Never go to bed mad. Stay up and fight.”― Phyllis Diller.

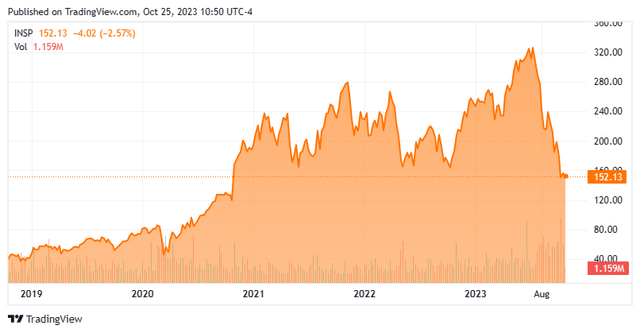

Today, we take our first look at Inspire Medical Systems, Inc. (NYSE:INSP). If you watch any TV at all, I am sure you have seen the ads for this company’s flagship product. Despite stellar revenue growth, this mid-cap stock trades near a 52-week low and at its worst levels since late in 2020. What’s ahead for this medical device manufacture? An analysis follows below.

Seeking Alpha

Company Overview:

This medical device maker is headquartered just outside of Minneapolis in Golden Valley, MN. Inspire Medical Systems is focused on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea, or OSA. Over 95% of the company’s overall revenues comes from within the United States. The stock currently trades just north of $150.00 a share and sports an approximate market capitalization of $4.5 billion.

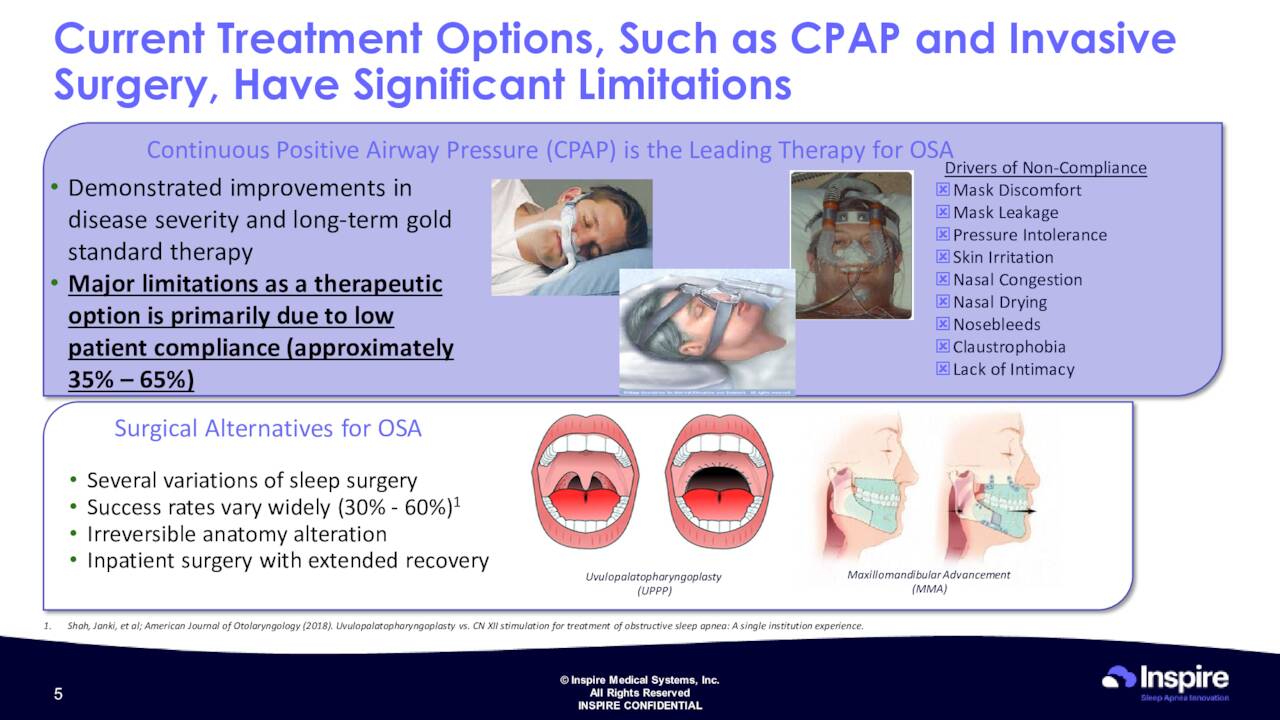

May Company Presentation

The company is targeting the OSA space with its approximately $10 billion annual market with a better “mousetrap” that does not have the limitations (above) of conventional products and procedures. Inspire’s much smaller device (below) does require an outpatient procedure conducting at a medical center.

