At a Glance

The current landscape of Regenxbio (NASDAQ:RGNX) presents a nuanced picture of opportunity veiled by challenges. Financially, the company maintains an impressive liquidity profile, with a robust current ratio of 3.21 and a significant cash runway. However, the diminishing year-over-year revenues and a lagging stock performance compared to broader indices reveal underlying operational vulnerabilities. Clinically, RGX-121, targeting MPS II, emerges as a potentially groundbreaking therapy with its ability to address both systemic and neurological symptoms—a stark contrast to existing treatments. The clinical trajectory appears promising, albeit fraught with regulatory complexities and an invasive administration route. The question remains: can Regenxbio navigate these hurdles to transform promise into commercial reality? This article delves into these multifaceted aspects.

Q2 Earnings

To begin my analysis, looking at Regenxbio’s most recent earnings report for Q2 2023, several aspects stand out. First, total revenues declined YOY from $32.6M to $19.9M, a significant contraction primarily attributable to decreased license and royalty revenue. On the expense side, operating expenses remained relatively flat at $93.1M, with R&D accounting for $59.9M. Share dilution was minor, evidenced by the weighted-average common shares outstanding increasing from 43,111 to 43,531. Loss from operations widened from $62.5M to $73.1M. Overall, the report signals headwinds in revenue streams and an uncurtailed operational cost structure.

Financial Health

Turning to Regenxbio’s balance sheet, as of June 30, 2023, the company’s total current assets were $378.8M, with cash and cash equivalents at $68.6M and marketable securities at $251.5M. Calculating the current ratio, we have $378.8M in total current assets divided by $117.9M in total current liabilities, yielding a robust ratio of 3.21.

Examining the cash flow statement for the last six months, the “Net cash used in operating activities” was $128.2M, translating to a monthly cash burn of approximately $21.4M. Consequently, with $682.5M in total assets primarily in liquid form, the company has an estimated cash runway of around 31.9 months. It’s important to note that these calculations are based on past performance and may not precisely predict future burn rates or cash needs.

Given the significant cash runway and a robust current ratio, the odds of Regenxbio requiring additional financing within the next twelve months appear low.

Market Sentiment

According to Seeking Alpha data, Regenxbio’s market cap of $684.47M suggests cautious market sentiment, especially against the backdrop of declining revenues and a one-year stock performance lagging the S&P 500 by roughly 45 points. Revenue growth projections are aggressive, expecting an uptick from $130.81M in 2023 to $249.85M by 2025, but this optimism conflicts with the recent contraction in license and royalty revenue. Relative to SPY, the stock is down significantly in various timeframes (-33.03% YTD vs. SPY’s +12.37%), reflecting weak momentum. Short interest is notable at 10.07%, implying that some investors are betting against a quick recovery.

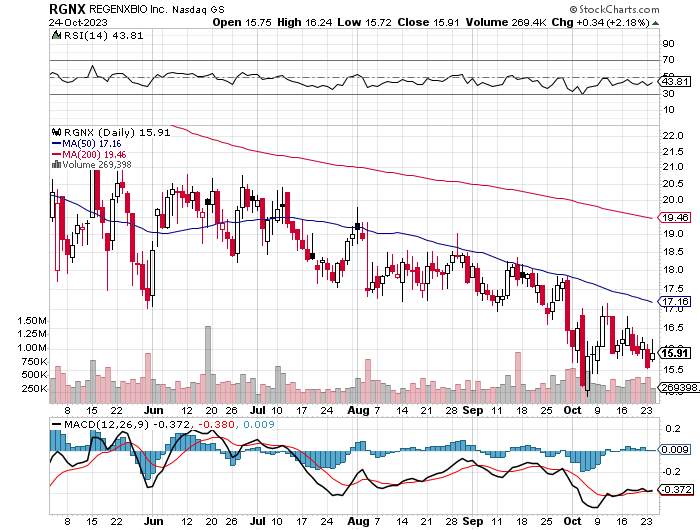

StockCharts.com

Technically, RGNX displays a bearish trend with consistent resistance below its 50-day moving average (MA50). The stock trades well below the MA200, further solidifying the bearish outlook. The MACD remains in negative territory, suggesting selling momentum. The RSI, at 43.81, indicates neither overbought nor oversold conditions. Immediate support is observed around $15.50. Potential investors should exercise caution and watch for signs of trend reversal.

Institutional ownership stands at 84.92% with new positions of 316,626 shares and sold out positions of 1,127,438 shares; noteworthy stakeholders include BlackRock, Vanguard, and JPMorgan Chase. Insider trading over the last year indicates a net positive activity of 399,625 shares, suggesting internal optimism.

