By Aditi Gupta, Client Portfolio Manager, Municipals

Five reasons why municipal bonds are compelling now

Between the regional banking crisis, debt ceiling melodrama that led to a further US sovereign rating downgrade, potential federal government shutdowns, heavy US Treasury issuance, and geopolitical risks, 2023 has been a tumultuous year in markets.

That’s after 2022, which was marked by rising interest rates and high inflation. Despite these headwinds, the municipal bond market has demonstrated stability and resilience.

We believe the asset class’s diversification feature is worth considering based on their low, or even negative, correlation to stocks and other risky assets. Here are five reasons to consider an allocation to tax-exempt munis now.

1. The macroeconomic environment should be less volatile ahead

The timeline and severity of a potential US recession has been downgraded amid low unemployment, strong consumer activity, and downward-trending inflation.

While the Federal Reserve is still concerned about the pace of price increases, its fight to tame inflation has generally worked.

Market expectations are mixed but point to the possibility of either one more rate hike in November or none at all. A macroeconomic backdrop of low growth and decreasing inflation is attractive for munis, particularly at today’s high yields.

2. Yields look attractive

Bond markets have returned to value, in our view, with nominal yields at or near their highest levels in over a decade (see chart below). Investment grade munis yield 4.32% and high yield municipals are yielding 6.25%, or 7.30% and 10.56%, respectively, on a taxable equivalent basis.1

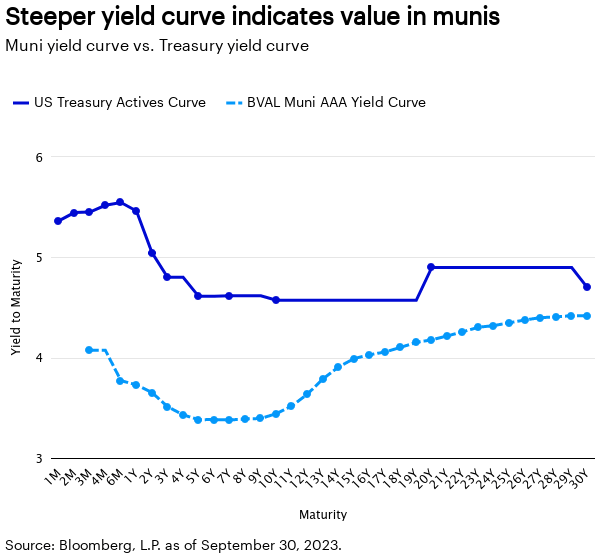

Relative value has also returned to the muni market. The municipal-to-Treasury ratio, which compares the yield on an AAA-rated muni bond to a Treasury with the same maturity before adjusting for taxes, is currently 75% in 10 years and 92% in 30 years, indicating value for most taxpayers, especially toward the longer end of the yield curve, because the muni curve is steeper than the Treasury curve.2

3. Technicals peaked in the summer but remain supportive

Summer was characterized by negative net supply, which was highly supportive of munis from a technical perspective. Fall may bring heavier issuance and less cash flow to the muni market via coupon payments and bond maturities and calls.

We expect 2023 to have negative net issuance of around $50 billion, however, which should support an orderly market while maintaining attractive municipal-to-Treasury ratios.

Year-to-date new issuance is on pace to be down 10% from last year, which was down 22% from the previous year.3

As expected, issuers with ample cash on their balance sheets have been reluctant to issue at higher interest rates. We expect the trend of negative net supply to continue into early 2024.

4. Cash is moving off the sidelines

Many investors have kept their assets in money markets, waiting until after the interest rate hiking cycle ends to consider longer-term investments. Signs that the hiking cycle is nearly finished should encourage them to move out of shorter-term investments.

Many investors are already extending duration because they’re more comfortable with the path of interest rates ahead. Some are using a barbell strategy, investing in both the short and long ends of the muni market. This strategy may have paid off because the muni yield curve has been inverted since December 2022.

