Investment Thesis

Whitecap Resources Inc. (OTCPK:SPGYF) (TSX:WCP:CA) is a Canadian mid-size oil & natural gas producer that released its Q3 2023 results yesterday after the close and will later today host a conference call. This is a company I have covered several times over the last year, and those articles can be found here.

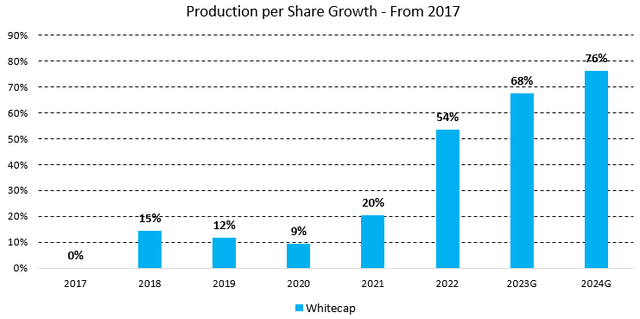

This article will be focused on the Q3 ’23 results and my general views on Whitecap, which has delivered excellent production growth per share over the last few years.

Figure 1 – Source: Quarterly Reports

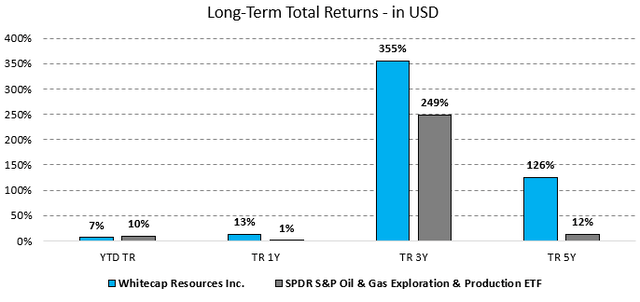

The stock price of Whitecap has underperformed the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) slightly in 2023, which is a decent proxy for peers. That is likely due to it having around 35% of production coming from natural gas and natural gas prices having been weaker in 2023. However, Whitecap has outperformed the ETF over the last 1y, 3y, and 5y periods, where solid production growth has likely been an important factor. So, I would not be overly concerned about the slightly weaker performance in 2023.

Figure 2 – Source: Data from Koyfin

Q3 2023 Results

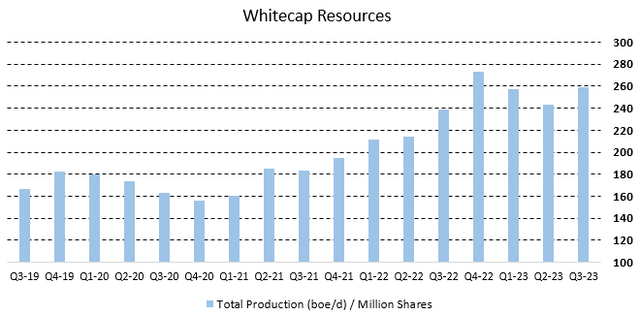

After a couple of quarters of declining production, due to some divestments earlier in the year, and the wildfires in Q2 ’23, we did in Q3 ’23 see a nice rebound in production and production per share. The company reported 157,026 boe/d in Q3 ’23, which is at the lower end of the 2023 annual guidance. The company is guiding for 165,000 boe/d in 2024, which would confirm the long-term growth trajectory.

Figure 3 – Source: Quarterly Reports

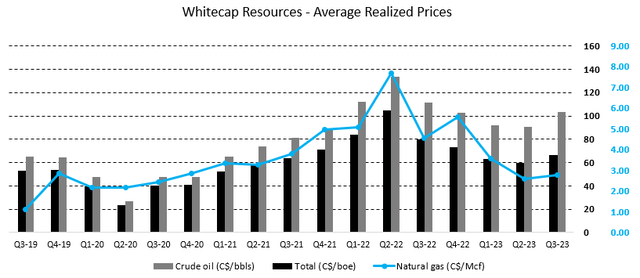

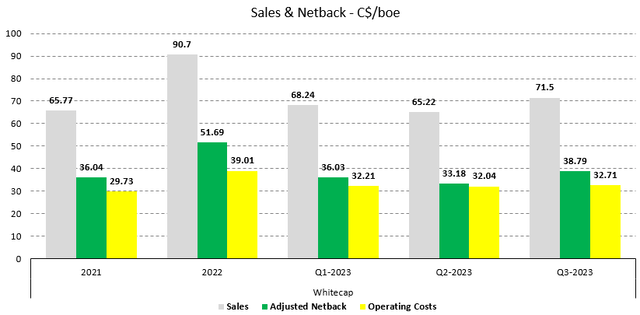

We did see a healthy rebound in commodity prices in Q3 ’23 compared to the prior quarter, primarily due to a higher oil price. So, we are now at a level where Whitecap has a very healthy margin.

