Investment Thesis

Basic-Fit N.V. (OTCPK:BSFFF), Europe’s largest low-cost gym chain, is one of those stocks that strongly reminds us of what value investing would look like according to Peter Lynch and Warren Buffett.

On the one hand, we are very familiar with the company because we know Basic-Fit here in Belgium and have used their services, which Peter Lynch would qualify as “investing in what you know,” and on the other hand as an undercover company trading at very attractive valuations, with a “wide moat” as Warren Buffett would like to see. And although Basic-Fit is already up 26.65% since our last review, we think there is much more room for upside.

We think the stock is trading about 37.47% below intrinsic value of €60.48, and has 314.30% upside by 2032 with a price target of more than €156.69 per share.

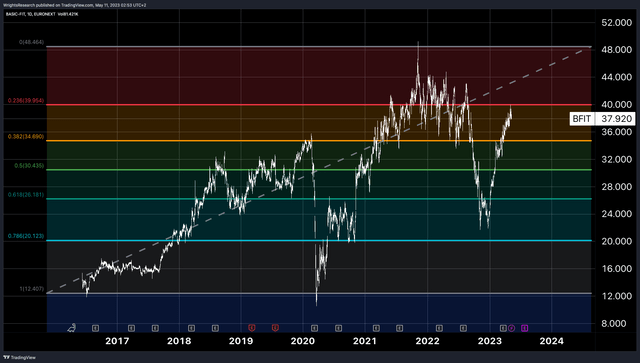

Tradingview, Wright’s Research

The Overlooked Moat

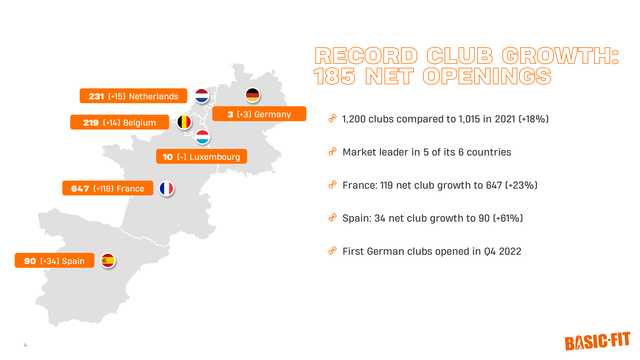

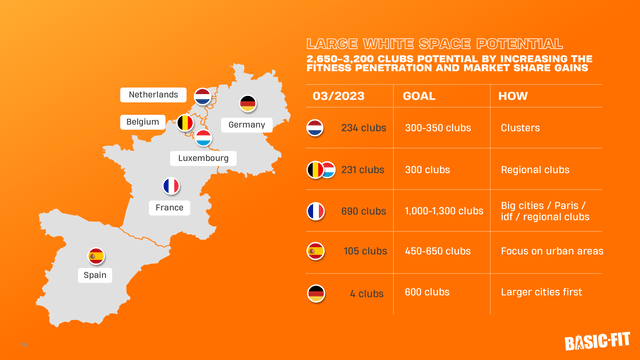

Assuming some people are not yet familiar with Basic-Fit, here is a brief overview. Basic-Fit is Europe’s largest low-cost gym, currently operating mainly in France, Belgium, Luxembourg, the Netherlands and recently in Germany and Spain. As of Q1 2023, Basic-Fit has 1,268 gyms in these six countries.

Most subscriptions range from €19.99 ($21.83) to €29.99 ($32.74) per 4 weeks. Subscriptions can vary from region to region, but pricing usually depends on choosing to access either 1 club with a basic subscription or all clubs in the country/ Europe. As of Q1 2023, average revenue per member per month is €22.63 ($24.71). This is far below the European average. In Germany, for example, the average in 2019 was €42.6 per month.

