Cabot Corporation (NYSE:CBT) has witnessed solid growth over the past few years. I believe that Cabot is a buy even with solid prior price movement due to its fair dividend, operational improvements, and undervaluation assuming my DCF figures. I also will highlight how the firm’s current leverage is safe and will be able to withstand economic headwinds.

Business Overview

Reinforcement Materials and Performance Chemicals are the two main divisions of Cabot Corporation, a specialty chemicals and performance materials company. Supplying reinforcing carbons used as rubber reinforcing agents in tires and other rubber-based products including hoses, belts, profiles, and molded items is the area of expertise of the Reinforcement Materials industry. Additionally, it provides solutions utilizing synthetic elastomer composites. This market serves industrial applications, such as the car sector.

Performance Chemicals, in contrast, concentrates on providing specialized carbons appropriate for a range of applications, including inks, coatings, plastics, adhesives, toners, batteries, and displays. Additionally, it offers fumed alumina and conductive carbon additives, both of which are crucial parts of batteries, particularly those used in electric vehicle batteries. Another item in this category smoked silica, is utilized in a variety of sectors, including adhesives and sealants, cosmetics, and medicines. Aerogel, a hydrophobic silica-based particle used in thermal insulation and specialized chemical applications, is another product the industry offers.

In addition, Cabot provides masterbatch and conductive compound products utilized in a variety of sectors, including electronics, packaging, agriculture, consumer goods, and the automotive, industrial, and agricultural. Additionally, it produces inkjet colorants specifically designed for inkjet printing applications. A network of distributors and sales agents spread throughout the Americas, Europe, the Middle East, Africa, and the Asia Pacific distribute the company’s goods.

Cabot

Financials

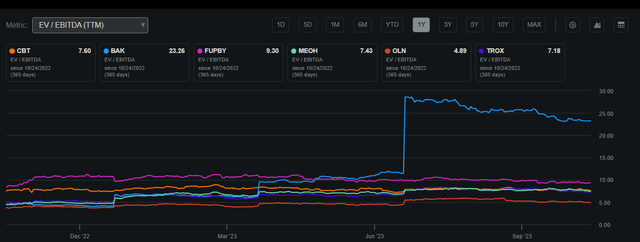

Cabot’s present market capitalization is approximately $3.73 billion, coupled with a noteworthy Return on Invested Capital standing at 15%. The current stock price is $66.89 per share, which is slightly under its 50-day moving average of $69.47. An additional valuation metric, EV/EBITDA, is calculated at 7.6. This figure, although slightly under the average of its industry peers, signifies that the company is trading at an undervalued position relative to its counterparts.

Cabot EV/EBITDA Compared to Peers 1Y (Seeking Alpha)

The firm also pays a dividend of 2.4% displaying a 28.54% payout ratio. This consistent income for investors provides value to shareholders while also leaving ample FCF to capitalize on its 15% ROIC. This FCF usage to improve Cabot’s core business is prudent until the firm grows larger and ROIC declines. The firm also has a consistent share buyback program which will improve EPS per share and is an excellent value avenue in my opinion as shares are undervalued relatively and fundamentally as demonstrated in the valuation portion of my article.

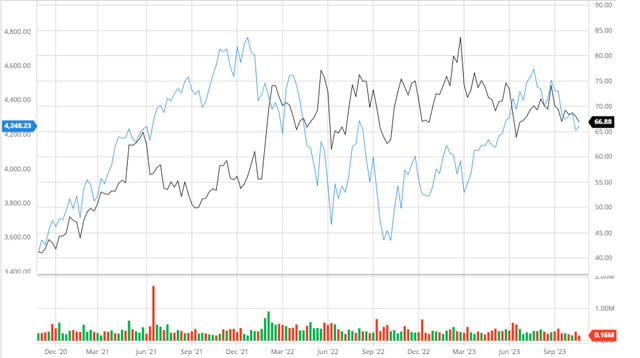

Cabot Annual Shares Outstanding (Trading View) Share Performance (Seeking Alpha)

Performance Compared to the Broader Market

Over the past 3 years, Cabot has outperformed the S&P 500 when adjusting for dividends. This demonstrates the firm’s ability to provide value through multiple avenues. I believe that in the future, Cabot will continue to improve its core business while also ramping up shareholder value initiatives which gives me confidence In the firm’s future cash flow usage.