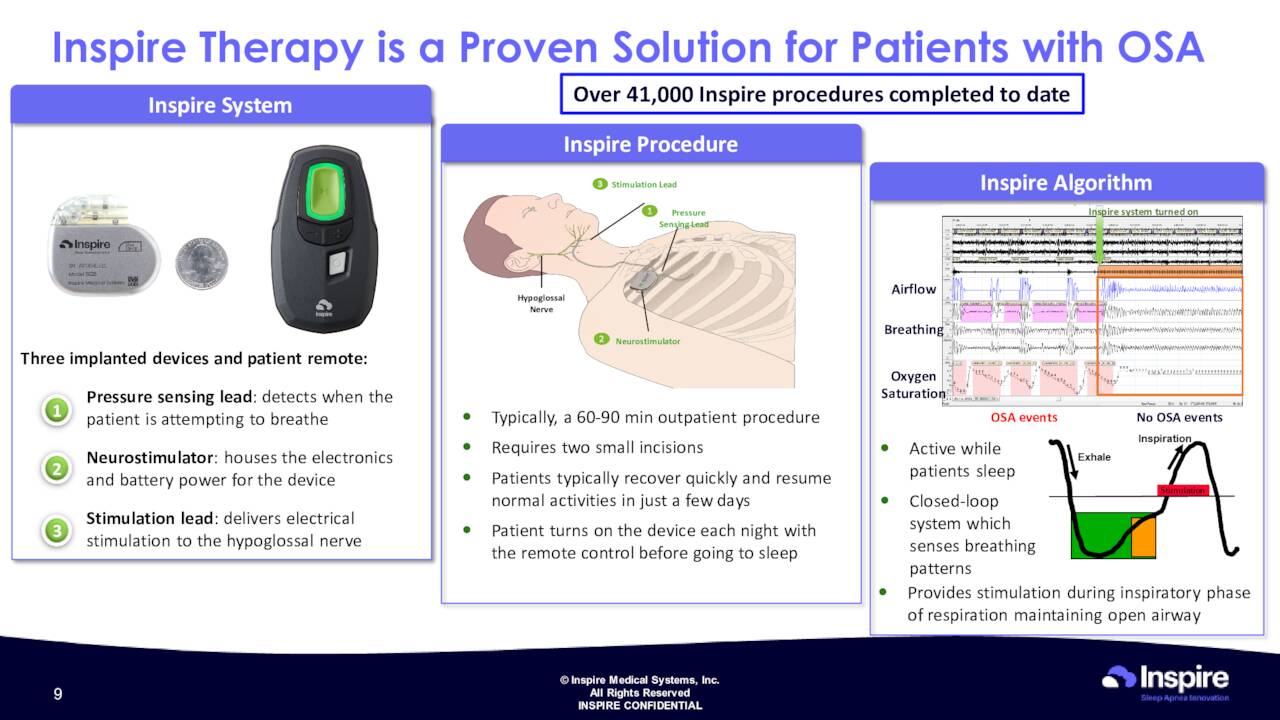

May Company Presentation

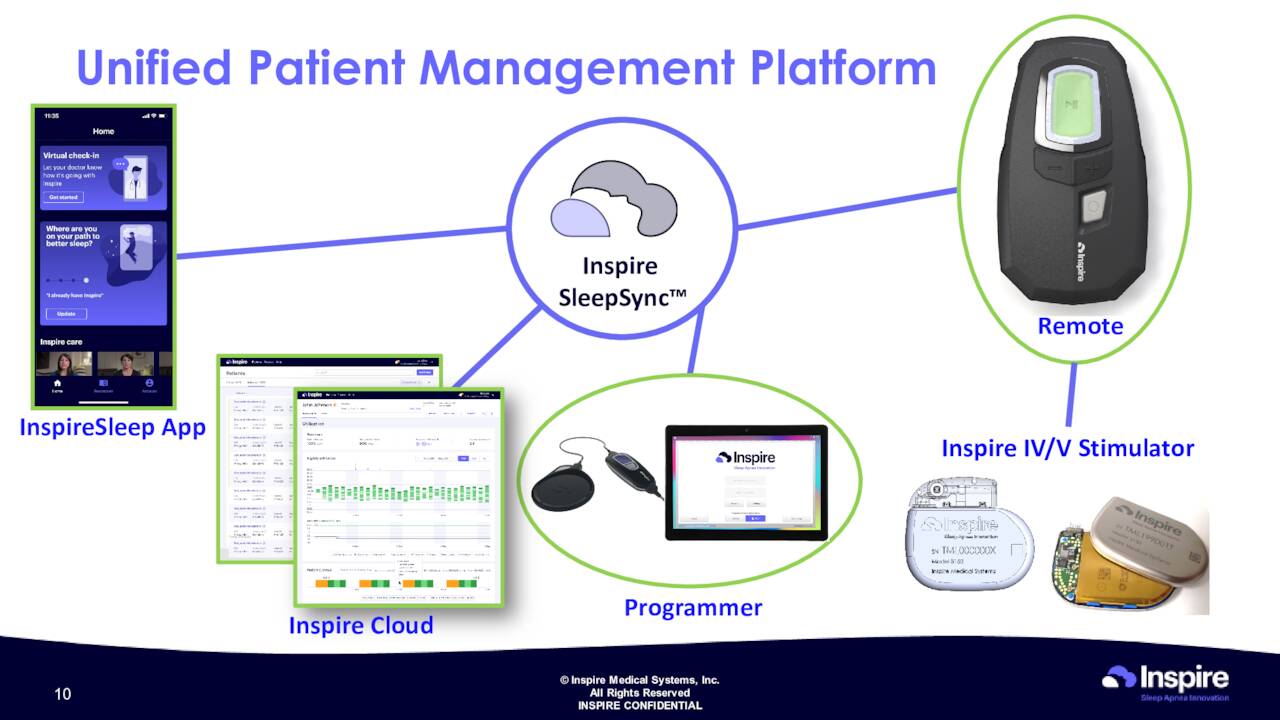

This system allows monitoring, tracking and modification. It is a “best of breed” solution for the OSA space.

May Company Presentation

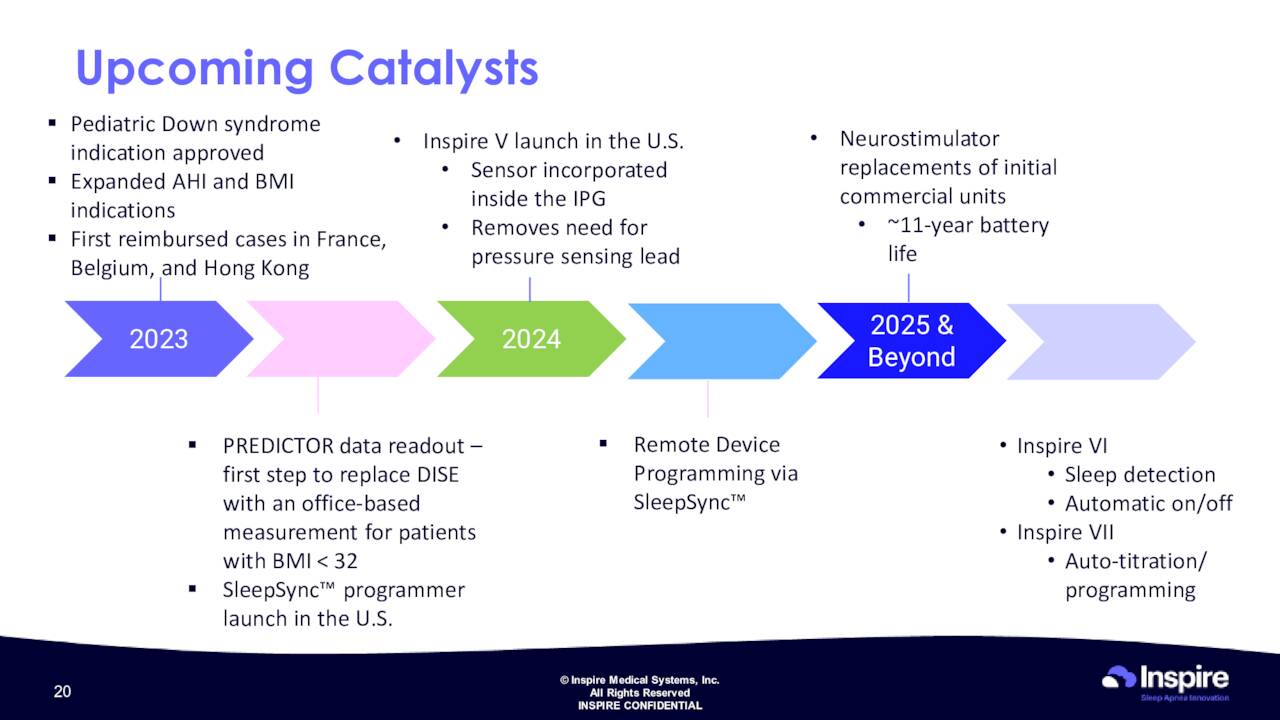

To date, close to 45,000 procedures have taken place. This neurostimulation treatment/device was originally approved for moderate to severe OSA some years ago. The company continues to grow the potential population for this system and plans to continue to add new features to it. Inspire won FDA approval for another indication in June of this year.

