Chipotle Mexican Grill (NYSE:CMG) announced third quarter results that easily exceeded expectations, as EPS of $11.36 beat by $0.73, and revenue of $2.5B beat by $30M.

The company has not only demonstrated resiliency amid a supposable tough consumer environment, but it also calmed investors on its long-term trajectory, with a better-than expected guidance for Q3, and an accelerated expansion planned for 2024 and beyond.

After we said the seemingly always-overvalued Chipotle approached fair valuation following the post-Q2 earnings selloff, I find the company attractively valued at current levels, and upgrade the stock to a Buy, with a price target of $2,132 per share.

Introduction

At the beginning of May, I wrote an article covering Chipotle, claiming ‘The Underlying Assumptions In Its Valuation Aren’t Unreasonable’ and rated the stock a Hold, as I thought its valuation at the time demanded underlying assumptions that were too positive, and thus, left no room for upside.

In an earnings follow-up in July, I wrote that Chipotle is finally approaching fair valuation, after the stock plummeted nearly 10% on investors panic over a minor revenue miss which overshadowed great fundamentals.

Before I dive into my third quarter results, I encourage you to read my May article, in which I delved into the company’s business plan, long-term strategy, major growth prospects, and risks, as well as described my view of the most important pillars for the success of a food chain.

In short, I view Chipotle as a best-in-class food chain, specifically in terms of operational efficiency, management quality, menu, and most importantly, growth trajectory. Let’s see how all those have fared in the third quarter.

Financial Review & Guidance

Chipotle announced total revenues increased 11.3% Y/Y to $2.5B, primarily due to 5.0% comparable sales growth, with the other 6.3% of the increase attributed to new locations. Restaurant-level margin was 26.3%, a 118 bps decrease Q/Q, and 100 bps increase Y/Y, resulting in gross profit of nearly $650M in the quarter, a 15.5% increase over the prior year period.

Operating profit amounted to $395M, as operating margin reached 16.0%, reflecting a 120 bps decrease Q/Q and a 90 bps increase Y/Y. Net income amounted to $313M, as profit margin reached 12.6%, reflecting a 100 bps decrease Q/Q and a 100 bps increase Y/Y. With the combination of buybacks, revenue growth, and margin expansion, Chipotle once again achieved EPS growth of over 22%.

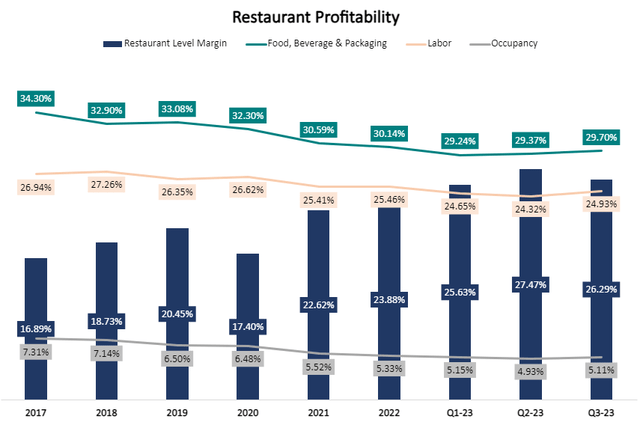

Created and calculated by the author using data from Chipotle financial reports.

Digging deeper into the restaurant margin, we can see a small Q/Q uptick in every item. As a percentage of sales, food, beverage & packaging was 29.7% with the company seeing inflation across several food costs, most notably beef and cheese. Labor expenses were 24.9%, as benefits of higher sales were offset by wage inflation. Occupancy was 5.1%, and Other operating costs, which are not in the graph, were 13.9%.

Looking ahead, management expects food, beverage & packaging to come in at 30% in Q4. Labor is expected to come in at mid-25%, and other operating costs should be 15.0%. No guidance was given regarding the overall restaurant margin, but altogether, the guidance reflects a decline of 200 bps Q/Q to approximately 24.4%. I estimate it will come slightly higher than that, as Chipotle’s management typically takes the route of leaving room for upside to their guidance.

