Shares of Chubb (NYSE:CB) have been a mixed performer over the past year, rising about 4%, a positive return but one that has lagged the S&P 500. However, the company reported solid Q3 earnings results, reaffirming its status as a premiere underwriter while rising interest rates are helping to support investment income. At less than 12x earnings, long-term investors will be rewarded from buying shares of CB, in my view.

Seeking Alpha

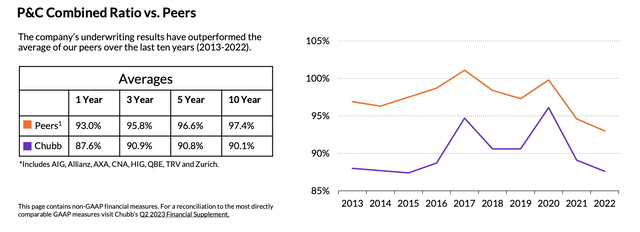

In the company’s third quarter, Chubb earned $4.95 in adjusted EPS, blowing past consensus by $0.53. This was up 58% from last year’s results, aided by higher interest rates as well as strong underwriting results. Some of this increase was also due to a favorable catastrophe environment as last year Hurricane Ian caused large losses for the industry whereas the hurricane season this year was fairly mild. Even factoring in this, underwriting results were solid. I would note this is typical for Chubb, which has structurally been a good underwriter, with an industry-leading combined ratio.

Chubb

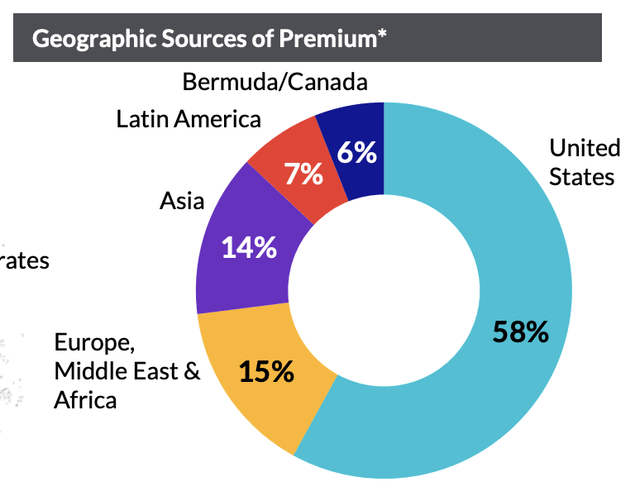

In the third quarter, Chubb’s P&C new premiums written rose 8.4% to $11.65 billion, though this was weighed down by a 13% decline in agriculture premiums in North America, which was partially due to timing. Excluding this, global P&C premium growth was 12.3%; consumer lines were up even more strongly at 17.6%. It is also worth noting that Chubb is somewhat unique among US insurers in being a truly global player. While the US is the majority of its business, CB does have global diversity, which helps to mitigate risk to any particular storm, event, or industry.

Chubb

While premiums rose by double-digits, this was not due to CB writing an incredible amount of new business. In fact, large increases in business can serve as a warning sign that insurance buyers view as underpricing risk, which could result in worse underwriting profits in future years. Rather, CB is charging more for policies with pricing generating essentially all of the premium gain. Prices were up 13.9% in North America and 11.7% overseas.

High inflation has been a headwind for insurers’ profitability as they have to pay out more to rectify claims, creating an increased “severity” of losses. CB, and others like W. R. Berkley, are now recapturing pricing to catch up from the inflation we have experienced, which should support better underwriting results in the future. This should protect Chubb’s ongoing underwriting performance.

Indeed, Q3 underwriting results were strong as these pricing gains materialized. Underwriting income came in at $1.3 billion, up 84% from last year. This was because Chubb’s calendar year combined ratio declined to 88.4% from 93.1%. As a reminder, a ratio of 100% represents breakeven—the insurer is paying out 100% of premiums. At 88.4%, CB is earning $11.6 on every $100 of business it writes, just from underwriting (i.e. excluding investment income).

Now, as noted, the lack of hurricanes flattered these results. Excluding catastrophes, the combined ratio was 84.3% from 84% last year. Last year’s 9.1% cat impact was particularly severe, and this year’s 4.1% impact was probably lighter than what an average Q3 will be, with the “norm” lying between these two.

84.3% is a strong core underwriting result, and while it ticked up modestly from last year, this was largely due to shifting timing out of its agriculture business. I was particularly glad to see North American personal P&C combined ex-cat ratio of 78.9% vs 79.5% last year, a 60bp improvement off of an already impressive level. CB is also growing this part of the business faster than overall premiums, up 18%.

