Deutsche Bank (NYSE:DB) reported a stronger than expected Q3 2023, beating consensus on both topline and earnings. During the 3 months leading up to end of September, the largest German lender accumulated EUR 7.1 billion in revenue and EUR 1.7 billion of pre-tax earnings. This brings Deutsche Bank’s annualized operating profit to EUR 6.8 billion, against a market capitalization of less than EUR 21 billion (implied P/E of about 3x).

I have long argued that Deutsche Bank’s earnings power is underrated by markets (read here); and, that investors are poised for an enormous flow of capital distributions (read here). While Deutsche has managed to show earnings quality for quite some time now, Q3 finally brings first insights on an accelerating capital distribution outlook. Accordingly, as I see my equity thesis unfolding as argued, I feel more confident than ever to assign a “Strong Buy” recommendation with a >$30/ share target price.

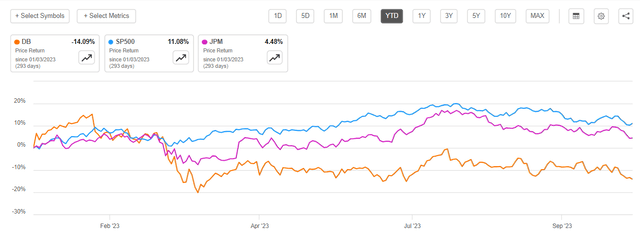

For context, despite the impressive fundamentals Deutsche Bank continues to underperform the broader market. YTD, DB shares are down 14%, compared to a gain of 11% for the S&P 500 (SP500) and a gain of 4% for industry leader JPMorgan (JPM). However, with Deutsche Bank’s equity distributions accelerating, I see an inflection point for DB’s relative performance.

Seeking Alpha

Deutsche Bank Beats In Q3

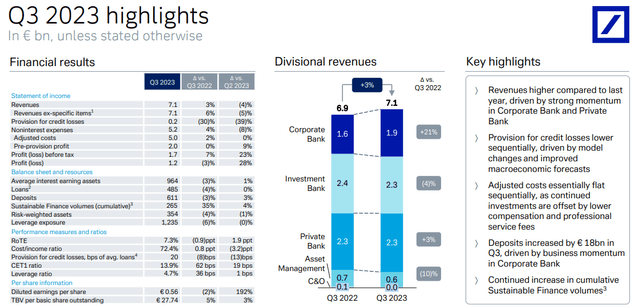

In the third quarter of 2023, Deutsche Bank demonstrated its ability to capitalize on a favorable interest rate environment. Over the June to September period, Germany’s largest bank — which has long been a turnaround story — achieved approximately €7.1 billion in total revenues, marking a robust 3% year over year growth compared to the same period in 2022. Cumulatively over nine months, revenues surged by 6%, totaling €22.2 billion. With that context, it also noteworthy that in Q3, Deutsche Bank’s revenues exceeded analyst expectations by nearly €100 million, according to Refinitiv’s estimates. For the full year, management now sees EUR 29 billion of total revenues, topping the upper end of the bank’s guidance at the beginning of the year.

In terms of profitability, Deutsche Bank reported a quarterly pre-tax profit of €1.7 billion, surpassing analyst consensus by approximately €100 million. Deutsche Bank’s operating income increased 7% year over year, outpacing top line growth on favorable operating jaws. Over nine months, pre-tax profit now stands at €5.0 billion. Referencing profits, Deutsche Bank reported a quarterly pre-tax return on tangible shareholders’ equity of about 7.3%. Furthermore, the bank achieved a cost-to-income ratio of 72.4%, an improvement of about 90 basis points compared to Q3 2022.

Deutsche Bank Q3 reporting

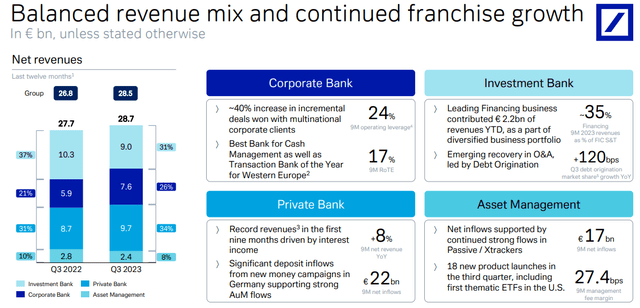

With regard to Deutsche Bank’s four key segments, a few metrics stand out:

- YTD, the Corporate Bank recorded EUR 5.8 billion of revenue (up 27% YoY). The performance was supported by all sub-segments: Corporate Treasury Services was up 19% YoY, reaching €3.3 billion; Institutional Client Services was up 23% YoY, totaling €1.4 billion; Business Banking revenues were up 69% YoY, reaching €1.1 billion.