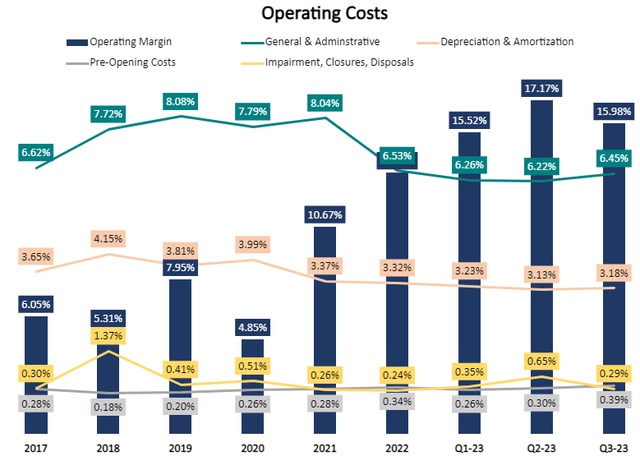

Created and calculated by the author using data from Chipotle financial reports.

Looking at operating items, G&A is the highest input, amounting to $159.5M. G&A as a percentage of sales increased Q/Q to 6.5%. We saw a similar trend in depreciation & amortization, as depreciation increased to 3.2% as the company’s footprint continues to expand. Impairments returned to their normalized trend after the closure of the Pizzeria Locale operating in Q2, and pre-opening costs increased only slightly to 0.39% of sales.

For Q4, management expects G&A expense at $163M, D&A at $74M, pre-opening at $15M, and impairments of $8M. Subtracting these costs from our restaurant-level margin estimate, we expect operating margin of 14.5% in Q4, which reflects a 150 bps decline Q/Q and a 90 bps increase Y/Y.

Overall, Chipotle’s third-quarter results demonstrate great operational efficiency. Management said it expects fourth quarter and full year comparable restaurant sales growth in the mid to high-single digit range, reflecting an acceleration from the third quarter. Despite pricing actions, they continue to see resilient traffic growth, providing further certainty of the company’s pricing power amid a tougher consumer environment.

Expansion Update

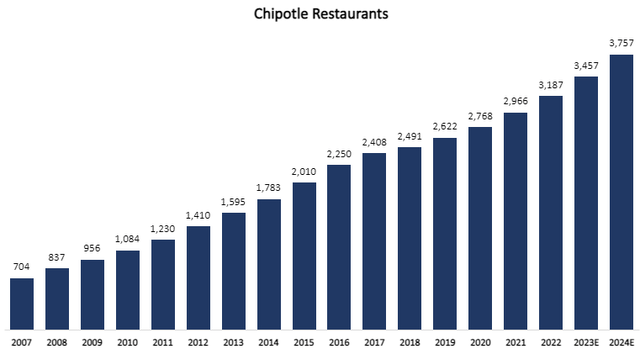

If I had to pick one reason Chipotle gets a premium over most of its peers is its simple growth trajectory. As of the end of the last quarter, the company owned and operated 3,321 locations, and management is constantly reaffirming its target of 7,000 locations in North America, which means more than double the number of existing locations. Towards that goal, management plans to grow at an 8%-10% pace.

Created and calculated by the author using data from Chipotle financial reports.

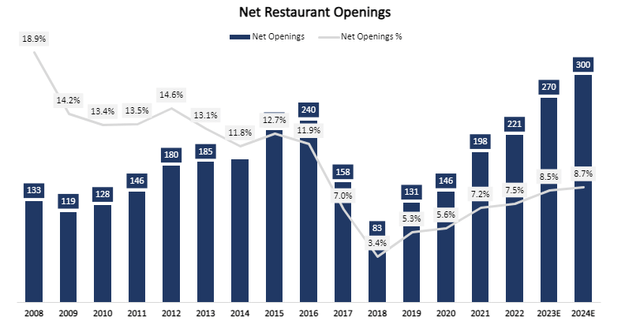

During the quarter, Chipotle opened 62 locations with 2 relocations. Management addressed an extended development timeline, due to bottlenecks occurring at the bureaucratic level. However, they are confident in their pipeline and believe it’s big enough to enable them to the higher end of their annual expansion rate in 2025 even if the relevant bodies return to normal timelines. This is important news, as we are now expecting the footprint expansion pace to accelerate. And, if regulatory bodies normalize, there’s even room to surpass the 10% pace, but let’s leave that outside our expectations for now.

Created and calculated by the author using data from Chipotle financial reports.

As we can see, up until the E coli outbreak in 2017, Chipotle was expanding rapidly. Then, growth dropped to low single digits, before accelerating even through Covid-19. Naturally, as the company’s baseline expands, it’s going to be harder to stick to the 8%-10% range, but management is confident in its ability to supervise and maintain that rate for the foreseeable future.

Outside of North America, I believe the conservative approach management is taking with the international expansion impressive, and provides confidence in its ability to get to their long-term targets in a steady and profitable manner.