5. Municipal credit fundamentals remain robust

Even as the economy has moved toward the later stages of the credit cycle, municipal credit fundamentals have generally remained strong due to fiscal stimulus and strong revenue collections. Municipal credit upgrades have outpaced downgrades over the past nine quarters by a ratio of as high as 6:1.4

The COVID-19 pandemic cash that helped many state and local governments maintain their balance sheets is starting to wane.

While these savings will eventually be depleted, default risk in the muni market remains extremely low, in our view. Historically, high-yield munis have held up well in past recessions versus corporate bonds.

Conclusion

Muni bonds are compelling in the current environment, especially as investors have become more constructive on interest rate and credit risk after the recent market moves.

We believe a more favorable macroeconomic environment, historically attractive yields, positive market technicals and credit fundamentals, and a potential return to longer-term investments as investors move out of cash, could potentially suggest positive muni performance ahead.

Footnotes

1 Bloomberg L.P., as of September 30, 2023. Investment grade municipal bonds are represented by Bloomberg Municipal Bond Index. High yield municipal bonds are represented by Bloomberg Municipal High Yield Bond Index. Taxable municipal bonds are represented by the Bloomberg Taxable Municipal Index. Assuming a top tax rate of 40.8%, 37% federal tax rate and 3.8% net investment income tax (NIIT), effective Jan. 1, 2023. Irs.gov, as of October 18, 2022. Top marginal tax rate for single taxpayers with more than $578,125 in taxable income or couples with $693,750 or more. NIIT is the net investment income tax investment income for single taxpayers with more than $200,000 in taxable income or couples with $250,000 or more.

2 Source: Refinitiv, data as of September 30, 2023

3 Bloomberg L.P., data as of September 30, 2023

4 Source: Standard & Poor’s; includes rating actions during the second quarter of 2023 and the eight prior quarters.

Important information

NA3169615

Diversification does not guarantee a profit or eliminate the risk of loss.

Municipal securities are subject to the risk that legislative or economic conditions could affect an issuer’s ability to make payments of principal and/or interest.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.

Junk bonds involve greater risk of default or price changes due to changes in the issuer’s credit quality.

The values of junk bonds fluctuate more than those of high-quality bonds and can decline significantly over short time periods.

All fixed income securities are subject to two types of risk: credit risk and interest rate risk. Credit risk refers to the possibility that the issuer of a security will be unable to make interest payments and/ or repay the principal on its debt. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa.

Municipal bonds are issued by state and local government agencies to finance public projects and services. They typically pay interest that is tax-free in their state of issuance. Because of their tax benefits, municipal bonds usually offer lower pre-tax yields than similar taxable bonds.

BVAL (Bloomberg Valuation Service) Municipal AAA Yield Curve is populated with high quality US municipal bonds with an average rating of AAA from Moody’s and S&P. The curve is a standard market scale with non-call yields up to year 10 and callable yields thereafter.

US Treasury Actives Curve relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. These market yields are calculated from composites of quotations obtained by the Federal Reserve Bank of New York.

Treasuries are backed by the full faith and credit of the US government as to the timely payment of principal and interest, while legislative or economic conditions could affect a municipal securities issuer’s ability to make payments of principal or interest.

A Yield Curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates.

An Inverted Yield Curve slopes downward, indicating short-term interest rates exceeding long-term rates.

A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. NR indicates the debtor was not rated and should not be interpreted as indicating low quality. For more information on rating methodologies, please visit the following NRSRO websites: www.standardandpoors.com and select ‘Understanding Ratings’ under Rating Resources on the homepage; www.moodys.com and select ‘Rating Methodologies’ under Research and Ratings on the homepage; www.fitchratings.com and select ‘Ratings Definitions’ on the homepage.

All data as of September 30, 2023 unless otherwise noted.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. It is not intended or written to be used, and it cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on the taxpayer under US federal tax laws. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Past performance does not guarantee future results. An investment cannot be made into an index.

Forward-looking statements are not guarantees of future results. They involve risks, uncertainties, and assumptions; there can be no assurance that actual results will not differ materially from expectations.

There is no guarantee the outlooks mentioned will come to pass.

5 Reasons Why Municipal Bonds Are Compelling Now by Invesco US

Read the full article here