I cautioned Tesla, Inc. (NASDAQ:TSLA) investors in my previous article in August to be wary, even as it surged into its July 2023 highs, which has panned out accordingly. I reminded holders that TSLA was still “slightly overvalued,” and its price action wasn’t favorable, as it didn’t offer an optimal entry zone.

However, I also reminded investors that I would consider TSLA stock if sufficient sellers appeared to help push it back down to the “low $200s zone.” You know what? We finally got there last week, as TSLA plunged following its third-quarter or FQ3 earnings release. In other words, TSLA is looking interesting to me again.

Keen Tesla investors should recall that CEO Elon Musk spooked investors, analysts, and the market at the company’s Q3 earnings conference. Instead of trying to assure investors that Tesla’s growth rate remains on track, he cautioned that it’s not possible to keep focusing on maintaining a 50% deliveries CAGR “indefinitely, as it would eventually exceed the mass of the known universe.”

Furthermore, Musk didn’t attempt to soften the technical difficulties in ramping production for its “revolutionary” Cybertruck, which is expected to span over 18 months. As such, volume production for Tesla’s highly-anticipated entry into a new segment is anticipated from 2025 and not expected to be earnings accretive in the near term.

Moreover, Musk didn’t provide clear indications on when its next-gen platform could roll off, although it’s expected to take a much shorter time to ramp than the Cybertruck.

Adding the complexities from the macroeconomic uncertainties as long-term Treasury yields surged, investors are likely pricing in further execution risks for Tesla. Notably, Tesla’s operating margin took an additional hit, reaching 7.6% in FQ3, down from Q2’s already low 9.6%. Furthermore, while Tesla’s price cuts could help maintain its market share and volume production, it hasn’t boosted its full-year deliveries outlook of 1.8M.

As such, I believe the market was right to inflict more pain on TSLA holders recently, as they likely anticipated a clear timeline toward its next-gen platform and Cybertruck. However, all they received from management was disappointment.

Notwithstanding the near-term pain, Tesla investors know its valuation has always been predicated on its long-term growth story. Accordingly, Tesla has made further gains in energy storage. Management updated that the segment posted a “significant jump in energy storage margins …primarily driven by Megapack deployments.”

Furthermore, investors must also reflect on the growth possibilities embedded in its autonomous driving opportunities and Optimus robot. Despite that, these long-duration growth drivers aren’t expected to be realized in the near- to medium-term, which could intensify selling pressure.

Therefore, I assessed that TSLA came under selling intensity from these buyers, as they anticipated a more pronounced production ramp in its automotive segment. However, with management’s disappointing commentary, they likely headed for the exits.

Notwithstanding the significant volatility TSLA holders needed to endure over the past three months since it topped out in July, the critical question is whether dip buyers have returned?

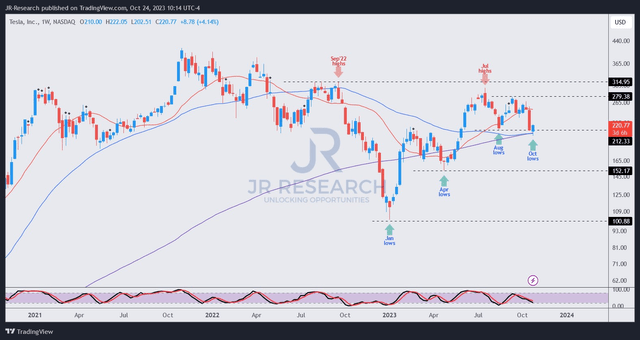

TSLA price chart (weekly) (TradingView)

TSLA buyers indeed returned this week, attempting to stem last week’s significant decline as buyers fled. TSLA’s low $200 zone is a pivotal support level that must be defended firmly to maintain the stock’s medium-term uptrend bias.

A decisive breakdown of this level could send it down toward TSLA’s April lows, indicating another prolonged downturn in TSLA stock, akin to last year’s battering. As such, I believe the battle between the buyers and sellers must be carefully watched at the current levels.

However, I’m confident that the risk/reward of Tesla, Inc. stock at the current levels is leaning bullish, as it’s no longer overvalued at its recent lows. With that, I’m ready to turn bullish and encourage investors waiting for an opportunity to strike to pick their spots.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here