As previously expected, HighPeak Energy (NASDAQ:HPK) has reduced its 2023 capital expenditure budget in an attempt to manage its liquidity. It is now projected to have around $171 million in cash burn at current strip. This should keep it from completely using up its credit facility borrowing capacity.

However, HighPeak now needs to deal with its February 2024 notes by the end of June 2023. This results in a significant chance of an equity offering to help repay those notes. I estimate HighPeak’s value at $17 per share in a long-term $75 WTI oil environment, but that doesn’t include the potential dilution from an equity offering.

Reduced Budget

HighPeak has reduced its 2023 capital expenditure budget by approximately $212 million, going from four rigs to two rigs starting in June 2023 until early 2024. This results in a roughly 2,000 BOEPD reduction in its expected 2023 average production and a roughly 4,000 BOEPD reduction in its projected 2023 exit rate production.

It appears that HighPeak is also guiding for higher absolute lease operating expenses. It initially expected lease operating expenses per BOE to be around $5.50 in 2023. It has now increased this to approximately $7.00 per BOE, resulting in a $23 million increase in lease operating expenses despite slightly lower production expectations.

At $70 WTI oil, HighPeak’s 2023 cash burn would be reduced by approximately $150 million as a result of its reduced capex budget combined with lower production and higher lease operating expenses.

HighPeak has kept its tentative 2024 capex budget at $900 million for now, but has reduced its expectations for average 2024 production by 10,000 BOEPD and its expectations for 2024 exit rate production by 4,000 BOEPD. This reflects the impact of the decrease in new wells coming online in 2H 2023. As well, HighPeak’s updated 2024 expectations appear more realistic, as I had thought that it would be difficult for it to average 73,000 BOEPD in production in 2024 with a $900 million capex budget.

2023 Results At Current Strip

I’ve now updated HighPeak’s model to account for its updated guidance (at the midpoint of its guidance range) for 48,000 BOEPD in average production during 2023. It reported 37,222 BOEPD in average production in Q1 2023, essentially flat with its Q4 2022 production. HighPeak has indicated that its production growth can be pretty lumpy, so it still expects significant growth later in 2023.

At current strip of $73 WTI oil, HighPeak is projected to generate $1.097 billion in revenues after hedges now.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Oil | 14,366,400 | $73.00 | $1,049 |

| NGLs | 1,839,600 | $26.00 | $48 |

| Natural Gas | 7,884,000 | $1.75 | $14 |

| Hedge Value | -$14 | ||

| Total | $1,097 |

HighPeak’s 2023 capital expenditures may now end up at around $993 million. This results in a projection of $171 million in cash burn for HighPeak in 2023 at current strip.

One thing to keep an eye on is HighPeak’s lease operating expenses (including workover expenses), which increased to $9.83 per BOE in Q1 2023, up from $6.94 per BOE in Q4 2022. This per BOE rate should decrease with higher production later in 2023, but I am modeling it at $7.50 per BOE (the high end of its revised guidance range) now.

| Expenses | $ Million |

| Lease Operating Expense | $131 |

| Production And Ad Valorem Taxes | $61 |

| Cash G&A | $12 |

| Cash Interest | $71 |

| Capital Expenditures | $993 |

| Total Expenditures | $1,268 |

This would result in HighPeak ending 2023 with approximately $896 million in net debt, including around $421 million in credit facility debt (if it had zero cash on hand). This includes $11 million in current annual dividend payments.

HighPeak’s borrowing base was increased to $700 million in March 2023, along with aggregate elected commitments of $575 million, so it looks okay in terms of room under its credit facility now.

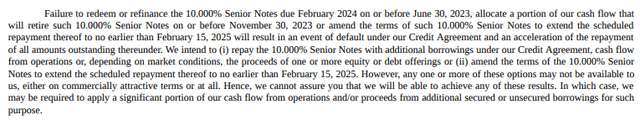

However, HighPeak is now also required to deal with its $225 million in 10% unsecured notes due February 2024 very soon. It needs to refinance or redeem those notes by the end of June 2023 or otherwise get the maturity date extended to at least February 2025.

It is also allowed to allocate cash flow to retire those notes before the end of November 2023, but it doesn’t appear at this point that HighPeak has the ability to do that (without at least partially refinancing its notes or issuing additional equity or debt) based on current strip prices.

Potential 2024 Results

HighPeak now expects to average approximately 63,000 BOEPD in production during 2024 with a $900 million capital expenditure budget. There is still some operational risk there, but the production target seems more realistic than the 73,000 BOEPD that HighPeak was aiming for before.

At current 2024 strip of $68 WTI oil, HighPeak is projected to generate $1.355 billion in revenues after hedges.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Oil | 18,855,900 | $68.00 | $1,282 |

| NGLs | 2,414,475 | $24.25 | $59 |

| Natural Gas | 10,347,750 | $2.75 | $28 |

| Hedge Value | -$14 | ||

| Total | $1,355 |

This leads to a projection that HighPeak could generate $144 million in free cash flow in 2024 if it meets its production targets.

| Expenses | $ Million |

| Lease Operating Expense | $149 |

| Production And Ad Valorem Taxes | $75 |

| Cash G&A | $12 |

| Cash Interest | $75 |

| Capital Expenditures | $900 |

| Total Expenditures | $1,211 |

Thus there is potential for HighPeak to generate positive free cash flow at current strip if it meets its production targets for 2024.

Notes On Valuation

I have trimmed HighPeak’s estimated value to around $17 per share in a long-term $75 WTI oil and $3.75 NYMEX gas scenario. The reduction is mainly due to HighPeak’s operating expenses increasing noticeably. This price target also assumes that HighPeak can navigate its near-term debt maturities successfully, as it needs to deal with its February 2024 notes soon. If it is unable to deal with those notes by the end of June 2023, it faces an event of default with its credit facility.

HighPeak’s February 2024 Notes (highpeakenergy.com)

Conclusion

As expected, HighPeak has reduced its 2023 capital expenditure budget to rein in its cash burn. Based on its updated guidance, HighPeak will now have approximately $171 million in cash burn in 2023. The reduced capex budget for 2023 will also have a carryover effect into 2024, as its 2024 production expectations have been reduced by 10,000 BOEPD as well.

HighPeak needs to deal with its February 2024 notes by the end of June 2023. If it is unable to do so, this would trigger an event of default for its credit facility. I’d expect HighPeak to be able to deal with those notes, although it may need to issue equity to do so. HighPeak’s estimated value is approximately $17 per share if it can deal with its near-term debt maturities, although that doesn’t take into account the potential dilution from equity offerings.

Read the full article here