Management said they outlined a plan for Europe to deliver economics that would support accelerated growth. This includes improving operations by aligning their training tools, systems and culinary with the U.S. operations, as well as building brand awareness. In essence, they want to perfect their formula before duplicating it in a quick pace.

In the Middle East, they decided to go with a franchising model, which enables a low-risk market penetration.

Other Important Notes – Weight Loss, California Wages, Average Restaurant Sales

Let’s begin with average restaurant sales. Chipotle achieved a record high $2,971M per-location, which they calculate based on the trailing 12-month food and beverage revenue for restaurants in operation for at least 12 full calendar months. According to management, they are closing in on the $3B mark, and believe they can do even more than that as they improve throughput.

Clearly, the higher the sales of each location, the more valuable each incremental store opened is. Furthermore, the ability to grow their footprint aggressively while steadily improving on a same-store basis is the entire investment thesis in a nutshell, and Chipotle proved once again it is certainly capable of delivering.

Transitioning to the hottest topic right now, weight loss drugs, management addressed this matter on the call. In short, they said they have not seen any material impact from it. They emphasized their menu is highly customizable and can fit any diet, whether it’s GLP-1 drugs, keto, or a Whole30 diet, Chipotle can provide clean food done in a very healthy way.

Lastly, about the new minimum wage inflation in California (AB 1228), management said they following:

We’ve been studying that, as you can imagine, it’s going to be a pretty significant increase to our labor. Our average wages in California are right around 17%, so we get the minimum up to 20% and to make sure that we take care of compression as well. We’re going to have to increase wages in call it the high teens to 20% or so. We haven’t made a decision on exactly what level of pricing we’re going to take. But to take care of the dollar cost of that and/or the margin, part of that we haven’t decided yet where we will land with that. It’s going to be a mid to high single digit price increase, but we are definitely going to pass this on. We just haven’t made a final decision as to what level yet.

— Jack Hartung, Chief Financial and Chief Administrative Officer, Q3-23 Earnings Call

In terms of exposure, 15% of Chipotle’s restaurants are located in California. However, in my view, this won’t be a major issue. First, it’s an industry-wide issue, which means everyone are going to increase prices in California, and Chipotle will maintain its relative value compared to its peers. Secondly, their general pricing strategy is to offset sticky inflation items, which primarily includes wage. As such, I see no reason they won’t raise prices accordingly. While higher prices could result in slower demand in the short-term, a 2%-3% increase shouldn’t have a material effect over the long-term.

Valuation

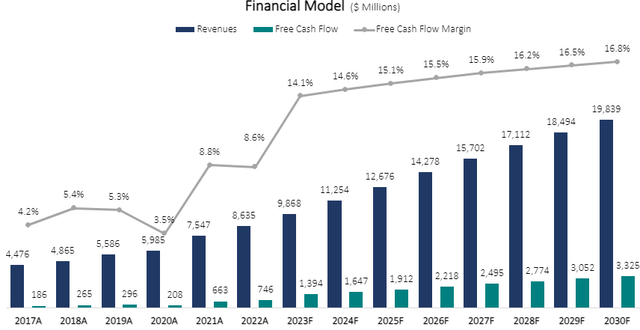

I used a discounted cash flow methodology to evaluate Chipotle’s fair value. I expect the company will grow revenues at a CAGR of 10.5% between 2023-2030, based on a 9.0% growth rate in total store count annually, and steady comparable sales improvements.

I project Chipotle’s free cash flow margins will increase incrementally up to 16.8% in 2030, due to improvements in restaurant level margin, and operational leverage which will result in a decrease of operating costs as a percentage of sales.

Created and calculated by the author based on Chipotle’s financial reports and the author’s projections; Free cash flow is adjusted for stock-based compensation.

Taking a WACC of 8.0% and adding Chipotle’s net cash position, I estimate the company’s fair value at $58.9B or $2,133 per share, reflecting a 40x P/E multiple over my estimated 2024 EPS. For reference, notable peers like McDonald’s (MCD), Domino’s (DPZ), and Starbucks (SBUX), trade in the 24-26 range, but with much less of a growth runway and high net debt, compared to Chipotle’s net cash position.

Conclusion

Chipotle provided investors with everything they needed to hear in the third-quarter. The restaurant-level margins remain high, traffic is resilient and growing despite price increases and tougher economic environment, innovation is on track, and the expansion pace should accelerate even without a normalization in the development timeline.

With its clear trajectory for double-digit for the foreseeable future, I upgrade Chipotle to a Buy.

Read the full article here