Cabot Performance Compared to the S&P 500 3Y (Created by author using Bar Charts)

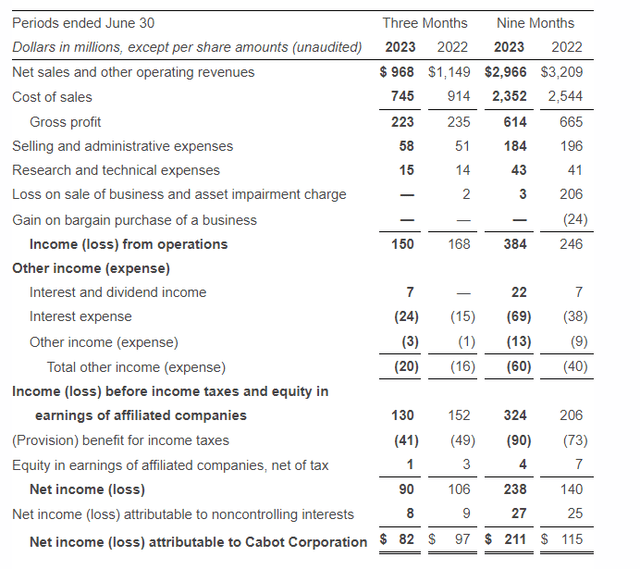

Earnings

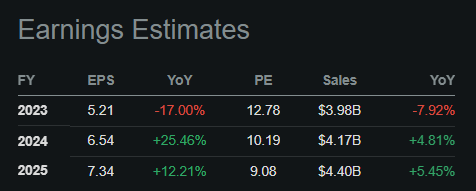

Cabot’s Q3 2023 earnings fell short of expectations, with an EPS deficit of $0.13, coming in at $1.42, and revenues missing by a significant $122.49, totaling $968 million, which demonstrates a substantial 15.75% year-over-year decline. This underperformance can be attributed to the persistent and impactful inflationary pressures that have contributed to decreased volume from Cabot’s core clientele. This underscores the company’s imperative to sustain its profitability by exploring alternative avenues, as further detailed in this article. While there are expectations for an improvement in both EPS and revenues in the upcoming years, it is essential to closely monitor factors such as inflation trends and the Federal Reserve’s decisions regarding interest rates, as they hold a critical role in determining the company’s future performance and cash flows.

Earnings Estimates (Seeking Alpha)

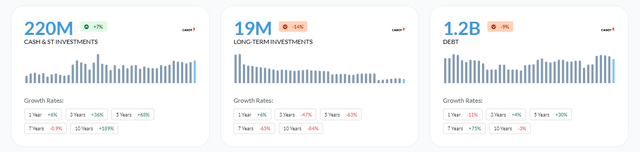

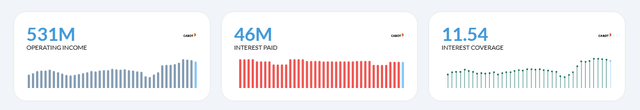

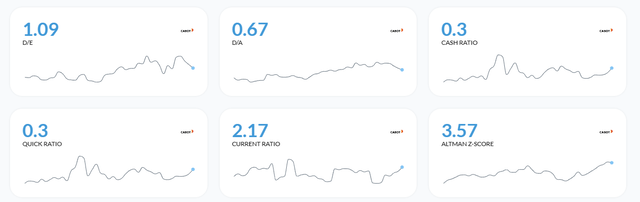

Balance Sheet

Cabot’s balance sheet is relatively stable with debt remaining stagnant and interest coverage improving to 11.54x. I believe that this debt coverage is very favorable when moving into macro headwinds where profitability could be hurt leading to financial strains. With this solid coverage, the firm would not damage its core business if underperformance were to continue in my view. With a Current Ratio of 2.17 and an Altman-Z-Score of 3.57, Cabot should also continue to remain solvent in the medium term.