Basic-Fit IR

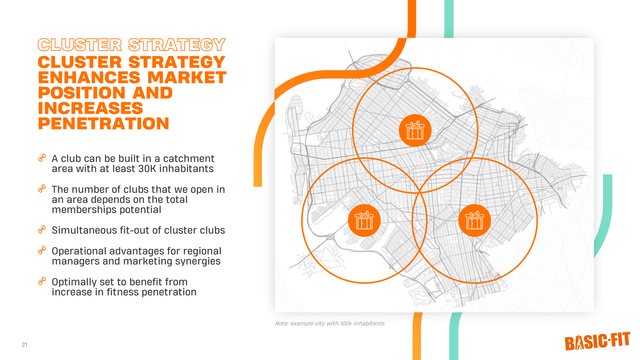

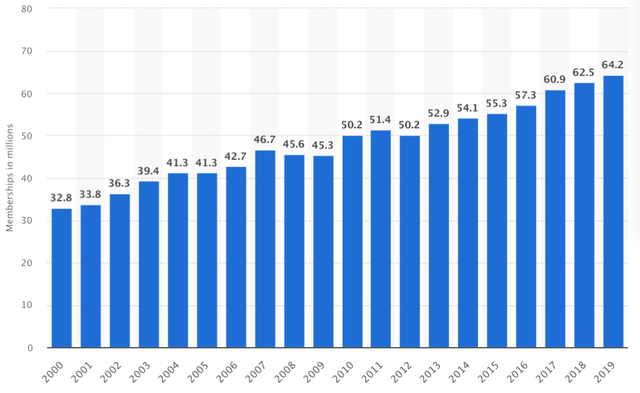

When it comes to moat, we think investors usually underestimate the longevity Basic-Fit strives for, and see it as just another gym. There are a few things that really set Basic-Fit apart, and that relentlessly protect them from competitors. One of those things is the clustering of their clubs. The European gym market in general is a fairly young and immature market, with an overall population of gym-goers that is far below that of other countries such as the U.S. and Scandinavian countries.

In some of these countries, gym membership penetration is currently only around 10%, but this percentage is steadily increasing and will likely approach that of the U.S. and other Scandinavian countries, which are currently at 20%. This gives Basic-Fit the first-mover advantage. The company is basically conducting a land grab, having secured the best locations and offering access to multiple gyms in multiple cities with their Premium membership.

Basic-Fit IR

This essentially makes it so that smaller, individual gyms compete with Basic-Fit, the 700-pound gorilla in the room, which has both access to the capital markets and the advantage of tremendous scale when it comes to ordering equipment, signing leases and general overhead requiring far fewer staff. You can imagine what the price difference would be when ordering equipment for 10 gyms compared to 1,200 gyms. It gives a huge bargaining power because we are the main customer of manufacturers like Technogym.

Some of Basic-Fit’s gyms don’t even need to be staffed full-time with multiple people because the work can simply be outsourced by hanging the gyms full of cameras for surveillance. Currently, the company is even deploying AI to detect tailgating, aggression, person count, “man-down,” etc. This allows many gyms to be open 24/7, compared to regular gyms that have to employ several people full-time. Shared overhead costs can simply be shared by more than 1,200 gyms right now. Basic-Fit already has the best locations in most countries currently, and trying to compete with a group of clustered gyms would not make much sense. It would be like trying to outdo Walmart on cost and location (WMT).

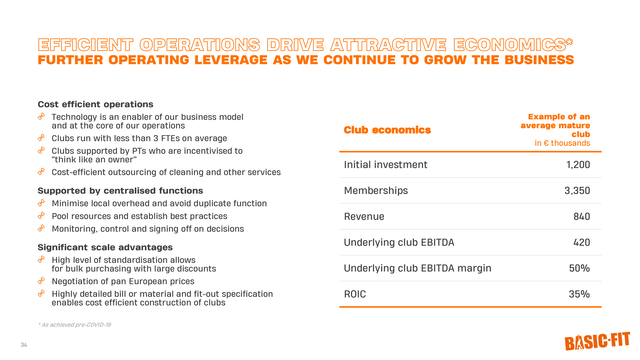

In terms of cost savings, it costs about €1.2 million as an initial investment to build a club. With 3350 members paying €20.90 per month, the clubs are expected to generate €840K in annual revenue and €420K in EBITDA. Most expenses are rent (about 17.5%), labor (about 15%) and other costs (about 17.5%). Maintenance costs are estimated at about €70K-75K per mature club.

