When looking at IAC (NASDAQ:IAC), it is best to look at its individual businesses and holdings, which for the most past have been struggling.

MGM Resorts International (MGM)

IAC owns 64.7 million shares of casino operator MGM. It spent just over $1.2 billion acquiring its stake in the company, with the bulk purchased in 2020 and some more shares bought in 2022.

While the stock has taken a hit since the end of July, it is still currently worth about $2.4 billion, and on an after-tax basis about $2.1 billion (20% taxed on the gain from its cost basis). As such, it is probably IAC’s most valuable asset.

The company experienced a cybersecurity incident that hurt its September occupancy, and which impact its Q3 results. However, it was projecting a strong Q4 helped by football and the inaugural Las Vegas Grand Prix Formula 1 race in November.

Dotdash Meredith

IACI’s largest segment by revenue is its Dotdash Meredith business, which consists of a portfolio of print and digital magazines and websites. This segment is home to some iconic brands, including PEOPLE, Entertainment Weekly, Travel + Leisure, and Better Homes & Gardens, among others. The company primarily generates revenue through advertising and subscriptions.

Given the softness in the ad market, not surprisingly the segment has been struggling. Digital revenue for Q2 fell -10%, although the company said much of the revenue was low value, while noting that June revenue rose 1%. The company also said it saw 12% growth in performance marketing. It said applying performance marketing to the Meredith properties was one of the big reasons for the acquisition in 2021.

Overall, it is looking for the segment to generate between $250-300 million in adjusted EBITDA for the year. At the time of the $2.7 billion acquisition, it was expecting the combined Dotdash and Meredith business to have adjusted EBITDA of over $450 million in 2023. Obviously, the business has underperformed those expectations. The purchase price would have been a 6x multiple if it did achieve those projections.

At a 5-6x EBITDA multiple, the segment is worth between $1.3-1.8 billion. Of course with a better ad market, it could be able to post better EBITDA closer to its original forecast.

ANGI Homeservices (ANGI)

IACI owns 83.9% of publicly traded ANGI, a service that connects homeowners with home repair and improvement specialists. That would value IAC’s stake at around $725 million.

ANGI has struggled this year, and its stock is down nearly -30% year to date. The company saw its Q2 revenue drop -27% to $375.1 million. While part of that was due to the current macro environment less spending of home remodels, and tough year-over-year roofing comps, the company also was actively ramping down some areas that it didn’t think were good for the long-term health of the business.

On its Q2 call, ANGI CEO Joseph Levin said:

“I’ve been saying for a while that there were areas where I thought Angi had focused on optimizing for shorter-term revenue over the longer-term health of the business and our customer experience and that we were going to make changes along those lines. And for the past few quarters, we’ve been doing that. In the second half of this past quarter, we saw a further opportunity to do that, and I made the call to make that change, which I have no doubt was the right call in the business. I think the impact of that call, which was really restructuring some demand channels, ramping down channels pretty quickly over the course of the quarter. And this was revenue in the quarter, and it was also profitable revenue in the quarter. We ramped that down pretty quickly, and the impact of that would be most pronounced in Q2. I think we’re already seeing July was better on a profit perspective. And I think we’ll see the benefit of some of the changes we made in Q2 over the coming quarters. So that impact was most pronounced. But the substance of it was turning off channels of demand or reducing channels of demand that we thought [couldn’t] deliver the ideal customer experience. And that in exchange for that, what we’re going to drive is longer-term retention of pros and better homeowner experience on our platform.”

Once the clean-up is done, the company is looking to drive innovation of the homeowners’ side in the second half and try to reignite growth in 2024.

The company has forecast 2023 EBITDA of between $100-130 million.

Search

IACI’s Search business consists of a number of search website businesses. Among its properties include Ask.com, Reference.com, Concumersearch.com, and Shopping.net. The segment generates revenue from paid listings derived from search results as well as display advertisements. The company has a service agreement with Google (GOOGL), who supplies the paid listings.

Search revenue declined nearly -11% in Q2 to $177.0 million. Adjusted EBITDA, meanwhile, fell -47% to $14.0 million.

I’d value the Search business around $300 million, which would be about a 5x multiple on $60 million in yearly EBITDA.

Emerging & Other

The emerging segment includes a number of other businesses, such as Care.com, which connects families with caregivers; news website The Daily Beast; Mosaic Group, which develops mobile apps; Vivian Health, which pairs healthcare professionals with job opportunities; and IAC Films, which produces featured films.

Emerging revenue fell -8% in Q2 to $147.9 million. Adjusted EBITDA, however, flipped to a gain of $6.3 million versus a loss of -$17.1 million. Adjusted EBITDA was $21.1 million for the first 6 months of the year.

While tougher to value this collection of emerging businesses, I place around a $250-300 value for them at the moment, which is around 6-7x multiple on around $40 million in EBITDA.

Turo

IAC also owns about 30% of interest in peer-to-peer car sharing platform Turo through preferred shares. The investment is currently carried at about a value of $430 million on IAC’s balance sheet. Turo has filed an amended S-1, so could look to IPO.

Discussing Turo at a TD Cowen conference in June, IAC CFO Christopher Halpin said:

“They have an amended S-1 on file. So there’s limited things we can say, including about prospects and as such. But we are big believers in Turo. Joey and Barry and the IAC team have seen marketplaces scale over time and know the hallmarks of a successful marketplace. The trends, the positioning, the competition for Turo in the rental car and car usage market, we feel very good about where they sit. And they’ve really cracked the code, we believe, on liquidity, on insurance pricing, on margins, et cetera, and that’s taken trial and error. But big believers in the asset in the business and Andre and the management team and the opportunity there. So we saw the opportunity to increase our stake. Excited to own more, and we’ll be long-term Board members and supporters of the company.”

Conclusion

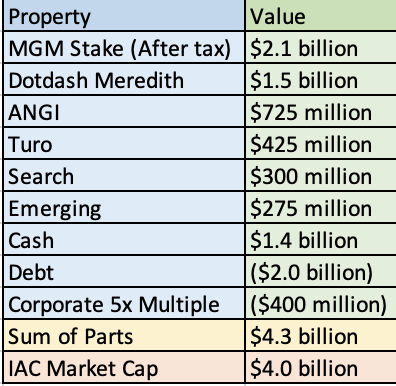

When taking into consideration corporate costs, IAC looks pretty close to fairly valued for the businesses and assets it owns on a sum of parts basis. As such, the biggest reason to really own it would be on the expectation of a rebound at Dotdash Meredith, or perhaps a Turo IPO. While MGM and ANGI could also rebound, you can just buy those two stocks directly if that was your thesis.

IAC Sum of Parts (Company Filings And Self)

IAC has some opportunities to improve Dotdash Meredith through the introduction of performance marketing and its new cookie-less advertising tool D/Cipherm, which lets advertisers target specific interests, bypassing Apple IOS privacy settings. That said, right now the macro and ad market will far outweigh any changes the company can make. The segment will likely never to be a big revenue growth machine, but it should eventually improve from a better ad market.

All in all, I think IAC is a “Hold.” You’re not getting the best assets, but they do have turnaround potential.

Read the full article here