Financial Position (Alpha Spread) Interest Coverage (Alpha Spread) Solvency Ratios (Alpha Spread)

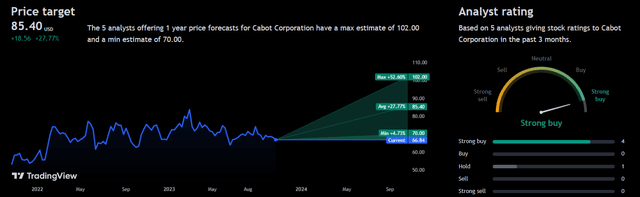

Analyst Consensus

Analysts currently rate Cabot as a “strong buy” with a 1-year price target of $85.40. This demonstrates a 27.84% potential upside which I think exemplifies analysts’ confidence in the firm’s ability to execute its plans to improve profitability.

Analyst Expectations (Trading View)

Valuation

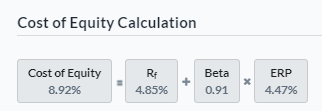

In order to accurately find Cabot’s fair value, I must find the firm’s Cost of Equity using the CAPM to create an accurate discount rate. Assuming a risk-free rate of 4.85% using the 10-year treasury yield, I found a cost of equity of 8.92%. This demonstrates the return demanded by investors by holding Cabot’s equity.

Cost of Equity Calculation (Created by author using Alpha Spread)

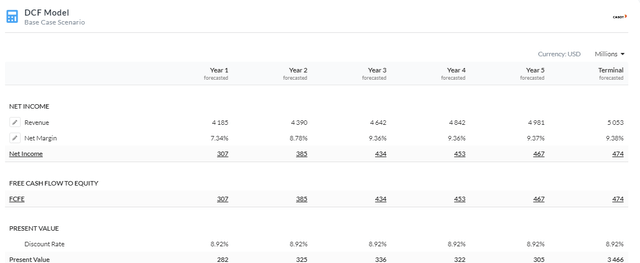

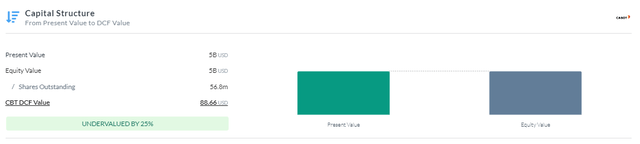

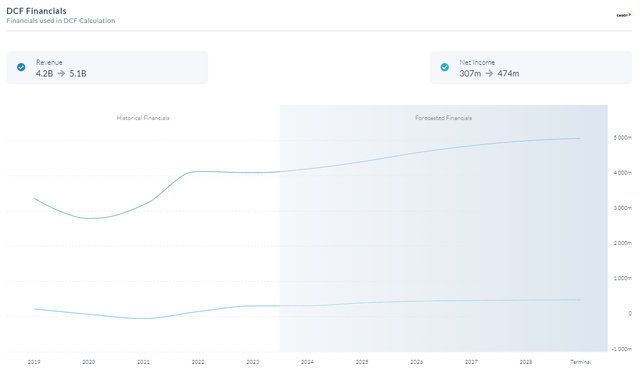

Using the previous cost of equity, I used a 5-year Equity Model DCF based on net income. This resulted in a fair value of $88.66 which presents a 25% potential upside. I decided to use a discount rate of 8.92% which is in line with my cost of equity calculation as I believe that the firm’s balance sheet will demonstrate resilience in these macro headwinds. I also estimated revenues to be below analysts’ expectations to account for volume declines and to adjust for analysts’ generous estimates.

