, my revenue projections for MAXN may prove overly sanguine, thereby potentially further undermining the company’s valuation.

Hence, MAXN is now also orchestrating a 15% reduction in its global workforce by 2023’s end, streamlining operations and recalibrating its market focus between DG and utility-scale markets. This initiative, I infer, is an endeavor to ameliorate product offerings and customer experience and fortify market positioning amid industry upheavals. Yet, if the recently divulged adversities prolong, a reevaluation of the sector’s 9.90% CAGR growth forecast might be warranted, potentially inflicting further devaluation on MAXN’s shares. Thus, while my bullish stance on MAXN remains intact, I perceive it as a quintessential speculative buy, hinging on numerous discussed factors, some of which are largely beyond managerial control.

Conclusion

Overall, MAXN exemplifies a harmonious blend of strategic foresight and technological acumen. Challenges sparked by contractual discord with SunPower and market demand shifts have propelled the firm toward strategic realignments. These are evident in the acquisition of Solaria’s sales channel assets and the pursuit of a Department of Energy loan. However, the stark decline in stock price from $36.50 to $6.30 per share since May 2023, along with a 15% contraction in its global workforce, highlights the challenging landscape MAXN navigates. In my view, my valuation model supports a “buy” rating, indicating a 26.0% upside potential with a price target of $7.90 per share. However, please note that MAXN has substantial speculative tones. Thus, I think MAXN classifies as a speculative buy, embodying both the promise and the perils ingrained in the dynamic solar technology sector.

Read the full article here