Basic-Fit IR

On a side note, we believe Basic-Fit has tremendous leverage, being virtually the largest low-cost operator, with 3.6 million memberships dwarfing even the next largest players.

Any additional price increase of €1 per month could generate huge value for the company because demand is relatively inelastic. At the 3.6 million memberships Basic-Fit currently has, a €1 per month increase would directly impact results, generating €43.2 million in additional free cash flow. At an FCF multiple of 18x, that could theoretically add €777.6 million to Basic-Fit’s market capitalization, which currently stands at €2.5 billion.

It also differs from Planet Fitness (PLNT) in that Basic-Fit does not franchise gyms, at least not yet, and does not specifically target people who are not comfortable in typical gyms with things like Lunk Alarms and Pizza Night. Basic-Fit is as the name implies: everything you need, from cardio equipment to weights and group exercise classes, for a low price.

Basic-Fit IR

Business As Usual

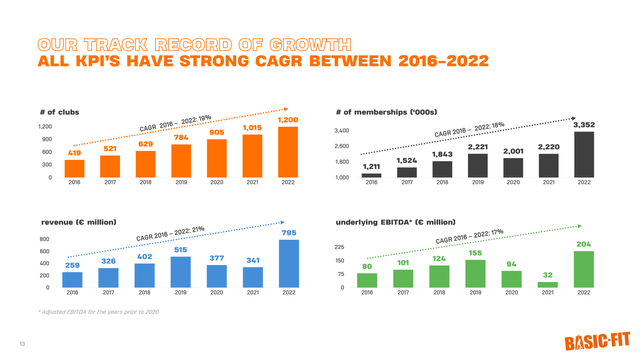

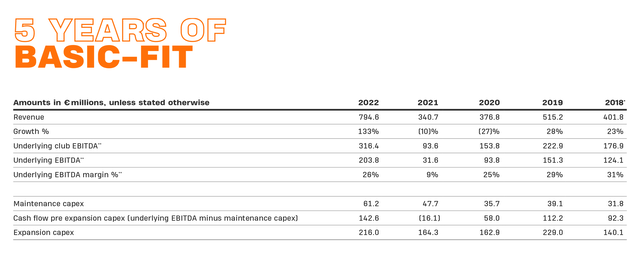

After a disappointing 2020 and a tepid 2021 during crisis years, Basic-Fit rebounded strongly in 2022, expanding to 1,200 clubs and even regaining the membership growth it had before.

