Ryder System, Inc. (NYSE:R) shares have been a strong performer over the past year, rising 33%, though there was some profit-taking after the company reported third quarter earnings Wednesday morning. With the economy slowing down, and more notably vehicle prices normalizing, Ryder has passed its peak results. However, Ryder has pivoted its business to reduce economic cyclicality and make earnings more predictable.

Seeking Alpha

In the company’s third quarter, Ryder earned $3.58 in adjusted EPS, which was down from $4.45 last year as used truck prices have moderated. Still, this beat estimates by $0.36 even as revenue of $2.92 billion was $90 million light. While revenue fell from last year, this was due to a $58 million decline in fuel revenue and the exit of its UK business; fuel is a pure pass through to customer, so there is no material P&L impact from this decline. Operating revenue of $2.4 billion was up 3% due to higher contracted revenue, offset by a weaker rental environment.

Over the past several years, Ryder has worked to shift its business away from short-term rentals to long-term leases. Longer-term contracts provide more cash flow visibility, and they also help to protect Ryder’s profits from used truck prices. Ryder buys trucks, rents or leases them, depreciates them every quarter, and eventually sells them. When it enters into a long-term lease contract, it can set the rate based on anticipated depreciation out several years to lock in economics, whereas rental rates can move, making the final economics dependent on the sales price.

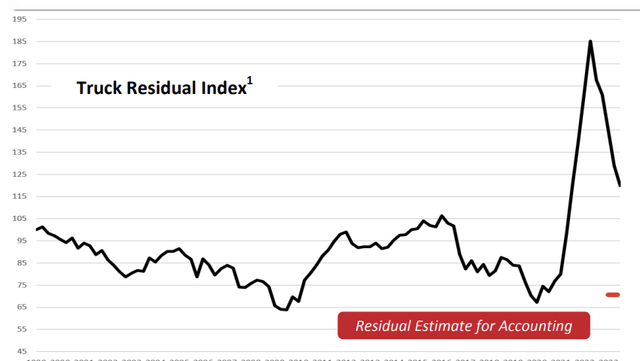

In 2020, as Ryder was about to make this pivot, I argued investors should buy shares because Ryder was forced to write down its vehicle price assumptions, and by shifting to a much more conservative depreciation assumption, eventually Ryder could actually see gains from its truck sales. Given the supply chain issues that followed, this is exactly what happened. As you can see below, vehicle prices spiked in 2021-2022. While they have fallen, they remain above Ryder’s conservative residual valuation.

Ryder

When Ryder sells a used vehicle above its residual value, it books a gain on sale, and as prices have fallen, these gains have declined, which is why earnings have moderated. This is why I view Ryder as unlikely to return to $16+ EPS. Still, underlying results continue to be solid.

Its fleet management unit (FMS) saw revenue down 3%, down 1% excluding its UK exit due to lower rental demand. Operating margins fell to 13.4% from 20.4% due to lower utilization and smaller gains on used vehicle sales. The company targets low double-digit margins here, and so results last year were really unsustainably high when a shortage of trucks and drivers meant pricing was extremely high. The business’s profitability today is more in-line with run rate expectations. Used vehicle pricing is down 30% from last year but still above book value. As it right-sizes its fleet, Ryder sold 30% more vehicles. Ryder’s used vehicle for sale inventory is up to 7,800 from 3,600 and in-line with the 7-9,000 unit target. FMS has declined to what is a more normal operating posture.

While FMS was down due to lessened rental demand, we can see the pivot to more lease activity with supply chain solutions (SCS) up 9% to $909 million, and margins rose to 9%, with earnings before taxes (EBT) rising 14% to $81 million. This margin is consistent with its high single-digit target as pricing gains take effect. Its dedicated (DTS) unit saw revenue rise 3% to $325 million, with flat EBT as margins contracted to 8.5% from 8.9%, in-line with target.

It was encouraging to see Ryder’s leasing units generate faster revenue growth. These contracts can last multiple years, providing a degree of revenue certainty even if economic conditions were to slow down. While rental activity is reducing FMS profits, this is less of a problem than it would have been a few years ago given this pivot.

