A couple enjoying a relaxing sunset.

What’s the most surefire way to build generational wealth? From my vantage point, I would argue that buying companies that dominate massive and growing industries is a good place to start.

That’s because when a piece of a pie is growing and a company is also growing its share of that pie, amazing things like net revenue and earnings growth happen. Take, for instance, BlackRock (NYSE:BLK): The company’s total assets under management as of September 30 stood at a whopping $9.1 trillion. That equates to roughly $2 trillion more than its next closest competitor, Vanguard, and its approximately $7 trillion in AUM.

It also gets even better. The global asset management industry is expected to grow from $111.2 trillion in AUM in 2020 to $145.4 trillion in AUM in 2025. Since I covered BlackRock last month and rated it a buy, the stock has dipped 7%. Let’s revisit the company’s fundamentals and valuation to unpack why I am upgrading it to a strong buy.

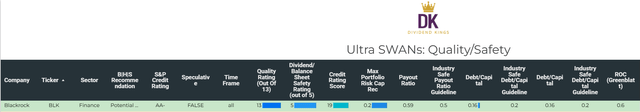

DK Research Terminal

When 10-year U.S. Treasuries yield 4.9%, BlackRock’s 3.2% dividend yield isn’t going to get a lot of attention. As I’ll expand on further, that’s a shame. The company’s EPS payout ratio of 59% is more than the 50% that rating agencies like to see from the asset management industry. However, the company is in an earnings trough year. As it recovers in 2024 and beyond, the payout ratio should stabilize.

BlackRock also has a remarkably robust balance sheet. The asset manager’s 0.16 debt-to-capital ratio is below the industry-safe guideline of 0.2. Along with its market-leading position in its industry, that is why S&P has assigned an AA- credit rating to BlackRock on a stable outlook. This puts the company at just a 0.55% risk of closing its doors by 2053. Put another way, in 181 out of 182 scenarios, BlackRock won’t be going bankrupt in the next 30 years. That makes it a smart pick for capital preservation.

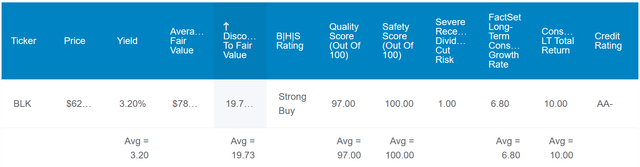

Not to mention that investors buying at the current valuation are building in a margin of safety that could give a valuation boost to the stock moving forward. This is because the shares of BlackRock are trading at a 22% discount to their fair value of $783 a share. That could translate into a 29% upside from the current share price of $607 (as of October 25, 2023).

- 3.2% dividend yield + 6.8% FactSet Research annual earnings growth consensus + 2.6% annual valuation multiple expansion = 12.6% annual total return potential or a 228% total return by 2033 versus 10% annual total returns from the S&P 500 (SP500) or a 160% total return by 2033

Still The King Of Asset Management

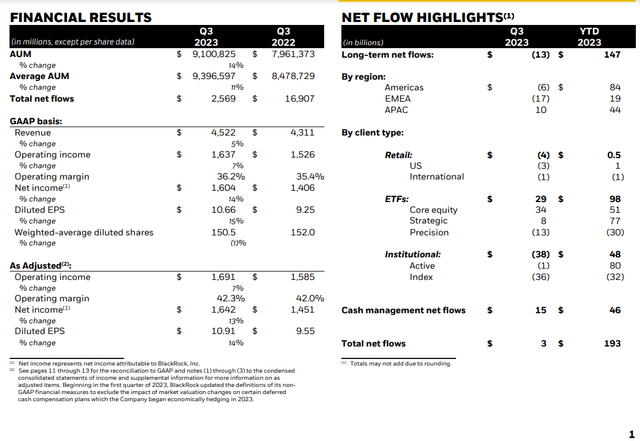

BlackRock Q3 2023 Earnings Press Release

BlackRock reported healthy results for the third quarter ended September 30, 2023. The company’s net revenue grew by 4.9% year-over-year to $4.5 billion in the quarter, which was in line with analyst expectations.

The market rally in 2023 primarily fueled the company’s 10.8% expansion in average AUM to $9.4 trillion during the third quarter. To a much lesser extent, the $3 billion in net inflows also helped.

Where BlackRock especially shined, however, was the bottom line. The company’s adjusted diluted EPS soared 14.2% higher over the year-ago period to $10.91 for the third quarter. That was far more than the analyst consensus of $8.34. BlackRock’s higher net revenue base combined with a lower share count and improved profit margins were responsible for this massive beat (figures sourced from BlackRock Q3 2023 earnings press release and Seeking Alpha link included above).

Looking well into the future, FactSet Research’s annual earnings growth consensus is 6.8%. That is because as the global asset base expands and BlackRock adds to its collection of 1,300+ ETFs (more than 85 were launched in 2022 alone), net revenue and earnings can’t help but grow (ETF info according to slide 4 of 138 of BlackRock Investor Day Presentation).

Rounding out BlackRock’s vigorous fundamentals, BlackRock’s balance sheet is rock-solid. The company’s debt is rated as AA- by S&P, which makes it a financial fortress.

Decent Dividend Growth Can Continue

BlackRock’s quarterly dividend per share has grown by nearly 60% from $3.13 this time in 2018 to the current rate of $5 – – a 9.8% compound annual growth rate. I wouldn’t expect growth to be quite this high in the years ahead, but it doesn’t need to be to make BlackRock a quality dividend growth stock.

In 2022, the company generated $4.4 billion in free cash flow. Against the $3 billion in dividends paid that year, this equates to a 67.6% FCF payout ratio. Because the asset management industry is a very capital-light business model, this is a sustainable payout ratio in my opinion (details per page 73 of 108 of BlackRock 10-K filing). That is why I would expect routine 6% to 7% annual dividend growth from BlackRock for quite a while longer. Paired with its 3.2% dividend yield, that’s not a bad mix of starting income and growth potential.

Risks To Consider

BlackRock’s steady operating fundamentals and sturdy financial positioning earn it ultra SWAN status or a perfect 13/13 on the Dividend Kings quality rating. However, the company isn’t completely shielded from risk.

It’s unlikely that a newcomer is going to dethrone BlackRock as royalty of its industry. Though, if the company can’t keep outperforming its benchmarks and launching ETFs that clients demand, Vanguard or Fidelity could make up that ground. This could result in lost market share and damaged fundamentals for BlackRock if it were to materialize.

The risk of a global recession is also worth considering. An economist at Ernst & Young believes the Israel-Hamas war could result in a global recession and a 20% selloff in the stock market. If this were to play out, BlackRock’s financial results and its stock price could be pressured in the near term.

Summary: BlackRock’s Yield Doubles The S&P While Poised For Market-Beating Returns

Zen Research Terminal

As I indicated in the opening of my previous article on BlackRock, it is a proven compounder that arguably belongs in every dividend stock portfolio. The asset manager checks off all of the boxes that are important to me.

- Promising operating fundamentals? Check.

- A safe and market-topping dividend with growth ahead? Check.

- A secure balance sheet? Checkmate. Game, set, match.

The icing on the cake is the 22% discount to fair value. I can’t predict how far BlackRock’s stock could fall in the next 12 months. But from such a cheap valuation, valuation multiple expansion over the long run is a near-certainty. For these reasons, BlackRock could turn $1 into $3.28 in the next 10 years – – superior to the $2.60 into which the S&P could parlay $1 during that time. Thus, my reasoning for upgrading the stock to a strong buy for dividend growth investors.

Read the full article here