- The Investment Bank continues to show resilience: During the trailing nine months, net revenues amounted to €7.3 billion, down only 12% YoY. Within the segment, Origination & Advisory revenue volume showed a surprising 17% growth, now accounting for €941 million.

- Revenue from DB’s Private Bank increased to EUR 9.7 billion (up 8% YoY), seeing EUR 22 billion of deposit inflows — highlighting the strength of the DB consumer franchise.

- The Asset Management arm saw EUR 17 billion of inflows YTD. However, revenues were down about 10% YoY, mostly as a function of lower management fees.

Deutsche Bank Q3 reporting

Capital Progress A True Delight

Deutsche Bank has now been reporting solid quarterly earnings, with consistent profitability, for quite some time now. I think investors have accepted the turnaround on this angle. What is relatively new in Q3, and in my opinion the long-awaited upside catalyst, is the bank’s accelerated progress on capital build-up and guidance for shareholder distributions.

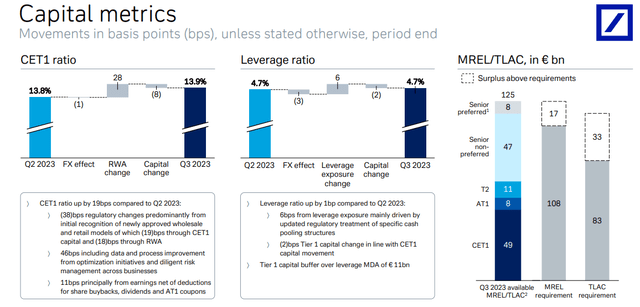

In Q3 2023, Deutsche Bank’s Common Equity Tier 1 increased to 13.9%, now well-above regulatory requirements. On that note, Deutsche Bank sees a further ~€3 billion of capital release from RWA reduction potential and updated Basel III estimates through 2025. The bank also sees capital strengthened by a better than expected asset quality performance, with provision of credit losses at 20 basis points of average loan size. These considerations prompted Christian Sewing to comment confidently on the outlook for increased shareholder distributions:

… we have materially improved our capital outlook thanks to our strong results and focused capital efficiency measures. This gives us scope to invest in growing our Global Hausbank model, further improve returns, and increase and accelerate distributions to our shareholders

Personally, I now model that Deutsche Bank will likely return EUR 2.5-3 billion of capital to shareholders in 2024, suggesting an equity yield of 13-15%. And if the bank’s guidance remains as stated (which I don’t doubt), there is further upside for capital distributions in 2025 and beyond. On a 11% ROTE estimate and a 50% distribution, I model Deutsche Bank’s steady state implied equity at 18%. This is very high; and should suggest a substantial rerating of Deutsche Bank’s equity — with the implied yield trending towards 7-8% on a >$30/ share target price.

Deutsche Bank Q3 reporting

A Note on Risk

I generally hold the belief that bank investments offer a level of security greater than the current market sentiment suggests. However, it’s essential to recognize the existence of heightened tail-risks. In exceptionally severe financial distress scenarios, Deutsche Bank’s financial stability could face significant pressure, akin to the challenges experienced during the global financial crisis of 2008-2009.

For banking institutions, it is paramount to acknowledge the sensitivity of their fundamentals to economic downturns and interest rate fluctuations. Moreover, factors such as credit and loan risks, along with operational concerns like compliance, could act as triggers, exposing vulnerabilities that might only surface in a recessionary economic climate. While, as of the third quarter, I haven’t identified any specific, noteworthy risks, it remains prudent for investors to remain vigilant regarding the intricate dynamics of the broader economic landscape.

Nonetheless, Deutsche Bank’s 13.9% Common Equity Tier 1 ratio serves as a substantial safeguard for the company’s balance sheet, even stressful scenarios.

Investor Takeaway

Deutsche Bank’s Q3 2023 performance has exceeded expectations, again, with robust revenue and earnings figures. The bank’s annualized operating profit now trends towards EUR 6.8 billion, against a market capitalization of less than EUR 21 billion. This underscores the bank’s underrated earnings potential I’ve long advocated for. Furthermore, Deutsche Bank appears to make progress in the second leg of my long-held equity thesis, namely that the bank is poised to distribute highly attractive amounts of capital — trending towards a 13-15% yield for 2024. I reiterate a “Strong Buy” rating on DB stock, with a target price exceeding $30 per share.

Read the full article here