Introduction

In the current era of higher interest rates in the financial markets, it is now more important than ever to focus on the financial health of the companies I am tracking. And although preferred shareholders are better off than common shareholders, odds are that in a bankruptcy procedure, both classes of equity will be wiped out anyway.

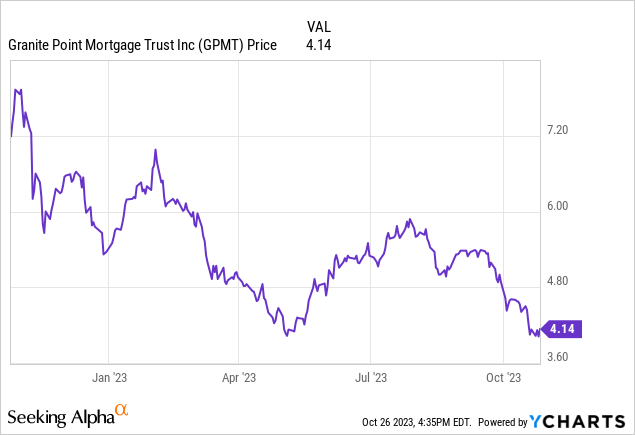

Just to be clear, I am not trying to mention “bankruptcy” and Granite Point Mortgage (NYSE:GPMT) in one sentence, but Granite Point is one of the companies and real estate investment trusts (“REITs”) I need to keep an eye out for on a quarterly basis. Granite Point will report its Q3 results in November (expected November 7th).

More loan loss provisions

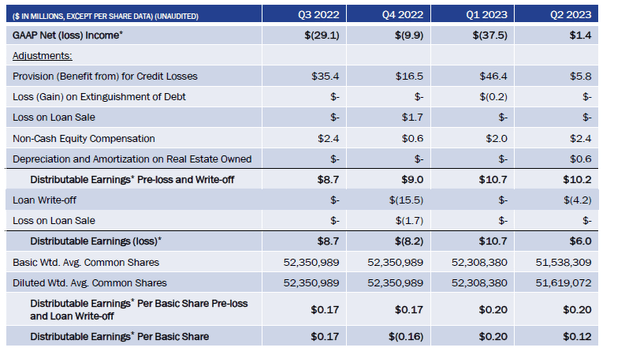

The company is very well aware that even the perception of having issues is enough to make its share price crater, and Granite Point proudly mentioned it was able to generate a pre-loss distributable earnings result of $0.20 per share while its leverage ratios are “considerably below the longer-term targets.”

GPMT Investor Relations

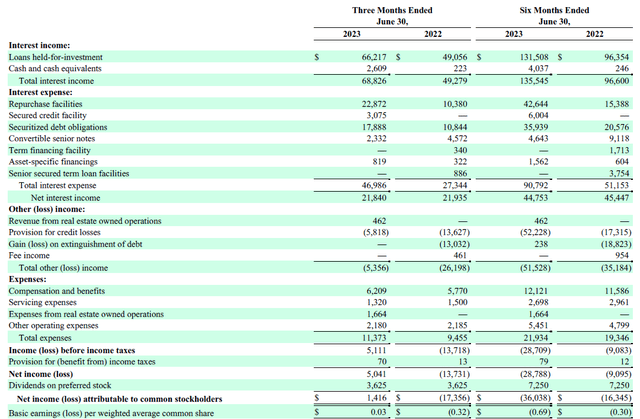

Before looking at the distributable result in more detail, let’s have a look under the hood of Granite Point’s income statement.

As you can see below, the REIT saw a very substantial increase in its interest income but its interest expenses increased by the same amount in absolute numbers (on a relative basis, the interest expenses obviously increased at a much faster pace), and this resulted in a pretty flat net interest income compared to the second quarter of last year.

GPMT Investor Relations

As the other operating expenses were relatively low as well at $11.4M while the REIT also recorded a $5.8M loan loss provision, the pre-tax income was $5.1M. Unfortunately for Granite Point’s common shareholders, about 70% of the reported net income had to be used to cover the preferred dividends. And that’s why the attributable net income was just $1.4M, or $ 0.03 per share.

This also somewhat explains why it makes sense to look at the distributable earnings instead of the reported net income. But while I agree a loan loss provision is a non-cash provision and some sort of “temporary unrealized loss,” it does indicate a loss of value which is ultimately reflected on the balance sheet.

GPMT Investor Relations

The image above shows the calculation of the distributable earnings. As you can see, you need to add the $5.8M in loan loss provisions back to the net income of $1.4M. Additionally, the $2.4M in non-cash compensation and $0.6M in depreciation expenses need to be added back to the equation. This results in a $10.2M in distributable earnings ($0.20 per share) but after deducting a $4.2M write-off (not to be confused with a provision: a company first records a provision before it needs to calculate the definitive write-off), the distributable earnings were just 12 cents per share.

What about the dividend coverage level and asset coverage level?

The preferred dividend coverage ratio is getting a bit worrisome based on the income statement as the REIT needs approximately 70% of its net income to cover the preferred dividends. That being said, if you remove the $5.8M in credit loss charges from the equation, the preferred dividend coverage ratio is much higher at approximately 300% as the REIT needs just $3.6M of its $10.9M in pre-preferred dividend net income to cover the preferred dividends.

