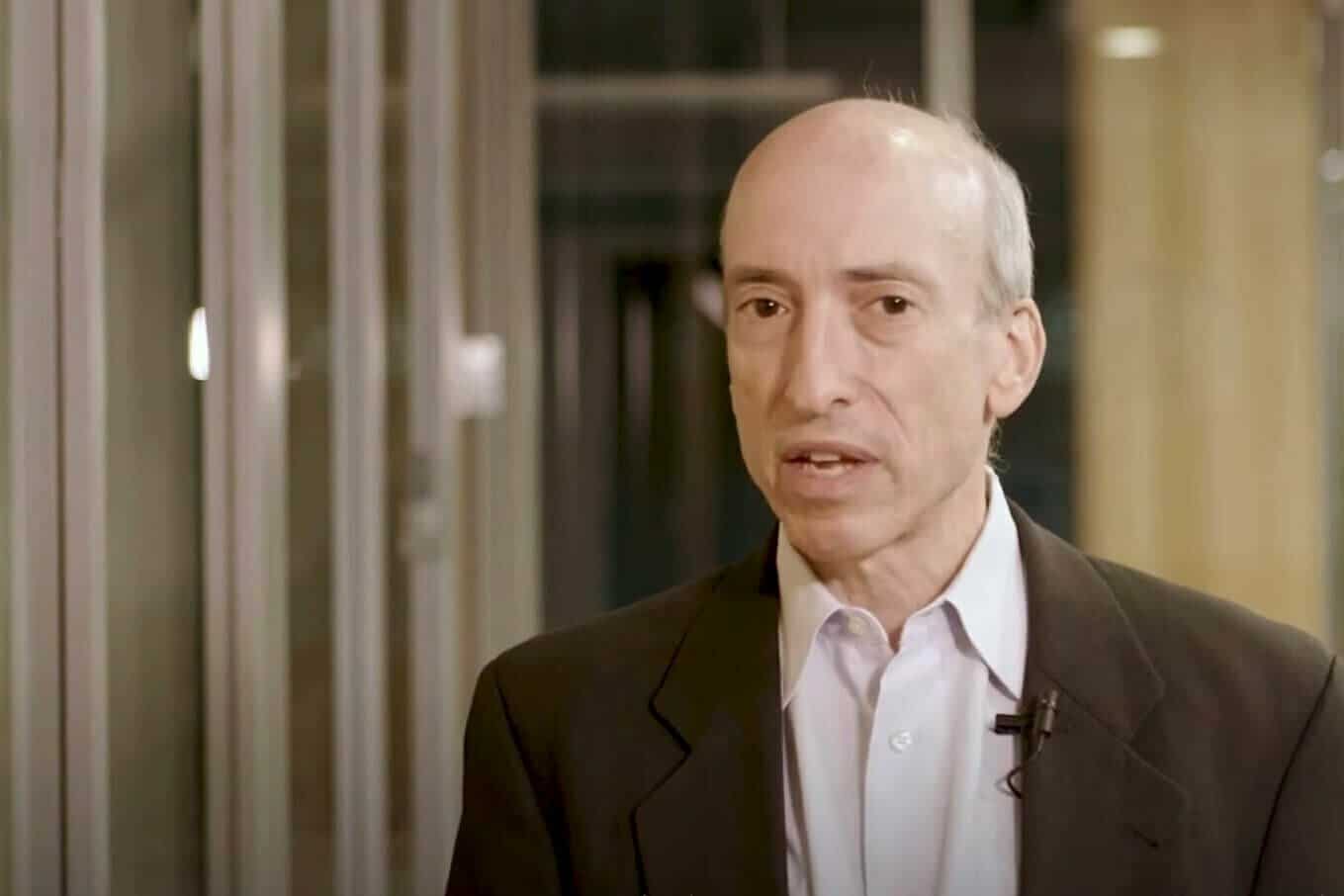

Despite tremendous pressure to approve a spot Bitcoin ETF for trading on public markets, Securities and Exchange Commission (SEC) chairman Gary Gensler refuses to discuss his agency’s next steps.

On Monday, the SEC received an order from the Court of Appeals to review Grayscale’s Bitcoin ETF application. The company owns the world’s largest Bitcoin fund, which it plans to convert into a spot ETF as early as it can.

“Those are things that are in front of staff,” Gensler said at a Securities Enforcement Forum event in Washington, according to CoinDesk. While waiting for SEC staff to make recommendations to him and the commission, he said he would “let that play out” and not prejudge the situation.

Gensler didn’t give a clear answer when asked about the order in which the SEC might handle similar applications.

Right now, the agency has roughly a dozen near-identical spot Bitcoin ETF applications in review, all from big-name fund managers such as BlackRock, Fidelity, Franklin Templeton, and others.

Grayscale officially re-entered that mix with Monday’s court order, which followed its legal victory over the SEC in August, and the agency’s refusal to appeal the case.

The victory has bolstered market confidence that a spot ETF approval may indeed happen. Grayscale’s GBTC share discount has narrowed to 14%, while Bitcoin’s price reached a yearly high of $35,000 this week.

The SEC is also juggling an ongoing case against Ripple for its institutional sales of XRP, wishing to make the company pay a $770 million fine for its unregistered securities sale of XRP. Earlier this month, the SEC dropped similar charges against Ripple’s co-founders.

The SEC is also continuing lawsuit against crypto exchanges Coinbase and Binance for alleged securities law violations.

“I’m going to let each of these crypto exchange cases speak for themselves, and they’re in front of jurists,” he said. “They’ll play themselves out where they play themselves out.”

Gensler appeared at the event to deliver a speech about SEC enforcement, which was riddled with criticisms about the crypto industry that he said is “rife with non-compliance.”

“We have a $110 trillion capital market,” he said during the question period. “Crypto worldwide might be a trillion, but in the U.S. is less. So just by that, it’s well less than one percent of U.S. capital markets.”

Read the full article here