RGX-121’s Unique Approach to Treating MPS II

RGX-121, the firm’s lead gene therapy, emerges as a promising candidate for addressing the unmet medical needs in MPS II, capitalizing on its unique mechanism to not only address systemic manifestations but also penetrate the Blood-Brain Barrier (BBB) to mitigate the neurological decline associated with this disorder. This dual-action approach sets RGX-121 apart from the existing Enzyme Replacement Therapy [ERT] with recombinant idursulfase (ELAPRASE), which, although approved, falls short in addressing the neurocognitive and behavioral symptoms due to its inability to cross the BBB.

The preliminary data from clinical trials bolster the potential efficacy of RGX-121, showcasing significant reductions in cerebral spinal fluid [CSF] heparan sulfate levels, a crucial biomarker for MPS II, and also hinting at long-term therapeutic effects with consistent reductions up to two years post-administration. Additionally, RGX-121 demonstrated restored I2S enzyme activity and improved neurobehavioral function in murine models, further attesting to its therapeutic potential.

Nonetheless, the road to FDA approval and market adoption for RGX-121 is laden with challenges. The intricacies of intracisternal administration, an invasive procedure, necessitate a robust safety profile to mitigate associated risks such as infection. The FDA’s stance on long-term safety data, particularly concerning novel gene therapies and invasive delivery methods, could pose significant regulatory hurdles.

Moreover, the competitive landscape presents another layer of challenge. Other gene therapies targeting MPS II are under development, and the existing ERT, despite its limitations, provides a less invasive treatment option. The competition could exert pressure on pricing and market adoption, impacting the market potential of RGX-121 even with FDA approval.

On the regulatory front, RGX-121 has garnered FDA Fast Track Designation, alongside orphan drug product and rare pediatric disease designations, propelling its review process. The consideration for an accelerated approval pathway with a

Biologics License Application (BLA) filing expected in 2024 underpins the regulatory optimism surrounding RGX-121, albeit the long-term safety data and intracisternal administration could still pose significant hurdles.

In conclusion, RGX-121 presents a compelling narrative of potentially transformative benefits against the backdrop of regulatory, competitive, and procedural challenges. Its unique mechanism of action addressing both systemic and CNS manifestations of MPS II augments its position in the MPS II treatment landscape. However, navigating through the regulatory intricacies, establishing a convincing safety profile, and standing firm against the competitive pressure are imperative for RGX-121 to realize its market potential and deliver on its promising clinical outcomes.

My Analysis & Recommendation

Given Regenxbio’s recent financial performance and pipeline prospects, investors ought to exhibit prudence. The firm’s stable financial footing, as reflected in its solid current ratio and cash runway, is a pillar of support amidst the rigorous and expensive clinical development journey. However, the diminishing revenues and unfavorable stock trajectory vis-à-vis broader market indices expose operational hurdles and perhaps a cautious market outlook regarding the company’s growth trajectory.

Exploring the broader pipeline, Regenxbio’s foray into AAV-mediated therapies underscores a methodical endeavor to tackle unmet medical needs, prominently in orphan and pediatric diseases such as Duchenne Muscular Dystrophy and Batten Disease. These designations could potentially expedite the regulatory process and offer market exclusivity, yet they also epitomize the high-risk, high-reward narrative inherent in biotech investing. The ambition to develop gene therapies for chronic diseases, like wet AMD, while noble, warrants skepticism, given the enduring nature of these conditions necessitating long-term, often lifelong, therapeutic solutions.

Investors should closely follow the clinical progression and regulatory dialogues concerning RGX-121, particularly its safety profile amidst the challenges of intracisternal administration. Additionally, an assessment of the competitive milieu for MPS II therapies and the market dynamics encircling gene therapies is crucial.

Near-term investment strategies could include diversification within the biotech sector, perhaps leaning towards entities with established revenue streams and a diversified pipeline, to mitigate the risks tied to Regenxbio’s gene therapy focus. A balanced portfolio, encompassing both developmental and commercial-stage biotech firms, may foster a more resilient investment posture.

Given the operational, regulatory, and competitive challenges juxtaposed against a strong financial footing and a promising yet risky pipeline, advocating a “Hold” stance, is prudent. The next few quarters could be pivotal, unraveling either a path of growth driven by successful clinical and regulatory milestones or a route laden with delays and competitive pressures. Hence, a cautious, well-informed approach is imperative for investors threading the Regenxbio narrative.

Read the full article here