Figure 4 – Source: Quarterly Reports

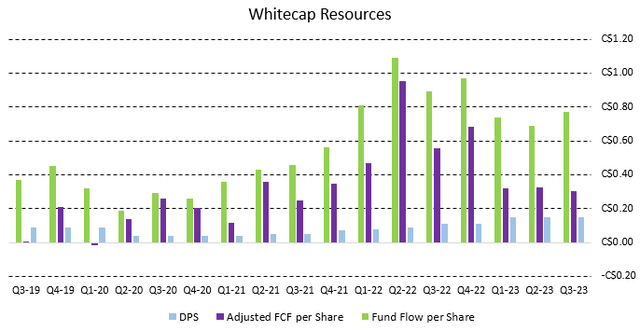

Due to the combination of increased production and higher commodity prices, Whitecap reported C$466M in funds flow, which was a 12% increase compared to the prior quarter. Free cash flow was down slightly at C$184M, primarily due to significantly higher capital investments in the quarter. The funds flow per share came to C$0.77 in Q3 ’23, and the free cash flow per share was C$0.30 in the quarter.

Figure 5 – Source: Quarterly Reports

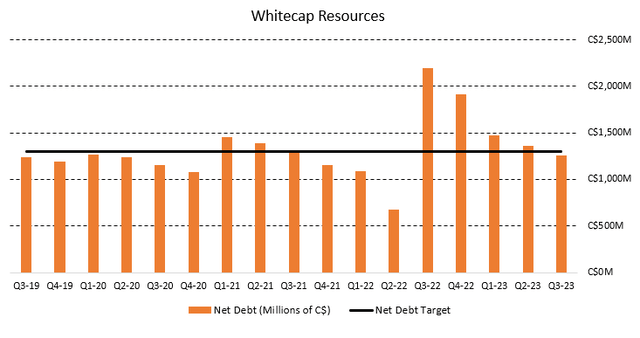

We can in the chart below see that Whitecap has reached its net debt target of C$1.3B, when it in Q3 ’23 reported a net debt of C$1,260M, which means that 75% of the free cash flow will now be distributed to shareholders in the form of dividends and buybacks. The base dividend will from the November payout be increased to C$0.0608 per month. That equates to an attractive dividend yield of 6.5% using the latest share price.

Figure 6 – Source: Quarterly Reports

The production growth has been an important reason why Whitecap has done well over the years, both operationally and in terms of performance. The low-cost operation has been another factor, where the company in the most recent quarter had operating costs as low as C$33/boe, which in turn generated an adjusted netback of C$39/boe. So, given that energy prices are today even higher than what we saw in Q3 ’23, the company is expected to do very well in this environment.

Figure 7 – Source: Quarterly Reports

2024 Outlook

Whitecap, is in 2024, guiding for an average production of 162,000-168,000 boe/d, with the capital budget estimated to C$1.0-1.2B. With the latest strip prices, we are according to the company looking at around C$1.8B in funds flow and C$700M in free cash flow in 2024.

These numbers are somewhat disappointing in my view, where the capital budget is above my expectations and the annual production guidance is also slightly below my expectations. C$700M in free cash flow translates to a free cash flow yield of 9% and 11%, using the enterprise value and market cap. This is below what I am expecting to see for most peers at a WTI price (CL1:COM) of around $80/bbl.

Conclusion

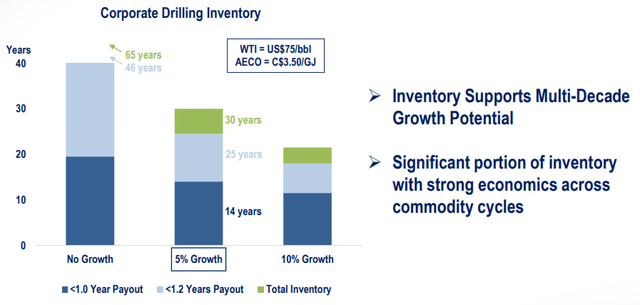

Figure 8 – Source: Whitecap Corporate Presentation

The Q3 ’23 result was mostly in line with my expectations, but the 2024 guidance was somewhat disappointing. Whitecap is still a quality company, with an impressive drilling inventory, high shareholder distributions, a quality management team, and dependable production growth over time.

The company was never going to have the highest leverage to higher commodity prices, due to the low operating costs and relatively little financial leverage. Having said that, I decided to liquidate my holdings in Whitecap at the open today as I did not like the 2024 guidance. While I do think a quality premium is warranted for Whitecap Resources Inc., it is simply too large at this point compared to many peers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here