The year-over-year growth rate of real Gross Domestic Product in the United States was 2.9 percent.

One year ago, the year-over-year growth rate of real GDP was 1.7 percent.

Two years ago, the year-over-year growth rate of real GDP was 4.7 percent.

The United States economy produced a very strong increase in the third quarter of 2023 but must be considered within the context of what has been going on in the economy over the past few years as the U.S. has had to deal with a spread of the Covid-19 pandemic and a following recession.

In one word, the recent behavior of the U.S. economy has been “disjointed.”

A lot of things are “out of whack” and this condition of disequilibrium must be taken into account in order to understand what is going on.

It is my belief that the U.S. economy is bouncing around because of the performance of the Federal Reserve System over the past four or five years.

As I have described elsewhere, the Federal Reserve responded to the spread of the Covid-19 pandemic and the subsequent recession very aggressively. That is, the Fed pumped lots and lots of money into the economy in order to make sure that the economy did not “collapse” and move into a serious economic contraction.

My conclusion on this fact is that the Fed’s actions provided a substantial “floor” on economic activity and prevented the United States from moving into a more serious downturn. The Fed succeeded very well in these efforts.

Quantitative Tightening

Over the past year the Federal Reserve into a position of quantitative tightening in order to fight inflation. For 19 months the Fed has reduced the size of its securities portfolio in order to tighten up on the banking system and squeeze out the excess liquidity that it has injected into the system during the 2020-2021 period.

Because of the behavior of the Federal Reserve, most analysts expected that a recession would take place in either late 2023 or in early 2024.

As can be seen by the numbers presented above, through the third quarter of 2023 it does not appear as if the U.S. economy is going into a recession, nor does it appear that an economic recession might happen any time soon.

What’s going on?

Another Narrative

The Federal Reserve is certainly conducting a policy of quantitative tightening and has reduced the size of its securities portfolio by over $1.1 trillion in the last 19 months.

The problem might be that the Federal Reserve, in combating the possible financial “collapse” put a lot more liquidity into the banking system than this amount, the amount the Fed has currently removed.

In fact, during the buildup to protect the financial system, the Federal Reserve increased its securities portfolio by more than $4.6 trillion.

Thus, so far the Federal Reserve has reduced the securities portfolio by less than one-quarter of the increase that took place earlier.

What does this seem to be allowing?

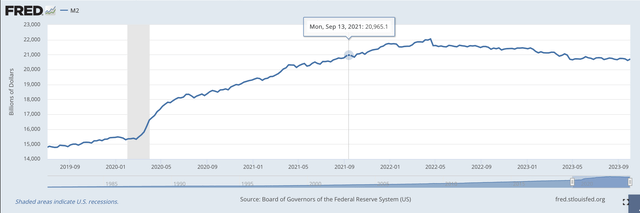

Well, let’s take a look at the M2 money stock.

M2 Money Stock (Federal Reserve)

In 2020 the M2 money stock growth took off and rose and rose and rose up into March 2022.

Money stock growth accelerated…and inflation began to pick up, the inflation that the Fed came to fight in March 2022.

With all this money moving into the banking system, why didn’t inflation rise to even greater heights? Why did the economy stay so benign?

Well, people didn’t go out and spend all the money…that’s why.

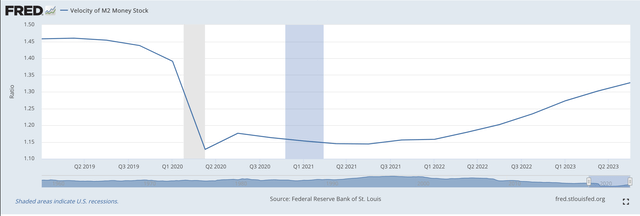

The velocity of the M2 money stock initially plummeted. Recipients of the Fed’s largess just held on to a lot of the excess funds that the Fed pushed into the system.

Velocity of M2 Money Stock (Federal Reserve)

It appears as if this is the major reason that the economy did not come out “hotter” from the Fed’s efforts and why economic growth seemed to show weakness when there was really a lot of liquid “spending power” still on the books.

As can be seen from the chart, however, the M2 velocity has been picking up in recent quarters and one of the driving forces behind this rise in the velocity measure in recent quarters has supported the economic growth that has come in at a faster pace than analysts had been expecting.

The real strength in the current figures has been consumer spending. These are the people who ended up with a lot of the monetary injection taking place during the efforts to fight the pandemic and recession.

These people had been holding onto the money until the time was right to draw on it and keep up their living standards.

Apparently, the time is right…and they are now reaching into their savings accounts and actually spending the money.

The Times Are Different

The times are different now. The last four or five years must be taken into account in order to explain the current situation.

The former economic models don’t work very well in this environment and we must take this into account and accept this fact.

The current strength of economic growth is a result of the savings that took place during the period of monetary expansion.

The Fed is attempting to remove a lot of these monies from the system, but, as noted above they have only moved a very small portion of the way back to a more normal situation.

How long will the economy be growing year-over-year in the 2.5 percent to 3.0 percent range given the assumption that the Fed will continue on with its quantitative tightening program?

That’s a very good question.

The M2 money stock is turning down and has been turning down.

The velocity of the M2 money stock seems to be increasing.

The United States government continues to spend and spend and spend.

The Federal Reserve seems content to continue its quantitative tightening.

Radical uncertainty?

The times have changed and policy-makers seem to be combating one another.

This is not a very comforting picture.

Read the full article here