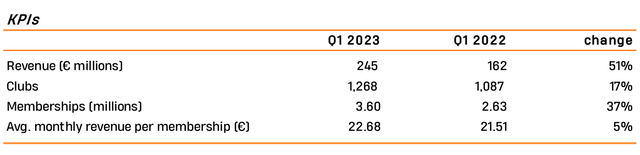

Basic-Fit IR

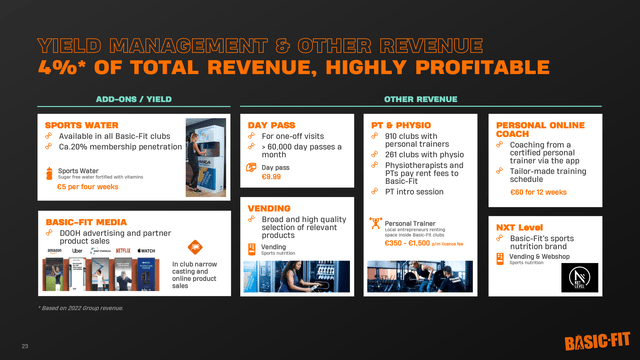

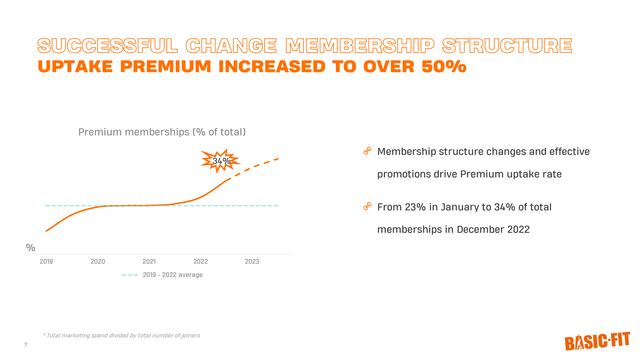

At the last Q1 trading update, revenues were a whopping €245M, meaning they are well on track and perhaps even ahead of their €1BN revenue target for 2023. Average revenue per membership is also growing significantly as Basic-Fit changes its membership structure in different countries, as Basic memberships used to give access to all clubs in Europe. Now most of the customer base is opting for the new Premium membership to still have access to multiple clubs.

Since subscriptions need to be renewed, we and Basic-Fit expect this trend to continue, which means more people will choose the Premium membership category. In some countries, such as France and Belgium, Basic subscriptions are now also €25, while Premium subscriptions have recently reached €30. According to our calculations, this should push annual revenue per member toward €25 by FY2024.

Basic-Fit IR

An Updated Valuation

Since rule No. 1 of investing is “don’t lose money,” we’ll look at where Basic-Fit stands today, and make an updated valuation based on those numbers already, if for some reason growth and profitability numbers begin to falter in the future.

Basic-Fit currently has 1,268 clubs, with 3.60 million active members, or 2,839 members per club. However, this includes a significant number of clubs that are not yet mature. It takes about 24 months for clubs to reach maturity, after which they average about 3,350 memberships. At the current average monthly subscription price of 22.68 euros, these existing gyms should bring in 1,156 million euros at maturity. At 50% Club EBITDA, after deducting Club Rent, Labor and other costs, that leaves €578M in Club EBITDA.

We still have to subtract shared marketing, overhead, etc. to arrive at the underlying Club EBITDA. Including marketing and expenses, overhead should come out to €173.4M, or about 15% of revenue, leaving us with €404.6M of overall EBITDA. But because readers of our previous article pointed out our preference for EBITDA measures, we will measure Basic-Fit’s actual profitability after deducting maintenance expenses. Maintenance expenses are estimated to be around €70-€75K per club. For fairness, we will increase this maintenance CapEx to €80K per club.

That would amount to €88.76 million in maintenance CapEx, leaving us with free cash flow of €315.84 million before tax and before interest expense. After deducting 25% tax and €15 million interest expense, that would mean that at current figures we could see free cash flow of €221.88 million, or €3.36 FCF per share at 66 million shares outstanding.

Basic-Fit IR

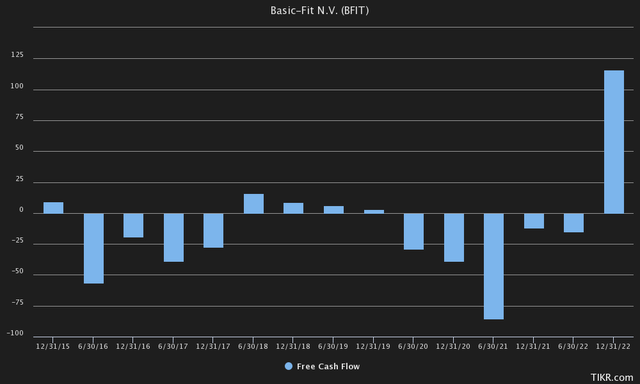

As a sanity check, it also fits nicely with the 2022 figures above, which show that after deducting maintenance costs, we are left with €142.6 million in pre-tax, pre-interest cash flow. Because Basic-Fit is a growing entity, and is constantly spending expansion capital, it perhaps hides the true profitability of the entity that will be under it when this growth phase ends. Even with expansion capital spending included, Basic-Fit’s FCF profitability in the second half of 2022 was promising.

