It’s always discouraging to see a company go from generating strong financial performance to generating bad performance. And it’s also very challenging to know when the turn in performance has staying power or whether it is something that can be reversed. Companies that go from strong performance to weak performance can experience significant downside in their share prices. A great example of this can be seen by looking at OUTFRONT Media (NYSE:OUT), an owner and operator of outdoor signage, especially billboards. Since I last wrote a bullish article about the company back in May of 2022, shares have generated downside of 47.4% while the S&P 500 has been up 5.8%.

Given this massive downside, you might think that the top line for the company was worsening. But that’s not the case. Revenue continues to grow nicely. But there are two problems. First, debt is high. And the second is that the firm’s cost structure, even ignoring the rise in interest expense caused by higher interest rates and higher debt balances, has pushed the company’s bottom line down quite a bit. The good news is that management is finally making moves aimed at optimizing operations. The first to move in this regard is fairly small in the grand scheme of things. But if management allocates the capital toward debt reduction, it should cut the company’s annual expenses by quite a bit. By focusing on other cost areas, the firm does have the potential to be attractive again.

A nice move to address a real problem

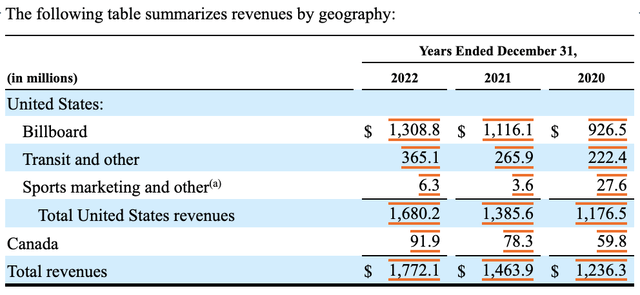

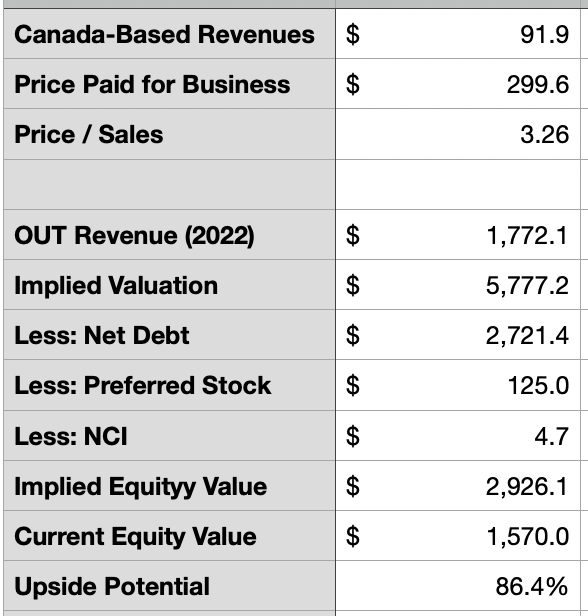

On October 23rd, the management team at OUTFRONT Media announced that it had reached an agreement to sell its Canadian business to Bell Media, which is a wholly-owned subsidiary of BCE Inc. (BCE). The price paid for the enterprise is C$410 million. At the current exchange rate, this translates to roughly $299.6 million. Although this may not seem like much, it’s worth noting I that, in 2022, the Canadian business generated $91.9 million in revenue for OUTFRONT Media. That is up significantly compared to the $59.8 million in revenue generated only two years earlier. But when you consider that overall sales for the company were $1.77 billion in 2022, it’s a little more than a rounding error.

OUTFRONT Media

The assets purchased consisted of 9,325 total displays at the end of last year. Of course, the number of displays doesn’t tell us too much. This is because different types of displays can have different types of values. For instance, billboards can be more valuable than transit and other types of displays. Digital billboards, meanwhile, can be more valuable than traditional ones. We do know that while the company was responsible for 5.2% of the firm’s overall revenue, it was responsible for 10.3% of its billboard displays and only 1% of its transit and other displays. Using data from the most recent quarter, the operations in Canada accounted for 14.3% of the company’s digital billboards but for only 6.7% of digital billboard revenue. So although these are higher quality placements, on average, compared to what the company has in the US, their revenue-generating track record so far has been quite disappointing.

