Sprott Focus Trust Inc. (NASDAQ:FUND) invests in stocks with a fundamentals-based approach through a closed-end fund (CEF) structure. The attraction here is the actively managed strategy from a recognized institution. Income investors may also find appeal in the 7% yield through a managed distribution.

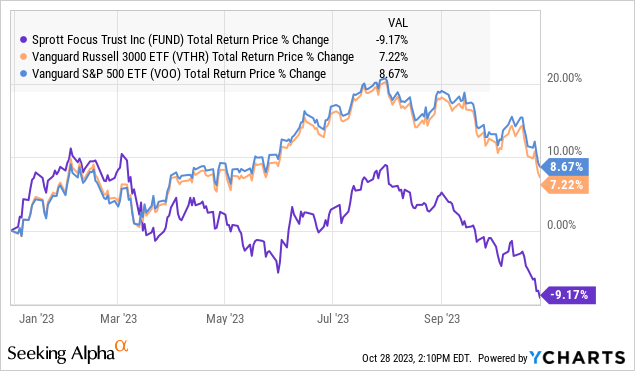

That being said, we’re highlighting an ongoing selloff and lagging returns more this year. The fund’s concentrated portfolio with a heavy tilt towards cyclical sectors including basic materials and energy sectors has underperformed in 2023 and faces unique risks in the current market environment.

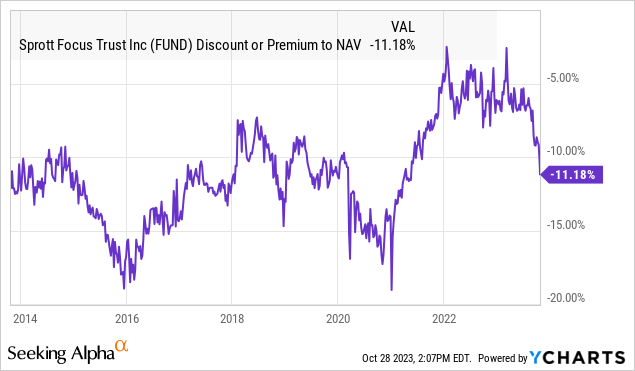

The signal we’re watching is a widening discount to NAV which likely reflects investor risk aversion toward this specific approach. We expect the volatility to continue and suggest avoiding FUND at the current level.

What is the FUND CEF?

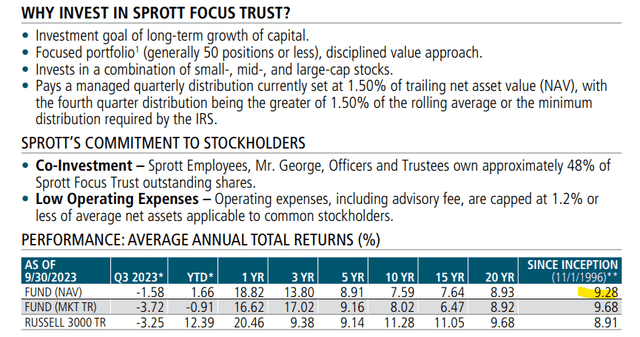

FUND has a primary investment objective of long-term capital growth. According to Sprott, the investment management team focuses on “high-quality businesses with strong balance sheets that are trading at attractive valuations”.

Technically, the distribution policy is to pay out 1.5% of the trailing net asset value, the actual yield achieved by shareholders reflects the changing share price. The quarterly dividend is variable in terms of the per-share amount. A portion of this amount has been classified as a return of capital.

Historically, the track record here is solid with data suggesting the fund has outperformed the Russell 3000 Index benchmark since its inception back in 1996. At the same time, the performance has been mixed over different time frames over the past two decades.

source: Sprott

FUND Portfolio

Even as FUND doesn’t have a major investing constraint or specific mandated exposure, we find the current portfolio reflects a particular market philosophy consistent with the fund sponsor Sprott Inc. (SII). The group is recognized for its precious metals investment vehicles as a pioneer in the segment since the 1980s.

In the latest managers’ commentary from the end of July, the FUND portfolio manager pointed to an outlook for structurally high inflation and rising interest rates as a tailwind for “hard asset investments”. In this case, beyond a select number of small positions in gold mining stocks, broader basic materials and energy sectors together represent 53% of the portfolio.

We find a “focused” portfolio of 34 stocks with Westlake Corporation (WLK), a chemicals producer, followed by Pason Systems Inc. (OTCPK:PSYTF) in the oil services industry, and Reliance Steel & Aluminum Co. (RS) as the largest holdings.