TIKR Terminal

With the above €3.36 FCF per share at the club’s current maturity, and at a multiple of 18x, we believe Basic-Fit should currently trade at a fair value of €60.48. That would represent an increase of nearly 60% from the current share price of €37.82, not taking into account any gym membership price increases or future expected growth, despite Basic-Fit’s 21% CAGR revenue growth.

The Best Holding Period Is “Forever”

As Warren Buffett once pointed out, perhaps the best period to hold a stock is “forever.” Therefore, let’s take a look at what the upside looks like in the distant future for Basic-Fit. Currently, their goal is to open about 200-300 clubs per year on average, with a target of about 3,000 gyms in the countries where they currently operate.

Basic-Fit IR

They target 3000-3500 clubs by 2030, but we assume 3000 by 2032 to remain more conservative. Instead of 3350 members per mature club, we assume 3100 members per mature club.

Since Basic-Fit should be able to continue to squeeze costs from inflation, which we estimate at a 3% CAGR between now and 2032, we expect the average price per subscription to reach €30.48. This would still be well below the average gym price charged even in Europe today. At 3000 gyms with an average of 3100 members, this would equate to 9.3 million members, or <16.5% of the current gym memberships in Europe. Revenues would come to €2.83 billion, compared with nearly €1 billion in the first quarter (Q1 Annualized). With EBITDA margins of 50%, club EBITDA would total €1.42 billion. After deducting 15% of Marketing & Overhead revenues, we would get €992.12 million of general EBITDA.

Then we calculate conservatively with €80K maintenance costs per club, or €240M for all 3000 clubs at maturity. That brings us to €752.12M before taxes and interest. As for interest, we assume that the outstanding convertible debt is converted into shares, increasing the number of shares outstanding to 72 million. After applying a 25% tax rate, with all clubs at maturity we are left with €564.09 million FCF, or €7.83 FCF per share. At 20x FCF, that would equate to €156.69 by 2032, or a CAGR of 15.27%.

And while this is a much higher return than the market, we believe our estimates are still very conservative and provide upside leverage. With nearly 10 million members at maturity and 3,000 clubs, every €1 of leverage passed on to customers, given inelastic demand, would result in €111.60M of FCF passed directly to earnings. That’s an additional €1.55 of FCF per share, or €31 at a FCF valuation of 20x P/FCF.

Basic-Fit IR

Therefore, we would not be surprised to see Basic-Fit quote over €200 per share sometime in the next 10 years, given its massive size and what we believe is not yet maximized leverage, especially given the price/value that members currently enjoy compared to competitors. There is also a chance that the company could even expand beyond the countries where it currently operates, to further tap into the existing 56.3 million gym members in Europe alone.

Basic-Fit IR

We think there is also an upside scenario, where management starts buying back shares with the excess free cash flow, further increasing returns. As of H2 2023, the company should be FCF-positive even taking into account the investments in expansion, allowing management to spend capital on buybacks and push the FCF/share target even higher by 2032.

Risks To Our Thesis

As for the risks to our thesis, we modeled several worst-case scenarios in our financial models, ranging from a wage-price spiral due to inflation to extremely high energy costs. But nearly in all scenarios, the company should do well in the long run.

As for energy, in its largest market (France) Basic-Fit has all its contracts fixed for 2023. Most leases also seem to have a cap on annual increases. In 2022, each club spent about €25K on energy, which means Basic-Fit should be able to weather temporary energy problems just fine, even with a temporary flare-up. We reckon measures like labor inflation and energy will be resolved in the long run, with our thesis for 2032.

