ServiceNow (NYSE:NOW) recently reported Q3 earnings, and the company did not disappoint. Revenues came in above expectations, as did earnings per share, which beat by 0.37 cents.

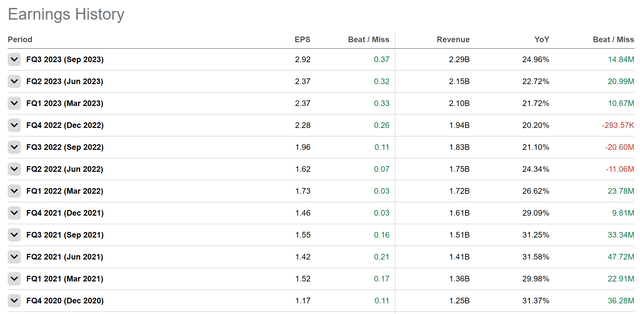

The report was consistent with previous earnings releases that beat on both top and bottom lines, continuing NOW’s trend of topping Wall Street expectations:

Seeking Alpha

However, in our view, this may have been the company’s most impressive earnings report to date. While the nominal EPS beat was the largest in the company’s history, there were also a number of positive developments that happened under the hood that prove that NOW still has a long runway of growth and profitability ahead of it.

Today, we’re going to dive into the top 3 key takeaways for investors from NOW’s Q3 blowout earnings report.

Ready? Let’s jump in.

Strong Financial Performance and Guidance

When we say “blowout” earnings report, we mean it. The company reported beats on a number of important metrics, but here’s a full rundown of the most important highlights.

Subscription Revenue Growth: NOW reported Q3 subscription revenues of $2.216 billion, marking 24.5% growth YoY. This performance surpassed the high end of their guidance range by over 100 basis points, showcasing outstanding organic growth at a substantial scale.

Deal Velocity: The company closed 83 deals with a net new Annual Contract Value (ACV) greater than $1 million, marking a 20% increase year-over-year. This includes their top deal with the United States Air Force, which stands as the third largest deal in the company’s history.

Operating Margin: NOW achieved an operating margin of 30%, surpassing guidance. This reflects disciplined cost management and a strong amount of operating leverage in the company’s business model.

Guidance: Due to their impressive Q3 performance, NOW raised its full-year outlook for 2023. The subscription revenues outlook was increased by $48 million to a range of $8.635 billion to $8.640 billion, representing 25% YoY growth. The operating margin target for the full year was also raised to 27%, with an expected Q4 operating margin of 27.5%. Continued strength in Federal contracts is a noted highlight and anticipated to contribute positively.

Retention and Customer Growth: ServiceNow maintained an exceptional renewal rate of 98% in Q3. The number of customers contributing over 1 million in ACV grew to 1,789, with 58% YoY growth for those contributing over $20 million.

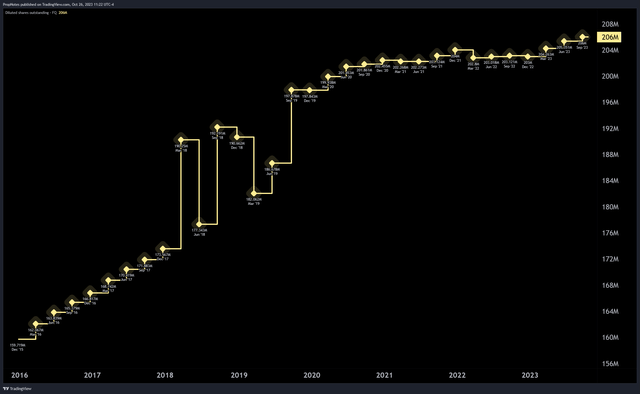

Share Repurchases(!): Finally, the company initiated its first-ever share repurchase program, buying back 0.5 million shares, with around $1.2 billion remaining of the original $1.5 billion authorization.

We expect this to grow over time as the company looks to begin ‘repairing’ the dilution it has used as an alternative means of funding up to this point:

TradingView

All in all, the company continues to grow like a weed, land new customers, make current customers happy, at the same time as it maintains significant operating leverage in the business – a rare combination.

We’re also thrilled that the company is beginning to buy back stock. While some may view this as a lack of opportunities for continued reinvestment, we see it as a sign of significant strength. NOW has matured to the point where it’s able to begin seriously rewarding shareholders who have stuck with it since IPO.