May Company Presentation

Second Quarter Results:

On August 1st, Inspire Medical Systems posted its second quarter numbers. The company had a GAAP loss of 41 cents a share, 17 cents a share above expectations. The company had a net loss of $12 million during 2Q2023, a slight improvement from the $14.5 million recorded in the same period a year ago. Revenues grew just over 65% on a year-over-year basis to $151.1 million, nearly $15 million over the consensus estimate.

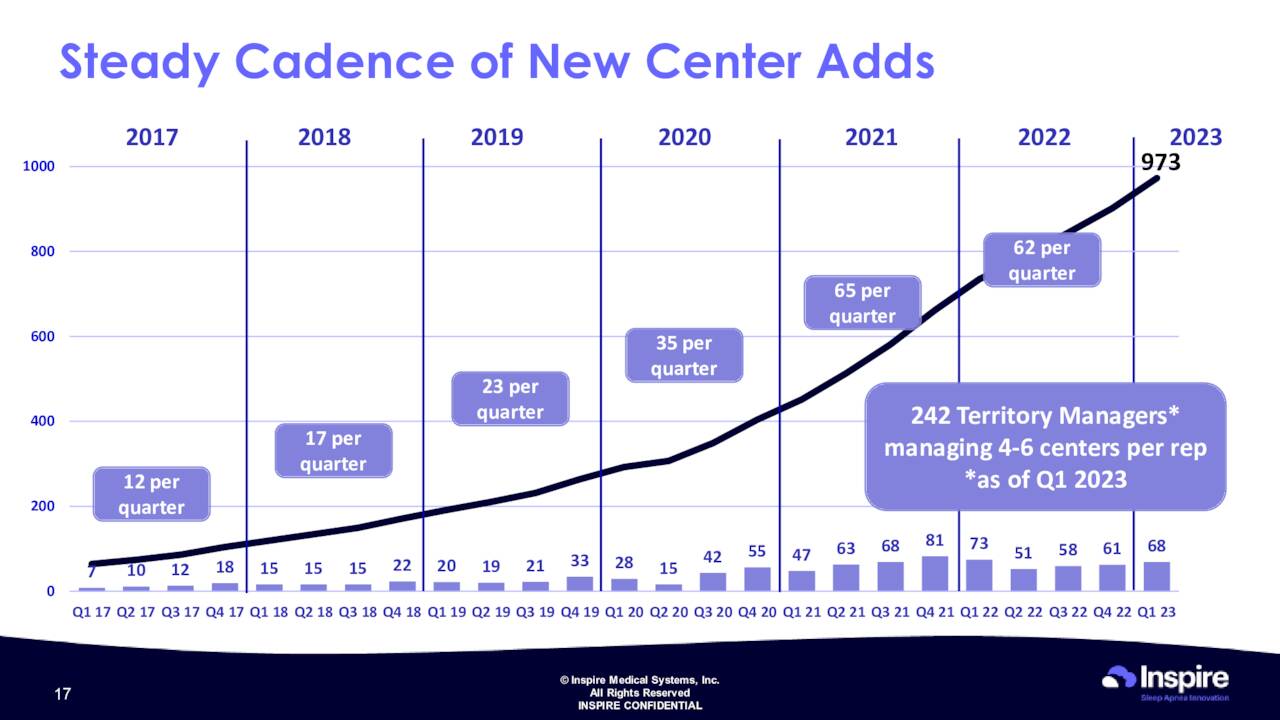

The company opened 72 new medical centers in the quarter, bringing its total to 1,045 centers. Management guided to opening between 52 to 56 new centers in each of remaining quarters in FY2023.

May Company Presentation

On the expense side of the ledger, operating costs spike by 57% compared to the same period a year ago to $143.4 million. The primary drivers of this increase were a continued expansion of Inspire’s U.S. sales organization, direct-to-patient marketing programs as well as continued product development efforts.

Based on the strong results, management bumped up its FY2023 sales guidance by $20 million to a range of $600 to $610 million.

Analyst Commentary & Balance Sheet:

Since second quarter results were posted, nine analyst firms including Piper Sandler and UBS have reissued Buy/Outperform. However, several of these had significant downward price target revisions. Price targets proffered range were in a broad range of $180 to $360 a share. Meanwhile, Oppenheimer maintained its Hold rating on INSP and Leerink Partners initiated the shares with a Hold rating and $159 price target.