In terms of overhead, we modeled that overhead and marketing costs were around 15%, down from 14% last year. Before the crisis in 2020 and 2021, this was even lower, as the figure was closer to 12-13% in 2019, where we believe it will also return to in the long run, especially given economies of scale. In addition to the valuation shown here, we also ran sensitivity tests and played with parameters such as higher commodity inputs and temporary indexed labor costs, which do not seem to have much impact on our long-term thesis. Basic-Fit’s management has demonstrated great capital control in recent years by keeping the cost of building new clubs low despite inflation.

Also regarding maintenance costs, we believe that the €80K per club per year is well within conservative estimates, as it is common knowledge that most equipment lasts 7–12 years, and management has indicated that a complete replacement/rebuild costs €600K. For €80K, fitness equipment is expected to last 8 years.

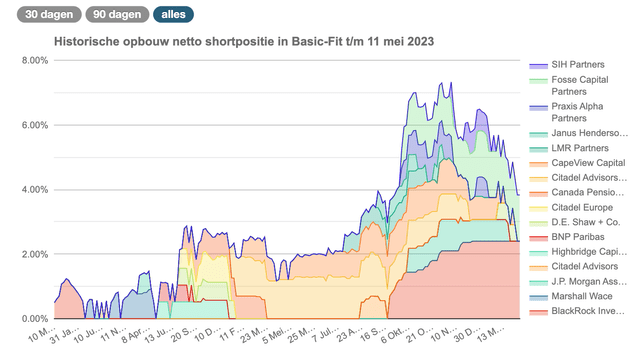

The stock used to be quite heavily shorted as well, although it seems that most hedge funds have covered recently after figures indicated that Basic-Fit is rebounding strongly from 2020 and 2021, and will probably get through this crisis of inflation and energy prices in Europe just fine.

Shortseller.nl

In terms of competition, most competitors have not expanded recently, or even started to change their subscription model from a low-cost to a premium gym, after seeing the rise of Basic-Fit and not being able to compete on this scale.

The company is also one of the only, if not the only company we know of that has access to the public capital markets in Europe, which allowed it to expand more quickly. Basic-Fit can actually also be seen as the Ryanair of gyms. Hardly anyone wants to compete against them, given their scale, cost advantages and the fact that they have found the best locations by clustering their gyms. If you were to ask us, we believe it is a terriffic moat against which it will only get harder to compete as Basic expands to 3,000 gyms. The economies of scale will only get better, and customers will have a wider network of gyms they can visit at the cheapest price.

And as a final note on the crisis, we think it is more likely that other gyms will be the first to go out of business in the event of an extreme energy/cost crisis. Basic-Fit has access to capital, and over 100 million in liquidity, including their revolving line of credit, which other distressed smaller gyms are unlikely to have. In terms of consumer behavior, gym memberships also held strong during the GFC, making Basic-Fit probably less cyclical and a great recession hedge.

Statista

The management, such as the CEO René Moos, is also connected to the shareholders: he still owns almost all of his shares after the IPO and even bought more shares recently when the stock was trading around €20-25 last year. René Moos used to be a Tenis professional, and we believe he still has the same competitive spirit when it comes to business.

The Bottom Line

We believe Basic-Fit is a great hidden asset (traded on Euronext Amsterdam), already producing an impressive $142.6 million in cash EBITDA (EBITDA-Maintenance CapEx), protecting shareholders from downside risk. On the other hand, the company is growing at a massive 20%+ pace, expanding its huge moat with gym clustering, and exerting even more leverage as it grows.

This creates a scenario with very significant asymmetric risk/reward ratio, leveraged upward if Basic-Fit’s growth plans succeed, and protected by current fundamentals if they don’t. We estimate fair value with current fundamentals at €60.48, and believe the upside is well above €156.69, depending on pricing power and scalability.

Also from a technical level, even though fundamentals have improved tremendously since 2018, they are still not far from those levels despite doubling sales. We see tremendous support at the €35 level, and still consider it a “Strong Buy.”

Tradingview, Wright’s Research

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here