Cross Vertical Strength

The second point to note here is the success that NOW has seen across different client sectors.

As NOW has worked to improve its offerings, one of the main points of focus has been developing its product roadmap with expanded use cases across industries. This includes telecommunications, financial services, retail, and the public sector.

This diversification demonstrates their commitment to catering to the unique needs of different sectors, and this improved product verticalization has driven strong results.

As the CEO mentioned on their recent earnings call, NOW drove substantial growth and engagement across a number of different industries, notably achieving their best ever quarter with the US Federal government.

NOW’s platform is becoming a standard choice for end-to-end digital solutions, which is evident from the 19 federal deals over $1 million closed in this quarter.

Also of note; Transportation and logistics, education, manufacturing, and CMC sectors also saw robust growth, with transportation and logistics growing over 100% YoY.

In our view, this stems from the product team’s ability to solve unique customer pain points better than other solutions, at scale. This is underscored by the tacit endorsement of the U.S. Government – an entity which thinks at scale and over long periods of time.

AI Developments

In addition to the financial results and wide industry appeal, a significant amount of buzz on the earnings call was made about the company’s efforts in AI.

Here are the main updates.

AI Investment and Impact: ServiceNow has doubled down on their investments in AI, releasing generative AI-powered Now Assist for all workflows. NOW emphasized that AI is driving growth and points to a pipeline of over 300 customers from various industries and stages of testing.

Workflow Milestones: NOW’s Creator Workflows product surpassed $1 billion in ACV during Q3, and the Employee Pro SKU saw a 100% growth in net new ACV YoY.

While most companies this year have emphasized the importance of AI on their business and emphasized how AI is working its way into end products, there is serious natural fit here for NOW.

Given that at its core NOW sells a workflow automation platform, using AI to identify and improve those workflows makes a ton of sense. Plus, the company has a huge data advantage given how many companies are plugged into the software.

Process mining for AI workflow generation could be a significant advantage going forward.

Risks

While we just laid out a few bullish takeaways from the Q3 earnings report which have us bullish on NOW for the foreseeable future, there are some risks that those interested in investing in the name should know about.

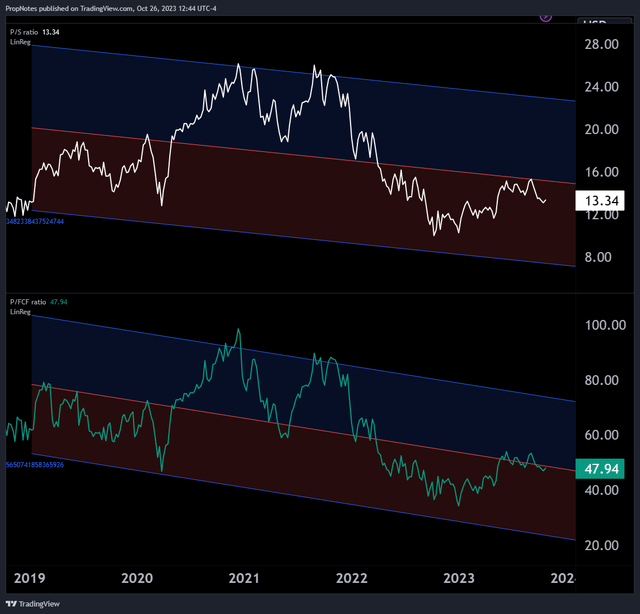

First, the company is trading at a relatively high valuation. To some degree, NOW’s recent success was modeled in by analysts in years past, as future success is being modeled in now.

Should the company’s growth dip or slow materially or for any real length of time, then the multiple could come in significantly, given that shares are currently trading at 13x sales and 48x free cash flow:

TradingView

This leaves a lot of room to the downside for investors if the company’s premium valuation wears off, especially when compared nominally to the average S&P 500 component multiple.

Additionally, the macro environment is still shaky. It may be difficult for NOW to continue its growth in a slower environment as businesses look to cut spend.

Paradoxically, more companies in a downturn are looking to do more with less, so automation software could be a beneficiary. It remains to be seen.

Summary

Overall, we’re as bullish as ever on ServiceNow given the recent report. Revenue, margins, and retention are all headed in the right direction, and recent progress with the public sector is highly promising for long term investors.

While the valuation remains stretched, we remain bullish on NOW, and rate the company’s shares a “Strong Buy”.

Cheers!

Read the full article here