Author – SEC EDGAR Data

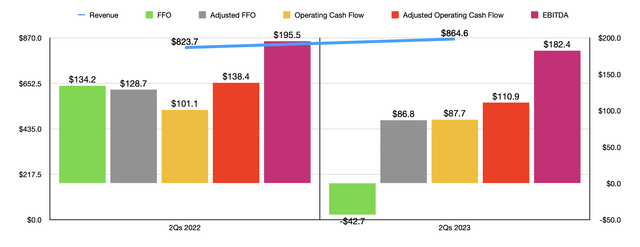

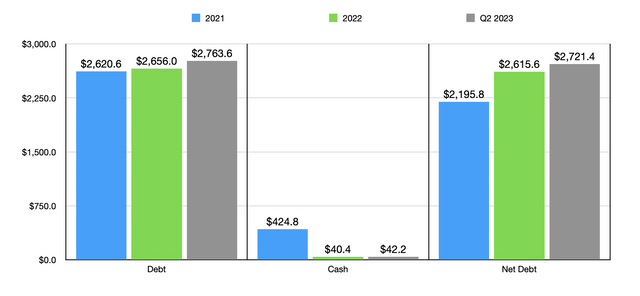

Recently, OUTFRONT Media has had something of an issue when it comes to interest expense. In the first half of the 2022 fiscal year, for instance, 7.6% of the company’s revenue went toward covering interest expense. Even though revenue grew from $823.7 million during that time to $864.6 million in the first half of the 2023 fiscal year, the amount of revenue that went to covering interest expense expanded to 9% this year. Although this may not seem like much, when you apply the difference to the amount of revenue generated so far this year, that’s an extra $12.1 million, or $24.2 million on an annualized basis. Some of this increase came from the fact that debt grew in recent years. Net debt went from $2.20 billion in 2021 to $2.62 billion last year. By the end of the most recent quarter, it totaled $2.72 billion.

Author – SEC EDGAR Data

The extra interest expense is a nice chunk of money when you consider the overall bottom line performance of OUTFRONT Media this year compared to last. In the first half of this year, the company reported FFO, or funds from operations, which was negative to the tune of $42.7 million. That’s down from the $134.2 million reported one year earlier. On an adjusted basis, FFO dropped from $128.7 million to $86.8 million. Because of impairments, I would say that the adjusted figure is more appropriate as a measure of value. Operating cash flow fell from $101.1 million to $87.7 million, while the adjusted figure for that dropped from $138.4 million to $110.9 million. And finally, EBITDA for the business declined from $195.5 million to $182.4 million.

Just running the math here, that increase in interest expense is not insignificant relative to the overall decline in profitability that the company saw year over year. Even if we use adjusted operating cash flow, the $12.1 million increase was 44% of the decline in cash flow that the company reported. We don’t know how management intends to use the proceeds. If management allocates this capital toward paying down its term loan, which is a loan that has an interest rate right now of 6.9%, that would save it, on a pretax basis, $20.7 million annually.

There are other issues too

This sale is interesting because, not only does it allow management to reduce debt if it so desires, but also because it helps to value the company. The sale price translates to 3.26 times the revenue generated by the assets in question. If we applied the same methodology to the revenue generated by OUTFRONT Media last year, we would get a total value of $5.78 billion. The enterprise value of it right now is $4.42 billion. But once we strip out preferred stock, non-controlling interest, and net debt, this implies upside for shares of 86.4% if the rest of the company were to be valued the same way as these assets were.

Author – SEC EDGAR Data

But there is a good reason why the market is not honoring this kind of valuation. And that’s because costs continue to be an issue. Even if we ignore the interest expense matter, and the rather high net leverage ratio of 5.76, it’s also true that other costs have risen in relation to sales. The one that’s worth pointing out is operating expense. This grew from 53.3% of sales in the first half of last year to 55.7% the same time this year. Year over year, transit franchise expenses grew by 7%, while posting, maintenance, and other costs increased 5%. But the real problem for the company involved a 14% rise in billboard property lease expense. Management attributed this rise to an increase in variable billboard property lease expenses that were caused by hikes in large markets and high-profile locations, as well as by new locations that included not only organic growth but also acquisitions. What it sounds like is that management might be placing billboards in areas that it’s not charging enough for and it’s experiencing cost increases that it either can’t or won’t push onto its customers. This is something that the company should look into addressing since it isn’t just causing margin contraction, but is outright causing overall profits to dip slightly.

Pay attention to earnings

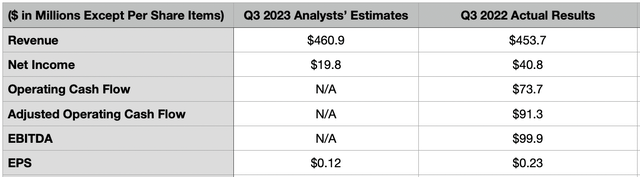

Although none of these changes will impact financial results for the third quarter that management has yet to release, it is possible that they could have an impact moving forward beyond this point. It will be interesting to see what management says when it does report financial results for the third quarter on November 2nd after the market closes. While we are on that topic, it might not be a bad idea to touch on current expectations. Right now, analysts are forecasting revenue of $460.9 million. That would represent an improvement over the $453.7 million reported the same time last year.

Author – Estimates

Just as has been the case this year, revenue is forecasted to be higher, while profits are forecasted to decline. I say this because analysts currently believe that earnings per share in the third quarter will come in at $0.12. That would represent a significant cut from the $0.23 per share generated last year. That would result in net income declining from $40.8 million to $19.8 million. Given that we have seen such weakness on the bottom line this year, a continuation of that weakness would not be shocking whatsoever. Other profitability metrics should also be paid attention to by investors. Those can also be seen in the table above, though analysts have not provided any guidance regarding them.

Takeaway

Based on all the data provided, I will say that OUTFRONT Media is making an interesting move here. This transaction gives an example of how the company as a whole might ultimately be valued and it’s clear that the assets in question, while more focused on digital displays, are also not all that valuable from a revenue perspective. The company gets to reduce debt and interest expense if it so desires and that should help to improve investors’ perceptions of it. Management still has some work to do before the ship can turn itself around. But because of how much the stock has fallen since I last wrote about it and because it is still cheap relative to cash flows, I’ve decided to keep it rated a ‘buy’ for now.

Read the full article here