5Y Equity Model DCF Using Net Income (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Operational Excellence Resulting in Improved Profitability

The operational excellence strategy adopted by Cabot Corporation has significantly improved the company’s financial performance. Cabot has improved its financial stability and profitability by giving efficiency and cost-cutting top priority across all of its businesses.

The decline in production costs is one prominent area of financial progress. Due to Cabot’s unwavering pursuit of operational efficiency, production procedures have been optimized, waste has been decreased, and resource usage has been cut down. Their specialized chemicals and performance materials are now produced at a considerable cost reduction as a result of their initiatives. Cabot has directly benefited from increased profit margins, meaning that a larger percentage of its sales are converted into net income. These savings prove Cabot’s dedication to providing high-quality goods while upholding rigorous cost control as shown in their latest earnings report below.

Statement of Operations (Business Wire)

The financial performance of Cabot has also been significantly influenced by effective supply chain management. In order to shorten lead times, cut down on transportation expenses, and effectively manage inventory, the firm has improved its logistics and distribution networks. By guaranteeing on-time delivery, this strategic approach has not only enhanced customer service but also produced cost savings thanks to decreased inventory carrying costs.

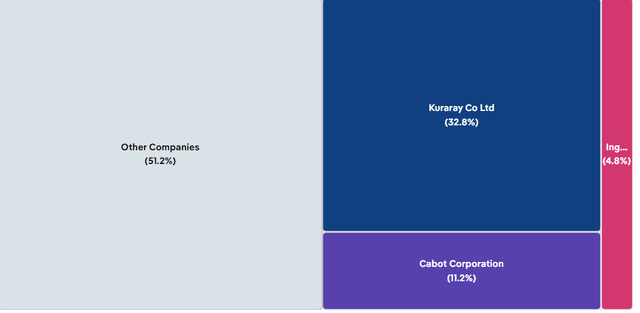

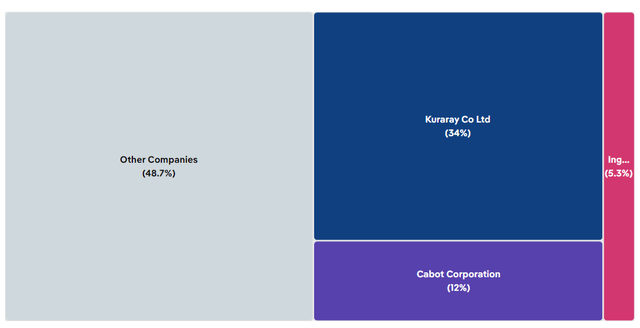

Additionally, I believe that Cabot’s focus on operational excellence has raised productivity levels at its production sites. The firm has been able to extend its market presence and fulfill rising client demand thanks to the improved output capacity. This has immediately enhanced sales and increased market share as shown below, strengthening Cabot’s financial position.

Cabot Market Share 2019 (IBIS World) Cabot Market Share 2023 (IBIS World)

Risks

Cyclical Nature of Industries: Cabot works with cyclical sectors including automotive, infrastructure, and electronics. Economic downturns may result in lessened demand for the business’s goods, which might have an impact on sales and profitability.

Regulatory and Environmental Compliance: Cabot works in a highly regulated industry where environmental rules that change or rigorous criteria that are not met will incur fines, legal troubles, and higher operating expenses.

Conclusion

To summarize, I believe that Cabot is currently a buy due to its solid income, excellent margin expansion, and undervaluation assuming my DCF figures. As noted before, keeping an eye on the stickiness of inflation as well as how hawkish the fed is will result in another update in the near future if my thesis were to change. With the firm’s balance sheet being rather stable, this would demonstrate Cabot’s ability to maintain cash flows and have solid future FCF for growth.

Read the full article here