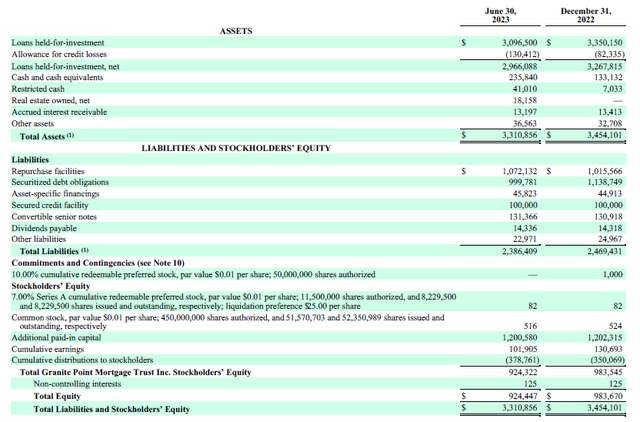

From an asset coverage perspective, I definitely appreciate Granite Point’s focus on its balance sheet. In the first six months of the year, it received in excess of $265M from loan repayments while it invested less than $35M in new assets. This indeed helped to shrink the balance sheet size from $3.45B to $3.31B, of which $924M consisted of equity.

GPMT Investor Relations

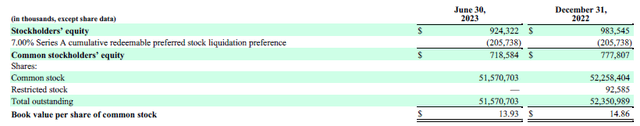

Of that amount, about $206M is classified as preferred equity, which means there is about $718M in common equity that acts as a cushion to absorb the first losses in the portfolio.

GPMT Investor Relations

This also means that even if the company loses an additional 20% on the value of its loans, the preferred equity could still be made whole. However, a 30% haircut would wipe out the preferred equity as well. This is just a theoretical number as some loans will be secured by specific properties whose valuations may fluctuate.

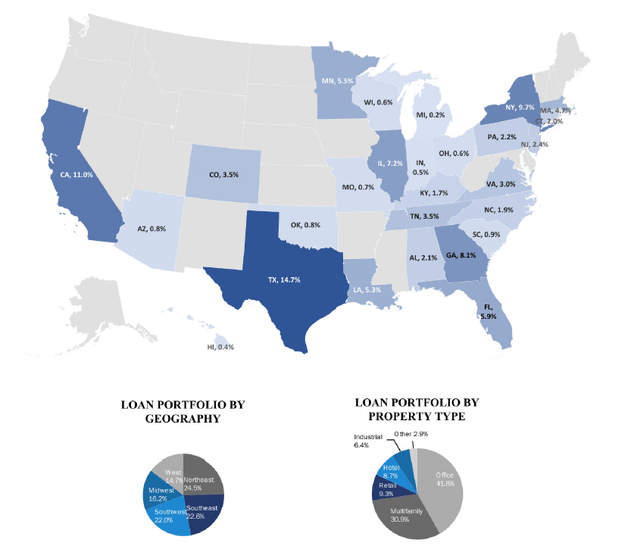

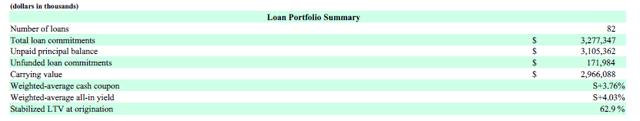

This means the quality of the portfolio is very important. Based on the REIT’s official statements, the average LTV ratio at origination was approximately 62.9%. The key word here is “at origination,” as you can be pretty certain the fair value of for instance the office assets (which make up almost half the portfolio- has decreased since the loans were originated in the past few years.

GPMT Investor Relations

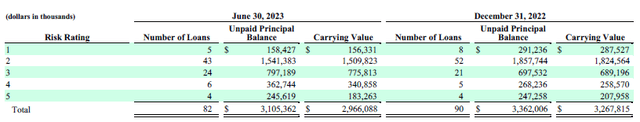

I do like the REIT’s transparency, as it consistently provides a breakdown of the loans with their respective risk ratings; as of the end of June, the REIT had 10 loans in the highest risk segments (risk rating 4 and 5) for a total of $607M.

GPMT Investor Relations

But as you can see above, the REIT has already taken action and the book value of those loans has been reduced to $524M. And additional haircuts could and should be absorbed by the common equity on the balance sheet.

This brings us to the preferred shares that are currently outstanding. Granite Point Mortgage Trust currently has just one series of preferred shares, which is trading with (NYSE:GPMT.PR.A) as a ticker symbol.

As a reminder, the preferred shares were issued in November 2021 and offer a preferred dividend of $1.75 per year for a preferred dividend yield of 7%. The call date is Nov. 30, 2026, and from the next preferred dividend payment, in 2027, the preferred dividend gets updated to the three-month SOFR rate plus a mark-up of 583 base points and the traditional 26 bp markup to the SOFR as it is a secured rate. A second interesting feature is that there’s a floor: The minimum preferred dividend will be 7%, even if the three-month SOFR would be zero.

That’s obviously not the case, and with the 3M SOFR at 5.35%, Granite Point will have to pay close to 11.4% on its preferred shares. And based on the current share price of just under $16 per preferred share, the yield would increase to a stunning 18%. Obviously, a lot can still change in the next three years and until the call date in 2026, preferred shareholders will receive $1.75 per share per year for a current yield of approximately 11%. That’s not too bad, either.

Investment thesis

While the Granite Point Mortgage Trust Inc. common shares are trading at a discount of 70% to the book value of $13.93 per share, I would still feel more confident owning the preferred shares instead of the common shares. While I do believe the REIT’s management is doing everything it can to further reduce the risk, I am not really a betting man and I am avoiding the Granite Point Mortgage Trust Inc. common shares.

I still have a long position in the preferred shares but I consider it a speculative position and I am not adding at this point.

Read the full article here