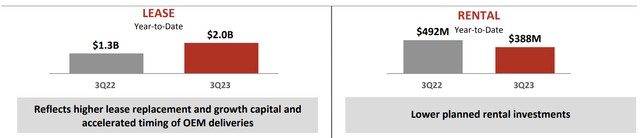

This shift is also apparent in how Ryder is investing in the business. As you can see below, Ryder is spending more buying trucks to be leased out and less to buy trucks to rent out as it shifts it fleet in line with where it is taking the business.

Ryder

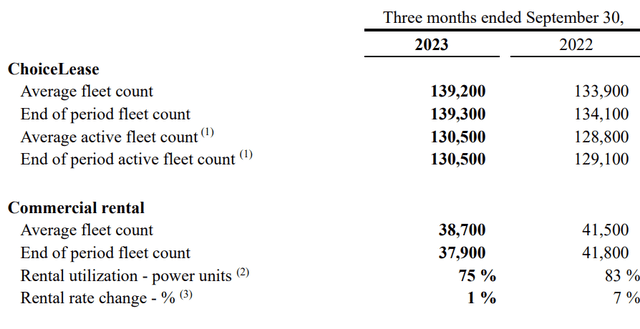

In 2023, gross cap-ex is expected to rise 500 million to $3.2 billion while sales decline $400 million to $800 million leading net capital expenditure to rise to $2.4 billion from $1.4 billion. As you can see below, this investment in cap-ex is leading its leasing unit to show growth in vehicles while Ryder has fewer vehicles in its rental unit where utilization has been falling, given the weaker macroeconomic environment.

Ryder

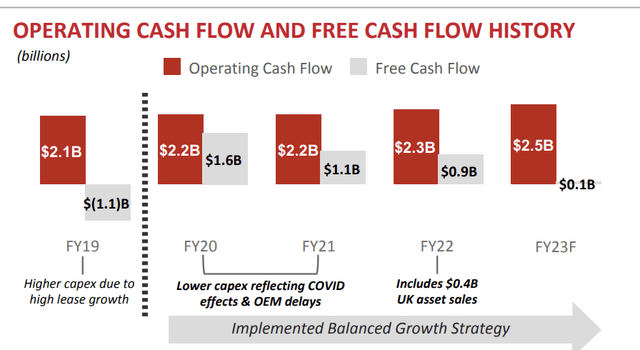

Because Ryder has been ramping up cap-ex spending and earning less of a windfall on used vehicle sales, its net cap-ex investment is rising, which is resulting in lower free cash flow. Ryder’s free cash flow is somewhat countercyclical. When economic conditions are soft, it can stop new purchases, age the average life of its fleet, and generate cash. Conversely, when it can sign attractive leases, it ramps up cap-ex, reducing cash flow. This creates a business with durability during downturns as it generates cash to reduce debt when the economy softens. Management expects $100 million in free cash flow this year.

Ryder

Alongside results, Ryder’s board authorized 4 million of share repurchases through 2025, half of which will offset stock-based compensation and half of which can reduce the share count. The share count is down 9.4% over the past year. It is likely to fall 2-3% per year the next two years, in addition to its 2.9% yield. The pace of buybacks is slowing due to a smaller windfall from used vehicle sales.

For the year, Ryder raised its EPS guidance to $12.60-`$12.85. That leaves the stock with a less than 8x multiple. However, some of this EPS is coming from used vehicle sale gains, which are likely to shrink further—this is a relatively “low quality” form of earnings. Ryder is earning about $8 excluding used vehicles, in my estimation. That leaves shares with a 12x multiple.

Given my expectation, we see some further softness in rental, offset by improved margins and growth out of its lease unit, I expect Ryder to continue generating about $8/share in run-rate earnings next year. Additionally with residual prices assumed at essentially record low levels, Ryder is structurally positioned to generate some gains on used vehicle sales over time. Even assuming another 10% decline in prices, Ryder will have run-rate $1/share gains on sales. All gains above that I view more as a one-time bonus, off of which shareholders benefit, but we will not see much of P/E multiple attached to those earnings.

For a capital-intensive business but one that is shifting to more lease-oriented revenue to improve cash flow visibility, I believe 12x is a fair multiple. At $9 in sustainable EPS, that is $108/share, or about 15% above current levels. While Ryder System, Inc. shares may be down somewhat today in recognition peak earnings have passed, Ryder’s pivot is working, and shares are relatively cheap. I would stay invested in the stock.

Read the full article here