If you know anyone who has Chubb insurance, they have likely talked about how much they like Chubb, a unique status in the insurance world. Chubb is one of the few financial services companies, alongside perhaps American Express (AXP), that has maintained a premium brand cache in a commoditized world. This is largely due to its emphasis on customer service.

Interestingly, this enables Chubb to charge a premium for its insurance and actually pay out relatively little in claims relative to many insurers with a combined ratio of ~90%. While Chubb is often perceived as generous, its personal line combined ratio is quite low. Chubb’s personal line business is a particular gem across its global operations and a significant driver of value. It continues to perform quite well.

Elsewhere, CB has a smaller life insurance unit, and this group is also performing solidly. Premiums were up 15% in constant dollars to $1.45 billion, and segment income was similarly up 15% to $288 million. Additionally, CB had a $200 million benefit for prior period reserves. Insurers estimate the losses on their policies, but as some policies last for years, these estimates need to be revisited with reported profits essentially a best estimate of how profitable a plan will be that are then subsequently revised as claims data come in.

It can be a warning sign when insurers are consistently having to take additional reserves that their underwriting is not fully capturing the risks and that current results will also need revision. Chubb is the opposite; if anything, it structurally is conservative in its loss assessments and turns out to be more profitable than originally anticipated. As noted in Q3, Chubb had a $200 million favorable prior-year development. That takes this year to a $596 million favorable development. This is on top of $876 million last year. By focusing on its niches and diversifying across products and geographies, Chubb has proven through cycles to underwrite prudently.

Beyond underwriting, net investment income came in at $1.4 billion, up $361 million from last year as Chubb benefits from rising interest rates. Chubb has a $109 billion fixed income investment portfolio. This is up $10.5 billion this year as it continues to grow its premiums and generate positive operating cash flow with which to invest. This portfolio is high quality with an average credit quality of A. 41% of the portfolio is rated either AA or AAA. The portfolio has a duration of 4.7 years, which means it has significant maturities that it is able to reinvest at today’s higher yields.

The combination of investing new funds as well as rolling over maturities issued from 2019-2021 when rates were very low has meant that the portfolio’s yield is up 50bp this year to 4.1%. Chubb reports investment income based on yields at the time of purchase with unrealized movements flowing into accumulated other comprehensive income (AOCI). The bonds have a market yield of over 6%, which gives a sense of what the incremental yield Chubb is earning on new dollars it deploys.

Over the coming quarters, I expect to see CB to continue to report rising investment income and investment yields, likely about 10bp per quarter from its core fixed income portfolio, just as it benefits from the current rate environment. In addition to its fixed income portfolio, CB has $15 billion of private equities and $6 billion of other assets, though its earnings are much more volatile quarter by quarter than the interest earned on its fixed income portfolio.

Thanks to premium growth, its insurance reserve, or float, is up $4 billion to $79.5 billion this year. Essentially, Chubb borrows from policyholders because it receives a premium today for claims somewhere in the future, during which time it invests and earns interest. As rates rise, the effective value of this float for shareholders rises. Moreover, because Chubb actually earns a strong underwriting profit, it is functionally borrowing at a negative rate, paying out less than it receives upfront. This is a potent combination, which is why income has risen so dramatically.

With these strong results, Chubb generated a return on tangible equity of 21.2%. Chubb has a $97/share tangible book value excluding its $11.5 billion in AOCI unrealized losses. Because Chubb’s float is subtracted in its entirety as a liability, even as it generates an underwriting profit and will not pay claims for years, its book value is an overly conservative estimate of its true net economic position. This is why almost all P&C insurers trade at large book value premiums.

At an 8% required rate of return, CB could trade at more than 2.5x book value, based on these results. Now, I do expect over coming quarters to see the combined ratio, including catastrophes to worsen a bit just given how the light of a storm season we had. Countering this, rising interest income will continue to support bottom line growth. As such, I expect run-rate earnings to be $4.75-$4.90 over the next year, or about $19.25 over the next twelve months.

That leaves CB with an 11x earnings multiple. For the premiere underwriter with a uniquely powerful brand among consumers and small businesses, I view this as an extremely attractive entry point. Because much of its earnings growth has come from rates, multiples are likely to stay somewhat compressed. However, rates seem unlikely to fall meaningfully soon, and even if they fall somewhat, they are likely to stay above the levels seen several years ago, meaning rolling maturing will continue to be accretive to earnings.

Ultimately, I think shares should move to new highs and can justify a 2.5 book value multiple or about $242, which would represent just a 12.5x earnings multiple. CB delivered another strong quarter, and I would expect upward analyst revisions as a result. Long-term investors will be glad to own such a strong operator at a discount valuation, and I view CB as among the most compelling opportunities in the insurance sector with these results affirming my conviction.

Read the full article here