Just over four percent of the stock’s outstanding float is currently held short. Several insiders took advantage of the stock selling in the high $200s and low $300s to dump more than $40 million worth of shares collectively in the first half of 2023. The company’s CEO was responsible for more than half of those shares sold. Insider selling has slowed considerably since then in the second half of this year as the shares trade at much lower levels. The company ended the first half of this year with just over $465 million of cash and marketable securities on its balance sheet.

Verdict:

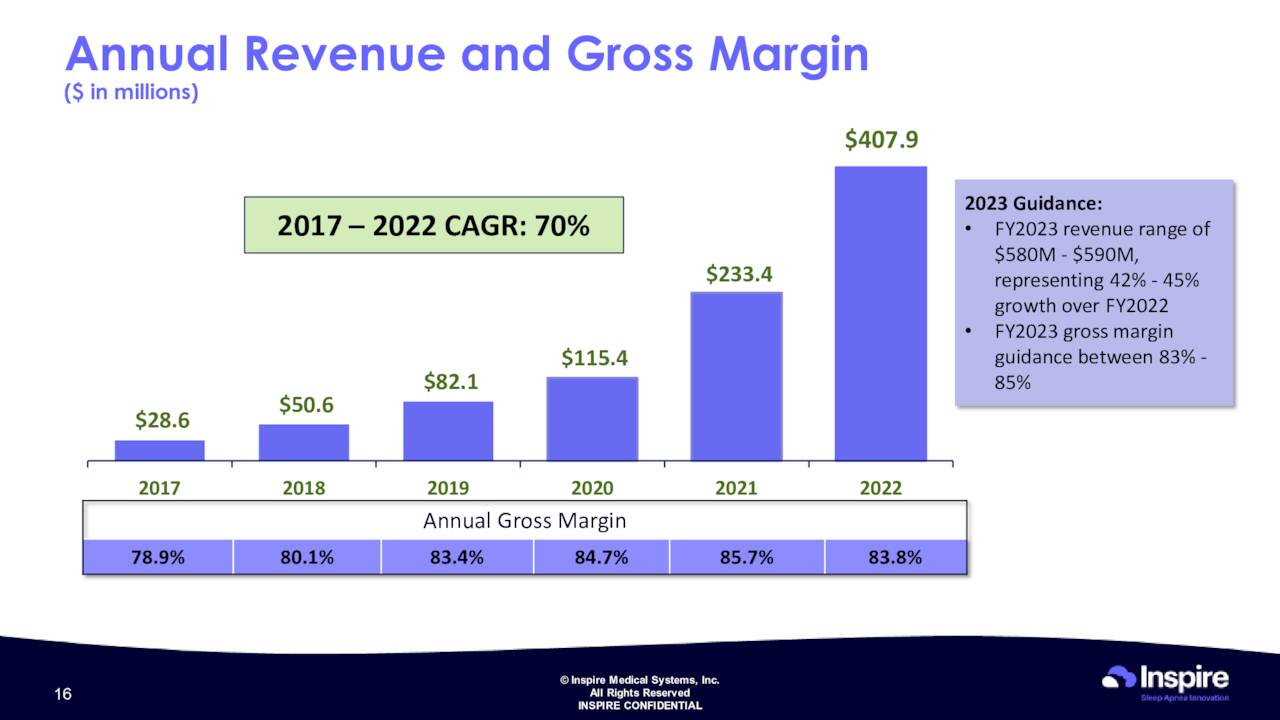

Inspire Medical Systems lost $1.06 a share on just under $408 million worth of revenues in FY2022. The current analyst firm consensus sees 50% sales growth in FY2023, but losses increasing to $1.75 a share. In FY2024, they see sales growth moderating to nearly 30% while losses fall to just under 70 cents a share.

May Company Presentation

The company has done a commendable job with its sales ramp of its Inspire sleep system while maintaining margins. The problem is with the yield on the 10-Year Treasury (US10Y) approaching five percent for the first time since 2007, unprofitable growth names simply are not in fashion in the current market. The company does have a rock-solid balance sheet and should have no need to raise additional funds before it achieves cash flow breakeven status, it should be noted.

I would be tempted to buy the just-over-50% decline in Inspire Medical Systems, Inc. stock from recent highs if the overall market environment was more conducive. However, that is not the case, and the shares still go for over seven times forward sales and insiders still haven’t stepped up to the plate by buying shares at these lower entry points. Therefore, Inspire is a story to keep an eye on, but I have no investment recommendation on the stock at this time.

Laugh and the world laughs with you, snore and you sleep alone.”― Anthony Burgess.

Read the full article here