Down the portfolio, it’s fair to say that FUND likes steel stocks with Nucor Holdings (NU) and Steel Dynamics (STLD) among the top 10 investments. Even as there are positions in some mega-cap “blue-chips” like Exxon Mobil Corp. (XOM) and Berkshire Hathaway Inc (BRK.A), the entire portfolio is primarily in mid-cap and small-cap stocks.

source: Sprott

FUND Performance

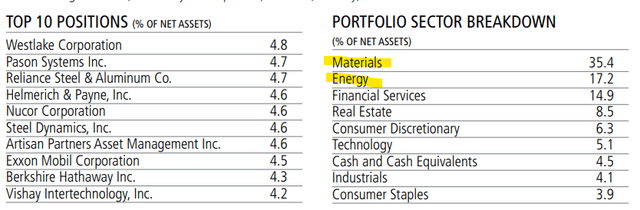

While the FUND investment team has been largely right on its call for higher interest rates and stubborn inflation, that backdrop just hasn’t translated with a particularly good market performance this year.

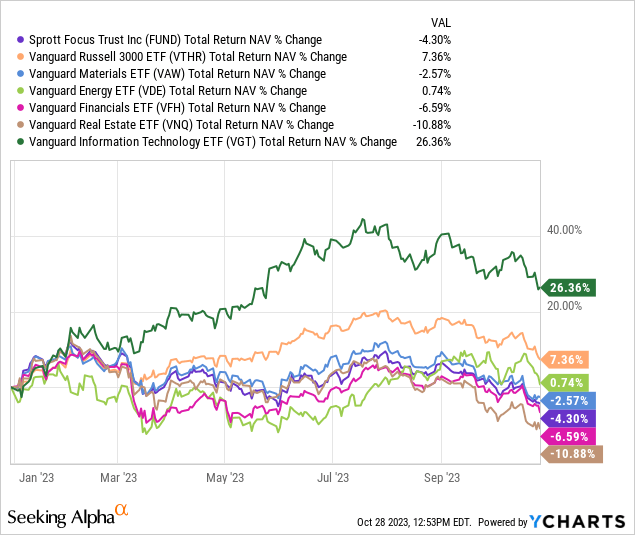

FUND is down by -4.3% on a total return basis at its NAV year to date, which is a large spread compared to the 7% positive return for its Vanguard Russell 3000 ETF (VTHR) benchmark.

Our explanation for the lagging returns is based on several factors. The first point goes back to FUND’s sector exposure with materials, financials, and real estate among the worst-performing groups this year. The sense is that these names have sold off more based on fears of a global economic slowdown while inflationary pressures have become less of a concern compared to 2022.

Separately, FUND is significantly underweight in technology sector stocks compared to its benchmark. This choice has been a detractor to the performance considering tech included some of the market’s biggest winners in 2023. By that same measure, the fund’s weighting toward small caps as a market segment has also underperformed, which has been another headwind.

We believe this current portfolio positioning is contributing to FUND’s widening discount to NAV which has compounded the losses for shareholders. Compared to the -4.3% YTD decline at the net asset value, FUND is also down -9% on a total return basis at the share price.

The current 11% discount to NAV is down from a low of 3% earlier this year. Our interpretation here is that the market isn’t too enthusiastic about the near-term outlook for this portfolio. Keep in mind that FUND has traded with a discount beyond 15% several times over the past decade which means there may be room for the fund to fall even further.

What’s Next For FUND?

In our view, the FUND strategy, including its recent performance and prospects leaves a lot to be desired. We’re not convinced that a portfolio built around basic materials will perform well over the near term and into 2024.

While the theme of inflationary beneficiaries stood out between 2021 and 2022 during a period of global supply chain shortages and momentum in commodities, the setup now is a more challenging macro backdrop. The ongoing strength of the U.S. Dollar and indications for weaker economic conditions going forward have pressured many of these cyclical names.

In many ways, FUND today appears more like a contrarian play betting that inflation will re-accelerate or that the global economy will experience some sort of growth renaissance.

Of course, we could be wrong, and it’s fair for anyone to have a bullish view of metals or even oil. Our response to that would be to say that there are likely more targeted or sector-specific funds that may be better at expressing that market outlook. Overall, FUND attempts to be multiple things at once while failing to have one strong selling point.

Final Thoughts

Sprott Focus Trust is a unique equity CEF that simply appears to be on the wrong side of current market trends. While its strategy has worked over various timeframes, we simply can’t recommend FUND as a core holding for most investors based on what we view as underlying weaknesses to its approach that carry too much risk.

Our base case here is for the fund to underperform its benchmark and the broader market on a total return basis with the expectation that the sectors the fund is underweight will end up outperforming going forward.

Read the full article here